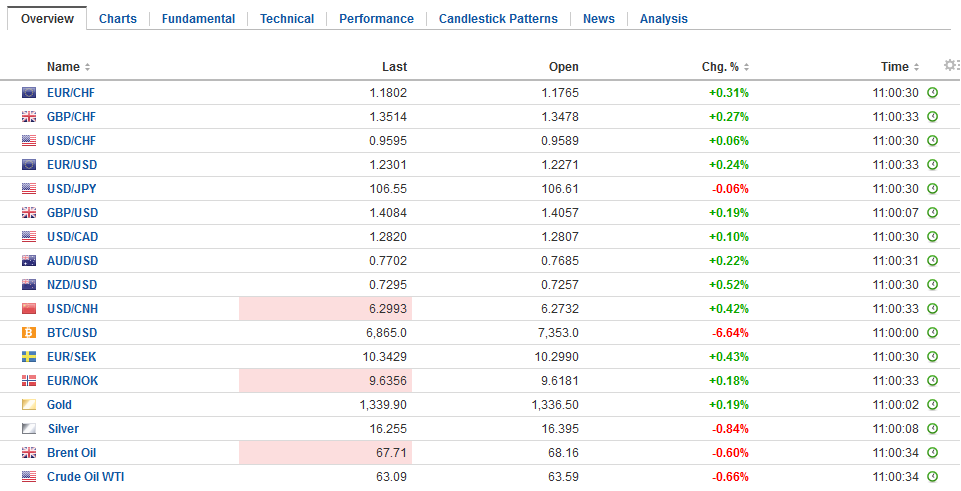

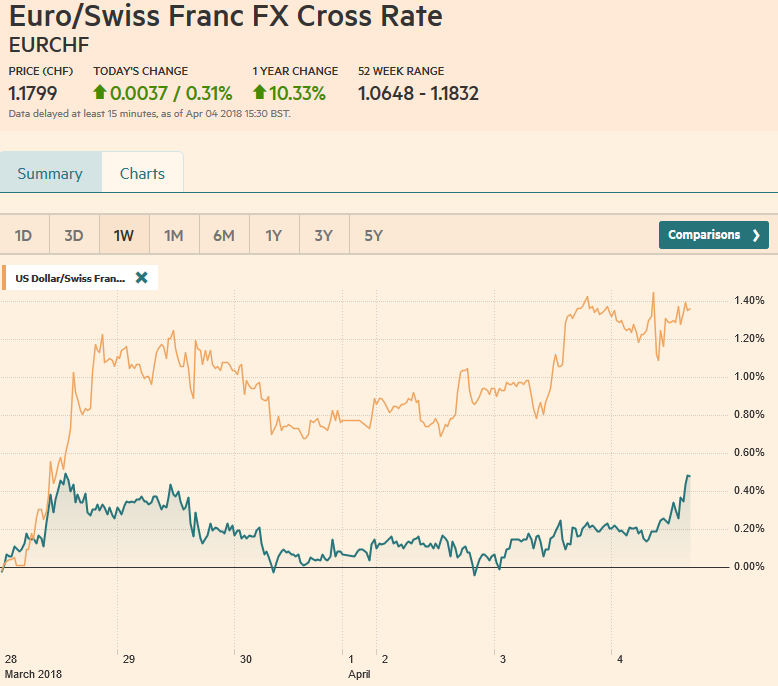

Swiss FrancThe Euro has risen by 0.31% to 1.1799 CHF. |

EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesLate yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations through the capital markets, driving down equities, corn and soybean prices (subject to Chinese tariffs). The US dollar was sold, especially against the yen, euro, and sterling. The dollar-bloc currencies lagged. There has been a low level but persistent US-China trade tensions for years, though we would quickly add that the same can be said about Canada. One of the most consistent themes of the Trump Administration has been reducing the US trade imbalance. Another consistent theme is doubts about the salience of “international community,” and the need for the US to defend its national interests. From these two themes arises the unilateral trade actions. |

