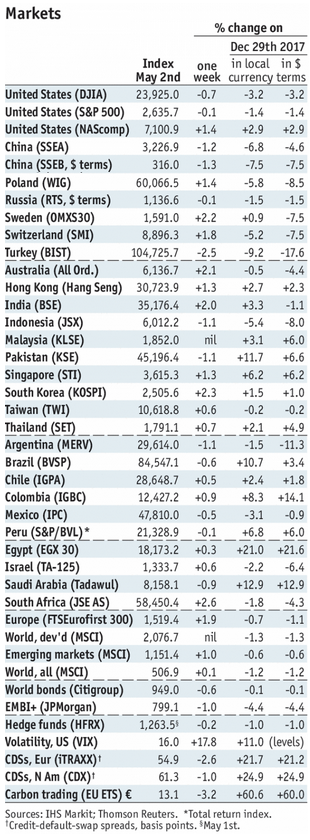

Stock MarketsEM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure. |

Stock Markets Emerging Markets, May 08 |

IndonesiaIndonesia reports Q1 GDP Monday, with growth expected to remain steady at 5.2% y/y. Price pressures remain low, but the weak rupiah is likely to push Bank Indonesia into a more hawkish stance this year. Next policy meeting is May 17, and rates are likely to be kept steady at 4.25%. Czech RepublicCzech Republic reports March construction and industrial output as well as retail sales Monday. It then reports April CPI Thursday, which is expected to rise 1.8% y/y vs. 1.7% in March. If so, it would remain in the bottom half of the 1-3% target range. The central bank tilted more dovish at its last meeting, suggesting the next hike won’t be seen until the end of the year. TaiwanTaiwan reports April trade Monday. Exports are expected to rise 13.5% y/y while imports are expected to rise 7.6% y/y. It then reports April CPI Tuesday, which is expected to rise 1.75% y/y vs. 1.57% in March. The central bank does not have an explicit inflation target, and we believe rates will be kept steady this year. ColombiaColombia central bank releases its minutes Monday. At that meeting, the bank cut rates 25 bp to 4.25%. CPI rose 3.1% y/y in April, near the middle of the 2-4% target range. With the economy sluggish, we think the easing cycle will continue. The bank has been cutting rates every other meeting, and so we expect steady rates at the June 29 meeting. March trade data will be reported Friday. ChinaChina reports April trade Tuesday. Exports are expected to rise 7% y/y and imports by 16% y/y. It then reports April CPI and PPI Thursday. The former is expected to rise 1.9% y/y and the latter by 3.4% y/y. The central bank does not have an explicit inflation target. However, low price pressures should keep the bank on hold this year. HungaryHungary reports March IP Tuesday, which is expected to rise 3% y/y WDA vs. 4.1% in February. Central bank minutes will also be released Tuesday. It then reports April CPI Wednesday, which is expected to rise 2.3% y/y vs. 2.0% in March. If so, inflation would remain near the bottom of the 2-4% target range. March trade will be reported Thursday. ChileChile reports April CPI Wednesday, which is expected to rise 1.7% y/y vs. 1.8% in March. If so, inflation would remain below the 2-4% target range. The central bank has signaled that the easing cycle is over. However, low price pressures would allow it to resume cutting if the economy slows significantly. MexicoMexico reports April CPI Wednesday, which is expected to rise 4.59% y/y vs. 5.04% in March. If so, it would be the lowest since December 2016 but still above the 2-4% target range. We see steady rates for now. However, if peso weakness picks up ahead of the July elections, Banco de Mexico may have to hike again. Next policy meeting is May 17, no change expected then. March IP will be reported Friday, which is expected at -3.6% y/y vs. +0.7% in February. MalaysiaBank Negara meets Thursday and is expected to keep rates steady at 3.25%. CPI rose 1.3% y/y in March, the lowest since July 2016. The central bank does not have an explicit inflation target. However, low price pressures should allow it to remain on hold for much of this year. Earlier that day, Malaysia reports March IP and manufacturing sales. PhilippinesThe Philippines reports March trade Wednesday. The central bank then meets Thursday and is expected to hike rates 25 bp to 3.25%. CPI rose 4.5% y/y in April, well above the 2-4% target range. Earlier that day, the Philippines reports Q1 GDP, which is expected to grow 6.8% y/y vs. a revised 6.5% (was 6.6%) in Q4. South AfricaSouth Africa reports March manufacturing production Thursday, which is expected to rise 1.0% y/y vs. 0.6% in February. The economy remains sluggish, even as inflation remains low. CPI rose 3.8% y/y in March, near the bottom of the 3-6% target range. Next SARB meeting is May 24, and much will depend on how the rand is trading then. BrazilBrazil reports April IPCA inflation Thursday, which is expected to rise 2.81% y/y vs. 2.68% in March. If so, inflation would remain near the bottom of the 2.5-6.5% target range. March retail sales will be reported Friday, and are expected to rise 5.3% y/y vs. 1.3% in February. PeruPeru central bank meets Thursday and is expected to keep rates steady at 2.75%. CPI rose only 0.5% y/y in April, which is well below the 1-3% target range. The bank has been cutting rates every other meeting recently and so we see a chance of a dovish surprise since it last cut rates in May. If not, then a cut is very likely on June 7. RussiaRussia reports March trade Friday. Higher oil price should boost exports, but the weak ruble remains a concern. As such, we think the easing cycle is over and that the next move is likely to be a hike. Next policy meeting is June 15, and much will depend on how the ruble is trading then. |

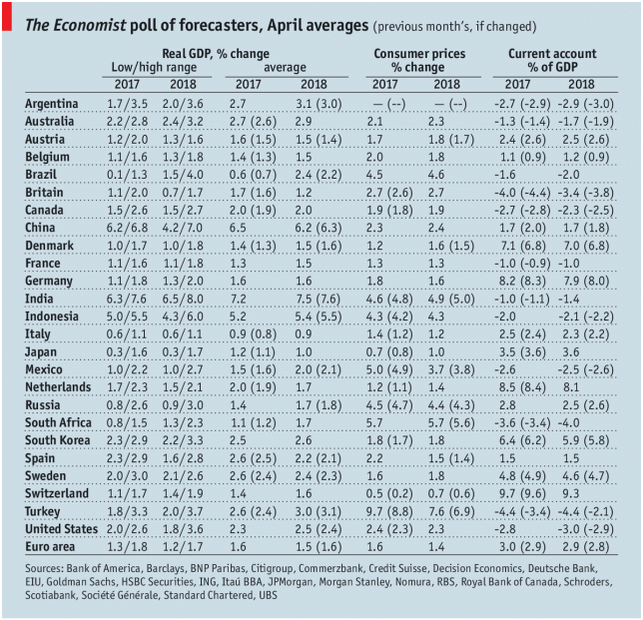

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Chile,China,Colombia,Czech Republic,Emerging Markets,Hungary,Indonesia,Malaysia,Mexico,newslettersent,Peru,Philippines,Russia,South Africa,Taiwan,win-thin