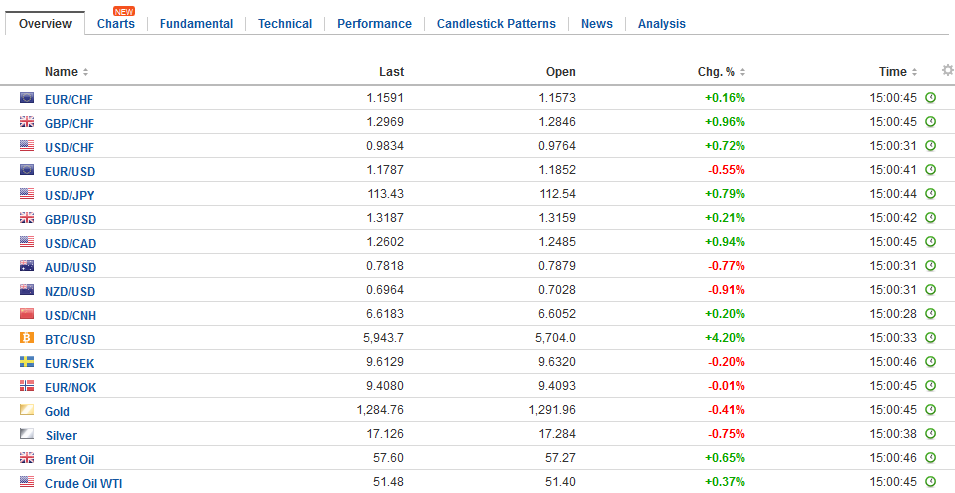

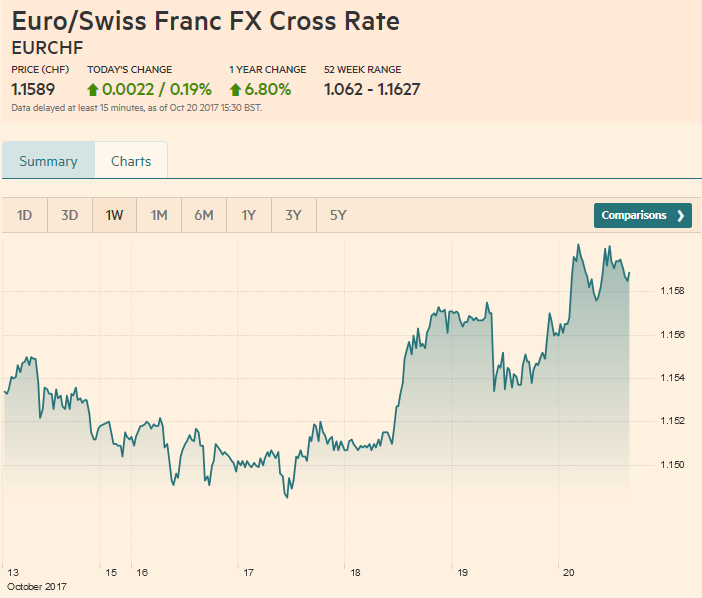

Swiss FrancThe Euro has fallen by 0.19% to 1.1589 CHF. |

EUR/CHF and USD/CHF, October 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies. The US 10-year yield is extending this week’s rise. It was up four basis points on the week coming into today, and it is up another four basis points today, to once again approach the upper end of its six-month range. While parliamentary maneuvering by the minority party was a threat, since the attempt(s) to repeal and replace the Affordable Care Act, the biggest challenge lies in the differences within the majority party. The Senate vote and the House agreement to vote on that bill as well shows greater coordination. We caution that there are many moving parts and many details that have yet to be worked out and time is of the essence for the debt ceiling and spending measures. Politico initially reported that Trump was leaning toward Powell to succeed Yellen at the Fed’s helm. Bloomberg is reporting that Trump’s advisers were encouraging Powell or Taylor. Previously, reports indicated than Treasury Secretary Mnuchin favored Powell. PredictIt has Powell drawing ahead at a little better than a 2:1 favorite. Yellen is second at about one-in-six chance. Taylor has slipped to a one-in-seven chance. |

FX Daily Rates, October 20 |

| The notable move this week regarding Fed expectations was not just who will get the nod, but terms of the trajectory of Fed policy. The implied yield on the December 2017 Fed funds futures contract rose a single basis point this week to 1.27%. Our work suggests fair value, assuming no chance of a hike in November and fully discounting a December hike, is 1.295%. The more significant change took place in the December 2018 contract. Its’ implied yield rose six basis points to 1.68%. This means that one hike next year is fully discounted. The Fed’s forecasts suggest that three hikes may be appropriate.