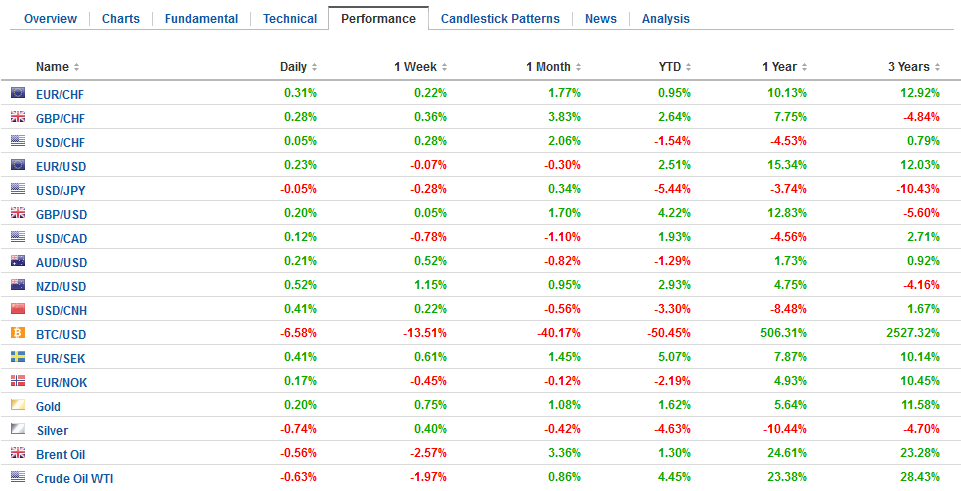

FX Daily Rates, April 04 |

| In recent discussions in China, we were struck by how many people cited what was happening in the US as reason why it is understandable that the PRC lifted the term limits for the head of state. To be sure, the Chinese president is also head of the military and head of the Party and both those positions are without term limits. By carrot and stick, the US cajoled the formation of a multilateral trade mechanism and the rule-of-law.

It may not have been ideal, and it was a work in progress. The ease at which a new administration could reverse course throws many off balance. China is taking many long-term strategic initiatives, of which the One Belt One Road and Made in China 2025 are but the highest profile examples. It cannot, many people suggest, take the chance and see the strategy upended because of some arbitrary time. |

FX Performance, April 04 |

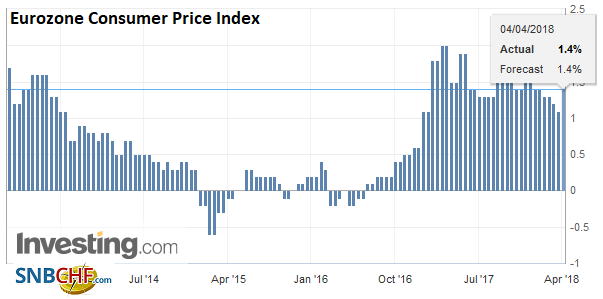

EurozoneThe eurozone reported March CPI was rose to 1.4% from a revised 1.1% in February (originally 1.2%). |

Eurozone Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

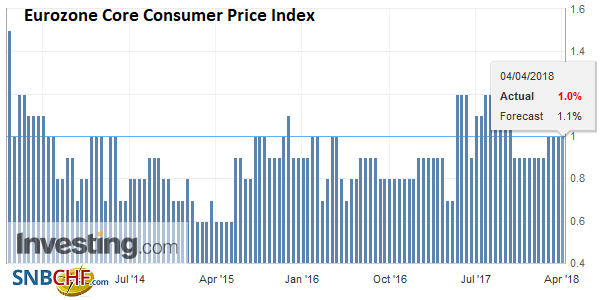

| The core rate was, disappointingly, unchanged at 1.0%. Many had expected it to tick up to 1.1%, not that that would make a big difference. |

Eurozone Core Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

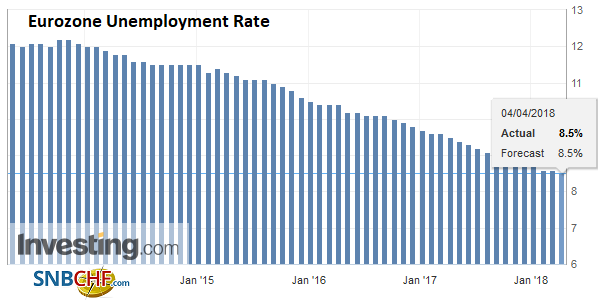

| Separately, the unemployment rate slipped to 8.5% from 8.6% in January. Today’s reports are close enough to expectations that views on the ECB are unlikely to change. The euro itself remains confined a trading range since mid-January (narrow $1.22-$1.24, broader $1.2155-$1.2555). |

Eurozone Unemployment Rate, Apr 2013 - 2018(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

