See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Irredeemably Yours… Yuan Stops Rallying at the Wrong MomentThe so-called petro-yuan was to revolutionize the world of irredeemable fiat paper currencies. Well, since its launch on March 26 — it has gone down. It was to be an enabler for oil companies who were desperate to sell oil for gold, but could not do so until the yuan oil contract. It has been possible to do in New York, so they obviously were not desperate to do this trade. The price of gold has fallen a bit since March 26 as well. In the holiday-shortened week, the price of gold rose $8 and the price of silver went up 4 cents. However, something has been happening to the fundamentals of one of them. We will take a look at that. |

USD/CNY Daily(see more posts on USD/CNY, ) After becoming progressively stronger over the past year, it looks as thought the 6.25 level in USDCNY is providing support for the US dollar. - Click to enlarge In fact, this was a resistance level in 2014 – 2015, which was first overcome in early August 2015, when the yuan weakened sharply. If we are not misinterpreting something, Beijing has hinted in veiled terms at possibly deploying its fairly tight control over the non-convertible currency’s exchange rate as a weapon in the ongoing trade dispute with the US. If so, the yuan may well weaken after its one-year long bout of strength. We get the thought process behind the quasi gold convertibility thesis, but we are not quite sure how it would work in practice (i.e., would one actually be able to move physical gold out of China willy-nilly if it were delivered against a yuan-denominated futures contract held by a foreigner? We have not really seen a detailed explanation of the mechanics of this type of transaction, but that may well be our fault for not making enough of an effort to search it out) |

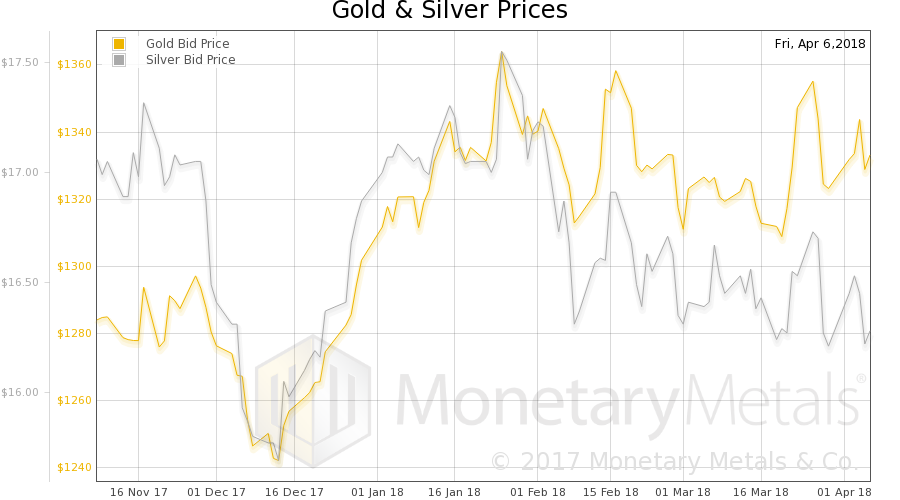

Fundamental Developments – Theoretical Fundamental Gold Price Reaches New High for the Move, Silver LagsBut first, here is the chart of the prices of gold and silver.

