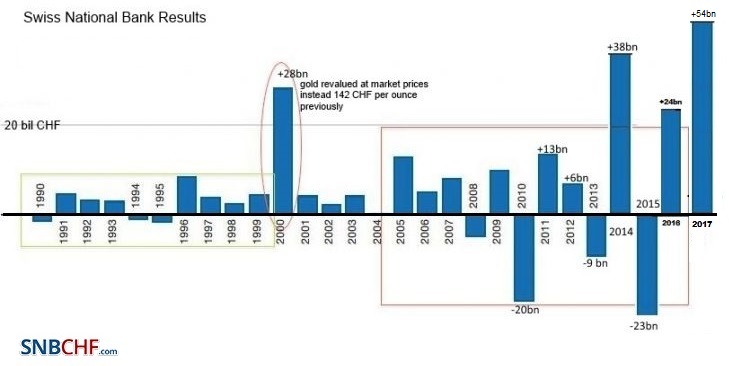

The increasing volatility of SNB Earnings

Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings.

But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse.

Good years of the Credit Cycle

This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now.

Franc will rise again with crisis or inflation

With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again.

And this at an exchange rate that is not digestible for the SNB.

We considered that after an inflationary period the

- EUR/CHF will fall to 0.90

- and USD/CHF to 0.75.

And this will lead to a massive SNB loss around 150 billion CHF. |

SNB Results Longterm 2017 - Click to enlarge |

Some extracts from the official statement.

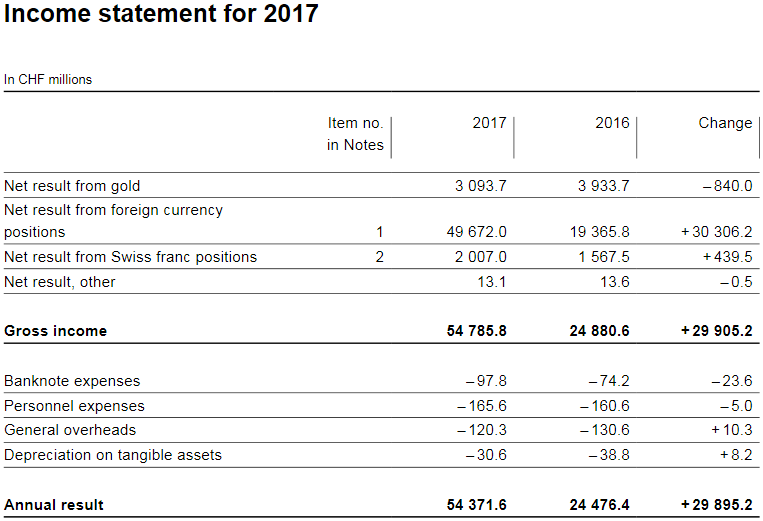

Annual result of the Swiss National Bank for 2017

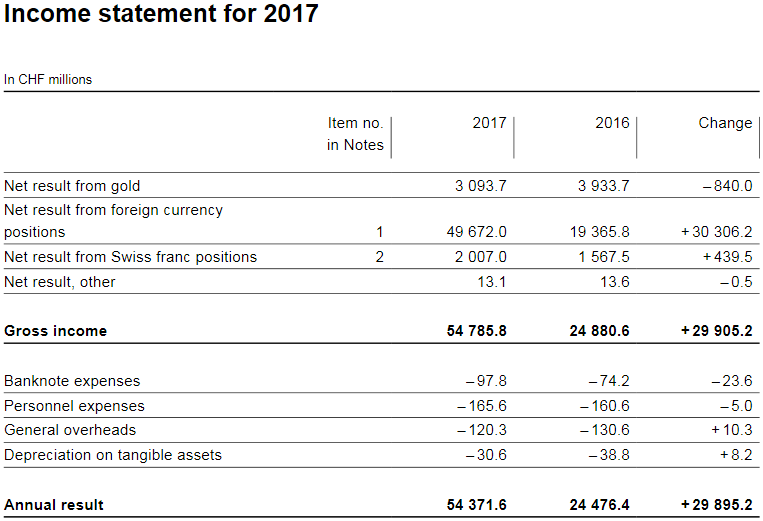

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion).

