Tag Archive: Hungary

Greenback Catches a Bid

Overview: The dollar has caught a bid ahead of the US retail sales and industrial production figures. It is higher against all the G10 currencies but the Swiss franc. The SNB meets Thursday. It surprised many by cutting rates in March and the same logic (low inflation, move ahead of the ECB, stronger franc) may apply now. A hawkish hold by the Reserve Bank of Australia has not done much for the Australian dollar, which is little changed on the day....

Read More »

Read More »

Consolidation Featured Ahead of Tomorrow’s US Retail Sales and Friday’s Japanese Wage News

Overview: We came into this week expecting the dollar to rise on the back of a recovery in rates. The two-year note has risen from 4.40% after the jobs report to 4.60%. The dollar's rise has

been less impressive.

Read More »

Read More »

Neither the Threat of Intervention Nor a Possible US Government Shutdown is Derailing the Greenback

Overview: The US dollar is stabilizing a bit but

only after extending its gains initially It reached almost JPY149.20, while the

euro slipped to $1.0570 before recovering to straddle $1.06 in the European

morning. Sterling sank a little through $1.2170 but stabilized to return to

almost $1.2200. The Australian dollar tested last week's low slightly below

$0.6390 before resurfacing above $0.6400. The US dollar toyed with CAD1.3500,

where there is a...

Read More »

Read More »

Yen and Yuan Fall to New Lows for the Year

Overview: Some creeping optimism about the US

debt ceiling, easing of pressure on bank shares, and a continued rise in US

rates helped the dollar extend its recent recovery. Over the past two weeks or so,

the US 2-year premium has risen 25-30 bp against Germany and nearly 25 bp

against the UK. The 10-year US Treasury has risen from the lower end of its

seven-month range (~3.30%) earlier this month to approach the upper end of the

range that has...

Read More »

Read More »

US CPI ahead of FOMC Outcome Tomorrow

Overview: The dollar

softer against the G10 currencies ahead of today’s CPI report and the FOMC meeting

the concludes tomorrow. Emerging market currencies are most mixed. The

Hungarian forint leads the complex with around a 1% gain on news of a

preliminary deal struck with the EU. The South African rand is the worst

performer, off around 0.8%, as impeachment proceedings against Ramaphosa

proceed. Global equities are mostly higher today after the...

Read More »

Read More »

Sterling and UK Debt Market Respond Favorably to the Return of Orthodoxy

Overview: The markets have returned from the weekend with a greater appetite for risk. Equities and bonds are rallying, and the dollar is better offered. China, Hong Kong, South Korea, and Indian bourses advanced. Mainland shares edged higher even though Zhengzhou, a city of one million people, near an iPhone manufacturing hub was locked down due to Covid. Europe’s Stoxx 600 is up nearly 0.5% to extend its recovery into a third session.

Read More »

Read More »

Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings.

Read More »

Read More »

Johnson Resigns, but Still not Clear if He Controls the Timing

Overview: The resignation of a UK prime minister makes for high political drama, but the markets hardly moved on it. Sterling, like most of the major currencies, are recovering against the dollar today.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

Russia’s Military Action Shakes Markets

Overview: News that the separatists were calling on Moscow for military assistance began the risk-off move, and Russia hitting targets across Ukraine has rippled across the capital markets. Equites have been upended. Most bourses in the Asia Pacific region were off 2%-3%, while the Stoxx 600 in Europe gapped lower and is off around 3.5% in late morning dealings.

Read More »

Read More »

No Turnaround Tuesday for Equities?

Overview: Activity in the capital markets is subdued today, ahead of tomorrow's FOMC meeting conclusion and the ECB meeting on Thursday. The MSCI Asia Pacific equity index fell for the third consecutive session. European bourses are heavy after the Stoxx 600 posted an outside down day yesterday. Today would be the fifth consecutive decline. Selling pressure on the US futures indices continues after yesterday's losses. Australia and New Zealand...

