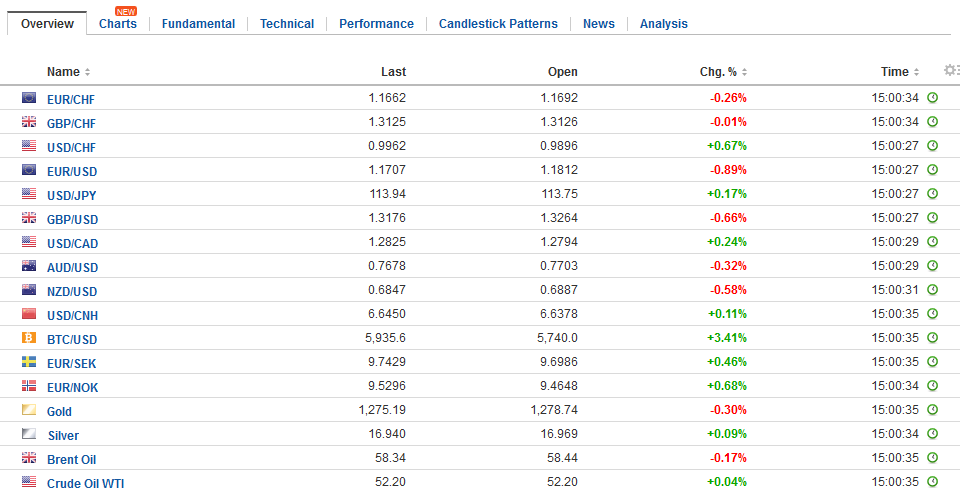

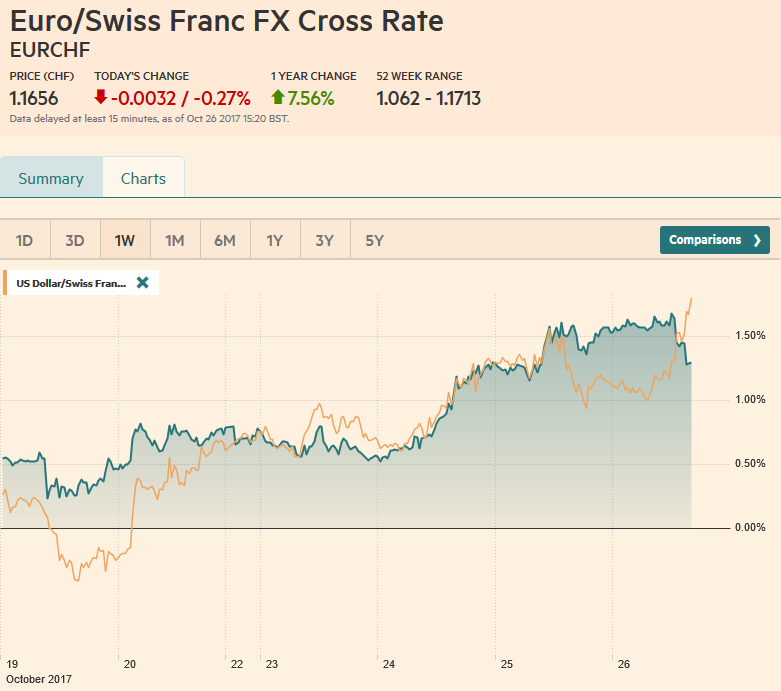

Swiss FrancThe Euro has fallen by 0.27% to 1.1656 CHF. |

EUR/CHF and USD/CHF, October 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesIt is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its “close but lower than 2%” target. The ECB judges that substantial additional stimulus is needed. It is currently buying 60 bln euros a month in assets, that consist of mostly sovereign bonds, but includes supras, corporates, and asset-backed securities. At the same time, investors seem to accept that under the current self-imposed rules, which the ECB has modified in the past, there are about 300 bln euros in eligible securities that can be bought by the Eurosystem next year. |