The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 5.0 billion. After taking into account the distribution reserve of CHF 20.0 billion, the net profit comes to CHF 69.3 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of CHF 1 billion as the distribution reserve after appropriation of profit exceeds CHF 20 billion. Of the total amount to be distributed (CHF 2 billion), one-third goes to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 67.3 billion.

|

Income statement for 2017 Source: snb.ch - Click to enlarge |

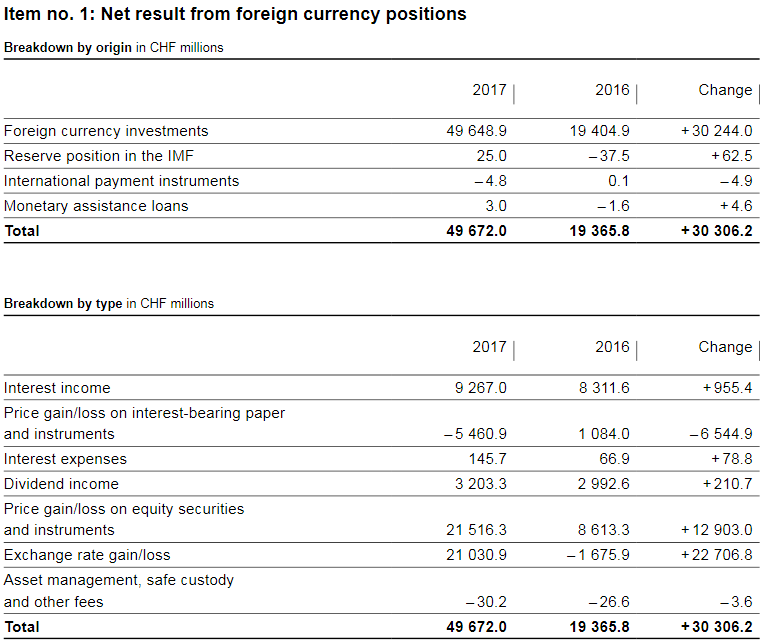

Profit on foreign currency positions

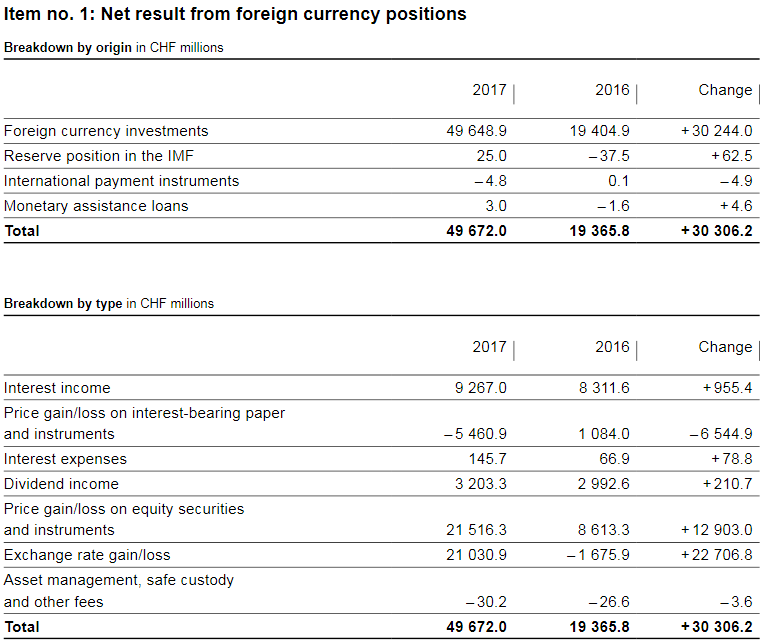

The profit on foreign currency positions was CHF 49.7 billion (2016: CHF 19.4 billion).

