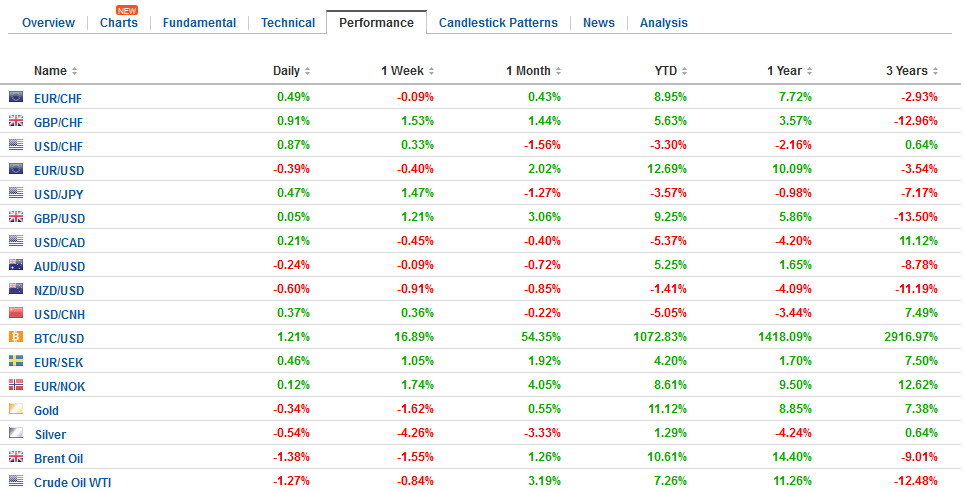

Swiss FrancThe Euro has risen by 0.46% to 1.1652 CHF. |

EUR/CHF and USD/CHF, December 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar opened higher in Asia and retained those gains through the European morning. The greenback has recouped most of the pre-weekend losses recorded in the wake of the indictment of a fourth former Trump Administration official by the special investigation into Russia’s involvement in last year’s election. However, two weekend developments seemed to blunt the impact of the guilty plea and admission of cooperation. First, it remains a mystery of why Flynn lied to the FBI when contact with Russia during the transition period was not illegal. Although some suspect that there is more to the story that will be ferreted out in the coming weeks, it is not clear where the investigation is headed. Also, the Republican Party has not abandoned the President by any means, and without this taking place, impeachment talk, which event markets have upgraded, seems premature at best. More importantly, the Senate passed its version of tax reform. It was not clear before the weekend that this would happen. The approval took place early Saturday morning. The next step is the reconciliation of the House and Senate version. The differences are so profound that one cannot simply assume that the bill that emerges from the reconciliation committee will look anything like the Senate or House versions. |

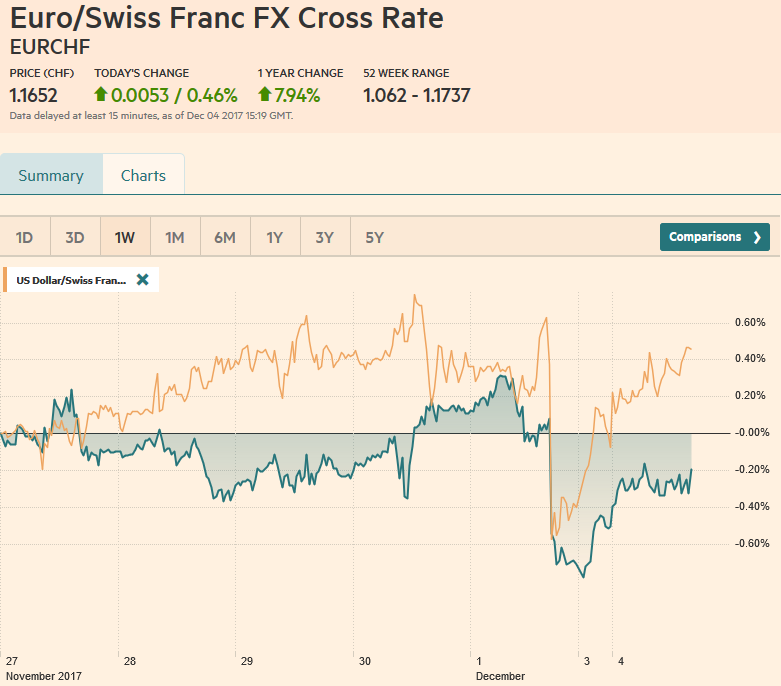

FX Daily Rates, December 04 |

| Moreover, a new twist to the plot emerged after the Senate passed its bill. President Trump indicated that he is now willing to compromise over his earlier demand that the corporate tax rate be cut to 20%. He now says 22% may be good enough. That two percentage point difference is worth around $200 bln over the next decade.

Without knowing more details, it is difficult to determine the economic impact of the tax reform. A poll conducted a month ago, found nearly half the economists surveyed by the National Association of Business Economists expected growth to be 0.20%-0.39% stronger in 2018. Opinion polls suggest in the battle for public opinion, the tax reform is not popular. The irony is not to be lost, in the heart of the economic crisis, many who voted for the tax reform had objected to the nearly $790 bln economic stimulus, on the grounds that the country could not afford it. Now with the economic expansion cycle among the longest in modern history, and possibly accelerating this year, many of the same Senators approved a $1 trillion tax cut. |

FX Performance, December 04 |

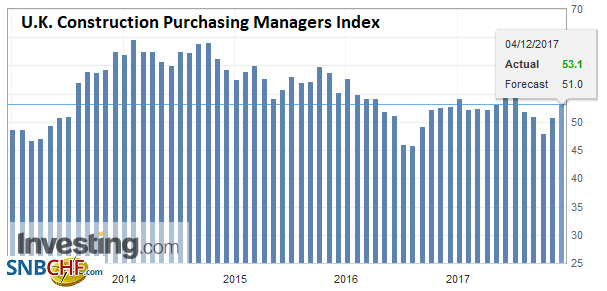

United KingdomThe other major story is Brexit. Today is understood to be a key deadline with UK Prime Minister May to make her last best offer to EU President Juncker in order to set the stage for the heads of state to signal the start of the next phase of negotiations when they meet in the middle of the month. However, there risk of disappointment is palpable. After much feet-dragging, May recently signaled willingness to improve the initial offer of about 20 bln euros. However, there seems to be some backsliding on an issue that was thought to have been resolved, which involved the role of the European Court of Justice in protecting the rights of EU citizens in the UK after Brexit. |

U.K. Construction Purchasing Managers Index (PMI), Nov 2017(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

EurozoneThere also seemed to be little progress on the Irish border. European Council President Tusk indicated that if the UK proposal is not acceptable to Ireland, it is not acceptable to the EU. This seemed to enshrine an Irish veto. To be sure, Ireland is particularly vulnerable to a disruptive exit by the UK, but ties between Northern Ireland and the Republic are of existential importance. |

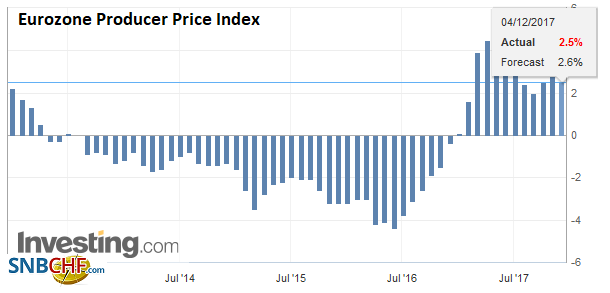

Eurozone Producer Price Index (PPI) YoY, Oct 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

Meanwhile the eurozone finance ministers meet today. Two big topics dominate the agenda. The first is to pick a successor for Dijsselbloem, This official begins what we have suggested is a two-year process whereby a number of key European institutions, including the European Central Bank, will see new leaders. There is a jockeying for position and horse-trading, and domestic politics, such as Merkel’s attempt to cobble another grand coalition.

The second key issue Greece. Greece may have been off many radar screens, but it is working toward an exit of its support program around the middle of next year. A staff-level agreement was struck on the new measures that must be taken to free-up the next tranche of funds, some of which will offer a cash buffer for Greece after its exit. The Greek parliament is expected top pass some measures before the end of the year, and a large omnibus bill is expected in the middle of next month. Greece is also expected to is a new bond (three- or seven-year obligation).

Asian equities were mixed, while European bourses are racing higher. Benchmark 10-year bond yields are higher. Core bonds yields in Europe are mostly two-three basis points higher, while the periphery bond are up less and Greek yields are a few basis points lower. The US 10-year yield has straddled the 2.40% area.

The euro finished last week near $1.19 and reached a low near $1.1835 before steadying. Key support is seen near $1.1800. Resistance now is pegged neat $1.1880. The dollar traded above JPY113.00 for the first time since the middle of last month. Initial resistance is seen near JPY113.20. Note that there are more than $1 bln of options that mature today, which are struck between JPY113.00 and JPY113.25. Sterling is trading near three-day lows near $1.3420. Given the recent run-up, it appears vulnerable to disappointment on the political front. Meanwhile, the Australian and New Zealand dollars are trading with a heavier bias. The Canadian dollar is consolidating its pre-weekend jobs inspired gains. The Bank of Canada and the Reserve Bank of Australia hold policy meetings this week, but are widely recognized to be on hold.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Producer Price Index,newslettersent,U.K. Construction PMI,USD/CHF