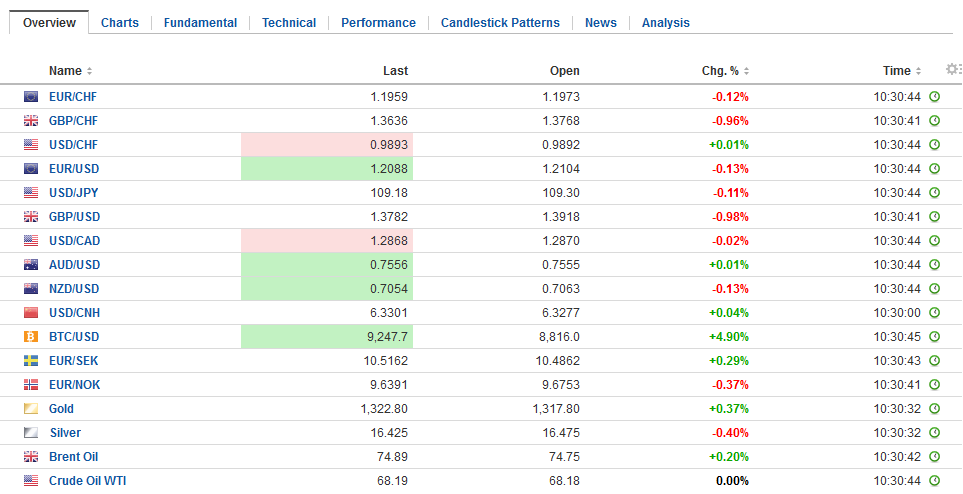

Swiss FrancThe Euro has fallen by 0.08% to 1.1958 CHF. |

EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar’s recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week’s gains to change market’s narrative, the fact of the matter, as we have pointed out is that April is the third consecutive month in which the Dollar Index fell in only one week. That translates into rising 10 of the past 13 weeks. A combination of market positioning, such as the speculative record net long euro position in the futures market as of April 17, rising US interest rates, and diverging economic performances (data surprises indices) seemed to have spurred the move. Although in some circles, the dollar’s “exorbitant privilege” may still be discussed, the US interest rate premium over Germany has never been higher. The interest rate premium over JGBs is sufficient to begin enticing Japanese asset managers to boost their unhedged allocation. |

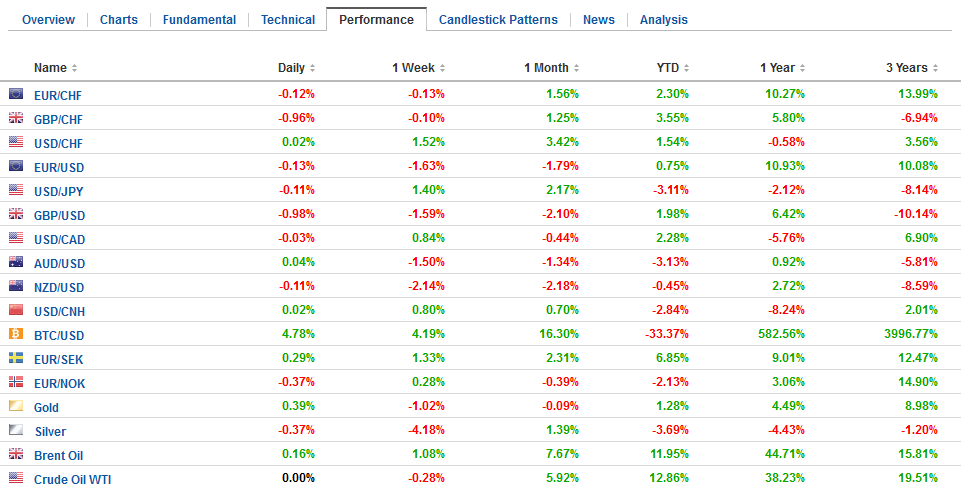

FX Daily Rates, April 27 |

| There are three drivers of the rise in US rates: Federal Reserve rate hike intentions, rising inflation expectations, and supply considerations. Suffice it is here to share three observations. First, next week there is a reasonably good chance that the core PCE deflator, the Fed’s preferred measure, will reach the 2% target for the first time in around five years. Second, Treasury announces the quarterly refunding details next week. The size of each offering may increase, including the TIPS (unlike the previous quarter). Third, the market is confident of a June Fed hike and a statement next week that is more confident (hawkish hold).

