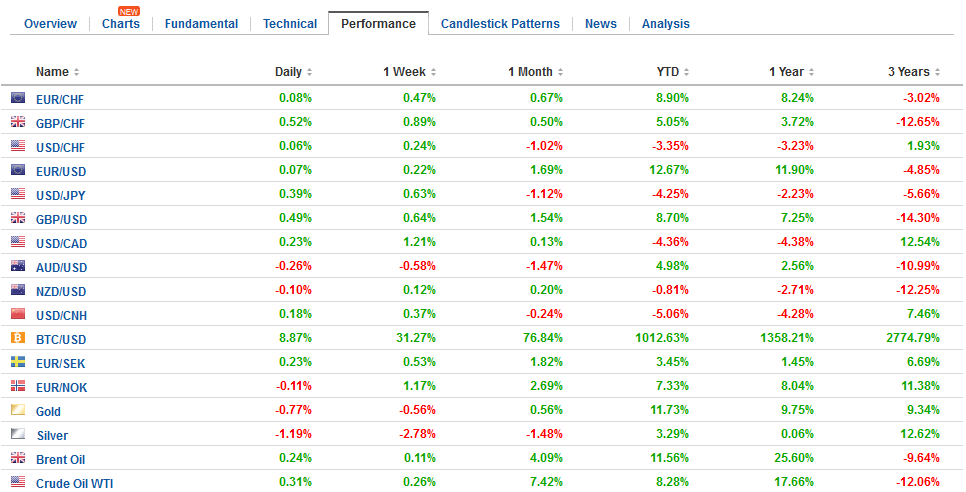

Swiss FrancThe Euro has risen by 0.12% to 1.1665 CHF. |

EUR/CHF and USD/CHF, November 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesProspects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today’s gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the near-term. Sterling has been trending higher since the middle of the month, largely as a function of the broad dollar weakness. However, the move over the past 24 hours is the reports that suggest the broad terms of the financial agreement has been reached. The UK will pay 45-55 bln euros and may have contingent exposure for that amount again (total as much as 100 bln euros). EU negotiators are warning that a final agreement on funds has not in fact been reached. The Irish border issue has not been addressed. There is a sense that some minimum effort by the UK on this in the coming days will suffice for the EU, and Ireland would be understood to be under pressure to accept. That does not mean that the Irish will capitulate, and the issue is additionally complicated by Prime Minister May’s reliance on the Democrat Unionist Party after having her parliamentary majority. |

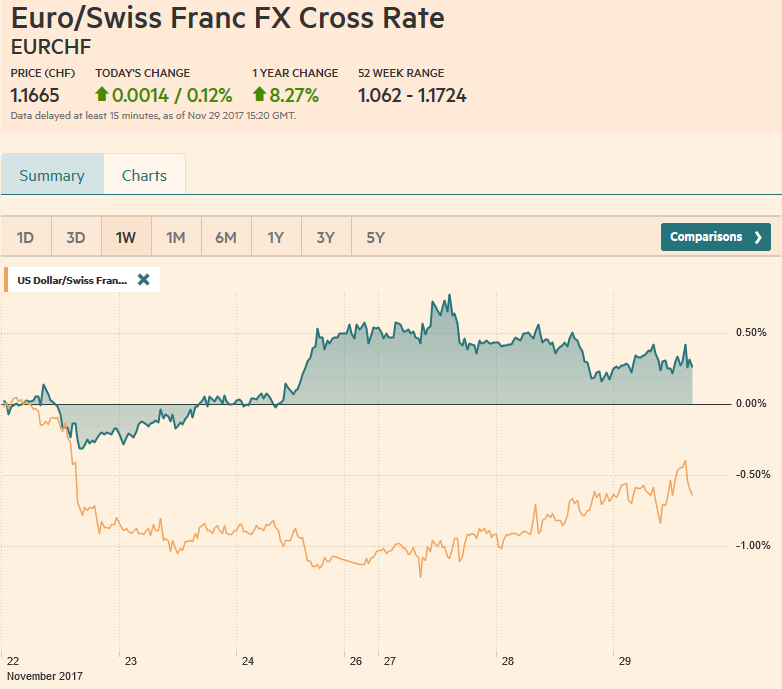

FX Daily Rates, November 29 |

| The increased possibility that a broader Brexit agreement will be achieved, that is to say, the UK will leave with an agreement in hand and be less destabilizing appears to be impacting perceptions of monetary policy. Investors have pushed up the implied interest rates in the short sterling futures market with the term steepening. It appears that another rate hike is being priced at Q4 18. Recall that when the OECD revised down UK growth forecasts earlier this week, it emphasized the uncertainty over Brexit. While the agreement on the financial obligation is important, many hurdles and uncertainties remain, suggesting expectations may be volatile.

