The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today.

The question is not so much about the next meeting in August. The Fed has only hiked rates at meetings that a press conference follows. This is the source of one of our persistent criticisms of the pattern became obvious nearly as soon as the normalization cycle began in December 2015. We have advocated a press conference after every meeting, but not for the sake of transparency, and not simply because that is the bar set by the ECB and BOJ. We largely argued on operational grounds. It would maximize policymakers’ degrees of freedom. Since Powell became Chair, there has been inside talk that this would be considered. The Wall Street Journal reported yesterday that this was indeed on the table.

The dollar traded higher when the news broke ostensibly on ideas that this would increase the scope for Fed hikes. But of course, the pace of Fed tightening is not really determined by the frequency of press conferences. We would suggest that the increased uncertainty of the timing of FOMC hikes is worth a bump in and of itself.

There are a few issues that are particularly salient. First and foremost is the number of hikes the Fed anticipates delivering. Although officials caution against coming up with a Fed view based on the summation of the individual member’s views, investors have little choice. For the median forecast to move to four hikes this year (two in H2), only one member has to shift their vote. It is that close. Failing to do so would be seen by some as a dovish hike, though the Fed funds futures strip does not show the market is convinced of an accelerated pace.

Second is the pace of tightening next year. The median dot plot suggests three hikes will be appropriate next year. This is important in its own right but also regarding the yield curve. The Fed itself seems split, with most of the regional presidents appearing more concerned about the risks of an inversion of the yield curve than the Board of Governors. While the yield curve is understood to be a robust, forward-looking indicator, there are some factors that may be distorting it. For example, a large amount of negative yielding bonds coupled with the ECB and BOJ are still buying their bonds, there may be a “natural” demand for US Treasuries. The increase in the short-end may not simply be the result of Fed hikes. The Treasury’s debt management has also favored the shorter end of the curve.

The third is what has become a fashionable argument: Given the large fiscal stimulus, the Fed should either slow down its hikes or slow the unwind of its balance sheet. That is to say, in the face of the fiscal stimulus the Fed should tighten less. This seems to turn economic logic on its head, though several distinguished people have put forth this argument. With fiscal stimulus hitting an economy that is already growing above trend and near full employment, tightening monetary policy seems quite orthodox, and not “financial suicide.” Recall it is the policy mix of the Reagan-Volcker years and the policy mix that German pursued on reunification. That policy mix tends to be supportive of a currency.

Global factors are important to the Fed. It is explicitly a variable in its policy-making equation. What happens in rest of the world can and does impact the US economy and the Fed’s ability to achieve its mandates. Fed tightening cycles often coincide with pressure on other countries, and especially with a set of macroeconomic conditions that make them vulnerable to a turn in the cycle, such as substantial current account deficits or reliance on dollar borrowing. Other countries that may be vulnerable are those in which the investment climate may not be particularly friendly, but the abundance of liquidity lifts all boats.

The FOMC meeting is followed by the ECB meeting tomorrow. The ECB is expected to provide some verbal cues that it will taper in Q4 with an eye toward stopping at year end. However, Draghi will likely be at pains to say that other elements of the extraordinary monetary policy will continue well past the end of the purchases. We continue to pencil in the first hike around the middle of next year.