The large euro option strike yesterday at $1.22 proved useful in navigating the price action. We suspect euro’s sell-off provided the lens to understand Draghi rather than something Draghi said the spurred the price action. He acknowledged some disappointing data throughout the area and suggested this rather than monetary policy per se was the subject of the council’s discussion. This should not have been surprising. Monetary policy is on auto-pilot until September. There is no external urgency to announce the post-September strategy, which the market has come around to expect further tapering. |

FX Performance, April 27 |

|

Those of our readers planning on buying Swiss Francs in the short-term future are seeing improving rates on almost a daily basis at the moment. The Swiss National Bank has had a job on its hands as in the eyes of many, the Swiss Franc has been overvalued for some time now. Due to the currency’s status as a safe haven currency investors tend to pool their funds into CHF in times of market uncertainty. Over the years this has presented a problem for the SNB, and its lead to them adopting one of the most loose monetary policies globally. If we take the GBP to CHF exchange rate as an example, it’s currently trading around an 18-month high with CHF losing quite a lot of value recently in relation to other currencies. CHF has lost 1.5% against GBP with week and over 6.5% over the past two-months to put things into perspective for our readers. The Swiss Franc’s performance against the Euro is also beginning to hit the headlines after losing a similar amount of value when paired with EUR, although the current level is a preferred one for the SNB as they’ve been attempting to soften CHF’s value through the momentary policies implemented. Wednesday will be the next key date for Swiss economic data releases as Retail Sales figures will be released. Do feel free to get in touch if you wish to be updated should CHF exchange rates move dramatically. |

GBP/CHF, April 27(see more posts on GBP/CHF, ) |

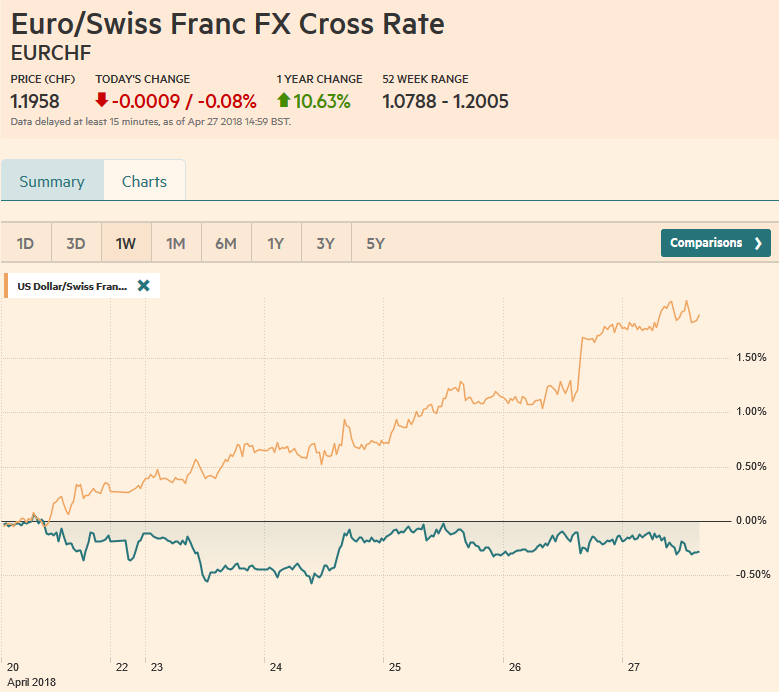

SpainDraghi stressed that the expansion remained solid and broad-based. Today’s data will not disappoint. Spain and Austria reported a 0.7% expansion in Q1 ( 0.7% and 0.9% in Q4 18 respectively). |

Spain Gross Domestic Product (GDP) QoQ, Apr 2013 - 2018(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

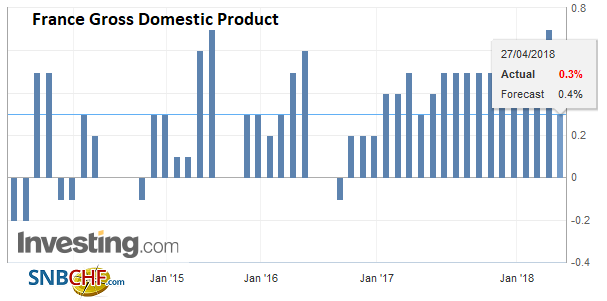

FranceFrance was on the low side with a mild 0.3% rise, which is probably more aligned with the trend growth than the 0.7% pace seen in Q4 17. |

France Gross Domestic Product (GDP) QoQ, May 2013 - Apr 2018(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

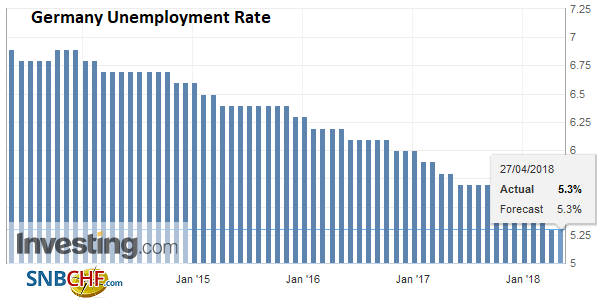

GermanyGermany reported another decline in unemployment in April, though by the least since last June. |

