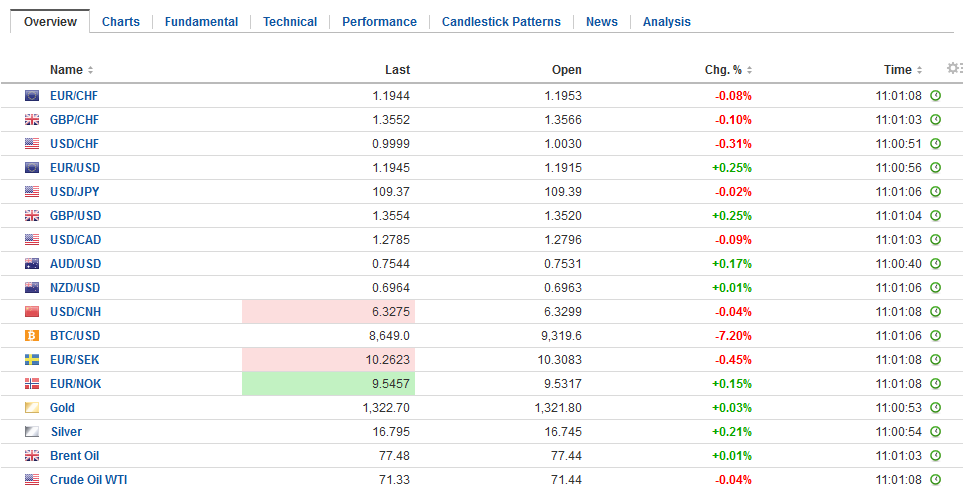

Swiss FrancThe Euro has fallen by 0.11% to 1.1937 CHF. |

EUR/CHF and USD/CHF, May 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

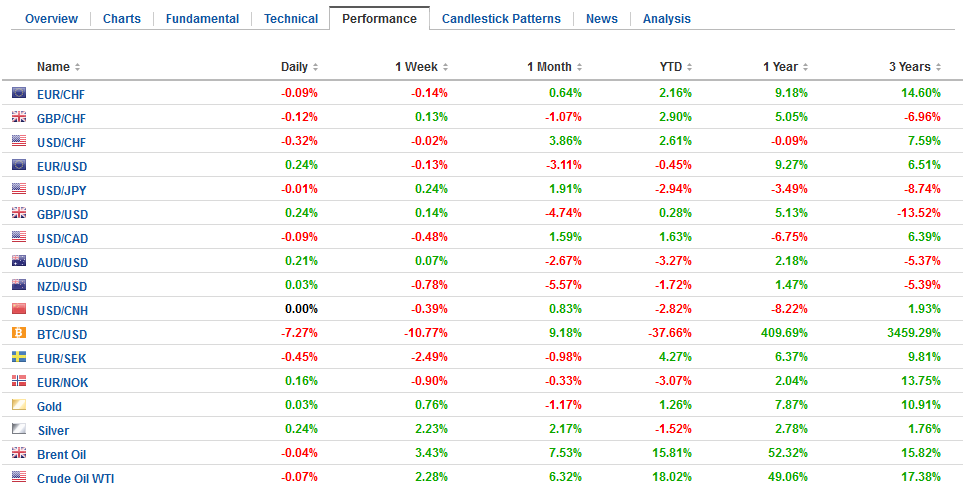

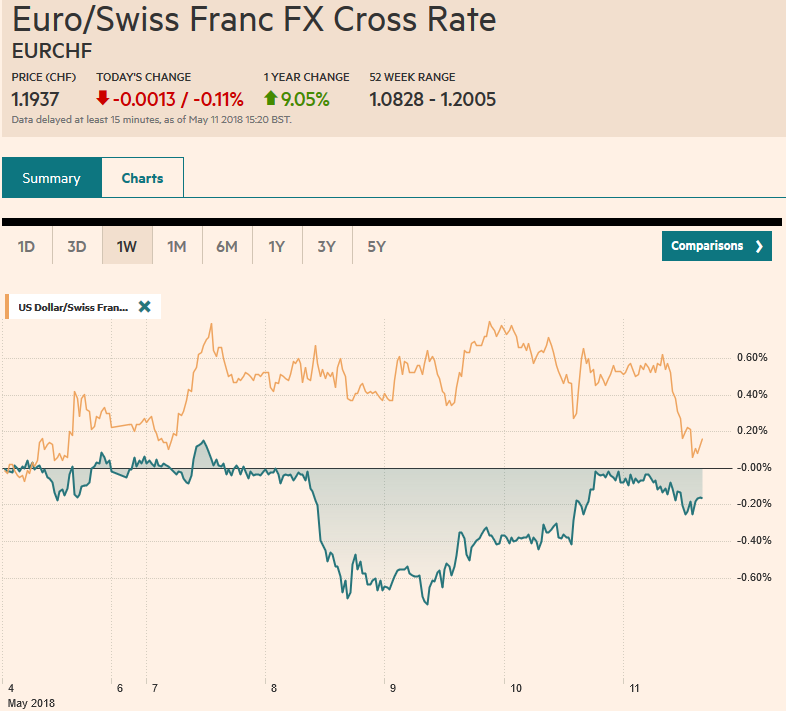

FX RatesThe US dollar pulled back following yesterday’s slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor consumer prices are accelerating. There is little reason in the recent string of data or official comments to suggest a more hawkish path for monetary policy (e.g., four rate hikes this year). Technical indicators have become stretched for the dollar, and we have on the lookout for signs of a near-term correction. With the loss of momentum over the last few days, the technical indicators are turning, and we will update our corrective targets in our weekly note. Not to get too far ahead of ourselves here, the initial targets are another cent to the upside for the euro and sterling. A break of JPY108.65, the neckline of a potential double top, could JPY107.30. The Australian dollar appears to have scope for a cent advance, while the greenback is recording a big outside down week against the Canadian dollar, suggesting losses back into the CAD1.24-CAD1.25 area. |

FX Daily Rates, May 11 |

| For today’s price action, note that there are some very large euro options expiring. There are 2.4 bln euros struck at $1.1900 and another 624 mln euros at $1.1925. At $1.1950 there are another 774 mln euros struck. There are also large expiring options in dollar-yen: There are $821 mln struck at JPY119.50, and $360-$472 mln options struck half a yen away as well. On Monday, there are quite large expires at JPY108.50 ($1.3 bln), JPY108.65 ($1.1 bln), and JPY110 ($1.3 bln). Lastly, there is an option struck at $1.3550 for GBP679 mln that also expires today.