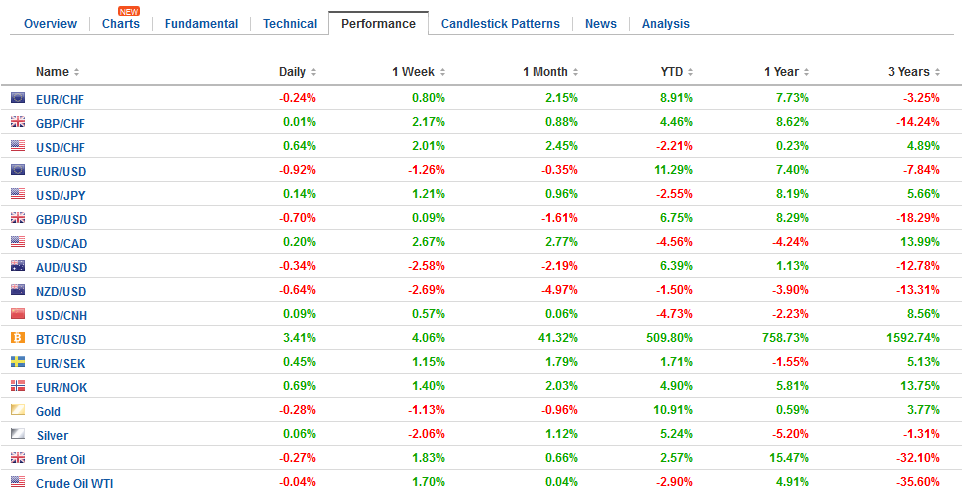

FX Daily Rates, October 26 |

| For the remainder of this year, the ECB is buying 60 bln euro, which is 180 bln euros here in Q4, while the Fed’s balance sheet will decrease by $30 bln. That divergence will continue to widen for the foreseeable future. It appears to be a consensus that the ECB extends its purchases through the first nine months of 2018 at a pace half the current size. That would allow the ECB to nearly exhaust its universe of acceptable assets. During the first three quarters of 2018, the Fed’s balance sheet is projected to shrink by $270 bln.

Many observers are not convinced that the asset purchases are doing much good, but they recognize that stopping would be potentially destabilizing. The other important element, if not of greater importance, is what the asset purchases say about rising rates. The ECB has been clear that like the Fed, it will not raise interest rates until after the asset purchases are complete. The longer the asset purchases, the further out lies the first rate hike. Last month, the consensus was for a six-month extension. |

FX Performance, October 26 |

EurozoneThe ECB will likely seek to maintain as much flexibility as possible. It is unlikely to call this tapering as it implies an endpoint, which the central bank does not want to suggest, even if we all know it is there. |

Eurozone M3 Money Supply YoY, Sep 2017(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

| The re-scaling of its operations is to adjust it regarding the evolving economic and financial conditions. Some details about the securities and maybe the composition of the assets it will buy may come in December. Consistently, and as recently as last month, Draghi played down concerns about the scarcity of assets. |

Eurozone Private Sector Loans YoY, Sep 2017(see more posts on Eurozone Private Sector Loans, ) Source: Investing.com - Click to enlarge |

SpainA climax of some kind is likely in Spain today. Catalonia’s Puigdemont will speak to the regional parliament and may formally proclaim independence. There has seemed to be a way out. Have new regional elections. However, this did not seem to forestall Prime Minister Rajoy’s push to invoke Article 155. It is before the Senate, which is expected to vote on it over the next couple of days. We have argued that with the businesses, the army, and several opposition parties siding with Madrid, the threat of secession is low. The political theater may continue, but investors are looking through it. The Spanish premium over Germany is almost back to where it was before the (illegal) referendum on Oct 1. The Dow Jones Stoxx 600 is off 0.5% over the past five sessions, while Spain’s market is off 0.60%. |

Spain Unemployment Rate, Q3 2017(see more posts on Spain Unemployment Rate, ) Source: Investing.com - Click to enlarge |

