A Truism that is Demonstrably TrueMost people are probably aware of the adage “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken in this context particularly with respect to US stock markets, and they confirm that the stock market on average exhibits relative weakness in the summer. What is the status of the “sell in May” rule in other countries though? I have examined the patterns in the eleven most important stock markets in the world. |

The Eleven Largest Markets in the World Under the Seasonal Microscope

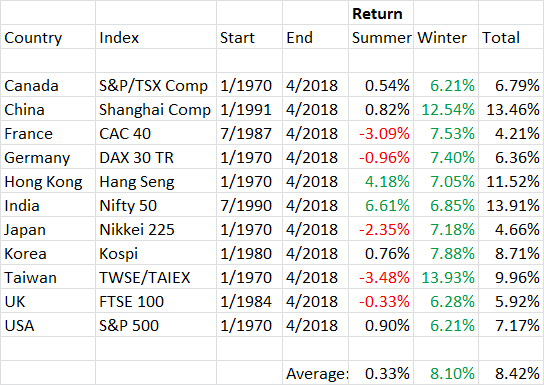

I have taken a look at the popular benchmark stock indexes of the eleven countries with the largest market capitalization from 1970 onward, or starting from the earliest year from which continuous price data are available.

The comparison divides the calendar year into a summer half-year from May to October and a winter half-year from November to April. The position is assumed to be closed out on the first trading day of the following month. In the respective half-year in which no position in stocks is taken, a cash position that earns no interest is assumed to be held, so as to avoid any distortions of the stock market’s seasonal returns by including interest income.

This much I will say in advance: The results are clear, in all eleven countries the winter half-year outperformed the summer half-year significantly. In five of these eleven countries one would actually have lost money during the summer half-year on average! These countries are:

- France

- Germany

- Japan

- Taiwan

- United Kingdom

In other words, in these countries it would have been definitely better to go on vacation in the summer months – or to invest elsewhere.

Detailed Results by CountryThe following table shows the half-year results of the eleven countries in detail. Half-year periods in which it was profitable to be invested on a risk-adjusted basis are highlighted in green. Half-year periods that generated losses are highlighted in red. The table underscores that the summer weakness (a.k.a. the “Halloween Effect”) does indeed exist. In this case we are once again looking at a very simple and well-known rule. There exist a great many more seasonal patterns, which one can identify with the help of the Seasonax app on Bloomberg and/ or Thomson-Reuters. Many of them are still completely unknown. “Sell in May” is a truism people have been aware of for decades. Nevertheless, as the statistics show, the pattern actually continues to work. Apparently far too few investors are actually taking action based on their knowledge of the pattern and there is almost no arbitrage activity trying to take advantage of it. The stability and persistence the pattern has exhibited hitherto suggests that the “sell in May” tactic will continue to work in the future. |

Overview of Country Selection: Half-Year Results |

Next week we will show you the charts detailing the pattern over time in all the countries we have reviewed.

“Sell in May” – sometimes the simple rules are the best!

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,The Stock Market