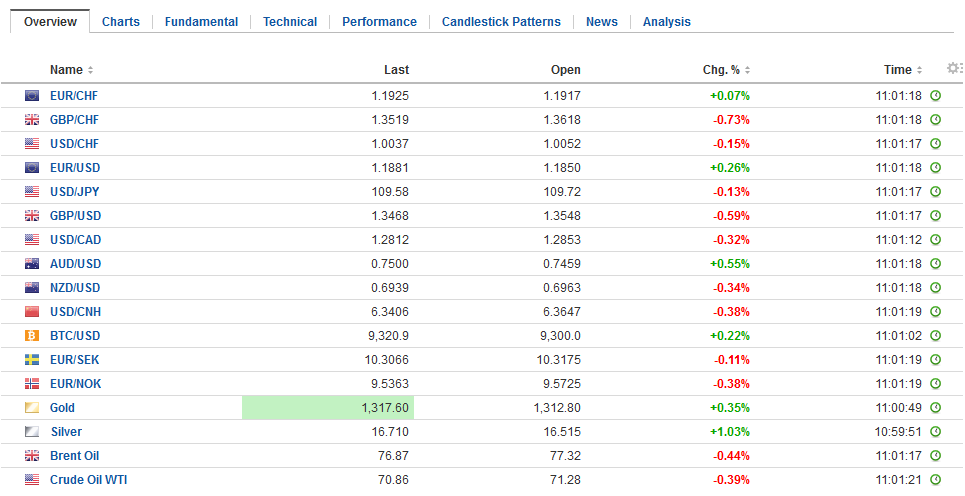

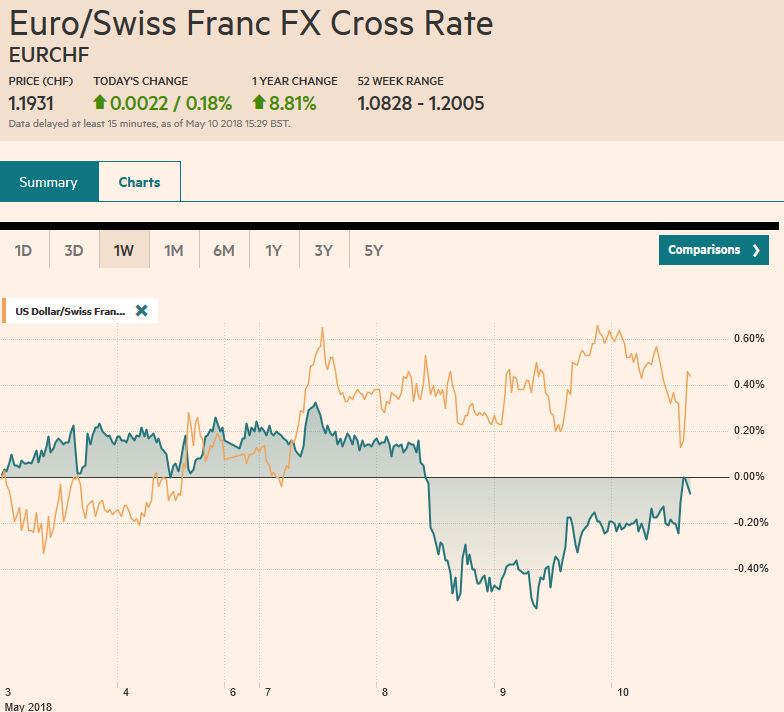

Swiss FrancThe Euro has risen by 0.18% to 1.1931 CHF. |

EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback’s consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday’s ranges. The dollar briefly and barely popped above JPY110. Some participants are picking a top to the greenback by buying the Canadian and Australian dollars. Equities are mixed. The MSCI Asia Pacific Index rose 0.5% and the MSCI Emerging Markets Index is up 8% for a fourth consecutive advance. Recall the MSCI EM index has fallen in six of the past seven weeks including the last three. European shares are slightly heavier and the Dow Jones Stoxx 600 is putting at risk the four-day advancing streak. Still, it is closing in on its seventh weekly advance Major bond markets are little changed, with Italy, as we noted trading heavier in the wake of the political developments. The US 10-year yield is steady a little below 3%. Oil is extending its gains. |

FX Daily Rates, May 10 |

| The Reserve Bank of New Zealand sent the New Zealand dollar sharply lower as the new central bank governor sounded an unexpectedly dovish note. The election result in Malaysia led to a defeat of the ruling party that has led the government for more than 60 years. In Italy, Berlusconi has dropped his opposition to a government by the Five Star Movement and the Northern League. If a deal can be struck, a technocrat government or new elections can be avoided.