United Kingdom |

U.K. Construction Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

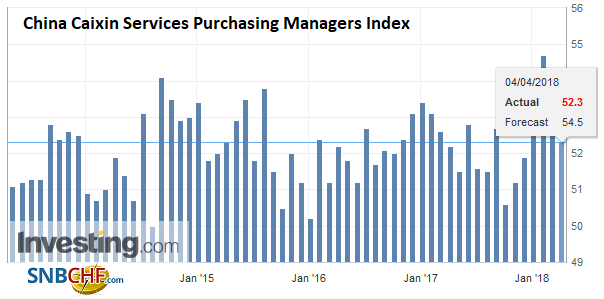

China |

China Caixin Services Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

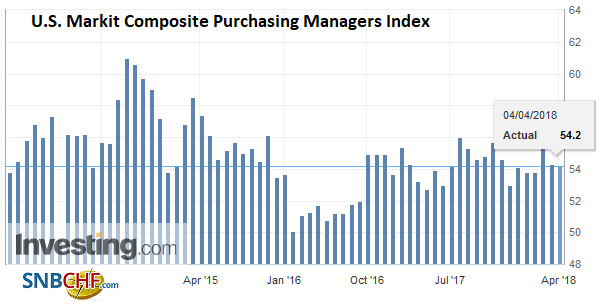

United States |

U.S. Markit Composite Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

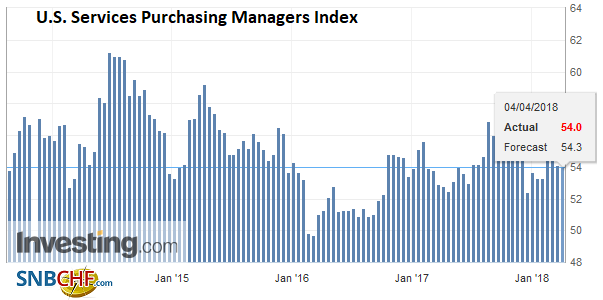

U.S. Services Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

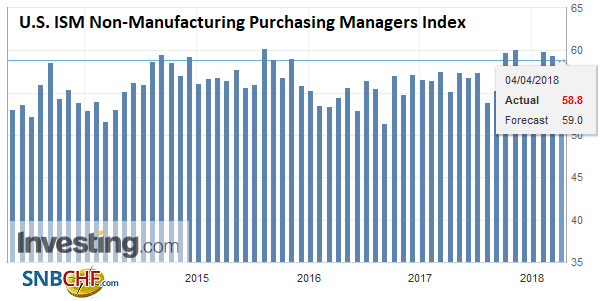

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

U.S. Crude Oil Inventories, Apr 2013 - 2018(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

The focus shifts back to the US. The billion-dollar question is whether the US initiates counter-retaliatory measures. If the US does, it would seem be a clear escalation. Currently, the US provocations escalated the chronic low-level tension. China took small steps on washing machines, solar panels, steel, and aluminum. Now, in response to the tariffs for intellectual property violations, it has ratcheted up its response.

While there may be a disapproval of the US unilateral actions, which could violate the WTO rules, there also seems to be wide criticism of China’s trade practices. There was a chance to present a united front. It is a lost opportunity for American leadership. Turning the challenge of integrating China into the world economy into a bilateral affair seems to be the least friendly for the investment climate.

The end of the low vol period in stocks ended with a bang in late January and early February, before trade tensions were escalated. However, it now is one of the factors preventing investors finding terra firma. Yesterday’s stronger than expected US auto sales suggests the world’s biggest economy is recovering from a soft patch at the start of the year. Fed Governor Brainard’s comments provide additional encouragement to look past the volatility and high frequency data noise. The bar for the Fed not to hike rates in June is quite high. That said, note that while tariffs are supposed to lift prices, corn and soybean futures fell by around 3% on China’s announcement.

Outside of trade, there were a couple of developments to note. First, Australia reported stronger than expected retail sales but a larger decline in building approvals. Retail sales rose 0.6% in February after a revised 0.2% gain in January (was 0.1%). Grains were broadly distributed over the various categories. February building approvals fell 6.2%. The Bloomberg median forecast was for a 5.0% decline. What was at stake was the slowing after the incredibly strong January surge of 17.2%.

The Australian dollar rallied on the news and reached almost $0.7720, but the trade tensions weighed. It recorded the session low in early Europe near $0.7665. The Aussie remain in the trough and not far from the year’s low (~$0.7645) seen a week ago.

While trade issues and the equity market drop are going to dominate investors’ focus today, there is a slew of US economic data. The highlights include the ADP private sector estimate (anything north of 200k is good), non-manufacturing PMI and ISM (both are expected to be little changed), and factory orders (a recovery after a 1.4% drop in January).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: $AUD,$EUR,China Caixin Services PMI,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,newslettersent,SPY,U.K. Construction PMI,U.S. Crude Oil Inventories,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF