Last year’s infatuation with globally synchronized growth was at least understandable. From a certain, narrow point of view, Europe’s economy had accelerated. So, too, it seemed later in the year for the US economy. The Bank of Japan was actually talking about ending QQE with inflation in sight, and the PBOC was purportedly tightening as China’s economy appeared to many ready for its rebound.

Operating under these assumptions, no wonder all the world is stuck with a labor shortage. We’ve heard enough about it here in the United States, but the term was applied more universally than that. From last November:

Julian Evans-Pritchard, China economist at Capital Economics, said price pressures in China appeared strong on the back of still-rapid economic growth, a tight labour market, capacity cuts and temporary disruptions to industrial production.

“Price pressures may remain strong for a while longer as the anti-pollution campaign keeps commodity prices elevated and this feeds through into core inflation,” he said.

Still-rapid economic growth? That’s where it all falls apart, the mainstream tendency to view relative changes as greater than they ever are. The global economy and China with it wasn’t as bad in 2017 as it had been in 2016 or 2015. That should mean something substantial, but in this lost decade plus it really doesn’t.

In terms of consumers prices and consumer price indices, it was China’s PPI that this kind of commentary leaned on the most. Inflation hysteria was as much Chinese producers as US drug addicts.

| But this, too, was a mistaken interpretation. As noted earlier this week, China’s upswing isn’t near forceful enough to produce the sustained cyclical forces required for the result equivalent to what people are talking about when they invoke globally synchronized growth. Commodity prices are up, but they aren’t really up; they are more aptly described as not being down as much. |

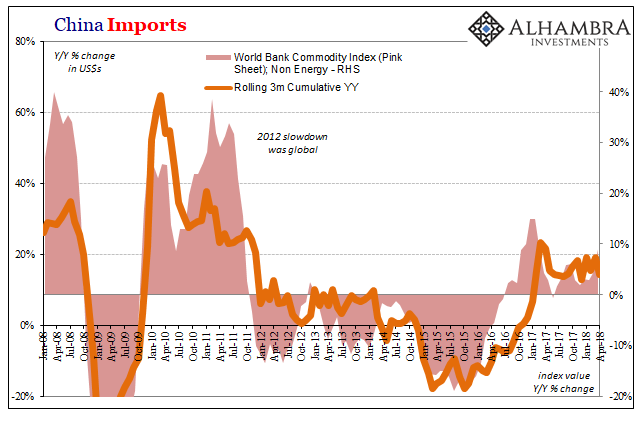

China Imports, Jan 2008 - Apr 2018(see more posts on China Imports, ) |

| That’s the big difference because it represents doubt, market doubt. Commodity investors want to be optimistic, but they’ve also seen all this before and not all that long ago (2014). Economists can talk about labor shortages all over the world, but they’ve been doing just that for years on end. The boom has to boom, it can’t stay imaginary forever. |

World Bank Pink Sheet Commodity Indices, Jan 1995 - May 2018 |

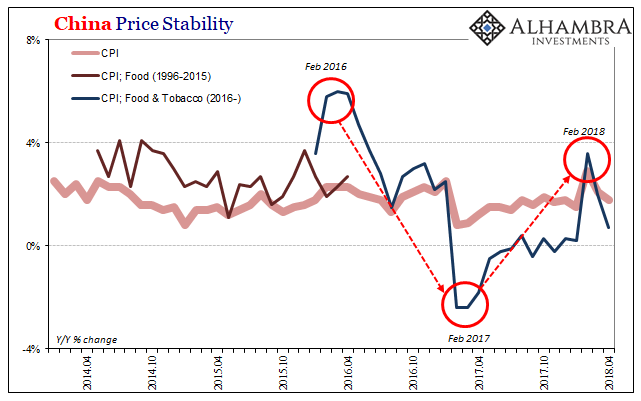

| The latest inflation update from China’s National Bureau of Statistics for April 2018 was, no surprise, more of the same. The Chinese Consumer Price Index (CPI) which had nearly hit the government’s 3% target in February is back down below 2% in April. |

China Price Stability, Apr 2014 - 2018 |

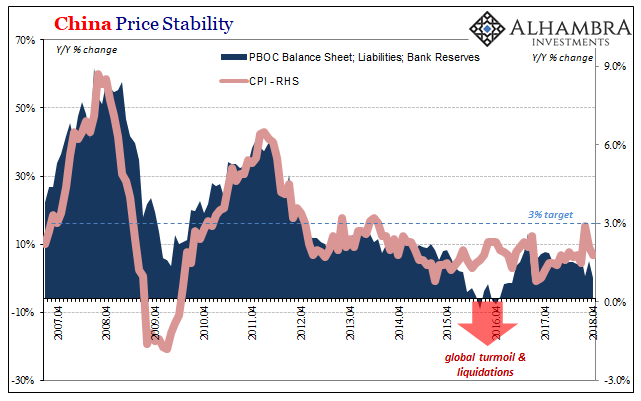

| At just 1.8%, that’s perfectly in line with the last six years, with the PBOC’s bank reserves, and most of all the PBOC’s bank reserves over the last six years. |

China Price Stability, Apr 2007 - 2018 |

| Analysts were caught well off-guard last month when the PBOC seemingly out of the blue decided to cut the RRR. It belied wage pressures due to a “tight labor market” as well as the narrative about the Chinese central bank tightening monetary policy on the basis of seriously renewed economic strength. On top of that, there have been persistent (unconfirmed) reports that this one RRR cut won’t be the last.

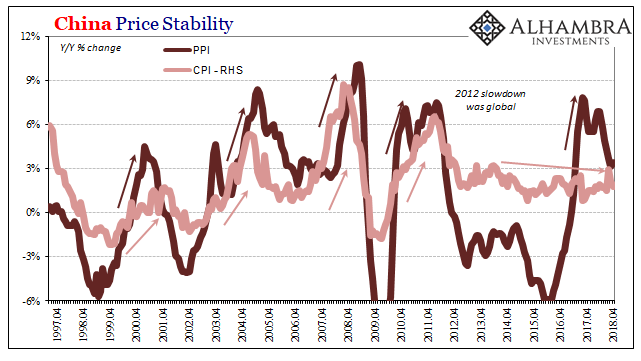

There are other factors involved, too, in the RRR, but the message is clear enough and it’s not the one that centers on a worldwide tight labor market and globally synchronized growth. That’s commodity prices betting on the narrative but not too heavily. In China’s PPI, overall producer prices have decelerated significantly since last year. The primary reason for so much worldwide attention to them was that they had declined for five years straight. Turning positive in later 2016 was supposed to have meant something, and it did, just not what everyone wanted. |

China Price Stability, Apr 1997 - 2018 |

It meant that the idea of global economic recovery, true recovery, was way ahead of itself even at a low retracing reflation. It was never confirmed by consumer prices (so much for rapid economic growth and a tight labor market) which was by far the more significant development in terms of Chinese prices. It’s that very dichotomy that we face in the spring of 2018.

I could understand to some extent the narrative about global growth, but inflation hysteria was plain ridiculous. But this is nothing new. It happens every three years or so. And it’s upside down under pressures of time; you would think that the longer something doesn’t happen the more people would realize it’s not likely to. Not in Economics, though, where the longer it goes without actual economic growth the more convinced everyone becomes that it will happen tomorrow.

Such rationalizations used to be the stuff of asset bubbles. No longer. All the world’s a labor shortage.

Tags: China,China Imports,commodities,commodity prices,Consumer Prices,CPI,currencies,economy,Federal Reserve/Monetary Policy,inflation,labor shortage,Markets,newslettersent,PPI