USD/CHFThe USD/CHF pair broke the bullish channel’s support line strongly and settled below it, to start bearish correction for the rise measured from 0.9420 to 1.0038, as the price started the breaking process to 23.6% Fibonacci correction level at 0.9892, hinting that the decline will extend towards 0.9800 areas in the upcoming sessions. Therefore, the bearish trend will be suggested for today, supported by the negative pressure formed by the EMA50, taking into consideration that the expected decline will remain dominant unless the price managed to breach 0.9910 followed by 0.9955 levels and hold above them. Expected trading range for today is between 0.9800 support and 0.9940 resistance.

|

USD/CHF, November 15(see more posts on USD/CHF, ) Source: economies.com - Click to enlarge |

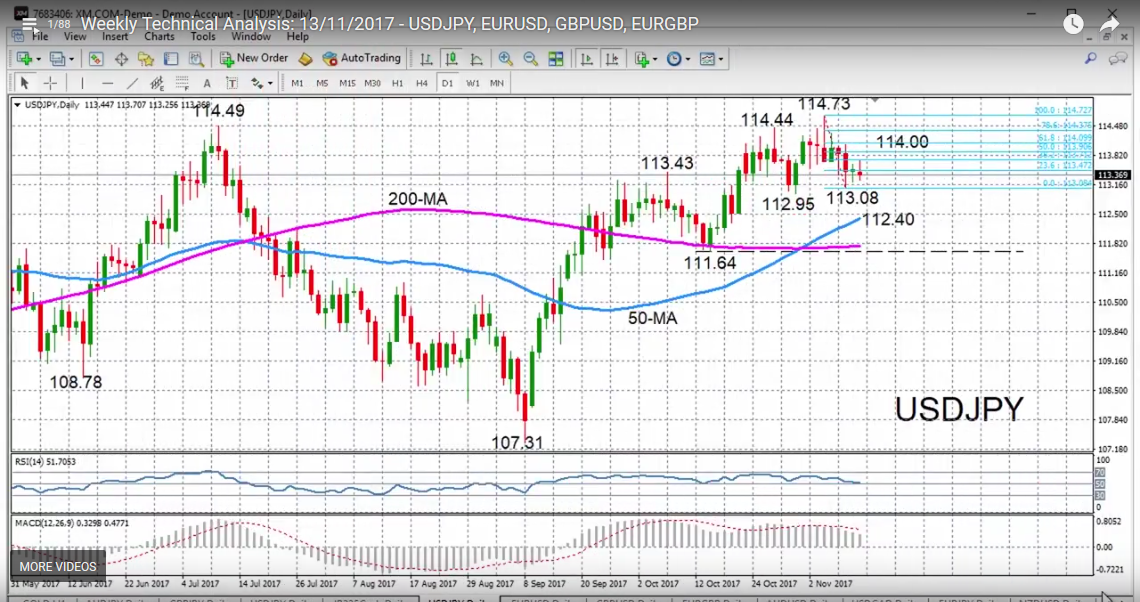

USD/JPY |

USD/JPY with Technical Indicators, November 13(see more posts on USD/JPY, ) |

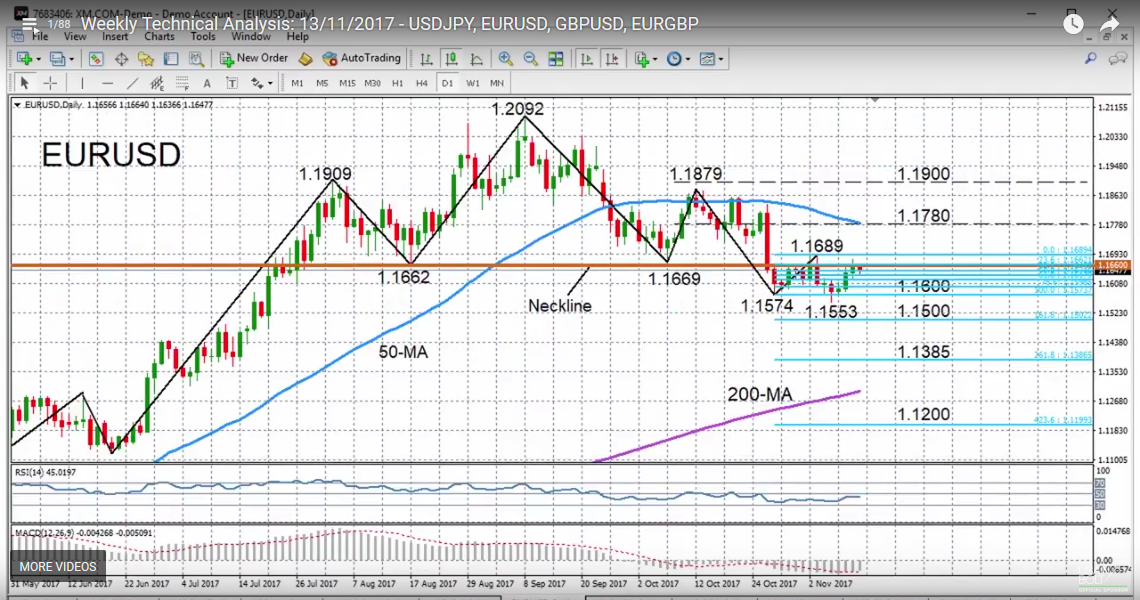

EUR/USD |

EUR/USD with Technical Indicators, November 13(see more posts on EUR/USD, ) |

GBP/USD

|

GBP/USD with Technical Indicators, November 13(see more posts on GBP/USD, ) |

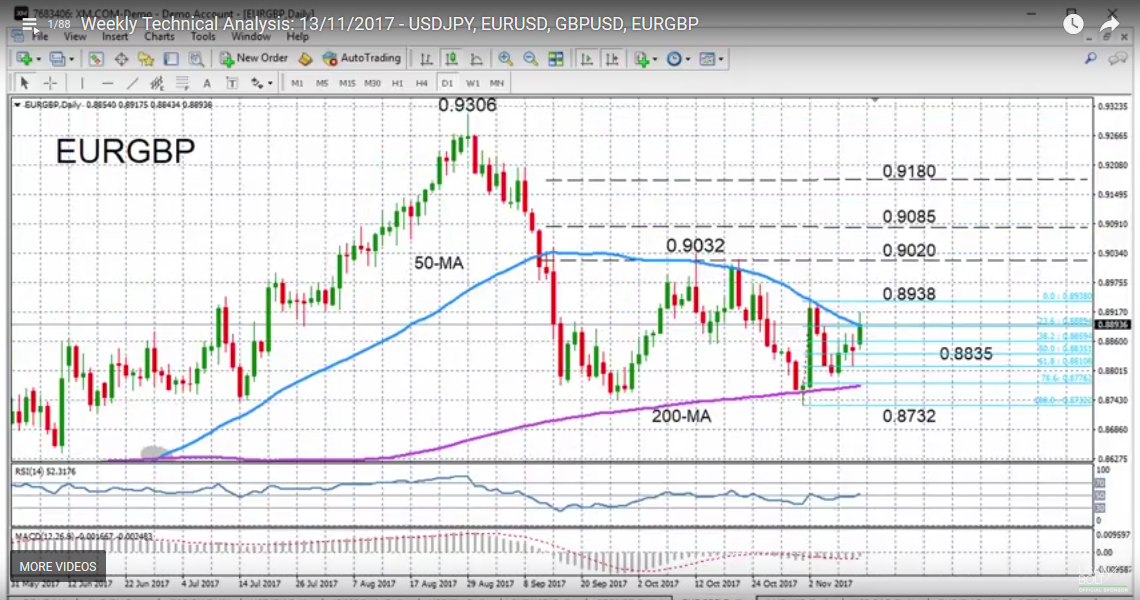

EUR/GBP

|

EUR/GBP with Technical Indicators, November 13(see more posts on EUR/GBP, ) |

Are you the author? Previous post See more for Next post

Tags: Australian Dollar,Bollinger Bands,British Pound,Canadian Dollar,Crude Oil,EUR/GBP,EUR/USD,Euro,Euro Dollar,Japanese yen,MACDs Moving Average,newslettersent,RSI Relative Strength,S&P 500 Index,Stochastics,Swiss Franc Index,U.S. Dollar Index,U.S. Treasuries,usd-jpy,USD/CHF,USD/JPY