A Purely Technical MarketLong time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money. The process of achieving more widespread adoption of these currencies as a means of payment and establishing appropriate (and potentially more stable) exchange rates relative to state-managed fiat currencies is still underway. At present the above mentioned process is still at a very early stage, hence speculative trading remains the dominant activity. Other use cases continue to be developed at a fairly rapid clip and an entire new economic sector surrounding blockchain technology and cryptocurrencies has emerged (currencies remain the major application for blockchain technology for now, but many other possibilities are explored). If and until the next stage is reached, cryptocurrencies are primarily one thing though: exciting trading sardines. It is particularly difficult to determine by what yardsticks to evaluate virtual currencies. Similar to gold, they have no P/E ratio, so to speak (gold at least has a lease rate though). Some people argue that one should compare the market cap of BTC to that of the outstanding supply of US dollars to arrive at a long term target for the exchange rate. We don’t believe it is that simple – and whether such comparisons make even a modicum of sense depends on the still uncertain prospect of BTC indeed becoming a general medium of exchange one day. Moreover, as we noted above with respect to the BCH fork, there is e.g. no good reason why BCH should trade at a large discount to BTC (it would actually seem to make more sense if it were the other way around). There is no rational explanation for the valuation gap, except for the first mover advantage argument. Obviously this is not something that can be quantified. Our point is that these markets are driven almost exclusively by psychological factors. In other words, they are purely technical markets. The only things worth analyzing are technical indicators and market sentiment. The latter can only be done via anecdotal evidence, as quantitative positioning indicators that could be used for this purpose don’t exist as of yet (note that inter alia no commercial hedgers are active in CBOE BTC futures). We don’t regard that as a problem; trading exclusively on technical signals is perfectly fine with us. Of course, traders had it very easy when the bull market – or bubble if you prefer – was still going strong. One could not make any fatal mistakes by buying during this time period, since all timing mishaps were eventually “bailed out” by the market. This is no longer the case now that the most recent bubble iteration has burst. Timing has become rather important if one wants to make money as a trader. Despite overarching bear market conditions the crypto markets remain attractive for traders though, as very high volatility in both directions continues to persist. |