At his first meeting since becoming Governor of the Reserve Bank of New Zealand, Orr pushed in a dovish direction even though the cash rate was left unchanged at 1.75%. The first rate hike was pushed out from Q2 2019 to Q3. The estimate for Q1 GDP was shaved to 0.7% from the 0.8% forecast made in February. Perhaps most importantly, Orr seemed to replace the tightening bias with a neutral stance, saying that the next move in interest rates could be up or down. The New Zealand dollar dropped nearly a cent to $0.6900. That brings the drop to five cents since mid-April. It is the weakest of the majors since then. The next chart support is not seen until closer to $0.6800, and even then, the lows from the end of last year were set near $0.6760. New Zealand’s 10-year bond yield fell four basis points and the two-year yield fell by five. |

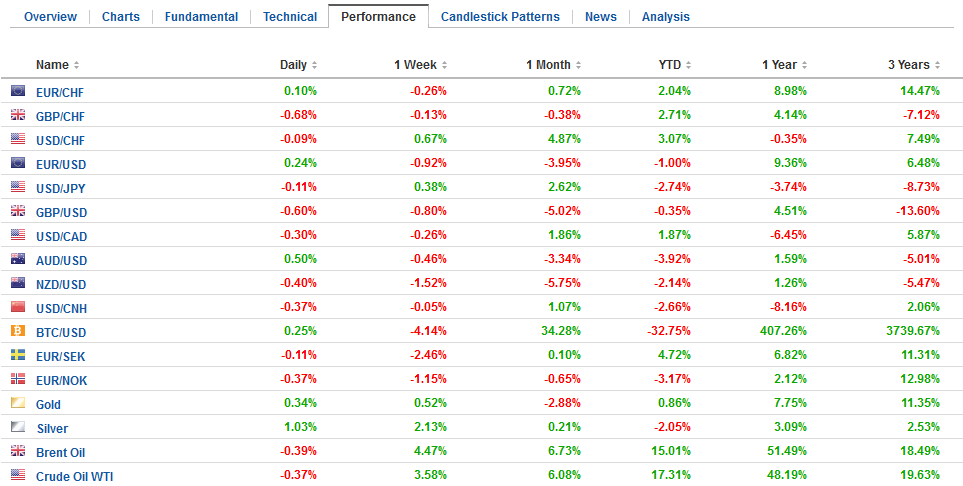

FX Performance, May 10 |

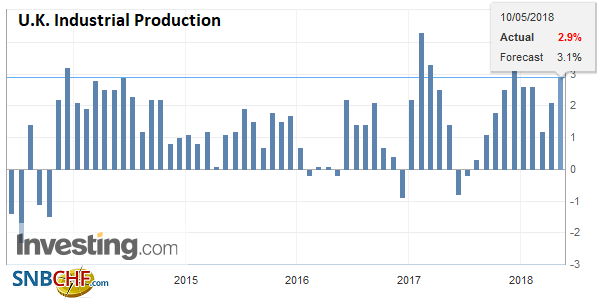

United KingdomSterling has dropped nine cents since the highest level since the referendum was recorded on April 17 near $1.4375. It has been stuck in a narrow range near the lows over the past several sessions (~$1.3485-$1.3600). Today’s data from March warns of the risk of a downward revision to Q1 GDP (0.3%). The trade deficit blew out to GBP3.09 bln from a GBP1.18 bln deficit in February (initially reported at GBP965 mln). |

U.K. Trade Balance, Jun 2013 - May 2018(see more posts on U.K. Trade Balance, ) Source: Investing.com - Click to enlarge |

| Industrial output rose 0.1% while manufacturing contracted by 0.1%, the second consecutive decline after a flat report in January. |

U.K. Industrial Production YoY, Jun 2013 - May 2018(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

| Manufacturing output fell in Q1. |

U.K. Manufacturing Production YoY, Jun 2013 - May 2018(see more posts on U.K. Manufacturing Production, ) Source: Investing.com - Click to enlarge |

United StatesThe US reports April CPI figures today. A 0.3% monthly rise in the headline would lift the year-over-year pace to 2.5% from 2.3%. It would highest since last February and provides further confirmation that the Federal Reserve’s assessment that the easing of price pressures last year was spurred by transitory factors. |

