Monthly Archive: November 2017

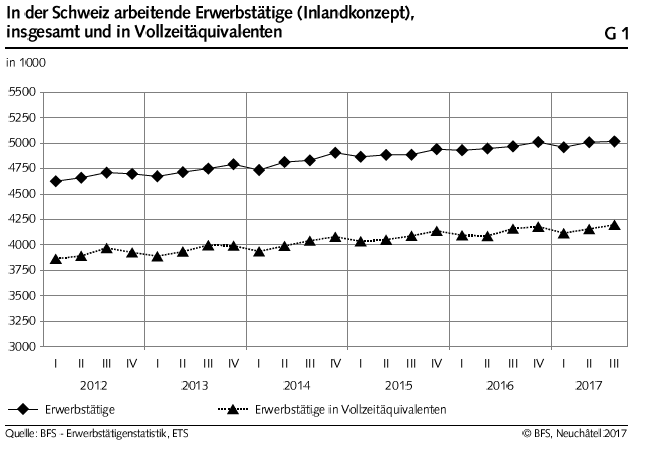

Swiss Labour Force Survey in 3rd quarter 2017: labour supply: 1.0 percent increase in number of employed persons; unemployment rate based on ILO definition at 5.0 percent

The number of employed persons in Switzerland rose by 1.0% between the 3rd quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 5.1% to 5.0%. The EU's unemployment rate decreased from 8.2% to 7.3%. These are some of the results of the Swiss Labour Force Survey (SLFS) conducted by the Federal Statistical Office (FSO).

Read More »

Read More »

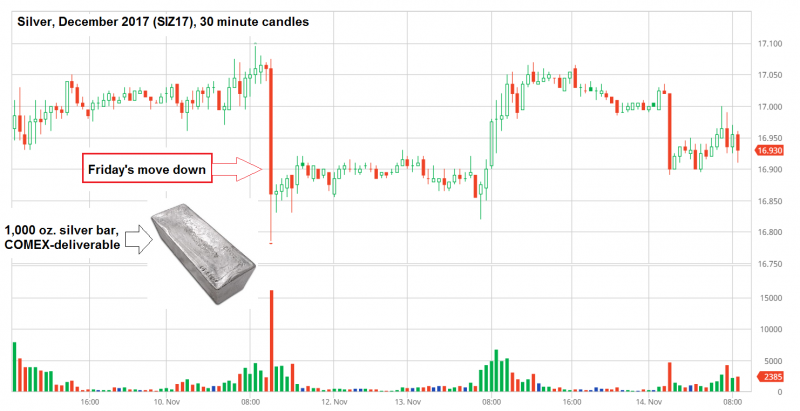

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter.

Read More »

Read More »

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Protect Your Savings With Gold: ECB Propose End To Deposit Protection. New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility. Fear covered deposits may lead to a run on the banks. Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure. Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins

Read More »

Read More »

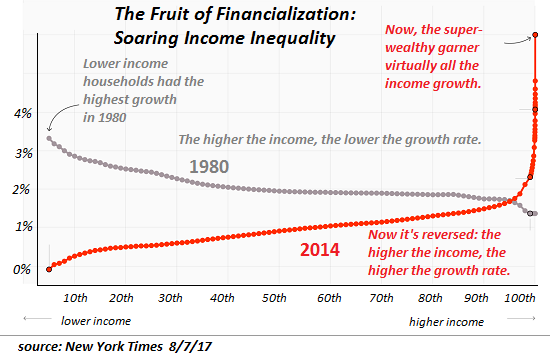

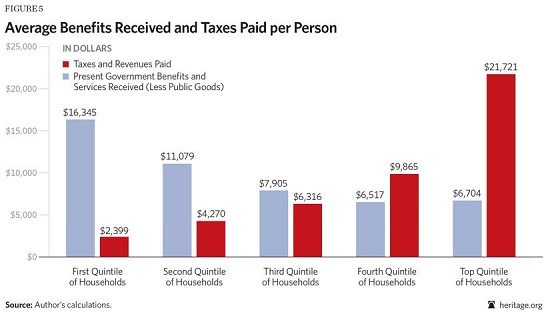

Forget the Bogus Republican “Reform”: Here’s What Real Tax Reform Would Look Like

The point is to end the current system in which billionaires get all the privileges and financial benefits of owning assets in the U.S. but don't pay taxes that are proportional to the benefits they extract. As has been widely noted, the Republicans' proposed "tax reform" is not only just more BAU (business as usual, i.e. cut taxes for the wealthy), it's also not real reform. At best, it's just another iteration of D.C. policy tweaks packaged for...

Read More »

Read More »

What President Trump and the West Can Learn from China

Expensive Politics. Instead of a demonstration of its overwhelming military might intended to intimidate tiny North Korea and pressure China to lean on its defiant communist neighbor, President Trump and the West should try to learn a few things from China.

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »

Credit Suisse Fined $135 million for Malpractices

Credit Suisse bank has been ordered to pay a fine of $135 million (CHF134.5 million) to the US authorities after an enquiry into the Swiss bank’s practices in setting foreign exchange rates. The figure was reached in a consultation between both parties.

Read More »

Read More »

Swiss justice minister calls for commodities crackdown

Following revelations in the so-called “Paradise Papers” of questionable deals done by Swiss-based commodities companies in Africa, Switzerland’s justice minister has said that the country – historically hands-off in regulating the sector – needs new legislation to force those companies to play by the rules.

Read More »

Read More »

The Fetid Swamp of Tax Reform

The likelihood that either party will ever drain the fetid swamp of corruption that is our tax code is zero, because it's far too profitable for politicos to operate their auction for tax favors. To understand the U.S. tax code and the endless charade of tax reform, we have to start with four distasteful realities: 1. Ours is not a representational democracy, it's a political auction in which wealth casts the votes that count.

Read More »

Read More »

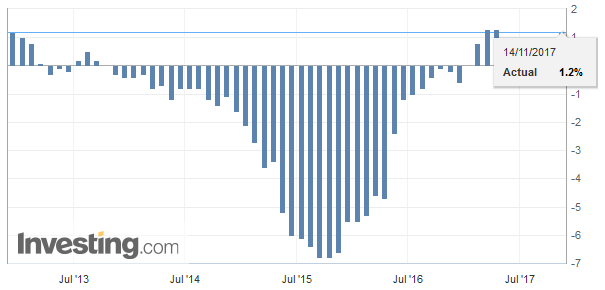

Swiss Producer and Import Price Index in October 2017: +1.2 YoY, +0.5 MoM

The Producer and Import Price Index rose in October 2017 by 0.5% compared with the previous month, reaching 101.0 points (base December 2015 = 100). The rise is due in particular to higher prices for machinery, electrical equipment and metal products. Compared with October 2016, the price level of the whole range of domestic and imported products rose by 1.2%.

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

Switzerland Less Attractive to European Migrants

Fewer people are moving to Switzerland from elsewhere in Europe. Between January and September this year, immigration from European Union states was down by 26%, compared to the same period last year. (RTS/swissinfo.chexternal link)

Read More »

Read More »

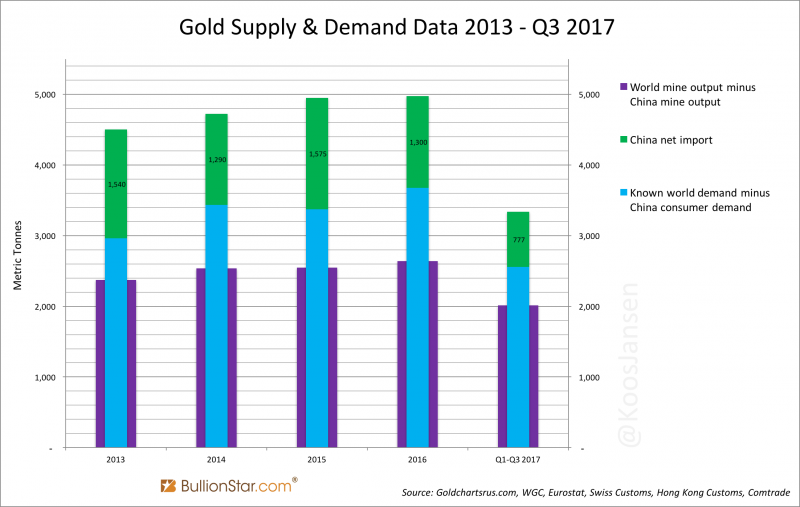

China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day.

Read More »

Read More »

Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see. Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe's future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others.

Read More »

Read More »

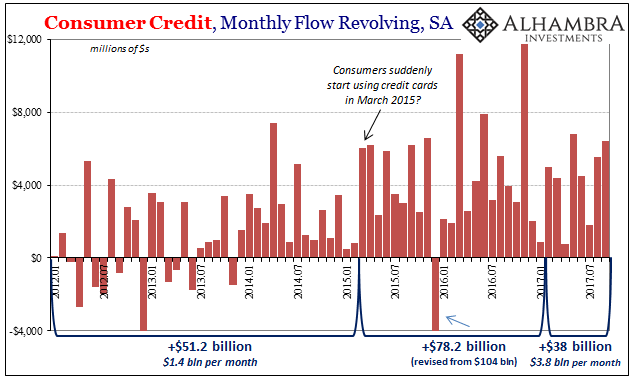

Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month.

Read More »

Read More »

FX Daily, November 13: Sterling Trounced by Growing Political Challenges

The US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means Committee was explicit that the Senate plan to repeal the federal tax break for state and local taxes will not find support in the House of Representative.

Read More »

Read More »

FX Weekly Preview: Week Ahead Data and Policy

There seems to be a broad consensus on the trajectory of policy in the remaining weeks of the year. Barring a major shock or surprise the Federal Reserve will hike rates next month. The ECB's course is set until at least the middle of next year when the current policy will begin to be debated in earnest.

Read More »

Read More »