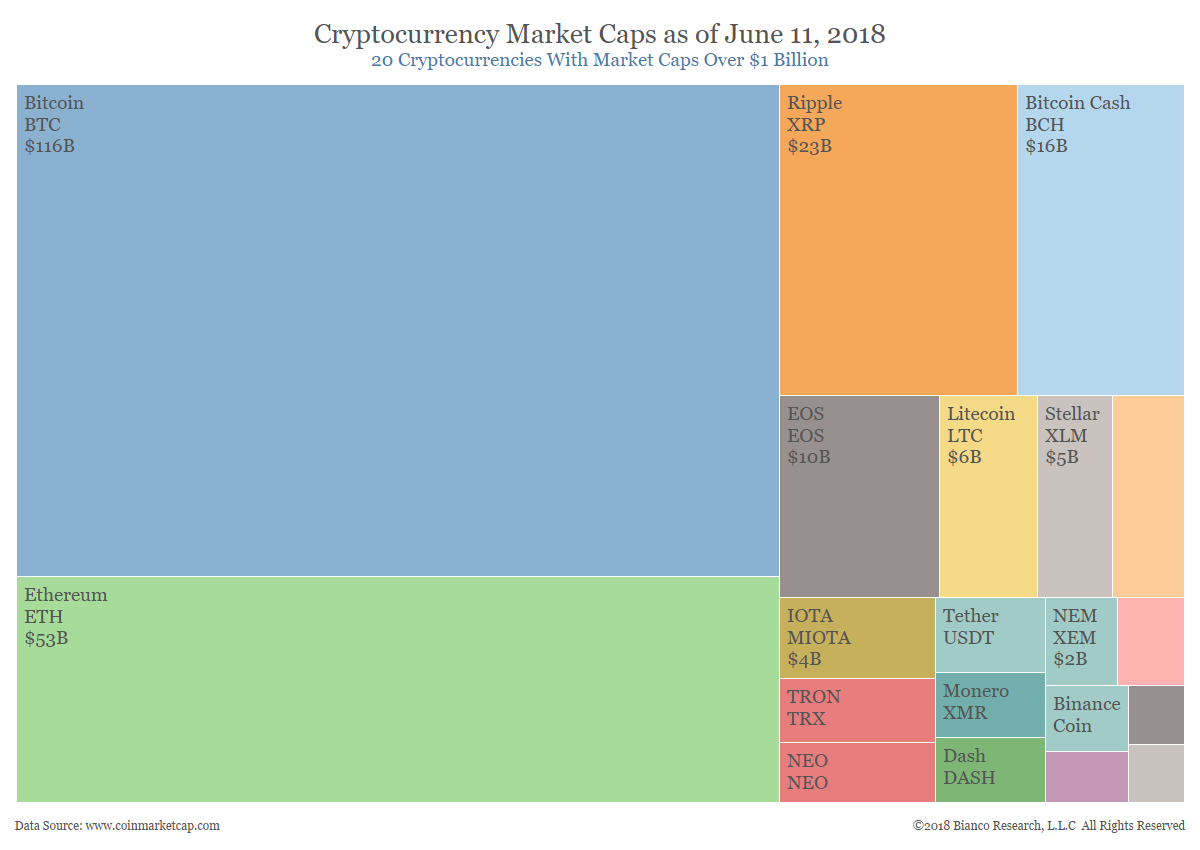

Cryptocurrency Market Cap, June 11 A snapshot of cryptocurrency market caps as of June 12 – they made local lows two trading days later. - Click to enlarge After the small rebound since then, market caps are now slightly higher than those shown on this map, but it is still roughly in the right ballpark. Note: XRP has the third highest market cap, but we do not regard it as a true “cryptocurrency”. It is not a decentralized currency at all, it is a token under control of the company that issued it (it can be traded though and for a while there was a big burst of speculative demand for it, oddly enough mainly from South Korea). Bitcoin Cash (BCH) is the most important fork from the original BTC blockchain and in our opinion the better Bitcoin. It has a much larger block size, avoiding the scaling problems BTC encountered late last year (which were associated with long waiting times for transactions and soaring fees). BTC still enjoys a first mover advantage and trades at a far higher level as a result. There is no logical reason why it should, but that is a topic for another occasion. |

Watching out for DivergencesIn order to gauge extremes in market sentiment, it is worth following the headlines of articles on market action and the associated comment sections on major cryptocurrency-focused web sites. Short term lows tend to be close when the frequency with which absurd upside targets are pronounced by assorted “experts” and/or fund managers talking their books subsides and headlines mentioning downside targets begin to appear. At the same time negative sentiment expressed in comment sections needs to be palpable. At that point it is usually worth looking closely at the charts. Consider the chart below, which compares BTC, the leading cryptocurrency (which all the others tend to follow) with BCH and LTC (Litecoin, one of the earliest BTC competitors) during the recent bear market period (note: this snapshot was made a few hours before publication of this article). |

BTC, BCH, LTC daily Comparison We recently discussed divergences in the gold sector. A similar analysis can be applied to cryptocurrencies. - Click to enlarge Since selling off from its December 2017 peak, BTC has put in three short term lows. Both BCH and LTC have diverged at the second and third low. On occasion of the second low, BCH put in a lower low vs. a higher low in BTC and LTC, and on occasion of the recent third low it put in a higher low vs. both, while LTC put in a lower low relative to the first low. This creates a low risk buying opportunity, as the recent lows can be used as stops. |

| We should mention that ETH diverged from BTC as well, with the divergences mimicking the ones seen in BCH:

During the bull market phase daily trading volume was a fairly reliable indicator helping to pinpoint short term correction lows. As a rule of thumb, one simply had to wait for reversal candles to appear that were accompanied by extremely high trading volume. Often these reversals were immediately followed by a resumption of the rally, sometimes the initial correction lows were retested on lower volume first. In any case, it was easy. However, in the bear market phase trading volume has experienced a steady downtrend and on daily charts one struggles a bit to identify any remarkable stand-outs (occasionally they still appear, such as in LTC in April at the beginning of the last short term rally). It is still worth watching volume, but one has to do it in a different time frame. |

ETH Daily Jan - Jun 2018 |

| The chart below shows a snapshot of BTC and BCH hourly charts taken earlier today. As these charts illustrate, panic selling waves, lows and subsequent upturns still tend to be associated with strong expansions in short term trading volume. Reversal candles so to speak “gain credibility” when they occur in conjunction with strong trading volume – this makes it more likely that a short term trend change has indeed occurred.

White For Desktop Wallpaper – www.walldes-download.com |

BTC and BCH hourly |

Caveat EmptorIf one looks at a longer term chart of BTC, it is immediately obvious that there are several important lateral support levels situated well below current levels – the next ones are two former resistance points that later became support, at $5,000 and $3,000. Given the inherent difficulty of evaluating these currencies and the large size of previous corrections, it is definitely possible that one or both of these levels will be seen again. Despite this caveat, it seems to us it is worth taking low-risk trading opportunities when they appear. “Low risk” in this case means: risk can be strictly defined by recent lows which are not too far off current levels and can be used as stops. As long as these lows hold, a sizable rally is possible, or rather probable. If these lows are violated and a stop-loss is triggered, one takes a small loss and waits for the next opportunity to emerge (the first of the above mentioned longer term support levels will become a likely target in that case). If a rally develops, the initial stop has to be changed into a trailing stop that takes into account that considerable short term volatility will accompany an upside move as well. If divergences such as those discussed above become manifest in the course of a rally (which happened prominently in December 2017 – January 2018 between BTC, ETH, XRP and a few other “alt coins”), it is advisable to immediately tighten trailing stops. Why is it worth it? Consider the rally from the April low: BCH had the best news flow during this rally and more than tripled in price in about six weeks. That is nothing to sneeze at, even if it was “just” a bear market rally.