U.S. Consumer Price Index (CPI) YoY, May 2013 - 2018(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

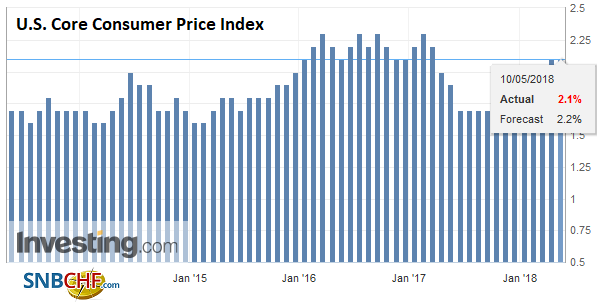

| The core rate may rise 0.2% on the month to lift the year-over-year pace to 2.2% form 2.1%. The core rate has not eased since last November. The market appears to have fully discounted a rate hike next month. |

U.S. Core Consumer Price Index (CPI) YoY, May 2013 - 2018 Source: Investing.com - Click to enlarge |

Malaysian markets were closed and are closed tomorrow as well. However, investors have sold the ringgit in the non-deliverable forward (NDF) market is about 3% lower. Malaysian ETFs were also lower, with some investors warning of 5-10% decline next week. Former Prime Minister Mahathir is set to return to head a new government. He campaigned to scrap the unpopular 6% three-year-old tax on goods and services and to re-introduce gasoline subsidies. The central bank kept rates steady as anticipated.

Separately, the Philippines central bank delivered a 25 bp rate hike (to 3.25%) as widely expected. The US dollar had been nursing small losses against the peso but snapped higher on the announcement. Still, the PHP52.00 area is blocking a retest on the PHP52.50, the upper end of a three-month trading range.

Italian assets may not have liked the prospect of early elections, but the possibility of a government by the Five Star Movement and the Northern League does not set well either. Italian assets are underperforming a little bit today, with a flat stock market and a little heavier bond market. The heads of both parties are likely to have senior ministerial portfolios in a new government, but not be Prime Minister.

Previously, the market had nearly priced in a rate hike from today’s Bank of England meeting. However, disappointing data and comments from Governor Carney saw the market push out the rate hike until Q3 and take back the prospect of a second hike this year. Many expect Carney to deliver a hawkish hold, and a couple of dissents in favor of an immediate rate hike may help drive home the point. However, the BOE’s inflation report is expected to shave growth and inflation forecasts, which may soften the hawkish hold.

That is small change compared with the construction sector. Output there fell 2.3% in March after a 1% decline in February and a 2.6% drop in January. It was the worst quarter for construction spending since May 2013.

The US dollar has been confined to a CAD1.28-CAD1.29 trading range for two weeks until May 8, when the greenback seemed to break out to almost CAD1.30. As we anticipated based on our reading of the technical condition, the greenback quickly returned to its trading range yesterday. The Canadian dollar’s recovery seemed to be driven by two main considerations.

First, the sharp rally in oil prices, recoupling the previous day’s decline and more. Disruptions of supplies from Venezuela and Iran got the ball rolling, while an unexpected drop in US oil (and gas and distillate stocks) helped sustain and extend the gains. Second, the Canadian dollar appears to be attracting speculative capital flows that have begun positioning for a pullback in the US dollar. Consider that the US premium over Canada has widened to 60 bp from 20 bp at the end of last year. This capped the spread in late 2015 and again early 2017, and both times coincided with a top in the US dollar.

After the upside break was rejected the greenback has been sold through the lower end of the recent trading. The break could prove to be false unless CAD1.2760 can be taken out convincingly. The technical indicators suggest this may be reasonable, but the market may be reluctant to do so ahead of the jobs data tomorrow. That said, a constructive report is expected. The US reported its jobs data last week. An important difference is that the 12-month moving average of non-farm payrolls peaked a little more than three years ago. In Canada, the 12-month moving average peaked last December and the 12-month average full-time position peaked the month before.

There are a few expiring options today that may influence activity. These include a large 2.4 bln euros struck at $1.19. Note that tomorrow another sizeable option (1.8 bln euros) struck there expires. There is an option at JPY110 for nearly $475 mln that rolls off today. Lastly, there is an A$738 mln option struck at $0.7500 that expires today.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,newslettersent,U.K. Industrial Production,U.K. Manufacturing Production,U.K. Trade Balance,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF