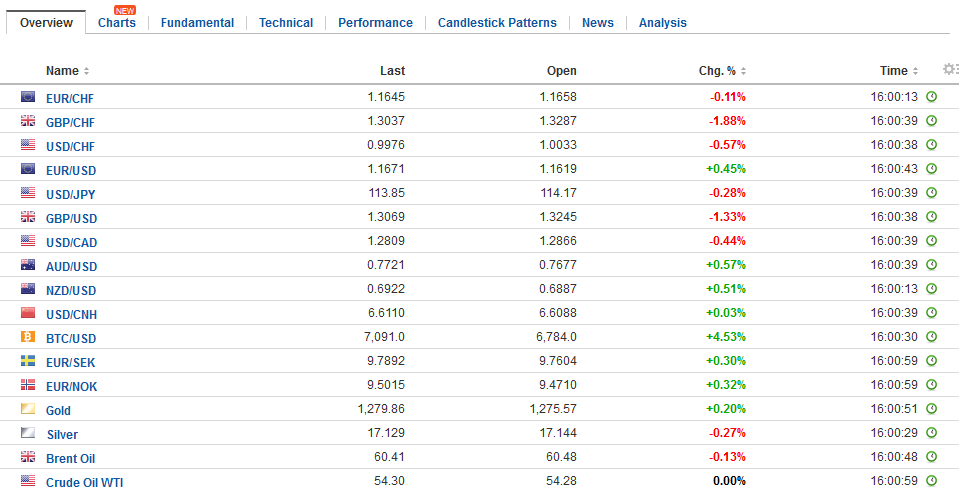

Swiss FrancThe Euro has fallen by 0.11% to 1.164 CHF. |

EUR/CHF and USD/CHF, November 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

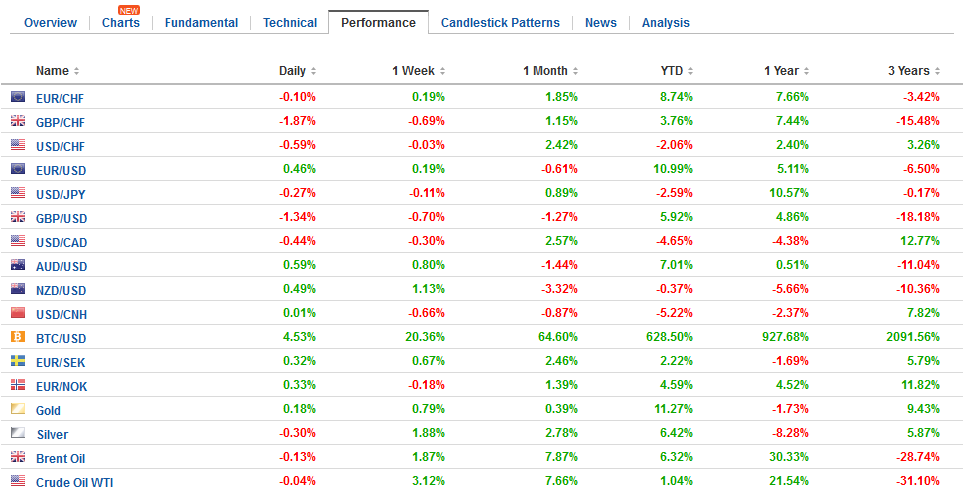

FX RatesWe suggested the market was at crossroads. It is still not clear if the dollar’s breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence. The euro was bid to $1.1670 in Asia, its best level since the ECB meeting. Similarly, the US dollar remains near a key technical level against the Canadian dollar (CAD1.2930), but has been unable to push higher. The greenback has appreciated by about 7.25% against the Loonie on the past two months (since September 8). The Australian and New Zealand dollar are also trading firmer, at their best levels in five or six sessions. |

FX Daily Rates, November 02 |

| Asia sold the dollar seemingly in response to developments at the Federal Reserve, though there has been no surprises. Neither the FOMC decision nor the heightened speculation that Governor Powell will be nominated (and easily approved) as Fed Chair came as a surprise. The Fed upgraded its economic assessment. The December Fed funds futures contract closed unchanged for the eighth consecutive session on Wednesday, implying an average effective Fed funds rate of 1.275%. We estimate that if a 25 bp hike were fully discounted, fair value is 1.295%.

There has been much speculation over the past several months who Trump will pick as the next Fed Chair. On balance, while many acknowledge the fine job Yellen has done, steering the Fed through the tapering, initial rate increases, and now the balance sheet reduction, there is a sense that political considerations do not favor her reappointment. Indications from Washington have persuaded most observers that Powell will likely get the nod, but the surprise may be that Taylor may still in be in the running to replace Fischer, as Vice Chairman. By late yesterday, it was a foregone conclusion that Powell will succeed Yellen. |

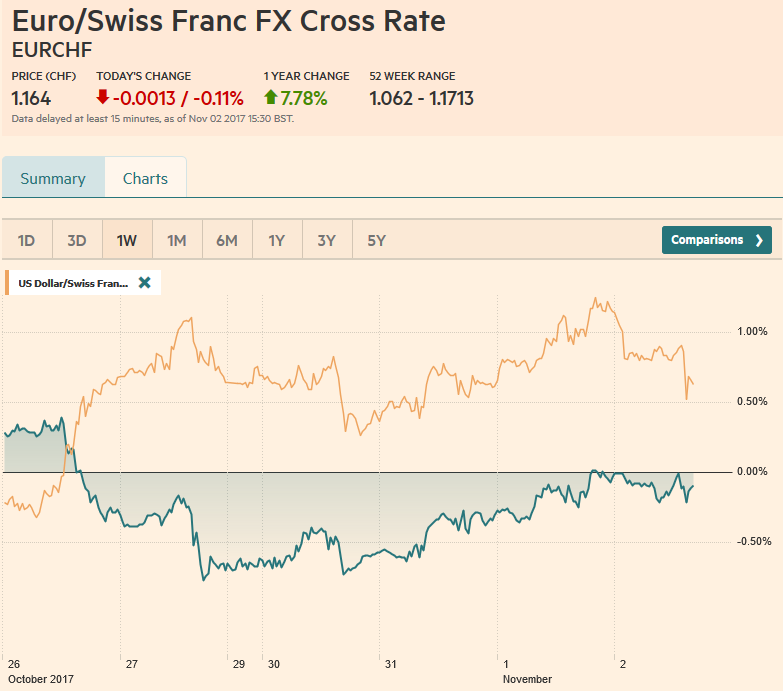

FX Performance, November 02 |

United KingdomThe Bank of England is widely expected to raise interest rates. A rate hike would put to rest the knock on Governor Carney of not delivering on a single rate hike despite his numerous threats. The reason that the BOE would raise rates is that inflation is projected to be above target for some time and the economy, while slowing, is near full-employment. There does not appear to be much spare capacity. |

U.K. Construction Purchasing Managers Index (PMI), Oct 2017(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

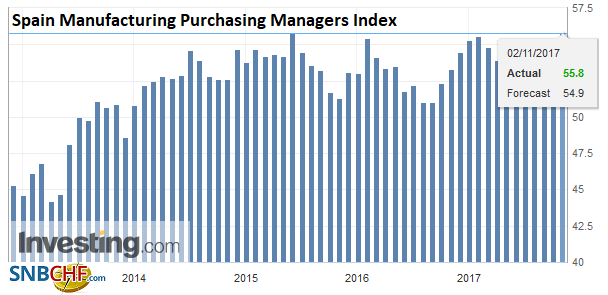

Spain |

Spain Manufacturing Purchasing Managers Index (PMI), Oct 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

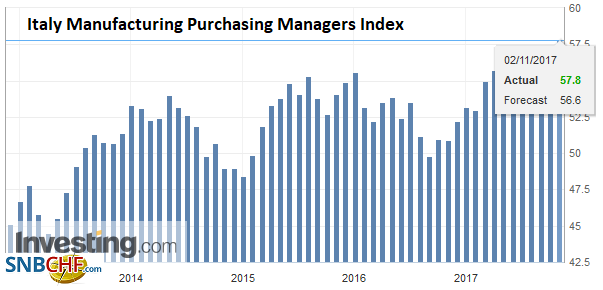

Italy |

Italy Manufacturing Purchasing Managers Index (PMI), Oct 2017 Source: Investing.com - Click to enlarge |

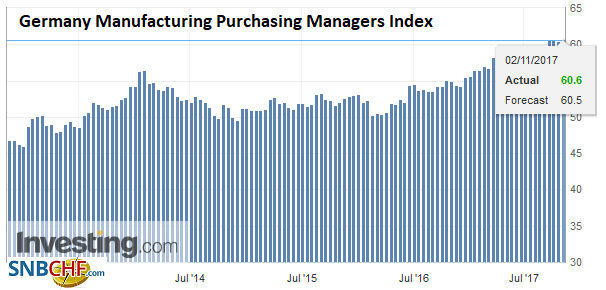

Germany |

Germany Manufacturing Purchasing Managers Index (PMI), Nov 2017 Source: Investing.com - Click to enlarge |

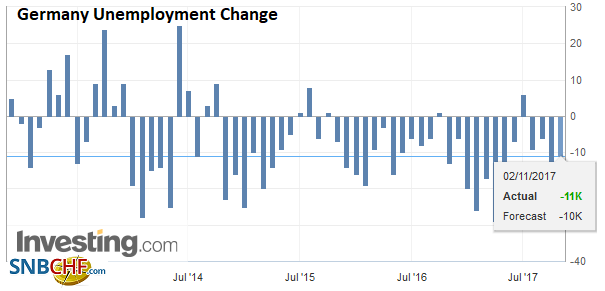

Germany Unemployment Change, Oct 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

|

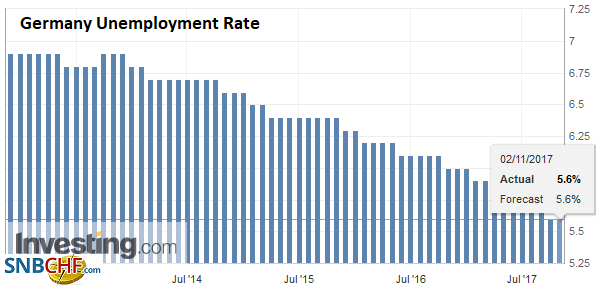

Germany Unemployment Rate, Oct 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

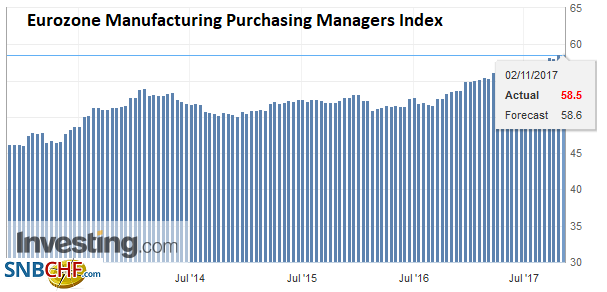

Eurozone |

Eurozone Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

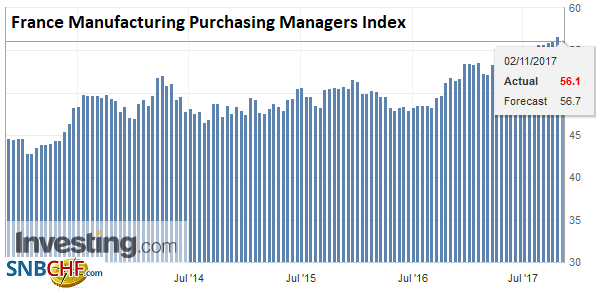

France |

France Manufacturing Purchasing Managers Index (PMI), Nov 2017 Source: Investing.com - Click to enlarge |

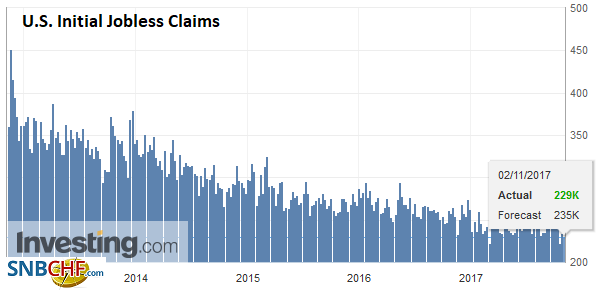

United States |

U.S. Initial Jobless Claims, 02 November 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

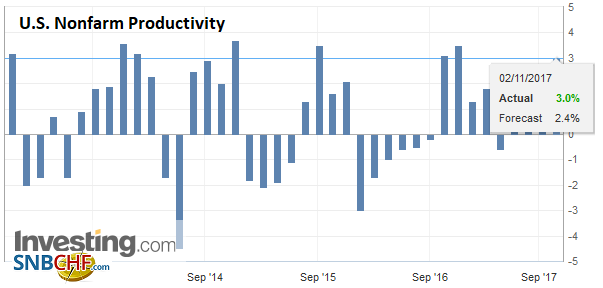

U.S. Nonfarm Productivity QoQ, Q3 2017(see more posts on U.S. Nonfarm Productivity, ) Source: Investing.com - Click to enlarge |

On the other hand, the reason why some would dissent for a rate hike, including perhaps one or both of the Deputy Governors, is that inflation is largely an echo from the past depreciation of sterling. It will soon drop out of the year-over-year measures. If the economy is already slowing, and household discretionary spending is being squeezed by inflation and miserly wage increase, a pro-cyclical monetary policy does not seem the best way to extend the expansion. Remember too, higher rates pass through to the households relatively quickly due to the widespread practice of floating rate mortgages.

A compromise may be a dovish hike, where Governor Carney makes clear his reservations and signals that this is not the beginning of a tightening cycle. He may emphasize the risks also speak to a cautious approach. Still, being able to engineer a dovish hike partly depends on luck and existing conditions. The best way to ensure a drop in sterling is not to hike rates, though a signal that a hike may still be delivered next month, would limit the loss after the knee-jerk surprise.

Then there is tax reform. We remain struck by how fluid the issues seemed to up until the last moment. Even the one-day delay, while not material, makes for poor optics. The market will have a knee-jerk reaction to the headlines as markers are placed on expected winners and losers. Sharp moves are unwarranted, it is very early on in the process. Health care reform also passed committee The immediate reaction to initial proposals may create opportunities for investors looking for particular assets (either to buy or to sell).

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Manufacturing PMI,France Manufacturing PMI,Germany Manufacturing PMI,Germany Unemployment Change,Germany Unemployment Rate,Italy Manufacturing PMI,newslettersent,NZD,Spain Manufacturing PMI,U.K. Construction PMI,U.S. Initial Jobless Claims,U.S. Nonfarm Productivity,USD/CHF