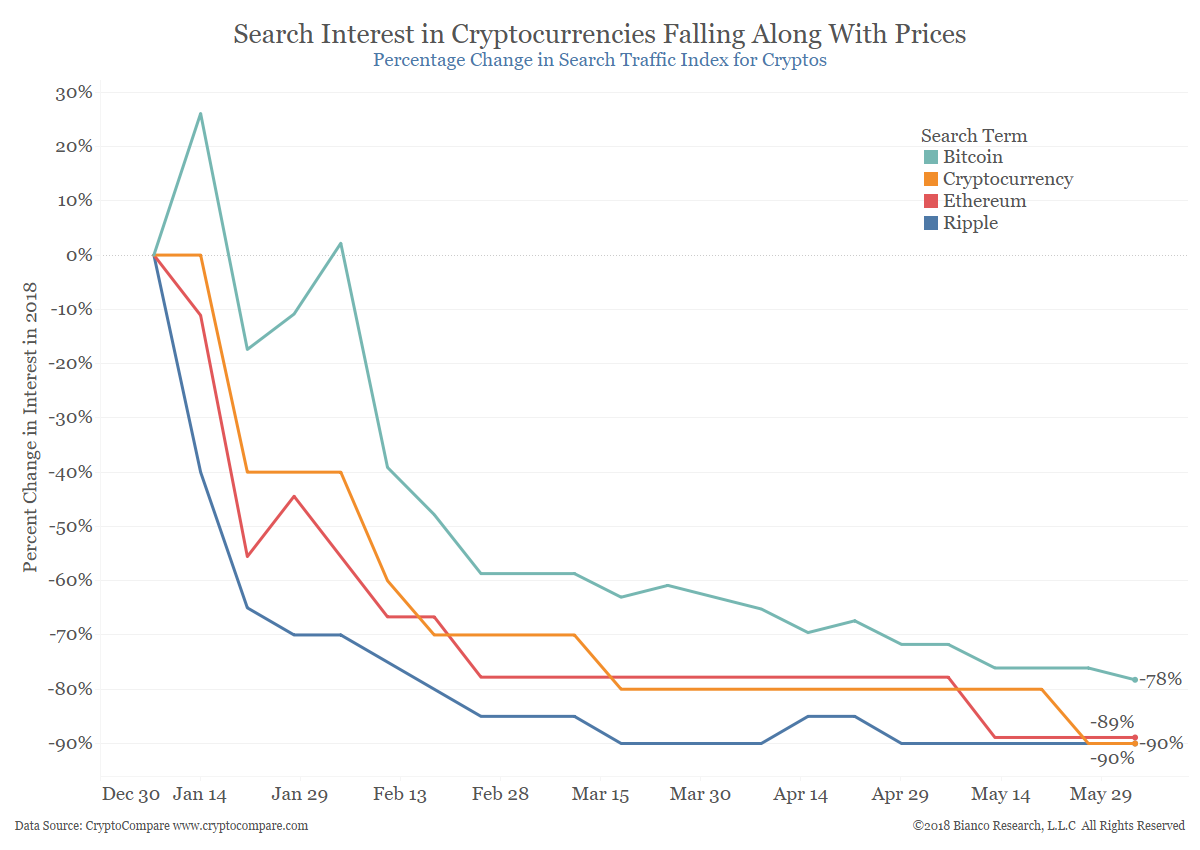

A Long Term Sentiment IndicatorLastly, here is one more sentiment indicator suggested in a recent article by Bianco Research on the May-June sell-off (requires registration). This strikes us as a longer term indicator, i.e., it is probably not very useful for short term timing purposes, but it seems definitely worth checking it out from time to time – namely Google search trends related to cryptocurrencies. Not surprisingly, the indicator is largely a function of price trends. |

Google Search for Cryptocurrencies Google search traffic indexes for the market cap leaders BTC, ETH and XRP and “cryptocurrency” generically. As prices have declined, so have searches. How useful this is as a contrarian indicator remains to be seen, but we suspect it is probably of medium to long term significance. - Click to enlarge |

Charts by: Bianco Research, cryptowatch

Full story here Are you the author? Previous post See more for Next post

Tags: Chart Update,Crypto - Currencies,newslettersent