US President Trump is intent on disrupting the post-WWII arrangement that prioritized and ideological conflict over economic rivalries. Last week, it was reported that Trump told his counterparts at the G7 summit that NATO was as bad as NAFTA. NATO’s annual meeting is July 12. Trump seeks a realignment of alliances and appears to prefer the illiberal forces that arisen in recent years. The US Ambassador to Germany was recently quoted expressing a desire to “empower” the populist- right.

Even if US Treasury Secretary Mnuchin is right that the President has not decided to withdraw from the WTO, which would need Congressional consent, despite talking about it, Trump’s hostility to it is becoming an economic force. At the recent ECB conference, there was a common warning from Powell, Draghi, Kuroda, and others, that trade tensions were risk to the economic outlook. Last week, two more Fed officials, Bostic and Bullard, shared a similar assessment. Bullard, for example, talked about the “full-throat angst” the trade tensions were causing among businesses.

The week is bookended by tariffs. On July 1, Canada’s retaliatory tariffs of 10%-25% on $12.8 bln of US goods take effect. Whatever definition of national security that is elastic enough to define steel and aluminum from Canada as a national security risk can include anything. Commerce Secretary Ross said that the results of the US investigation into auto imports national security grounds are likely in July or August. Public hearings will be held on July 19-20.

ChinaAt the end of the week (July 6), the US will impose an addition 25% levy on $34 bln of Chinese goods for intellectual property right violations. China has indicated it will retaliate in kind. There is another $16 bln in goods are waiting for the final decision that will be subject to the tariff. The US has threatened to impose another 10% tariff on $200 bln of Chinese imports for its retaliation. While protectionism threatens to dampen trade, there are important offsets. Some trade will be re-directed. Consider China’s announcement last week, which appears to have been in the works for some time, but the timing makes a point. Starting now, it will cancel or cut tariffs and other border taxes on numerous products (including soybeans) from members of the Asia Pacific Trade Agreement (India, South Korea, Sri Lanka, Bangladesh, and Laos). |

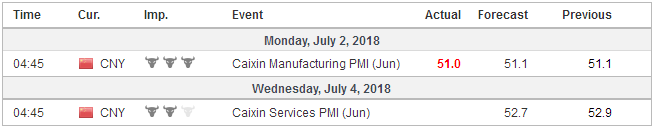

Economic Events: China, Week July 02 |

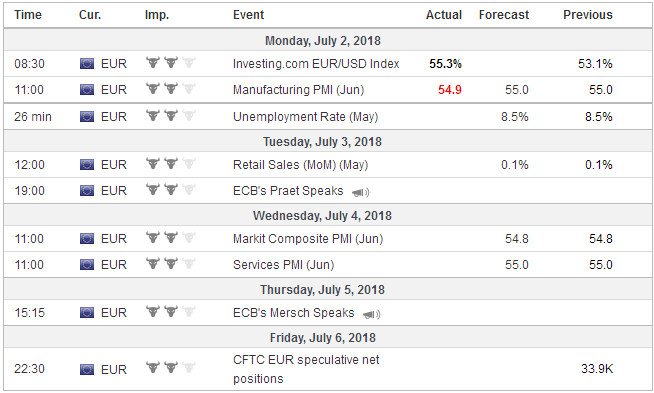

EurozoneThe yuan has slid lower over the past two weeks, but it stabilized ahead of the weekend. Given the dollar’s broad pullback in Europe and in North America before the weekend, a firmer yuan to start the new week would not surprise. The official PMI data showed slower manufacturing (51.5 from 51.9), while the non-manufacturing ticked up to 55.0 from 54.9. This may not be undesirable for Chinese officials, and the composite reading of 54.4 compared to 54.1 average for the first half and 54.3 the 2017 average. The flash PMI report for Europe steals the thunder of the final report. Recall that the composite rose to 54.8 from 54.1. It averaged 54.7 in Q2 and 57.0 in Q1. The retail sales report on July 5 risks a downside surprise. The Bloomberg consensus is for a 0.1% increase, but Germany reported an unexpectedly large decline (-2.1% vs. forecasts for -0.5%) and Spain reported a 0.4% decline. |

