The window dressing ahead of the end of Q2 failed to signal a turn in sentiment. Equity markets have taken back those gains and more. The US dollar is broadly firmer, though it was coming off its best levels near midday in Europe, and the three-basis-point slippage puts the US 10-year yield at 2.83%, its lowest in more than a month.

Investors are wrestling with the implications of escalating trade tensions. The US tariffs on $34 bln of Chinese imports are to go into effect at the end of the week. The US has threatened to put a 10% tariff on $200 bln of Chinese goods if it retaliates, fans fears to an escalating conflict that is seen as a headwind on the world’s economy. The huge fiscal stimulus in the US is thought to offer some cushion, but after a strong Q2 GDP (NY Fed GDP tracker says 2.8% and the Atlanta Fed GDPNow is at 3.8%), many economists expect the economy to slow.

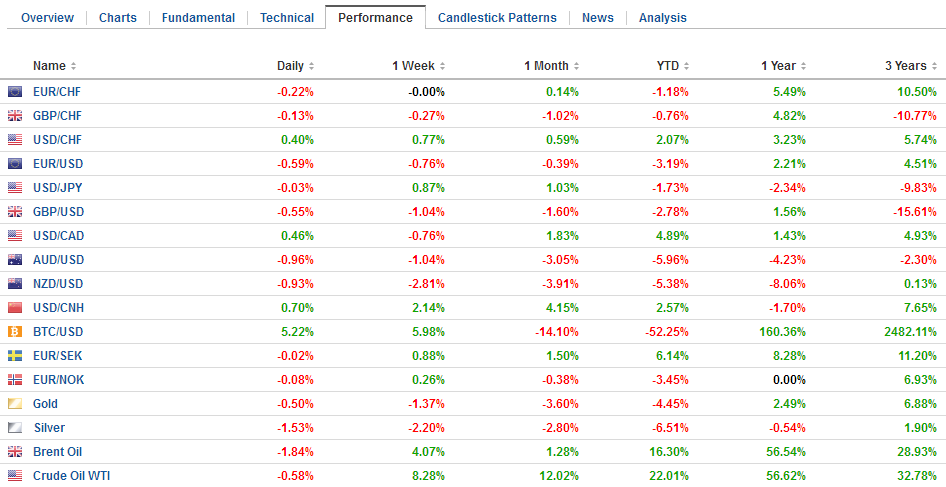

Swiss FrancThe Euro has risen by 0.24% to 1.1545 CHF. |

EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

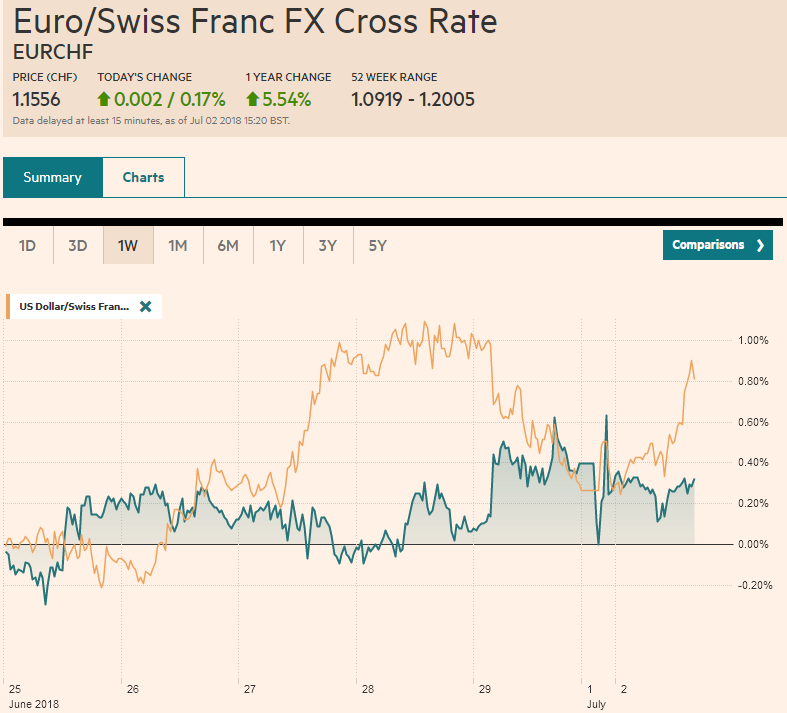

FX RatesEuropean bourses are around 1% lower. The Dow Jones Stoxx 600 also has surrendered its pre-weekend gains. Materials, financials, and energy are leading today’s rout that is sparing no sector. Still, it has thus far held above last week’s lows. The S&P 500 rally fizzled before the weekend, and the benchmark closed on its session lows. It will likely gap lower to retest the support near 2700. A convincing break could target the 2640 area. The US dollar is advancing against all the major currencies. After approaching $1.17, the euro has been steadily slow to nearly $1.1625 by early in the European session. A break of the $1.16 area would signal a retest on the $1.15 area that has offered support. An option struck at $1.16 for around 815 mln euros will be cut today. On the upside, resistance is pegged near $1.1660 now. The dollar traded above JPY111 for the first time since late May. There is an option struck there for $1 bln that expires today. Once the offers are absorbed, the next target is May high near JPY111.40. Note that Tankan survey picked up an expectation for the dollar to average about JPY107.25 in the current fiscal year (so far it has averaged ~JPY109.20). Sterling has given back a bit more than a third of the gains scored in the second half of last week. Initial support now is seen near $1.3130. The nearly GBP1.5 bln of options struck between $1.3095 and $1.3100 could help limit the downside, but there another GBP218 mln struck at $1.3150 at is in play. Last week’s low, which is the low for the year, was set near $1.3050. Elsewhere, the dollar-bloc currencies are off 0.3% to 0.5%. Last week’s oil surge has stalled, even though Libyan port closure is impacting as much as 850k barrels a day. The focus today in on the US pressure on Saudi Arabia to boost output. However, now both the US and Saudi Arabia appear to agree that there was no specific commitment. After the OPEC meeting, the Saudis will boost output but apparently not enough to offset the other supply disruptions. The US unilateral withdrawal from the nuclear agreement with Iran and the full court press to get other countries to cut off oil purchases from Iran is exacerbating the disruption in supplies (from Venezuela and Libya). The US dollar fell 3.5% against the Mexican peso over the past two weeks. Not surprising AMLO easily won yesterday’s election and the dollar is up about 0.4% against the peso today in activity prior to the open of the domestic market. Initial dollar support is seen near MXN19.50 while last week’s high was set near MXN20.24. |

