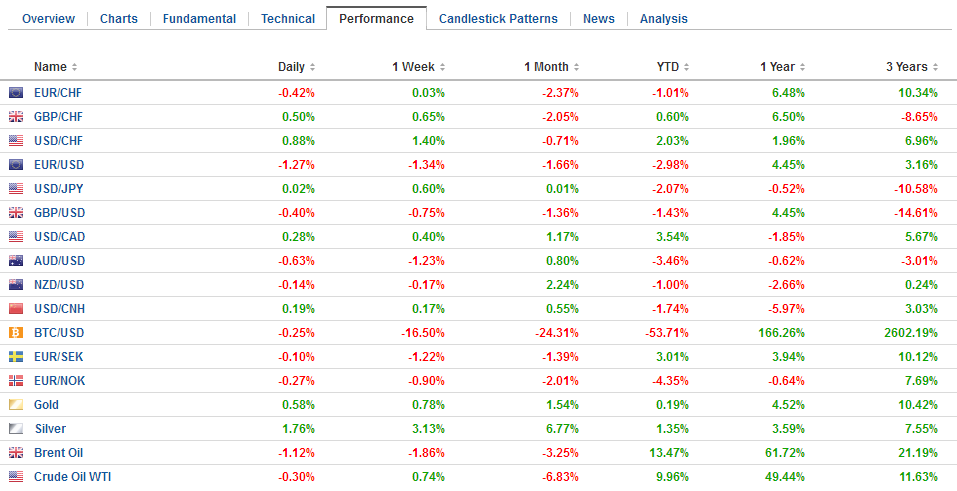

Swiss FrancThe Euro has fallen by 0.43% to 1.1568 CHF. |

EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

| The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy, and the signal of hikes in September and December, foretold today’s push lower. Not only does the ECB meeting lies ahead, but trade tensions are set to escalate. Consider that the US seems intent on making Americans pay 25% more for $50 bln of Chinese imports in retaliation for intellectual property rights violations. China wants American consumers to have access to their cheap imports and has threatened to retract the concessions it has made if the US goes forward.There are a number of other events and developments demanding investors’ attention. Let’s sum these up and point to market and policy impacts.Reserve Bank of Australia has underscored the importance of the labor market in its economic outlook and today’s employment report does nothing to suggest it will move off neutral any time soon. The 12k increase in jobs is a function of part-time employment. Full-time positions fell by 20.6k, which gives back the lion’s share of the 28k created in April (revised from nearly 33k). The participation rate slipped to 65.5% from 65.6%, which accounts for some of the decline in the unemployment rate (5.4% vs. 5.6%). The Australian dollar is the only major currency that is unable to rise against the US dollar so far today. It is trading within yesterday’s ranges.First, the BOJ reduced the amount of 3-5 year government bonds by JPY30 bln to JPY300 bln. It is the second reduction of bond buying this month. The lack of market reaction indicates that investors have taken on board the BOJ’s message that there is no policy implication to these operational adjustments. The actions are dependent on market conditions. There is no doubt that the BOJ will leave policy on hold when its meeting concludes tomorrow. Its current inflation forecast is above market expectations, and there is a reasonably good chance that the BOJ forecasts are pared (closer to 1%). The dollar peaked yesterday near JPY110.85 but fell to a three-day low a little below JPY110.00. A break of JPY109.80 would suggest scope for another big figure decline. There are chunky options that expire today: JPY109.50-JPY109.65 (~$870 mln), JPY109.90-JPY110.00 ($2 bln) and JPY110.50 ($820 mln). |