Many observers expressed alarm over North Korea’s ICBM test. The yen strengthened. Korean stocks eased even though the MSCI Asia Pacific Index rose 0.25%, for the first increase this week. However, what many seem to miss is that this test makes progress possible. First, the missile test suggests that North Korea has acquired the capability of striking the entire US mainland. North Korea’s leader said that with this test, the nuclear program is complete. That suggests further tests are not necessary. Does it still need to develop some features, like re-entry? Reports suggest perhaps. The euro is trading with a firmer tone after slipping for the past two sessions. It is trading within yesterday’s ranges. Initial support is seen near $1.1825, and resistance pegged in a 10-tick band on both sides of $1.1900. European equities are moving higher. The Dow Jones Stoxx 600 is up about 0.7%. Utilities and financials are leading the way. Energy, consumer staples, and health care are the main drags. Sterling gains appear to be weighing on the FTSE 100, which is off 0.6%, but the FTSE 250 is up 0.3%. |

FX Performance, November 29 |

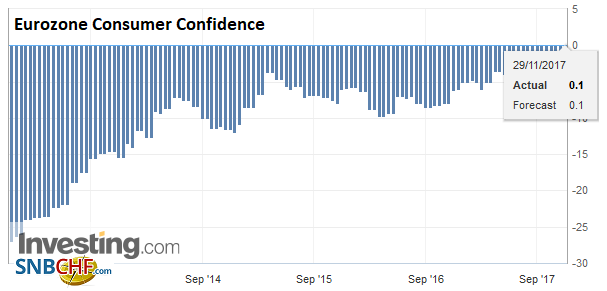

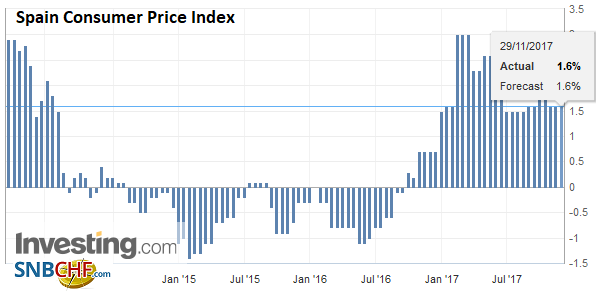

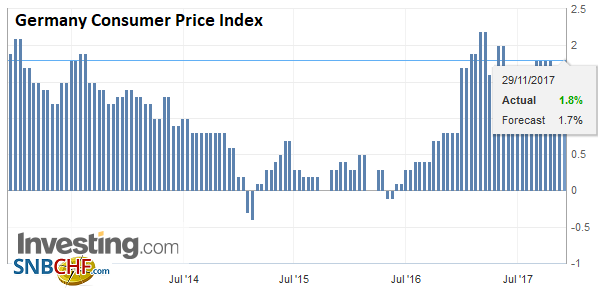

EurozoneTurning to the eurozone, ahead of tomorrow’s aggregate figures, Spain and German have released CPI figures. |

Eurozone Consumer Confidence, Nov 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

SpainSpain’s CPI was a touch less than expected, rising 0.3% in November, and an unchanged 1.7% pace year-over-year. The median forecast for the Bloomberg survey was 1.9%. |

Spain Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

GermanyGermany state reports were firm with a 0.3%-0.4% monthly increases. The national report will be released later today and the year-over-year pace to accelerate to 1.7% from 1.5%. |

Germany Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

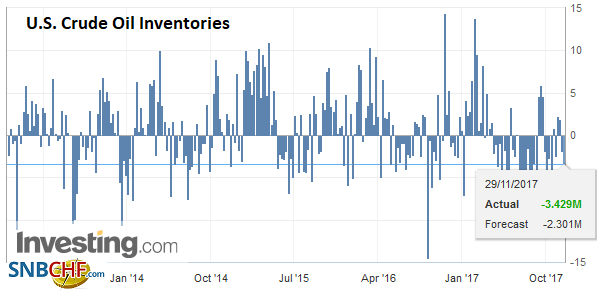

United StatesOil is off for a third consecutive session. The main weight is coming from concerns that the higher prices may sap the willingness of some producers to extend cuts as long as some have anticipated. The price of Brent has doubled since early last year. While Saudi Arabia has support at the nine-month extension of the restraint agreement that expires at the end of Q1 18, others may seek a six-month extension. Also, the industry estimate saw an increase in oil inventories in the US. The government release will be watched today, as many expect a sharp drawdown of nearly 2.5 mln barrels. Inventories fell 1.85 mln barrels in the week ending November 17, and that followed a two-week increase (total of nearly 4.1 mln barrels). |

U.S. Crude Oil Inventories, Nov 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

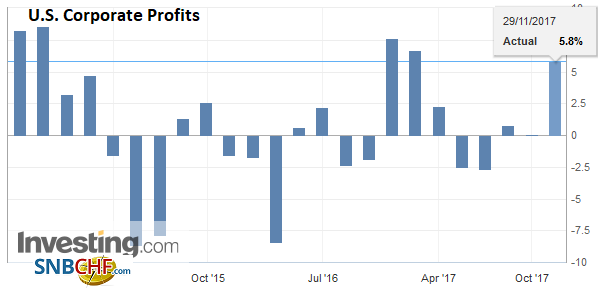

| In a vote along party lines, the US Senate Finance Committee approved the tax proposals, setting the stage for a vote by the entire Senate as early as tomorrow. It promises to be a close vote. The price of securing some Republican Senators has been to agree to some automatic tax increase if revenues fall short of what is projected appears to be alienating others. The trigger that has reportedly been agreed is a 1% rise in the corporate tax rate if revenues fall short after five years. Other Senators seem to be balking at the idea of being locked into tax increases in what could be adverse economic conditions, like a recession. Others seem to object because it injects unnecessary uncertainty.

The Republicans have a 52-48 majority in the Senate. They can afford to have two defections (with the Vice President then casting the tie-breaking vote). If the bill passes the Senate, the next step, which could begin next week, is the reconcile the House and Senate version. They are several important differences, but it is generally assumed a deal will be struck, even if the precise details are not known. |

U.S. Corporate Profits QoQ, Q3 2017(see more posts on U.S. Corporate Profits, ) Source: Investing.com - Click to enlarge |

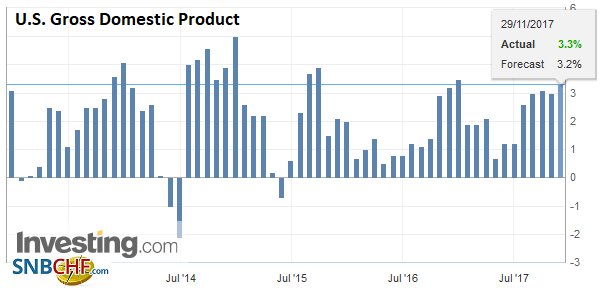

| The US is expected to report an upward revision to Q3 GDP. It is expected to be helped by consumption and inventories. Growth may exceed 3.0% at an annualized rate for the second consecutive quarter and this quarter also looks to be tracking a little north of 3%. Pending home sales are expected to have recovered in October after a flat September. Yellen appears before the Joint Economic Committee of Congress. Like Powell’s confirmation hearing yesterday, we do not expect the new ground to be covered by Yellen today. Dudley speaks in the NY morning on the US economy. His views are already known, and he is optimistic about continued above-trend growth and rising inflation. The Fed’s Williams speaks at lunch in Arizona, and Kashkari hosts a Q&A on Twitter late in the session. |

U.S. Gross Domestic Product (GDP) QoQ, Q3 2017(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Switzerland |

Switzerland ZEW Expectations, Nov 2017(see more posts on Switzerland ZEW Expectations, ) Source: Investing.com - Click to enlarge |

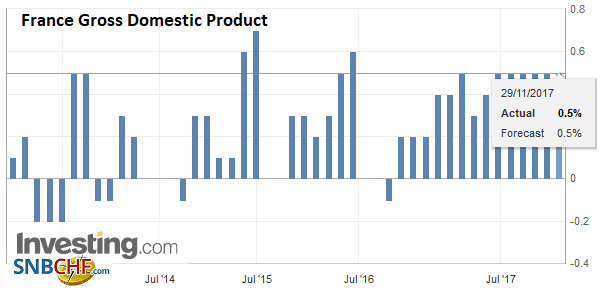

France |

France Gross Domestic Product (GDP) QoQ, Q3 2017(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

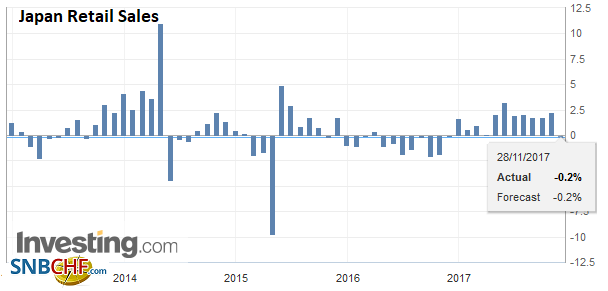

Japan |

Japan Retail Sales YoY, Oct 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

This is not a question certainty, but strategic ambiguity. It is like Israel traditionally refusing to confirm whether it has nuclear capability. It adversaries must assume it does. North Korea now has a face-saving way to stop its ICBM tests. This will allow the US to claim victory too–“better behaved North Korea.” And a greater sense of stability in the region.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,France Gross Domestic Product,Germany Consumer Price Index,Japan Retail Sales,newslettersent,Spain Consumer Price Index,Switzerland ZEW Expectations,U.S. Corporate Profits,U.S. Crude Oil Inventories,U.S. Gross Domestic Product,USD/CHF