FX Performance, July 02 |

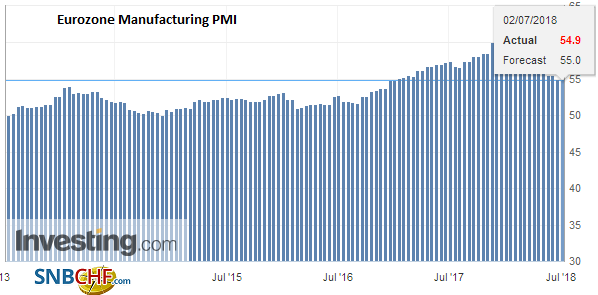

EurozoneThe news stream is light. In addition to trade, investors are watching a couple of developments. EMU’s manufacturing PMI disappointed. The flash PMI of 55.0 is revised down to 54.9. The manufacturing PMI has fallen every month this year. The source of the revision was France. Its manufacturing PMI was revised to 52.5 from 53.1 flash reading and 54.4 in May. It is the weakest since February 2017. Part of France’s negativity was blunted by Italy’s upside surprise (53.3 from 52.7 in May). Separately, Italy reported unemployment fell to 10.7% in May from a revised 11% in April (initially 11.2%). It is the lowest in six years. |

Eurozone Manufacturing PMI, June 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

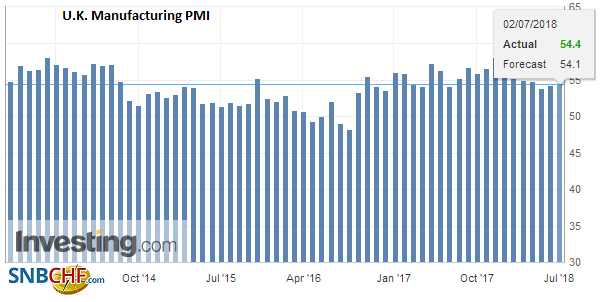

United KingdomSeparately, the UK manufacturing PMI stood at 54.4, which would have been unchanged from May, but it was revised to 54.3. from 54.4. Meanwhile, although the EU Summit struck a compromise on migrants, it was not sufficient to diffuse the German domestic political problem. The CSU faces a challenge by the AfD in Bavaria at the start of Q4. Merkel needs the CSU for her governing coalition. Polls suggest that the German people prefer Merkel’s immigration policies to what the CSU is advocating. The German Interior Minister and CSU leader Seehofer reportedly offered his resignation over the weekend, but negotiations between the Merkel’s CDU and the CSU are apparently continuing. The perceived risk to the German coalition is seen as euro negative. |

U.K. Manufacturing PMI, June 2018(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

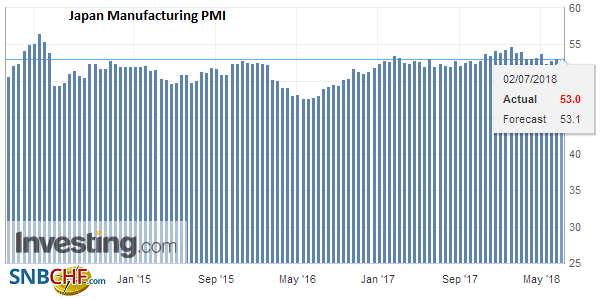

JapanJapan’s Tankan showed a weakness in sentiment for manufacturers, perhaps as a consequence of the trade tensions, while sentiment for the large non-manufacturers fared a bit better. On the other hand, capex plans were ramped up. Capital investment is expected to surge 13.6% after a 2.3% gain was expected in March. It is the large rise in capex since the early 1990s. Separately, Japan reported a slight downward revision in the June manufacturing PMI (53.0 vs.53.1 flash and 52.8 in May) and sharp 7.3% drop in June auto sales. Japan auto sales have fallen on a year-over-year basis every month since last October but April. Although the PBOC set the yuan’s reference rate higher, the market had other ideas. The dollar rose nearly 0.6% today, rising through CNY6.66 today before pulling back a bit in late dealings. The Shanghai Composite, which rallied 2.2% before the weekend, shed 2.5% today. The MSCI Asia Pacific Index fell 1.2%, finished at new lows for the year. Nearly all markets were lower, with over 2% declines recorded in Japan and Korea, in addition to China. |

Japan Manufacturing PMI, June 2018(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CNY,$EUR,$JPY,EUR/CHF and USD/CHF,Eurozone Manufacturing PMI,Japan Manufacturing PMI,MXN,newslettersent,U.K. Manufacturing PMI