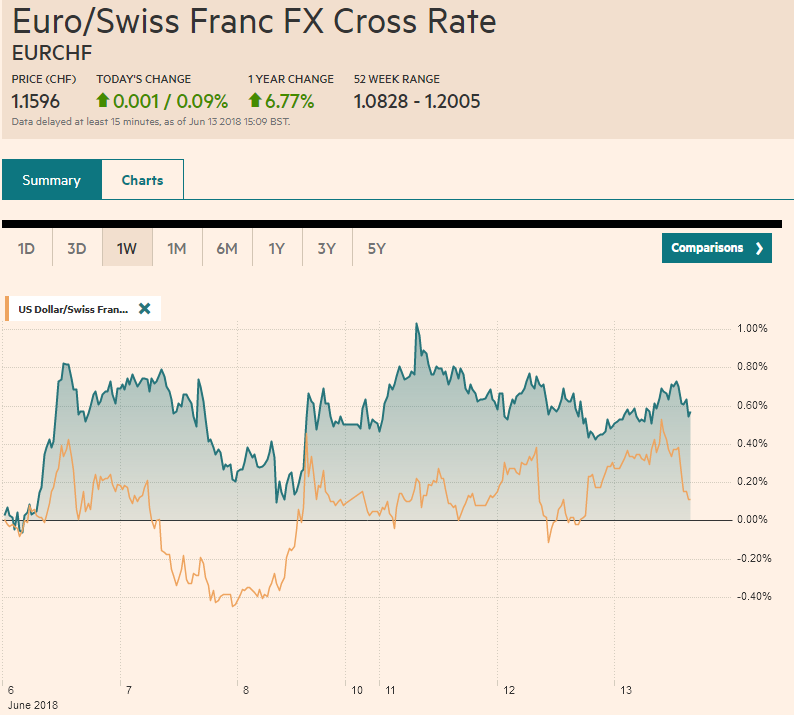

Swiss FrancThe Euro has risen by 0.09% to 1.1596 CHF. |

EUR/CHF and USD/CHF, June 13(see more posts on EUR/CHF and USD/CHF, ) |

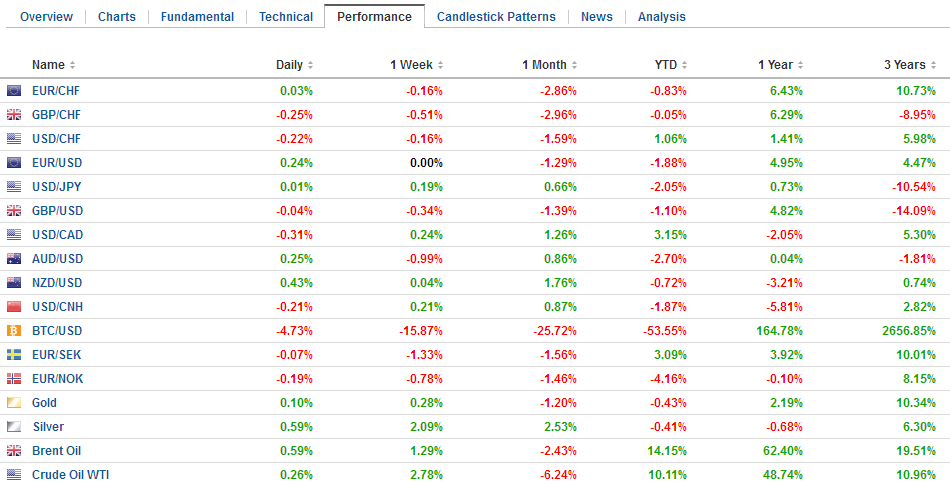

FX PerformanceA little above $1.33 is the 61.8% retracement objective of sterling’s bounce since the May 29 low near $1.32. There is a GBP200 mln option expiring there today as well. A break suggests the correction high is in place, and sterling can continue toward $1.30-$1.31 to complete the old double top (~$1.44) pattern. The euro has been stuck in about a quarter-cent range near yesterday’s lows. Support is seen in $1.1700-$1.1720. The support will be reinforced by the expiry of 3.3 bln euros in options struck between $1.1700 and $1.1705. On the top side, there is a $1.1750 option for 500 mln euros, another at $1.1725 is for one billion euros. The dollar’s gains against the yen have been extended to a little more than JPY110.70. It is the highest level since May 23. The neckline of a possible head and shoulders bottom has been overcome, and the measuring objective is near JPY112. First, it must overcome last month’s high of JPY111.40. The BOJ meeting concludes Friday. We suspect that the BOJ may cut its inflation forecast, but otherwise keep policy intact. |

FX Performance, June 13 |

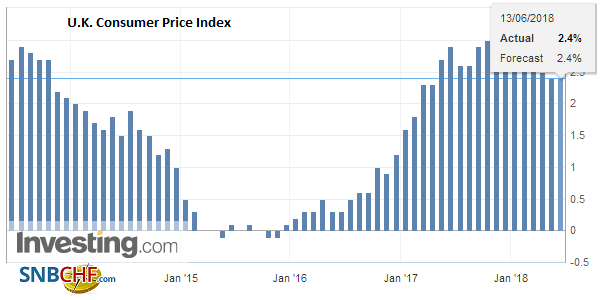

United KingdomThe UK’s inflation was in line with expectations, with CPIH rising 2.3% year-over-year, up from 2.2% in April. The core rate was steady at 2.1%. Producers saw higher input prices (2.8% month-over-month, 9.2% year-over-year) and a much smaller price in output prices (0.4% and 2.9% respectively). If this is sustained, it may warn of a profit-squeeze. Sterling has remained under pressure. The focus may not be so much on the inflation readings as the debate in the House of Commons. The Prime Minister made additional compromises yesterday modify the Withdrawal Bill to prevent more government’s strategy from unraveling. However, the more May compromises, the more likely there is a rebellion within her cabinet, which takes a harder line. And of course, after negotiating with itself, the UK has to negotiate with the EC. What is too much for May’s cabinet may be too little for the EC. |

U.K. Consumer Price Index (CPI) YoY, May 2018(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF and USD/CHF,FOMC,newslettersent,U.K. Consumer Price Index