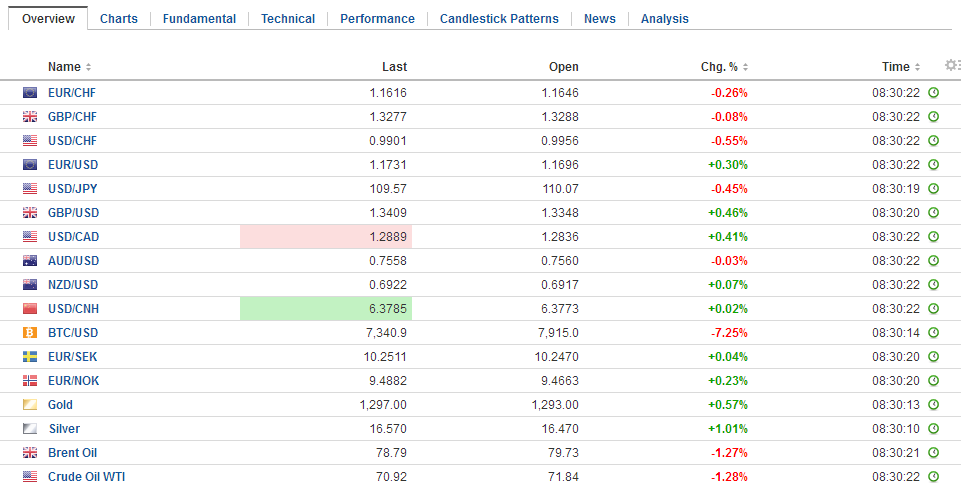

Swiss FrancThe Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. |

EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

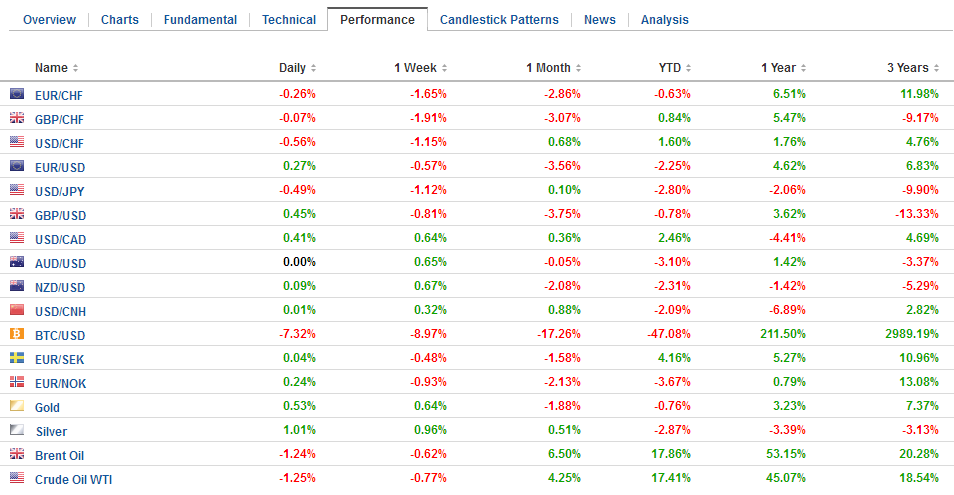

FX RatesThe US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday’s 300 bp rate hike could only stem the rot momentarily and the lira’s 2.3% decline today, wipes out 2/3 of the annual rate increase. Early in the Asian session, news broke that the Trump Administration was going to open an investigation into auto imports on national security grounds, like the steel the aluminum actions. As one would expect, the auto sector traded heavily in Asia. Past protectionism, dollar-fluctuations, and the desire to be near an important customer base have encouraged Asian and European automakers to locate production facilities inside the US. However, broadening of US protectionist thrust, and on national security grounds, keeps the breakdown of the liberal trading system very much in focus despite some optimism that had crept from a de-escalation of US-China tensions. |

FX Daily Rates, May 24 |

| Italy is being given a reprieve today as the prime minister-designate looks put together a government that can survive a vote of confidence in parliament. Italy’s 10-year yield is off seven basis points, leaving it up 21 bp over the past five sessions. The premium over Germany is narrowing by nine basis points today. Italian stocks are also leading the major markets higher today with a 0.8% gain. The Dow Jones Stoxx 600 is recouping about a quarter of yesterday’s 1.1% decline.

Sterling had been recovering from its lows, but the much stronger than expected April retail sales lifted sterling to new highs just north of $1.3420. It bottomed yesterday near $1.33. Retail sales rose 1.3% in April, excluding petrol. The median forecast in the Bloomberg survey was for a 0.5% increase after a 0.5% fall in March. It is the largest rise since October 2016. A recovery in the weather saw consumers snap up household goods and clothing. As inflation slows, and wages rise steadily if not impressively, consumers purchasing power will improve. |