Economic Events: Eurozone, Week July 02 |

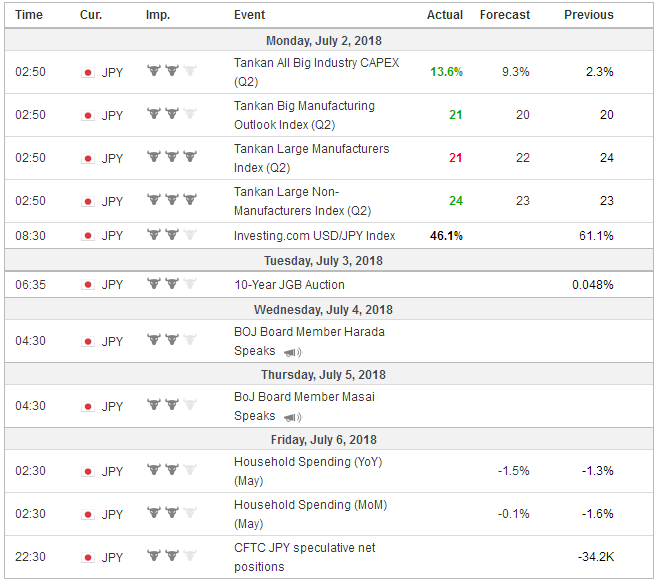

JapanJapan reports results of the Tankan Survey. Don’t look for fresh inspiration. The results are not expected to change much, though look for a strong rise in capital expenditure plans. While Japan’s labor market remains tight by most measures (2.2% unemployment rate in May and 2.5% in April), wages growth has been miserly. Real cash earnings are expected to be unchanged in the year through May, and household spending is forecast to have fallen 1.5% year-over-year. It would be the fourth consecutive year-over-year decline and the largest since February 2017. Before the weekend, the BOJ announced it was reduced its JGB purchases for the third time in June. The JPY20 bln reduction in its purchases of 5-10 year JGBs matches the move announced on June 1. In the middle of June, the BOJ reduced the purchases of 3-5 year JGBs. It was a bit awkward at first, but the BOJ has convinced market participants that its reduction of JGB purchases is not a change in policy as with a smaller float and targetting the 10-year yield allows the BOJ to turn back the dial of its purchases. The BOJ formally targets JPY80 trillion a year, and in the last fiscal year, it bought close to JPY50 trillion. |

Economic Events: Japan, Week July 02 |

United StatesThe US employment report is probably still the single most important data release of the month. US job growth has averaged a 179k over the past three months and 197k for the past 12 months. Net job creation in June is expected to be between these averages. The focus of the report, especially now that the unemployment rate has fallen below 4%, is average hourly earnings growth. Given the base effect, a 0.3% rise, which equals the May increase, would boost the year-over-year rate to 2.8%, matching the cyclical high recorded last September. Just like the employment data set the tone for much of the economic data, US auto sales are an important, even if under-appreciated, macro indicator. US auto sales have slowed in four of the first five months of the year. June sales are expected to have risen to 17.0 mln (seasonally-adjusted annualized rate) from 16.81 mln. If true, that would put the Q2 average below 17.0 mln for the first time since last August. Investor attention will increasingly turn to the earnings season. Earnings growth for the S&P 500 is projected to by 20% by Factset, which if true, would the second strongest since Q3 2010. Unusually, but for the second consecutive quarter, bottom-up analysts boosted their earnings forecast (0.8%) during the quarter. More typically, analysts shave their forecasts by an average of around 5%. In addition to the gap lower opening on June 25, which also appears on the weekly bar charts, and the poor close before the weekend, our cautious near-term outlook also reflects concern that one of the largest buyers of US shares, US corporations, move to the sidelines ahead of earnings. |

Economic Events: United States, Week July 02 |

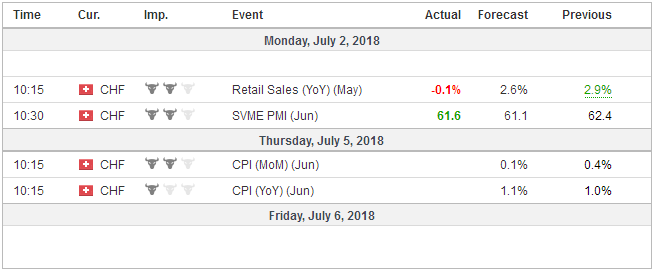

Switzerland |

Economic Events: Switzerland, Week July 02 |

Lastly, we note that the surge in oil prices to new highs since 2014 will lift headline inflation readings. However, rising energy costs also acts as a headwind on consumption (and therefore investment). It comes at a time when economists are increasingly expressing concern about the US economy after the fiscal boost subsides. While former Fed Chief Bernanke has warned of a “cliff” in 2020, many others see a cyclical slowdown by the middle of next year, which helps explain the market’s skepticism of the three rate hikes the median Fed dot plot suggests.

The main drivers of the surge in oil coming from supply considerations. The US has been drawing down its oil inventories and more than the market expected, but the larger driver is coming, at least partly, as a result of US actions. US sanctions on Venezuela coupled with local mismanagement reduces its oil output. Libyan output is compromised by the domestic political turmoil. The US unilaterally withdrew from the nuclear agreement with Iran and is threatening sanctions on countries that buy Iranian oil.

OPEC and non-OPEC countries recent agreed to boost output, but given the spare capacity, it means primarily Saudi Arabia and Russia can provide more oil. Yet the increase appears too small to offset the loss of output. Even with the increased Saudi output, OPEC’s production may remain below the agreed upon quota. Trump tweeted over the weekend that the Saudis agreed to boost output by up to 2 mln barrels a day. Saudi Arabia often is thought to have 1.5-2.0 mln barrels of unused capacity. Saudi Arabia typically boosts output in the summer months as it is one of the few countries that burn oil for electricity (and air conditioning demand increases).

However, Saudi Arabia played down the idea that it made the kind of commitment the US President suggested. Indeed, such an agreement would seem to be tantamount to defecting from OPEC, given the recent agreement, and the tensions between it and Iran. Saudi Arabia is the world’s largest oil producer, but it is not in its national strategic interest to allow prices to climb too much. High oil prices encourage marginal producers, and more importantly, makes alternative energy sources more attractive, which could undermine the value of Saudi’s huge reserves. Trump’s effort to pull Saudi Arabia away from OPEC has as much chance of succeeding as his efforts, reported in the press, to get France’s Macron to leave the EU. Of course, the US has its own strategic reserves it could draw down, and if oil prices continue to rise, this may become more likely.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,newslettersent,OIL,Trade