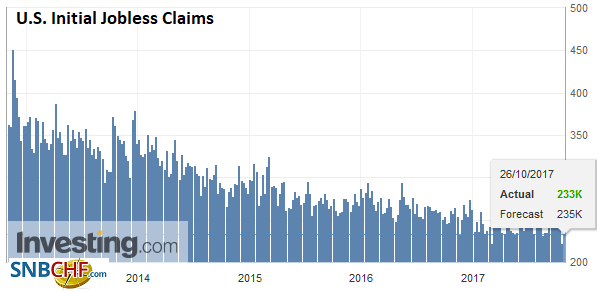

United StatesIn the US, weekly initial jobless claims, which fell to new cyclical lows last week may bounce back when reported today. The early call for next week’s non-farm payroll is over 300k, partly the bounce back from storms. The September trade balance and retail inventories will be the last pieces for economists to mull ahead of tomorrow’s first look at Q4 GDP. |

U.S. Initial Jobless Claims, July 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

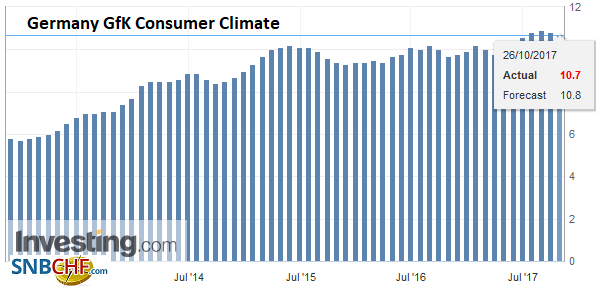

Germany |

Germany GfK Consumer Climate, Nov 2017(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

We suspect the short-term market is inclined to buy euros on as expected news. Despite widening interest rate differentials in the dollar’s favor the euro has been trading in a roughly $1.1720-$1.1880 trading range for more than the past two weeks. Speculators in the futures market have a substantial gross and net long position. The euro’s gains since Monday’s low (~$1.1725) appears to be some shorts who may have tried picking a top, covering ahead of the ECB meeting.

That said, we have not abandoned our expectation that last month’s dollar recovery marks the end of the slide that began with the defeat of the National Front in France in late April and concluded in early September. A break above $1.1880-$1.1910 would call into question what we think is a medium-term bearish technical pattern. Fundamentally, we think that the divergence meme is still the key driver over the longer term and we argue that the balance sheet and rate divergence have not peaked. And more. The peak is still more than a year away.

Many argued against this divergence emphasis. Didn’t the Bank of Canada hike rates twice in Q3? Isn’t that divergence? We distinguish central banks engaged in a sustained monetary cycle (Federal Reserve) and central banks that have a small tweak in policy. Bank of Canada Governor Poloz’s comments reinforce our view that Canada is in the latter group. We would put the BOE, which is poised to hike rates next week in that same camp. The Bank of Canada took policy rates back to where they were before the oil shock. The Bank of England may take back the cut delivered after last year referendum.

There are a few other notable developments today. First, Norway and Sweden’s central banks held policy-making meetings. As expected, neither changed rates. The Riksbank showed no signs of exit despite firm prices and a strong economy. The Norges Bank is also discussing institutional restructuring, like splitting off the wealth fund, and there is a recommendation from a panel established for these purposes to set up a separate monetary policy committee. It seems that post-crisis, the work of many central banks have increased. Norway may move toward a model more like the Bank of England.

Also in Europe, Italy’s Senate will vote on electoral reform today. It will likely pass over the objections of some small parties who might not be represented in the new parliament unless they form a coalition. The Five-Star Movement is opposed for the same reason. Also, while the focus is on the ECB, and the next Fed Chair (which can be announced anytime), Italy will shortly name a new central bank governor. Visco’s term is up and the end of the month. Although it had seemed that he would likely be reappointed, it becomes politicized, and he seems to be taking the fall for legacy issues more than what happened under his watch.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: EUR/CHF,Eurozone M3 Money Supply,Eurozone Private Sector Loans,Germany GfK Consumer Climate,newslettersent,Spain Unemployment Rate,U.S. Initial Jobless Claims,USD/CHF