-

Despite heightened trade tensions, the Swiss franc has been relatively weak against the US dollar of late. The defensive features of the franc seem to be outweighed by an unsupported interest rate differential.

-

But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential.

-

Capital outflows are unlikely to weigh significantly on the franc, while the SNB may have growing difficulties to justify its very accommodation monetary policy going forward.

-

Overall, our base scenario sees franc appreciation against the US dollar, with a three -month projection of CHF0.98 per USD and a 12-month projection of CHF0.92.

The Swiss franc has been relatively weak since the end of June (depreciating 1.3% vs USD) despite increasing trade tensions. Yet the defensive feature of the Swiss currency, stemming from a structurally large current account surplus and elevated stock of foreign assets (i.e. its net international investment position), favor some appreciation of the franc. However, as highlighted by subdued levels of volatility in US equity markets, investors do not seem to be particularly concerned about the impact of trade disputes on the US business cycle. A US economy still displaying ‘Goldilocks’ characteristics combined with an unsupportive interest rate differential likely explain the recent weakness of the Swiss franc as well as of other defensive assets, such as the Japanese yen and gold.

Limited downside potential for the francThe Swiss National Bank (SNB) is likely to remain accommodative despite the improving domestic macro economic background given renewed European political uncertainties. However, we do not expect significant downside pressure on the franc for several reasons. First, while the SNB still considers the franc “highly valued”, this is not obviously the case if one looks at the currency’s long-term equilibrium value (Chart 1). Coupled with the possible fallout from an escalation of trade tensions, this raises the bar for any SNB intervention to curb franc strengthening.

|

Purchasing power parity vs. REER deviation from long - term average |

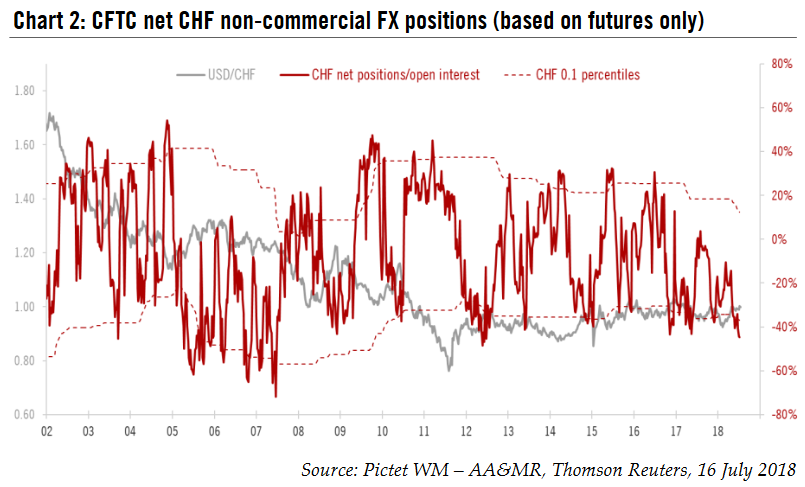

| Second, following the calendar – based forward guidance on rates provided by the European Central Bank (ECB) in June, the market has already largely priced the possibility that the SNB will not be raising policy rates until the end of next year. Looking at Euroswiss three – month contracts, a 25bp rate hike is now fully priced by the market for end 2019, which seems fair enough in our view . Furthermore, short – term positioning in the Swiss franc relative to the dollar is extremely short at the moment, an important hurdle for any additional sustained rise in the USD/CHF rate (Chart 2). In short, the market already expects the SNB to remain accommodative and will therefore need serious new policy arguments to push the franc lower. |

CFTC net CHF non - commercial FX positions (based on futures only) |

|

Third, our central scenario foresees robust growth and a pick-up in core inflation in the euro area in the fourth quarter, which should make the ECB more confident about normalization of its monetary policy. Given that the SNB is likely to track ECB ’s moves closely and given the magnitude of its own normalization process (both in terms of policy rates and balance sheet), upward pressure on the franc is likely in the coming months. Furthermore, markets may start refocusing on European political uncertainty around September when the new Italian government is due to present its first budget. This should prove a temporary tailwind for the franc.

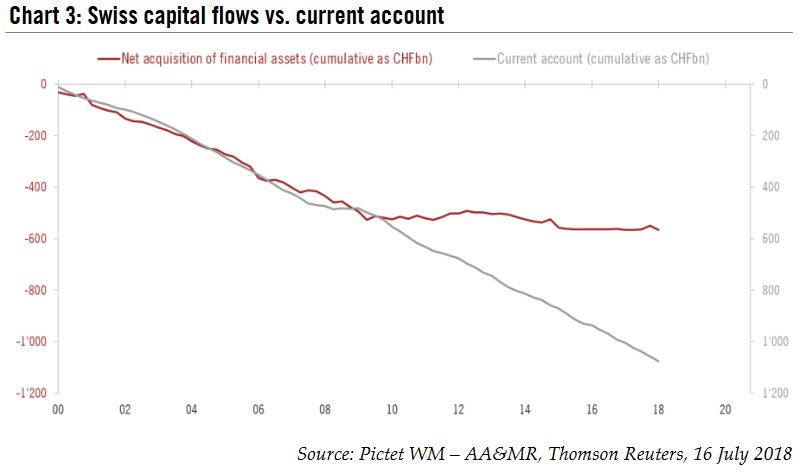

Fourth, capital outflows from Switzerland have been modest in recent quarters (Q4 2017 – Q1 2018) despite a booming euro area and relatively low political uncertainty (Chart 3). Given the moderation in euro area growth in the past couple of months and given the renewed political uncertainty originating in Italy, capital outflows are unlikely to significantly curb the upward pressure on the franc that results from Switzerland’s current account surplus.

Finally, our view that trade tensions could escalate in the next few months should ultimately weigh on risky assets and reduce global risk appetite. Such an environment would be favorable to defensive assets like the Swiss franc.

To sum up, it seems unlikely, in our view, that the Swiss franc will weaken significantly relative to the US dollar from current levels (the two currencies were at parity on 18 July). On the contrary, increasing trade tensions and heavy short positioning on the franc should pave the way for appreciation of the Swiss franc against the US dollar in the short term. We project a USD/CHF rate of CHF0.98 on a three-month horizon and of CHF 0.92 on a 12-month horizon.

|

Swiss capital flows vs. current account |

Full story here Are you the author? Previous post See more for Next post

Tags: Macroview,newslettersent