Read More »

Read More »

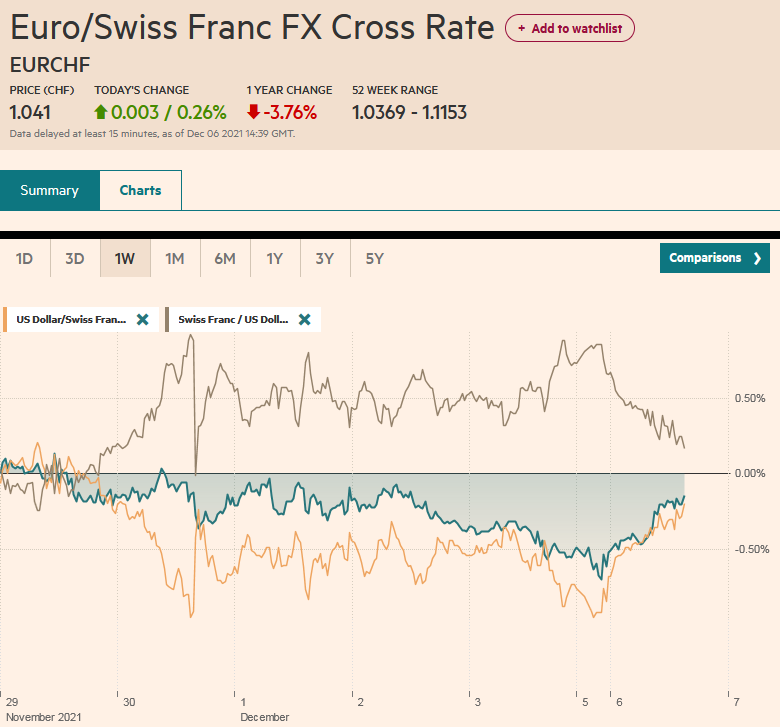

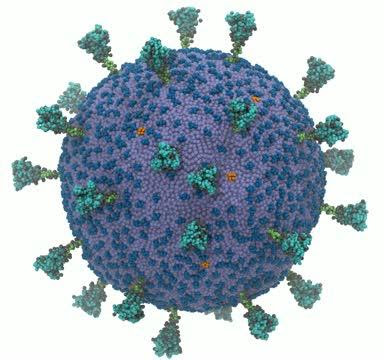

Animal Spirits Roar Back

Overview: A return of risk appetites can be seen through the capital markets today, arguably encouraged by ideas that Omicron is manageable and China's stimulus. Led by Hong Kong and Japan, the MSCI Asia Pacific rose by the most in three months, while Europe's Stoxx 600 gapped higher, leaving a potentially bullish island bottom in its wake. US futures point to a gap higher opening when the local session begins. The bond market is taking it in...

Read More »

Read More »

FX Daily, December 6: Semblance of Stability Returns though Geopolitical Tensions Rise

The absence of negative developments surrounding Omicron over the weekend appears to be helping markets stabilize today after the dramatic moves at the end of last week. Asia Pacific equities traded heavily, and among the large markets, only South Korea and Australia escaped unscathed today.

Read More »

Read More »

Covid Strikes Back

Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and...

Read More »

Read More »

Euro Bounces Back, but the Turkish Lira Remains Unloved

Overview: The US dollar's sharp upside momentum stalled yesterday near JPY115 and after the euro met (and surpassed) a key retracement level slightly below $1.1300. Led by the Antipodean currencies today, the greenback is mostly trading with a heavier bias. Among the majors, helped by a steadying of US yields, the yen is soft. In the emerging market space, the Turkish lira continues its headlong plunge while the yuan softened and the Mexican...

Read More »

Read More »

Dollar Slumps

Overview: While equities and bonds are firmer, it is the dollar's sell-off that stands out today. The greenback has retreated broadly.

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

FX Daily, June 22: Turn Around Tuesday or Dollar Rally Resumes?

Firming long-term US yields have lent the dollar support after trading heavily yesterday. The greenback is around 0.15%-0.50% higher against the major currencies. The Japanese yen and Canadian dollar are among the more resilient, and the Australian dollar and sterling among the heaviest.

Read More »

Read More »

FX Daily, May 26: RBNZ Joins the Queue, while Yuan’s Advance Continues

The decline in US rates and the doves at the ECB pushing back against the need to reduce bond purchases next month have seen European bond yields unwind most of this month's gain. The inability of US shares to hold on to early gains yesterday did not deter the Asia Pacific and European equities from trading higher.

Read More »

Read More »