FX Performance, June 14 |

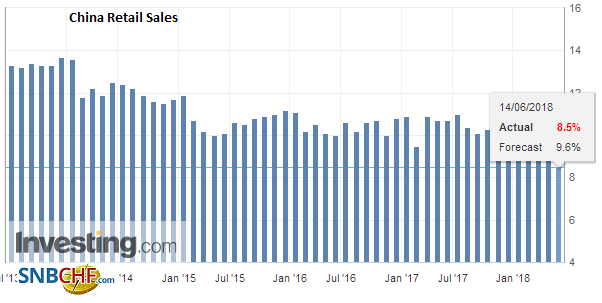

ChinaSecond, the past two Fed hikes saw the PBOC hike rates a token five basis points. Not today. Shortly after passing, the reason may have become clear. China reported a series of economic reports suggesting a cooling spring wind. Retail sales fell to 8.5% from 9.4%. Economists had expected an increase. Industrial output growth slowed to 6.8% from 7.0%. Fixed investment rose 6.1% from a year ago. Economists expected an unchanged pace of 7.0%. Earlier this week China reported what appears to be a sharp slowdown in shadow banking activity. Good demand is still being seen for mainland shares through the HK-connect, and the dollar is trading slightly heavier against the yuan. It had finished last week near CNY6.4070 and is now near CNY6.3920. |

China Retail Sales YoY, May 2018(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

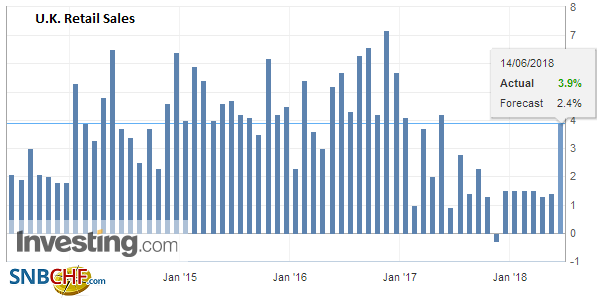

United KingdomBefore turning to the ECB meeting, let’s look at the UK. A strong retail sales report and poor dollar tone overshadow the Brexit morass to lift sterling. It is the strongest of the major, gaining about 0.5% and above 1.4 cents above yesterday’s low. The $1.35 area is the next target, and there is a GBP1.2 bln option that expires there today. May retail sales jumped 1.3%. The economists were forecasting a big pullback after the April surge (1.4% excluding petrol). The post-hoc explanation is the better weather and the wedding effect. We continue to think an August BOE rate hike is the most likely scenario. Brexit remains a mess. The UK government is negotiating with itself and what comes out seems unacceptable to the EC. That said, there does appear to some beams of light in the Irish border issue, and Ireland indicates that it will not seek block broader talks if no agreement is reached at the EU summit later this month. |

U.K. Retail Sales YoY, May 2018(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

Eurozone

The ECB meeting may very well prove anti-climactic.The euro has rallied smartly after finding support near $1.1725 yesterday post-Fed to make a five-day high a little below $1.1830. Last week’s high is found at $1.1840. There is a $1.1850 option that expires today for ~550 mln euros. There is a strong consensus of what the ECB will do and stay. Do nothing. It is expected to say that the staff has revised up the CPI forecasts (the euro is weaker, and oil is higher than anticipated in March). It is expected to indicate that its purchases will not stop suddenly in September and that it will taper further in Q4. It may not pre-commit to stopping completely in December, but that would be the clear indication.

The risk is that many put too much emphasis on the reduced bond buying as a sign of normalization. The ECB’s extraordinary policies are much broader than just QE. Its deposit rate is minus 40 bp. It is not going to raise this until at least the middle of next year. And when it does lift it, it is still not going to be at zero for at least several months after that. Even with conservative assumptions, this is unlikely to happen until the end of 2019 or the first part of 2020.

Like others, we too question the extent of the tightening the Fed signaled. However more hikes are coming, and this means that peak divergence still lies ahead. Previously the Fed was criticized for hubris. Yesterday Powell confirmed that the Fed is operating with a high degree of uncertainty about some key theoretical issues that underpin the policy edifice, like full-employment and r-star. Many don’t like that either. But more generally, the market appears to see the risk of a policy mistake. The pricing in the derivatives market suggests that the Fed funds may peak in the middle of next year.

Given the Fed’s move and the ECB press conference, the US retail sales will be of greater interest to economists than investors. For the record though another reasonable strong report, where the GDP components likely rose around 0.4%, which is twice the Q1 average.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CNY,$EUR,China Retail Sales,EUR/CHF and USD/CHF,newslettersent,U.K. Retail Sales