Of this, interest income amounted to CHF 9.3 billion and dividend income to CHF 3.2 billion. Movements in bond prices differed from those in share prices. Price losses of CHF 5.5 billion were recoded on interest-bearing paper and instruments. By contrast, equity securities and instruments benefited from the favourable stock market environment and contributed CHF 21.5 billion to the net result. Overall, exchange rate-related gains amounted to CHF 21.0 billion.

SNB results 2017

(in bn CHF) |

Profit |

BalanceSheet |

Profit in % |

| Total Profit on foreign currencies |

49.7 |

843.3 |

5.89% |

| Interest income (coupons) |

9.3 |

843.3 |

1.10% |

| Dividend income |

3.2 |

843.3 |

0.38% |

| Price changes in bonds |

-5.5 |

843.3 |

-0.65% |

| Price changes in equities |

21.5 |

843.3 |

2.55% |

| Exchange Rate Gains |

21.0 |

843.3 |

2.49% |

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

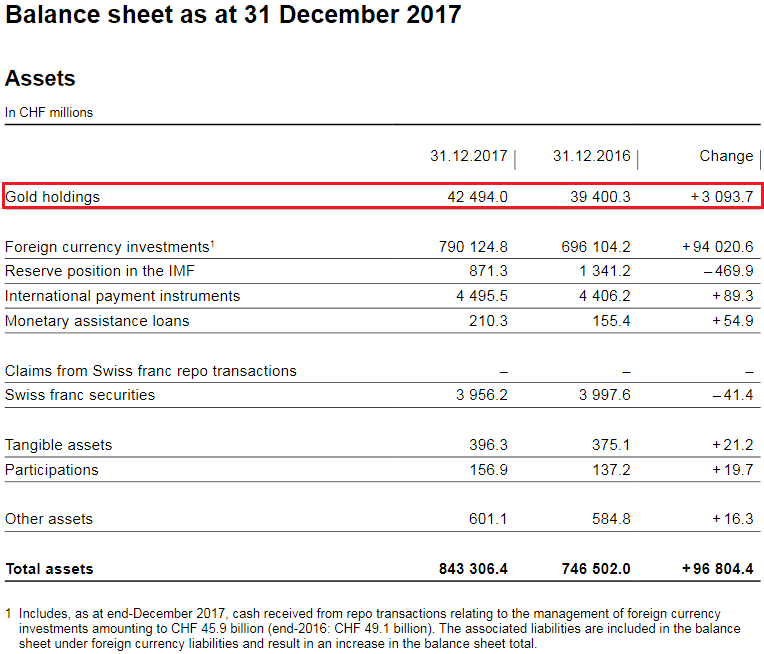

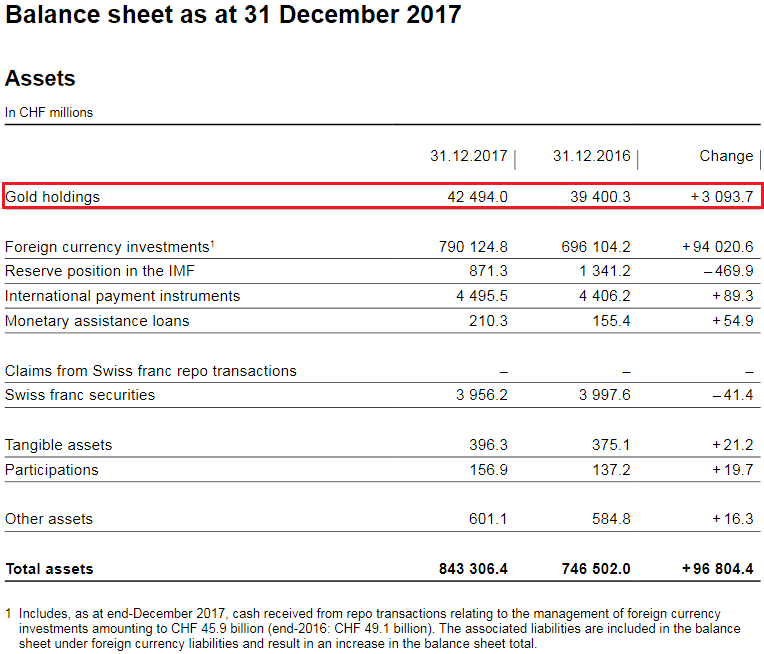

Valuation gain on gold holdings

At CHF 40,859 per kilogram, the price of gold was 8% higher than at the end of 2016 (CHF 37,885). This gave rise to a valuation gain of CHF 3.1 billion on the unchanged holdings of 1,040 tonnes of gold (2016: CHF 3.9 billion).

SNB Results 2017

(in bn CHF) |

Profit |

Balance Sheet |

Profit in % |

| Total Profit on Gold………………………….. |

3.1 |

843.3 |

0.37% |

Percentage of gold to balance sheet

The percentage of gold compared to the total balance sheet is falling.

SNB Balance Sheet items

(in bn CHF) |

2017 |

2016 |

2015 |

2014 |

| Gold……………………………………… |

42.5 |

39.4 |

35.5 |

39.60 |

| Total Balance Sheet |

843.3 |

746 |

640 |

561 |

| Gold in % of Balance Sheet |

5.04% |

5.28% |

5.55% |

7.06% |

Balance Sheet

The balance sheet has expanded by over 68.3 bn. francs by 8.81%.