Market expectations for Fed policy did not change for June meeting or the odds of a fourth hike this year. The effective Fed funds rate has traded on the firmer side of the Fed’s target range (1.50%-1.75%) recently. Fed funds change hands at 1.70% on a volume-weighted average basis. A 25 bp rate hike in June would put fair value of the July Fed funds futures contract 1.95% and it is at 1.945%. Assuming a follow-hike in September (lifts the average effective rate to around 2.20%) and a December hike would put the effective Fed funds rate around 2.45%. The January 2019 contract is unchanged, implying a rate of 2.285%. |

FX Performance, May 11 |

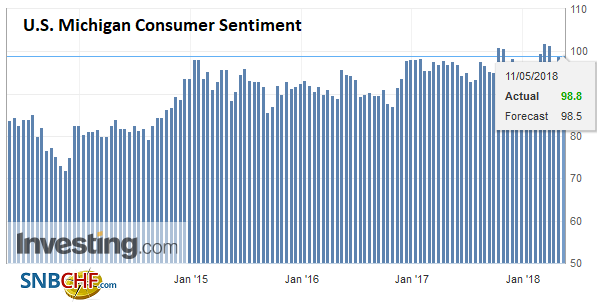

United StatesThe highlights for the North American session today are the Canadian employment data, we preview here yesterday and a speech by ECB President Draghi in Florence. Canada is expected to report another reasonably firm jobs report. Most of the 20k jobs it is expected to have created are projected to be full-time positions. The market is more inclined to see a Bank of Canada hike in July rather than at the meeting at the end of this month. Draghi may disappoint if he is expected to offer fresh insight into the EMU economy. In his recent phraseology, Draghi said, “cautiousness tempered with confidence” there is no doubt what came first. The US reports import/export prices. Both look firm. The University of Michigan consumer sentiment and inflation expectations survey will be reported, but are not the stuff that moves the markets. |

