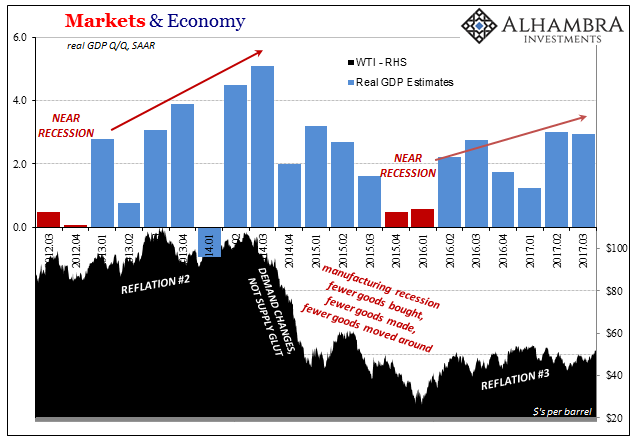

| Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy crude (futures) it certainly didn’t add any coincident selling pressure.

It’s likely a path of least resistance kind of thing, though the question is why. In other words, “global growth” is a story we’ve heard so many times before and we know how it ends. That is very likely why even after this latest price jump WTI is struggling toward $60 rather than $90 or $100 (or why rubles, real, junk credit, etc., can’t fully rebound, either). Markets are a quite a bit more aware of what’s really going on than how the world is described in the media. |

Markets and Economy. March 2012 - 2017(see more posts on Markets, ) |

| In other words, oil may be rising on upside risk potential, the Middle East at the forefront of those, but also the small possibility that “globally synchronized growth” does happen, that the Fed does get one thing right after the last ten years. If it was anything other than a slight probability, with actual evidence for it, WTI would be flirting with $90 or $100 because that’s how markets work.

So when the International Energy Agency (IEA) cuts its forecast for global crude demand growth, those downside risks are also factored in to the price holding it below $60. For the mainstream, however, it’s somehow a bit shocking:

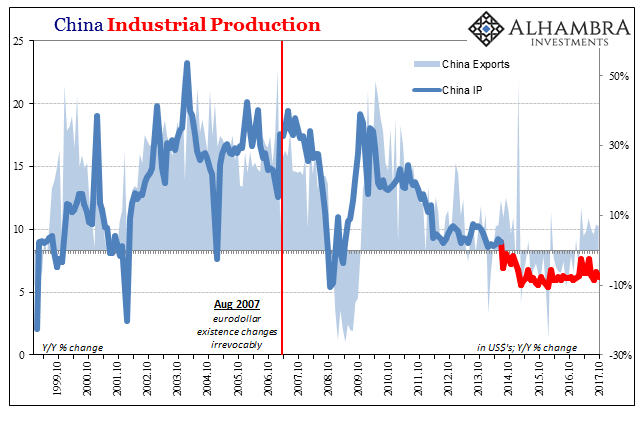

The word that stands out in CNBC’s description is “surprisingly.” Only if you believe in “globally synchronized growth” is it anything like surprising. The data is all there quite easily dispelling every such notion. It starts in China. Descriptions of the Chinese economy in 2017 vary, but at the worst it’s called stabilizing and oftentimes qualified by the usual hyper-positives like “strong” and “robust.” In truth, China’s economy experienced a very slight rebound from 2016, one so small it barely qualifies. There is no doubt that last year was a huge and dangerous disappointment to “global growth” starting as it does in China. For economic conditions to merely match them a year and a half later is already a downside risk before ever getting to more recent trends. Industrial Production in October 2017 was again up by just 6%. Outside of a few months earlier this year, IP remains stuck at a very low rate, over three years now below 8%. |

China Industrial Production, Oct 1998 - 2017(see more posts on China Industrial Production, ) |

| If there was ongoing global growth in any meaningful sense, the Chinese would be right now producing for it. Instead, these weak levels of production match only too well the current (weak) state of global trade. There is no acceleration in production because quite simply there is no demand for it whatsoever. |

China Industrial Production, Oct 1999 - 2017(see more posts on China Industrial Production, ) |

| Exports have turned positive again this year, but so what? Linear thinking gets hung up far too much on the plus sign. For Chinese industry, and therefore global growth in reality, there is no meaningful difference between exports growing at +6% and when they were declining up until late last year.

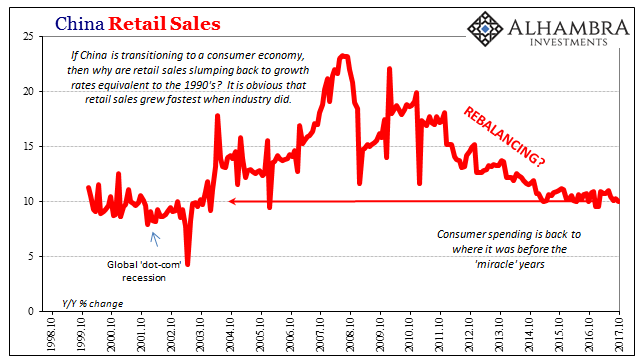

That puts even greater pressure on so-called rebalancing. If China can’t do anything about foreign demand for its products, and it can’t, then at the very least it can transform its own economy into a self-sustained growth engine on par with the US and Europe. Global growth could be reprioritized in that fashion, and it is a common perception in the mainstream. |

China Retail Sales, Oct 1998 - 2017(see more posts on China Retail Sales, ) |

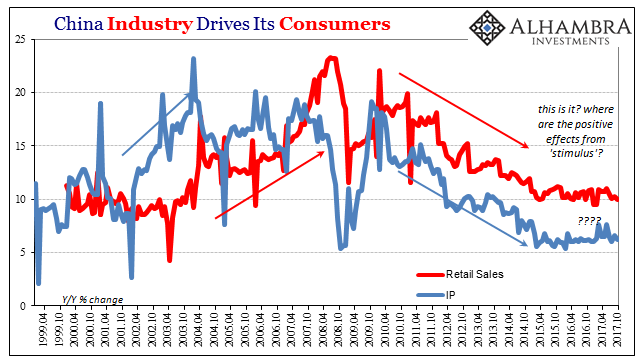

| And like everything else there is no evidence at all for it. Chinese Retail Sales rose by just 10% in October, one of the weakest months of the last fifteen years. For an economy that is supposed to be reinventing itself for global benefit, there is no sign that it is happening. Instead, retail sales follow only too closely Industrial Production stuck in serious weakness, about half the growth that might be considered for rebalancing to be anything other than an attempt at rationalizing optimism. |

China Industry, Apr 1999 - Oct 2017 |

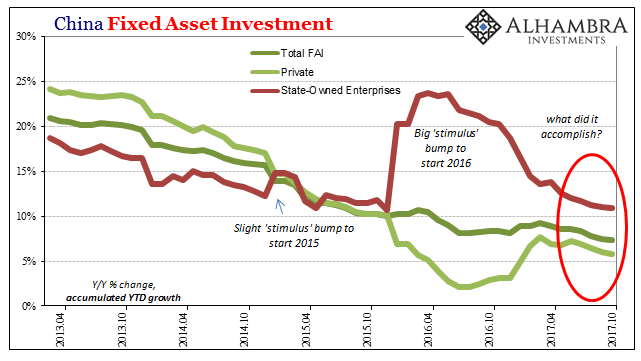

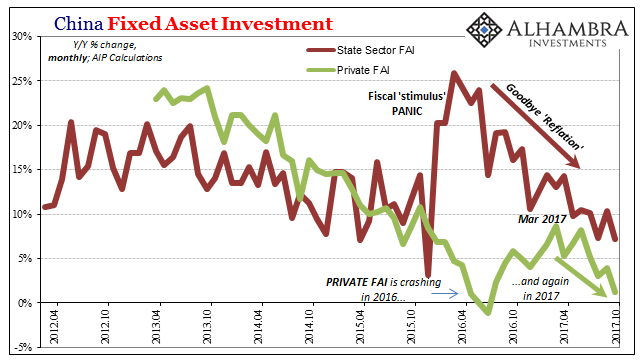

| What really matters more than either of those is the conviction of China’s private economy as to which direction it is all really moving: a rise in global growth just over the horizon, or the same if not worse continued depression and downturn. That means Fixed Asset Investment (FAI) which is the real stuff of China’s economic “miracle”, or at least the economic basis for it.

In 2016, Private FAI crashed, actually contracting (on a monthly basis) for several months in the middle of last year. It was the clear trajectory for it that surely sparked China’s “stimulus” panic. Without FAI, China’s economy projects only serious risks and for more than just economic factors. |

China Fixed Asset Investment, Apr 2013 - Oct 2017(see more posts on China Fixed Asset Investment, ) |

| Despite all the official effort in fiscal spending and monetary experimentation up to and including rerouting “dollar” flow via Hong Kong, Private FAI is crashing again in 2017. |

China Fixed Asset Investment, Apr 2012 - Oct 2017(see more posts on China Fixed Asset Investment, ) |

| As noted above, it never really got going all that much on the plus side. At best in March 2017, Private FAI was up 8% over March 2016. |

China Fixed Asset Investment, Oct 2013 - 2017(see more posts on China Fixed Asset Investment, ) |

| That’s nothing, certainly not the sort of economic conviction you would expect if globally synchronized growth was actually happening, or China’s rebalancing for that matter. As of the latest estimate for October 2017, Private FAI was up just 1.2%. |

China Fixed Asset Investment, Apr 1998 - Oct 2017(see more posts on China Fixed Asset Investment, ) |

| The downside risks to China’s economy have all re-emerged because they never really disappeared. It was only the narrative that changed. As has become normal, an almost perfect replay of 2014, Economists mistook an relative shift for a categorical one. The best that could ever be said of the global economy, and China’s within it, was that in the second half of last year and the first part of this year it wasn’t getting worse. That’s not at all the same as getting better.

And that despite so much “stimulus” intended to boost the economy not just hope it stabilized at an exceedingly low level and rate. The data in this half of 2017 continues to point in the direction of the 19th Communist Party Congress, the official declaration of a no-growth baseline. China appears to be the first nation to try and come to terms with globally synchronized permanent failure. In other words, unlike the beginning of 2016, Chinese officials this time are not going to be running to the rescue with “stimulus.” They’ve learned the hard way there is simply no point. It’s unfortunate because the very element orchestrating the global economy this way is right there out in the open, as it has been for the whole lost decade: |

China Industrial Production, Oct 1999 - 2017(see more posts on China Industrial Production, ) |

Tags: China,China Fixed Asset Investment,China Industrial Production,China Retail Sales,Crude,currencies,economy,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,newslettersent,OIL,oil prices,Retail sales