|

2017 |

2016 |

Increase in % |

| SNB balance sheet in CHF………………. |

843.3 |

746.5 |

8.81% |

| Swiss nominal GDP in CHF |

659 |

650 |

0.92% |

| % of GDP |

127.97% |

114,85% |

|

|

SNB Balance Sheet for Gold Holdings for 2017 Source: snb.ch - Click to enlarge |

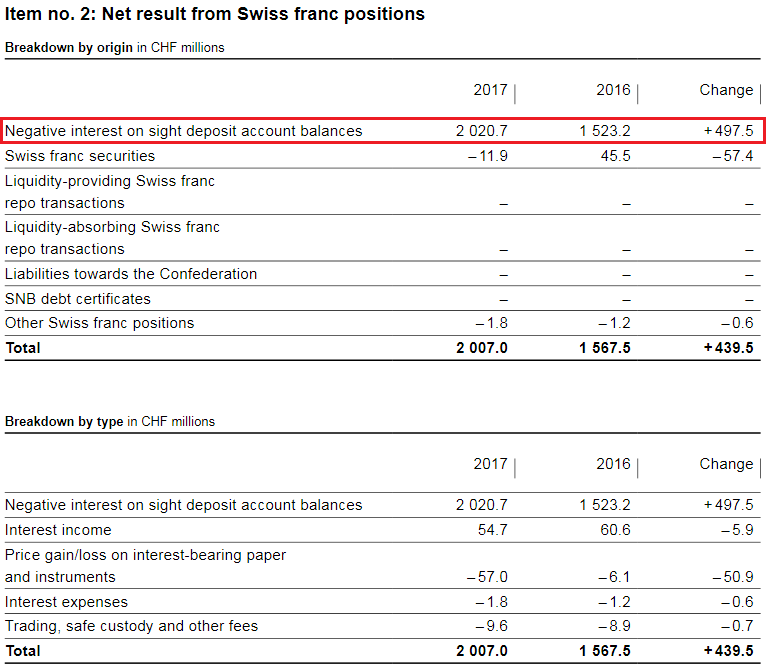

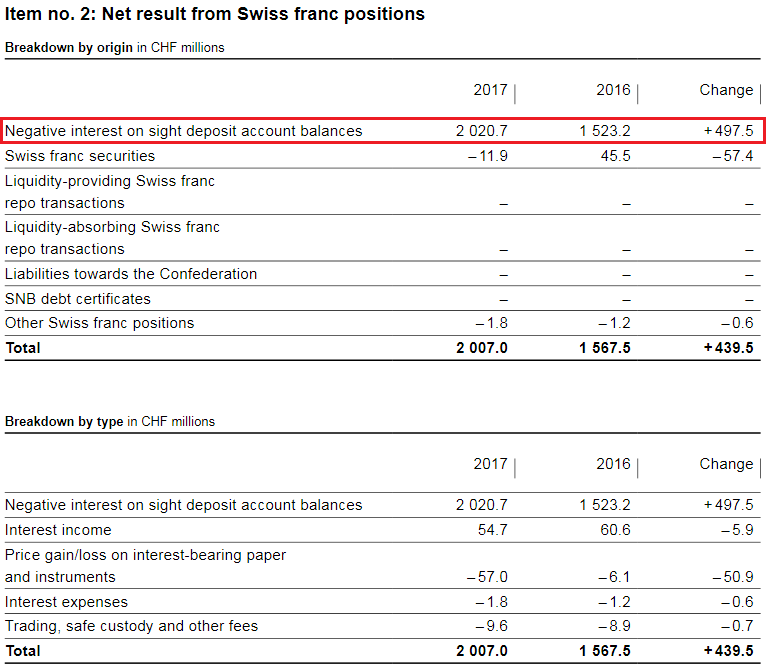

Profit on Swiss franc positions

The SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

The profit on Swiss franc positions, which stood at CHF 2.0 billion (2016: CHF 1.6 billion), largely resulted from negative interest charged on sight deposit account balances.

Negative Interest rates

Furthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

2017 |

2016 |

Change in % |

| Income through negative interest rates |

2.02 |

0.69 |

192.75% |

| SNB balance sheet |

843.3 |

746.5 |

12.97% |

| in % of balance sheet |

0.24% |

0.09% |

|

|

SNB Result for Swiss Franc Positions for 2017 Source: snb.ch - Click to enlarge |