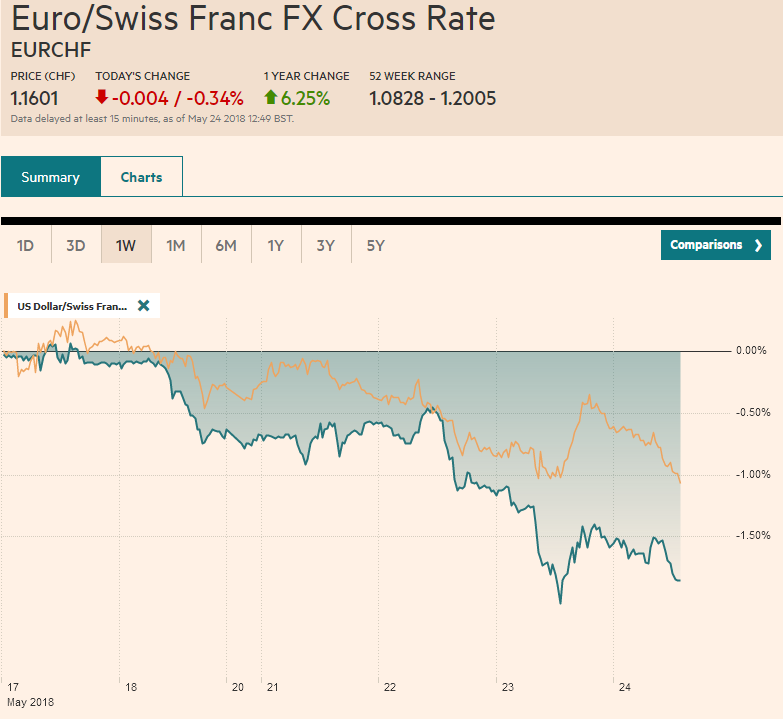

FX Performance, May 24 |

The auto action may be a way to add pressure on Canada and Mexico in NAFTA negotiations. Yet, reports had suggested that important progress was made on the issue and yesterday’s presidential tweet suggested good news would be forthcoming for US autoworkers. Many, including ourselves, had seen it as a comment on NAFTA and not threats of a 25% tariff on imported autos.

Over the past weekend, the US seemed to signal that there was an easing of trade tensions and new tariffs on China were put on hold. Some in the market seemed to think this applied to the steel and aluminum tariffs, but those were pre-existing, and this became clear earlier this week. Still, China is taking actions, including dropping the investigation into US sorghum shipments, lowering the on imported autos and auto parts. Last November, China indicated it would cut the tariffs on 187 categories of consumer goods. Reportedly, it is being implemented. Next month, China says it will open up its financial services sector.

One of the key points we make is that US companies service foreign demand more through local production than by exports. Some refuse to incorporate the affiliate sales production and sales alongside exports because that local production does not help American workers. But that is not true, and the picture is much more complicated. For example, perhaps the US business could not profitably export the good form the US. Also, studies suggest that while low skilled labor aborad competes with low skilled domestic labor, high skill employees abroad complement high skilled domestic employees.

Simply put, the foreign direct investment strategy is an alternative to the traditional export-oriented strategy. Both are expansion strategies that allow companies to share other countries’ aggregate demand. The tax reform, which taxes US-domiciled businesses global sales, may encourage more thinking along these lines.

Here are some concrete numbers. US companies exported 280k vehicles to China last year. GM, to take one American brand, sold 4 mln cars in China in 2017. The sales by affiliates of US companies told around $220 bln of goods and services in China in 2015, the last year complete records are available. This is a third more than the US exported to China.

Interesting news item. Sinopec, China’s largest refinery, will boost US crude oil imports to record amounts. The company’s trading arm, Unipec, bought 16 mln barrels to load in June. That is about 533 mln barrels a day. It is valued at a little more than $1 bln–a small down payment on the $200 bln improvements that the Trump Administration seeks. For the record, China as a whole imported about 330k barrels a day from the US in the six months through Feb.

Some observers also link US trade attitude to China to North Korea. When it appeared the summit would take place next month, it seemed the US courted China. Now that the summit has been threatened, the US stance on trade has hardened.

The FOMC minutes confirmed the Fed’s intention to hike rates next month. The minutes also showed that the Fed is willing to accept a modest, and what it expects to be a short-lived overshoot of its inflation target. It does not see inflation accelerating sharply. If there would have been updated forecasts, the tone of the minutes did not suggest a consensus on a fourth rate hike this year.

The FOMC minutes also acknowledged what we have noted about the Fed funds rate. The effective average rate, which is what the futures contract settles at, has firmed recently so it a few ticks below the top end of the Fed funds range. The interest rate the Fed pays on reserves is also the top end of the Fed funds range.

While this should cap short-term rates, some rates, such as the repo rate have edged higher. Some see this as a consequence of the Fed shrinking its balance sheet. In any event, to help anchor the ceiling, the FOMC minutes indicated that the interest on reserves will be adjusted, likely next month, so that it will be just inside the Fed funds upper range, which is assumed to be around five basis points. Short-term US interest fell on the news. The two-year yield fell four basis points, which is the biggest decline since the equity slide in early February. It is a little lower now.

The market has scaled back expectations of a fourth rate hike this year. The implied yield of the January 2019 Fed funds futures contract, which is arguably the best gauge of market expectations the target range at year-end, has fallen eight basis points this week. The implied yield of 2.235% is perfectly consistent with two more hikes this year and the second one would bring the target range to 2.00%-2.25%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,newslettersent,USD/CHF