|

Gold and Silver Prices(see more posts on Gold prices, silver prices, ) |

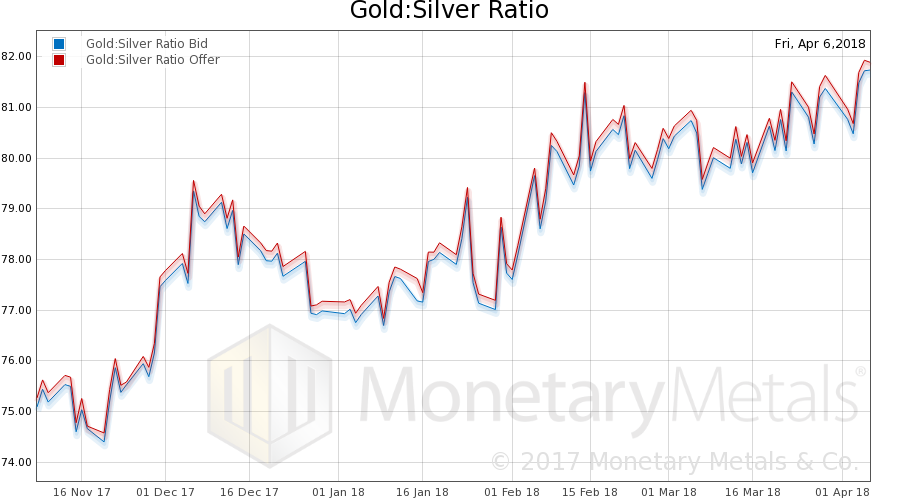

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose slightly. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

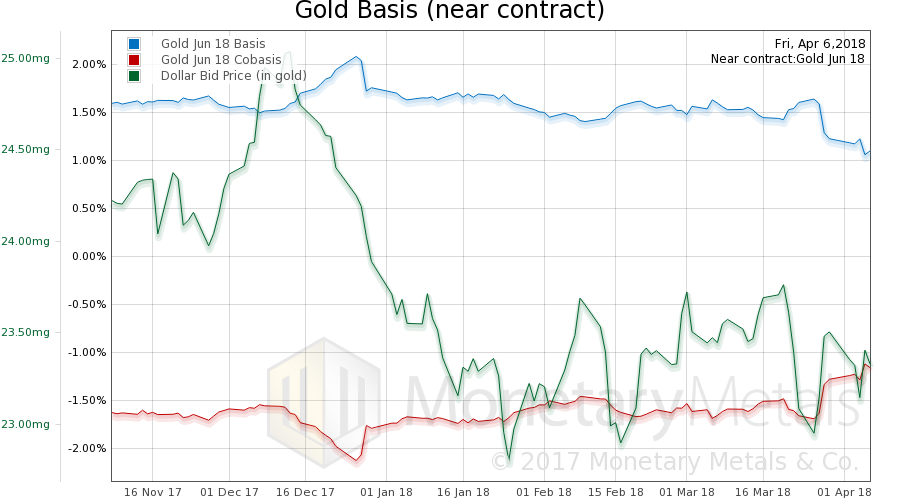

| Here is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price.

We have another instance where the dollar is falling (inverse of the rising price of gold, measured in dollars) while gold becomes scarcer at the higher price (i.e. the co-basis, the red line). Unsurprisingly, the Monetary Metals Gold Fundamental Price rose $44 this week, to $1,493. This is above the end-of-year target we published in our Outlook 2018. |

Gold Basis, Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

| Now let’s look at silver. |

Silver Basis, Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

| The May contract is nearing expiry, and as is typical in silver there is a falling basis and rising co-basis due to the contract roll aside from any changes in abundance or scarcity.

That said, the silver co-basis fell slightly from March 29. The Monetary Metals Silver Fundamental Price fell 14 cents to $17.10. Here are graphs of the gold and silver fundamental prices. There is a noticeable uptrend in gold, but not in silver. |

Gold Fundamental Price and Market Bid Price |

The fundamental price of silver is also well above the market price at present, but does not show a similar uptrend (note that silver usually lags gold when economic confidence is weakening. Over the past year or longer, the high (and rising) gold-silver ratio has been a rather odd outlier accompanying the economic expansion, particularly as it coincided with extremely tight rather than widening credit spreads most of the time. Perhaps this constitutes a subtle economic warning sign, or it is another hint that credit spreads have become distorted by central bank intervention (particularly by the ECB).

© 2018 Monetary Metals

Charts by: Bigcharts, Monetary Metals

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: dollar price,gold basis,Gold co-basis,Gold prices,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver prices,USD-CNY