U.S. Michigan Consumer Sentiment, May 2013 - 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Among the accomplishments at the Bank of Canada, Mark Carney made important contributions to central bank thinking about forward guidance. Ironically, his strength has turned into a weakness, and he was pressed hard by members of parliament about his communication. Of course, there had been a string of disappointing data, including inflation, that also encouraged investors to scale back tightening expectations. But this was not the first time that Carney seems to have reversed himself in a short period of time, leaving investors scratching their heads. The market has pushed the hike out into Q4.

The Mexican peso benefitted from the US dollar’s pullback. It was among the best-performing currencies yesterday. The dollar fell 1.75%. The latest poll for the July election showed the PAN candidate Anaya closing the gap with AMLO. According to the GFA-ISP polls, which has seen the race tighter than most other polls saw the gam closing to six percentage points from nine. The PRI’s candidate slipped two percentage points to 25%.

Separately, Mexico’s inflation slowed a little more than expected in April (4.55% from 5.04% in March). This may encourage ideas that the central bank will keep rates steady (7.50%) when it meets next week. The NAFTA uncertainty looks to be lifted shortly. As we have noted, the legislative process includes a 120-day review period and a 90-day impact study, and this will shortly bump up against the mid-term election and the end of this Congressional term. House Speaker Ryan indicated that May 17 is the cutoff date for a finished text if this Congress is to vote on it.

Initially, reports suggested that Argentina would seek a $30 bln flexible line of credit. We questioned whether it would qualify for such a facility, which is really designed for economically healthy countries. Only a few countries have been granted this line, and none have drawn on it. Reports indicate that Argentina will seek a standby agreement which is the traditional lending facility and requires a program of reform. The peso is consolidating a little above the low set earlier in the week. The main weight on the peso does not appear to be coming from foreign investors as much as domestic investors trying to dollarize their savings. Reports indicate that around ARS675 bln (~$30 bln) of Lebacs (short-term notes) are coming due next week. It represents an important challenge.

Consider that a three-month Lebac pays 25.7% annual yield. Sounds juicy, but a 6.5% depreciation of the peso offsets. The peso has declined by an average of 7% a quarter of the past four quarters. It has depreciated by 60% over the past three years. The peso has appreciated in only one quarter since the end of 2009.

The Dow Jones Industrials have a six-day winning streak coming into today. However, the S&P 500 is more impressive. It closed above its April high and negating the sequence of lower highs and smaller bounces off the 200-day moving average. The S&P 500 gapped higher yesterday and ended up not closing the gap created on April 19. The next effect has been to a carve saucer-like pattern over the past three weeks into an island bottom, which would project toward the March high a little above 2800. That was the highest it has been since February’s slide.

The bullish impulse was seen in Asia, where the MSCI Asia Pacific Index rose nearly 1% today. This is the largest gain in a month and a half and doubling the advance for the week to 1.9%. It closed a little below the April high. Although domestic markets in Malaysia remain closed, the offshore products, like NDFs and ETFs have begun stabilizing. If we are right about the dollar’s near-term downside correction, the emerging markets have anticipated it. The MSCI Emerging Markets is posting gains for a fifth consecutive session today and is snapping a three-week three percent slide. Ahead of the Latam open, the benchmark is up 2.5% on the week.

European shares nursing minor losses today for the second day in a row. The Dow Jones Stoxx 600 has rallied 8.6% from the late March lows but has stalled since mid-week. The technical indicators have not turned lower though look poised to do so shortly. On a purely directional basis, the correlation of the (value) of the euro and (the value of) the Dow Jones Stoxx is at its great inversion of the year (-0.75). This suggests that a pullback in European stocks may coincide with a firmer euro. The prospects of an Italian government of the Five Star Movement and the League is looking better, and the market is calm, with Italian bonds outperforming today. Equities are little changed but are snapping a six-week advance. The Dow Jones Stoxx 600 is extending its rally for the seventh week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,MXN,newslettersent,U.S. Michigan Consumer Sentiment,USD/CHF