Germany Unemployment Rate, Apr 2013 - 2018(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

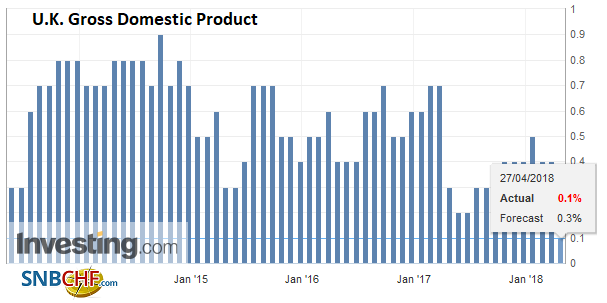

United KingdomThe UK disappointed. Most had been looking for 0.3% expansion in Q1. The risk was understood to be on the downside, but today’s 0.1% report, on the back of a contraction in services in February. Over the past week, the odds of a BOE rate hike at the May 10 meeting has been scaled back, and it has now been largely pushed back into Q3. This has weighed on sterling. Since falling below $1.40 at the start of the week, it has been unable to resurface it, including the last test yesterday. It is now testing $1.38. A break of $1.37 could signal the completion of a double top pattern that would project toward $1.30, which is where sterling carved a base last October and November. |

U.K. Gross Domestic Product (GDP) QoQ, May 2013 - Apr 2018(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

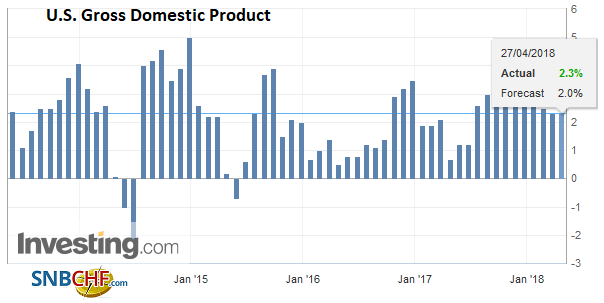

United StatesThe US reports its first look at Q1 GDP. The consensus is for around 2%, and if anything, after yesterday’s news of a smaller than expected US trade deficit, the “whisper number” is higher. It may be, but in our reckoning, the improvement on trade was blunted by the news on inventories and shipments of durable goods orders. The main drag on the economy, why it is expected to slow from the 2.9% annualized pace in Q4 18, is consumption. The shopping sprees in Q4 saw consumption (~65%-70% of the economy) rise at a 4% annualized pace. In Q1, it is thought to have slowed considerably (to a little more than 1%). The Employment Cost Index, which measures wages and benefits (compliments average hourly earnings data in the jobs report), will be released and it is expected to confirm that despite a tightening of the labor market, there is no significant acceleration in labor costs. |

U.S. Gross Domestic Product (GDP) QoQ, May 2013 - Apr 2018(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

The dollar has made a higher high against the yen every day this week. In the past three sessions, the greenback stalled in front of JPY109.50. We do not see any significant options struck there, but our data is not complete. The head and shoulders bottoming pattern for the dollar that we had been monitoring targeted JPY110.

The BOJ did not surprise. By an 8-1 vote, the extraordinary policy was continued. The sole dissent continued to come from Kataoka. The BOJ dropped the reference to achieving the 2% inflation target around FY19. Kataoka wanted an explicit statement about the timing, but he had not been convinced that it would be achieved what it had projected. The BOJ’s forecasts for core CPI in FY19 did not change (1.8%). It did cut this year’s forecast to 1.3%.

The takeaway is that while the BOJ is less confident in achieving its inflation target. It means that an exit from the extraordinary path is unlikely, and ways to make policy more sustainable may be explored. The newly arrived Deputy Governor Wakatabe did not dissent, as many had thought likely. However, the tweak in the forward guidance confirms the flexibility that we had detected privately.

The Fed can be more confident that the ECB that the loss of economic momentum is transitory. The US has as much fiscal stimulus in the pipeline as was provided during the heart of the Great Financial Crisis. Its targets are within spitting distance. Meanwhile, US corporate earnings growth has been solid, and although some of the Treasury auctions may be testing the market’s appetite, longer maturities may be more attractive. Some US asset managers and banks have argued that 3% on the 10-year is an attractive yield. Yesterday’s $29 bln seven-year note sale was the best received in three months.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$JPY,$TLT,EUR/CHF,France Gross Domestic Product,gbp-chf,Germany Unemployment Rate,newslettersent,Spain Gross Domestic Product,SPY,U.K. Gross Domestic Product,U.S. Gross Domestic Product,USD/CHF