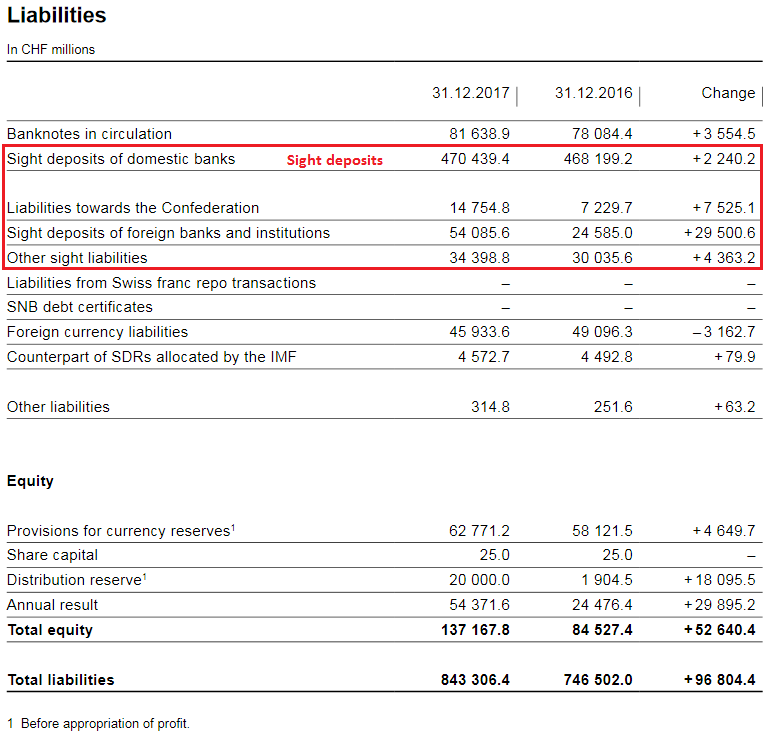

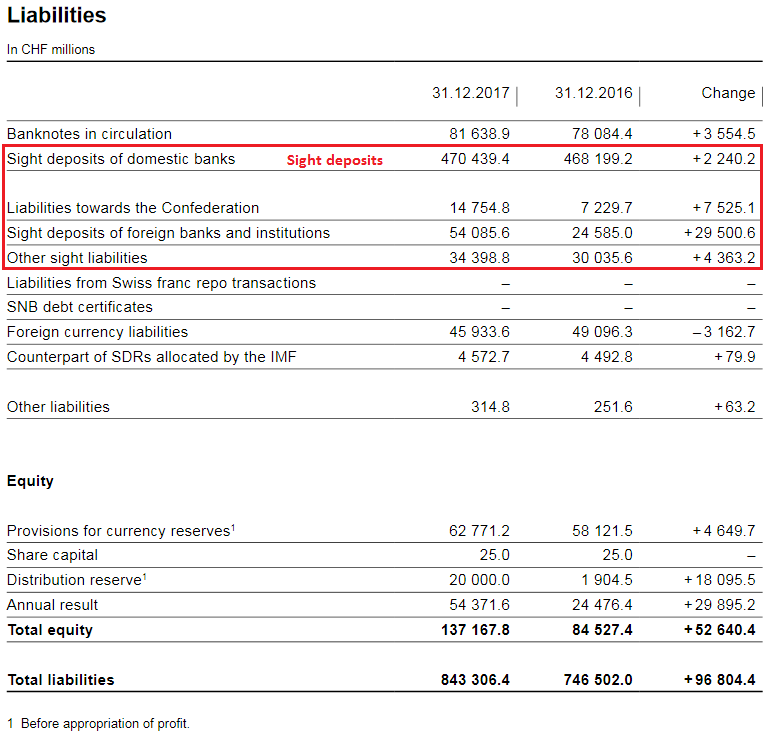

SNB Liabilities

Electronic Money Printing: Sight Deposits

Sight deposits is the biggest part of SNB interventions.

|

2017 |

2016 |

Change in% |

| Total Sight Deposits |

573,7 |

530 |

8.25% |

| Balance Sheet |

843.3 |

746.5 |

12.97% |

| % of balance sheet |

68.03% |

66.98% |

|

Paper Printing

Banknotes in circulation: -1.9 bn francs to 76 bn. CHF

The old form of a printing press, today a less important form of central bank interventions.

Provisions for currency reserves

In principle, given the high market risks present in the SNB balance sheet, the percentage increase in provisions is calculated on the basis of double the average nominal GDP growth rate for the previous five years. In addition, a minimum annual allocation of 8% of the provisions at the end of the previous year has applied since 2016. This is aimed at ensuring that sufficient allocations are made to the provisions and the balance sheet is further strengthened, even in periods of low nominal GDP growth.

Since nominal GDP growth over the last five years has averaged just 1.4%, the minimum rate of 8% will be applied for the 2017 financial year. This corresponds to an allocation of CHF 5.0 billion (2016: CHF 4.6 billion). As a result, the provisions for currency reserves will grow from CHF 62.8 billion to CHF 67.8 billion.

|

SNB Liabilities and Sight Deposits for 2017 Source: snb.ch - Click to enlarge |

Provisions for Currency Reserves are insufficient

Obviously the provisions for losses of

are insufficient to cover the 150 billion CHF loss with the next crisis.

Full story here

Are you the author?

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

Previous post

See more for 1.) SNB Press Releases

Next post

Tags:

newslettersent,

SNB balance sheet,

SNB equity holdings,

SNB Gold Holdings,

SNB profit,

SNB results,

SNB sight deposits,

Swiss National Bank