Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

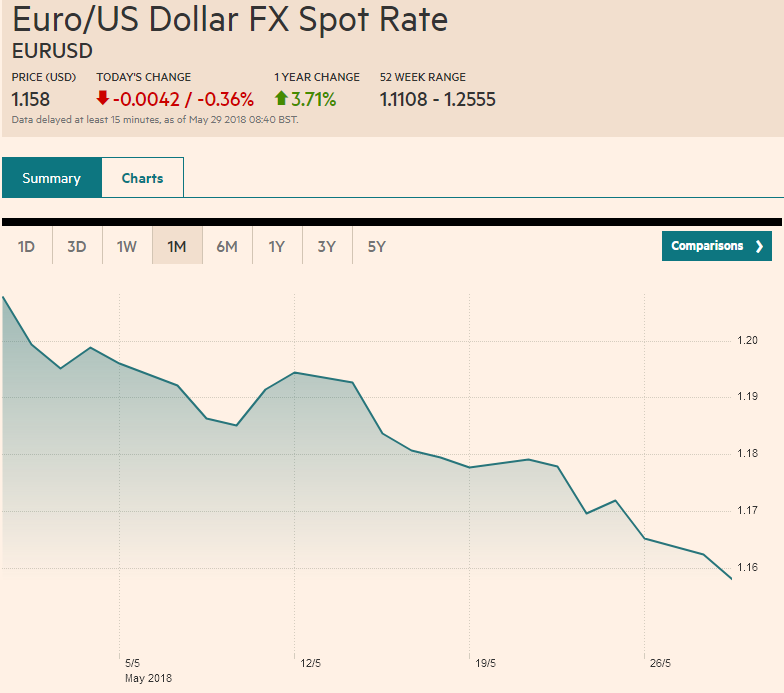

| The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as the US, the euro was threatening the six-month low set at the end of last week a little below $1.1650. The selling pressure eased as the euro approached $1.1600.

Recall that the euro has trended lower last September and October. It was bottoming around $1.1600 when in early November it spiked to nearly $1.1550. As we have noted, the speculative positioning in the futures market continues to hold a large net and gross long euro position. Speculators have added to their gross long position for the past two weeks. Some suspect a break of the $1.1550 area would press the euro bulls, while others see a cent lower as more important, which is where the 38.2% retracement of the euro’s rally since from the start of last year. Perhaps it will take the turn in the “golden cross” when the 50-day moving average crosses the 200-day moving average. This could take place next week. |

Euro/US Dollar FX Spot Rate, Monthly(see more posts on EUR/USD, ) Source: markets.ft.com - Click to enlarge |

Polls suggest that the Five Star Movement (5MS) and the (Northern) League will emerge from the election in a stronger position. Some observers even suspect that the League had been eager for new elections and that is why it reacted so quickly to the opportunity to do so.

Why would Italy’s President Mattarella insist on the turmoil that his rejection of Savona as finance minister would cause and set the stage for new elections? Savona may or may not still hold anti-EU and anti-EMU views. Mattarella apparently suspected that despite playing down their anti-European rhetoric during the campaign, the new government would likely move down that path. Savona was the lightning rod. It the coalition wants to go down that route, they should, it seemed like Mattarella reasoned, do it in the open and tell voters that that is their intention.

Mattarella has selected Cottarelli, formerly at the IMF, and is highly respected for his strict approach to state finances (his nickname, Mr. Scissors, says it all). Few candidates could be further away from the fiscal thrust that the 5MS and League had planned. If Conttarelli put together a government that can survive a vote of confidence, which seems unlikely, new elections may be held in early 2019. If not, fall elections look likely.

Moody’s fired a warning shot before the weekend and put Italy’s credit rating, two steps into investment grade territory, the same as the other main rating agencies, on review for possible downgrade. Investors continued to mark down Italian bonds. On the eve of the election, Italy’s 10-year yield stood at 1.70%. A month later it was below 1.50%. At the end of April, it was at 1.53%. Before the weekend it was 2.20%. Today it closed at 2.41%.

The rise in the two-year yield is even more pronounced. The yield doubled on Monday to 84 bp from last Friday (41.5 bp), which itself had doubled from the previous day (22 bp). On May 18, Italy’s two-year yield stood at 2.6 bp, and at the end of April, the yield was at minus 31 bp.

Italian banks continue to hold a substantial amount of sovereign bonds. Rising yields reduce the value of that portfolio. Italian bank shares have also been marked down aggressively. An index of Italian bank shares fell 8% last week after 7.3% the previous week. On Monday, the index lost another 4%.

The flow of savings out of Italy appears to favor the core over other peripheral countries. Spain has its own political challenge, but one that will likely be resolved in a direction that is not so unfriendly for investors. However, as the situation in Italy has evolved from a local and idiosyncratic issue to one now pregnant with system risks. Germany’s two-year fell five basis points on Monday to minus 67 bp, the lowest for the year on Monday. The 10-year yield fell six basis points to 34 bp, which is 30 bp lower than where it closed.

The Italian left is noticeable only in its absence. If the PD could have found a way, as the Social Democrats did in Germany, to work with the larger party to deter a larger shift toward nationalism and nativism, the current intractable situation may have been avoided or mitigated.

Another story emerged last week that impacted markets and continued to do so Monday. Saudi Arabia and Russia apparently have agreed in principle to boost oil output. Some observers want to give US President Trump’s tweet where he warned about high oil prices credit for the decision. There may have been other considerations as well. For example, the long declared target of bringing the inventories back to the five-year average has been achieved. Of course, the five-year average has been inflated in recent years, and some additional adjustment may not be unwarranted.

In addition, with Venezuelan and Iranian oil to be limited on the global markets, and other countries, like Angola, seeing a “natural decline” due to under-investment when prices were low, as well as Saudi Arabia’s larger-than-agreed upon cuts have helped boost prices more than expected. Countries like Saudi Arabia, with low population density and large oil reserves, wants to preserve the value of their wealth that is still in the ground. Too high of price encourages alternatives/substitutes, as well as marginal producers, and boom/bust cycles. In contrasts, countries, like Iran, with greater population density and relatively fewer reserves, prefer to maximize the value of current output.

In electronic trading on Monday, WTI for July delivery tumbled to $65.80 before recovering toward $66.40. That is a 2% loss after 4% pre-weekend loss. Despite the recovery, the contract still was below its lower Bollinger Band (~$66.80) in mid-afternoon.

Lastly, the Turkish lira recovered on Monday. The government appeared to give the central bank more independence, which immediately simplified its policy rates. It brought back the one-week repo rate as the key policy tool, as it was before January 2017. It was set at 16.5%. The lira rallied about 2.8%. The 10-year bond yield fell 55 bp (to 13.65%), and the stock market rallied 3.2%.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,EUR/USD,Italy,newslettersent,OIL,Turkey