The market has also been confident of a Bank of England rate hike next month. We have been less convinced on the grounds that this is not the first time or even the second time that Governor Carney and the MPC have sounded as if they were prepared to hike and then pulled back, and that the price cycle is peaking as the economy is slowing. Now, MPC member Cunliffe has joined Ramsden injecting a little more doubt in the market’s mind about the timing of the move. The yield of the December short sterling futures contract did test a two-week lower today was have recovered and is now down one basis point on the week. The resilience of US equities yesterday with early losses completely recouped by the closing bell may have impressed Asian investors. The Hang Seng recouped more than half of yesterday’s losses with a 1.2% advance today. Similarly, the Hang Seng China Enterprises Index rallied 1.8% today after falling 2.3% yesterday. Japanese shares extended their run. The Nikkei has advanced for fourteen consecutive sessions through today, while the Topix was up at its tenth session. The 0.7% gain in the MSCI Asia Pacific Index was a sufficient cushion for the losses over the past four sessions, and the regional benchmark is up 0.2% for the week its third weekly advance. |

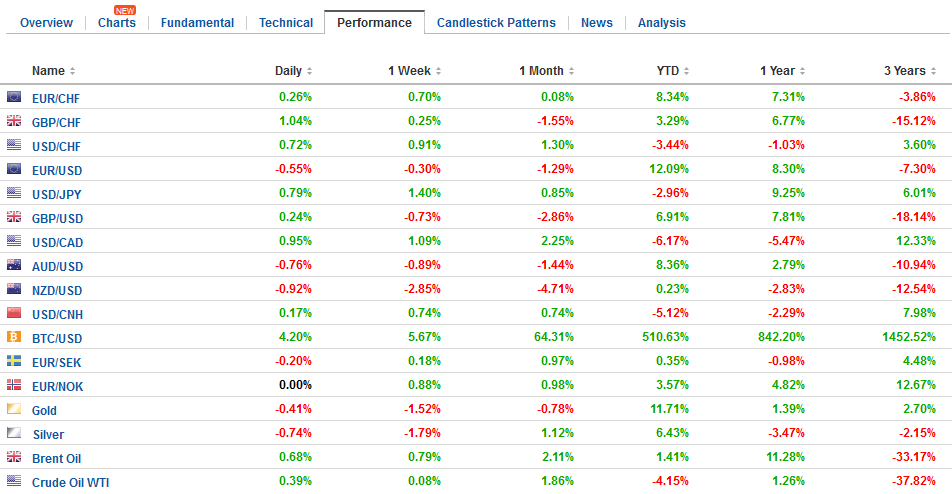

FX Performance, October 20 |

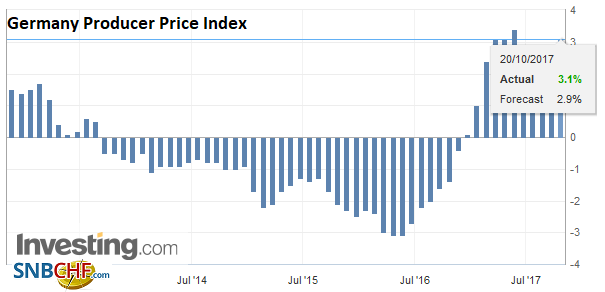

GermanyGermany’s Merkel provided UK Prime Minister May with a glimmer of hope. Merkel’s comments were among the most positive from officials that progress is being made and hold out the possibility (likelihood?) that sufficient progress will be made to take talks to the next stage. It appears that a greater financial commitment from the UK could get the ball rolling. |

Germany Producer Price Index (PPI) YoY, Sep 2017(see more posts on Germany Producer Price Index, ) Source: Investiing.com - Click to enlarge |

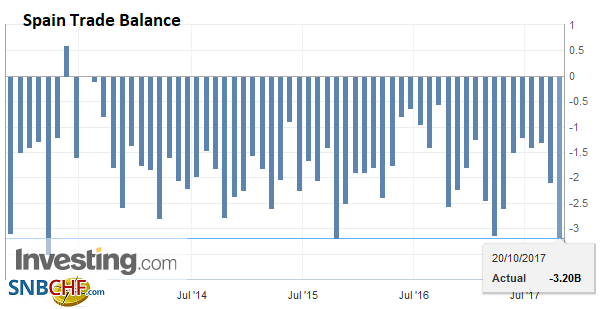

SpainThe Catalonia confrontation with Madrid saw a new front open. There was an attempt to spur a run on deposits on several banks. Spanish stocks are underperforming. Major bourses are higher, but Spain is off slightly. Financials are outperforming slightly. Spanish bond yields are a basis point higher, on par with Italy and faring better than the core bonds where yield are three-four basis points higher. Spain’s 10-year yield is up eight basis points this week. |

Spain Trade Balance, Sep 2017(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

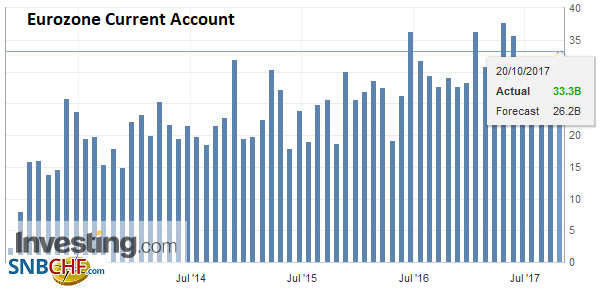

Eurozone |

Eurozone Current Account, Aug 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

Japan goes to the polls this weekend. The issue is not whether Abe’s LDP wins. The issue is the margin of victory, and if the coalition can hold on to its super-majority. The stronger the showing, the more likely the market concludes that the continuity of policy means that Kuroda would likely be the first Governor in a generation that serves a second term.

The euro’s two-day advance is being reversed today. Initial support is pegged in the $1.1770-$1.1780 area, which needs to be taken out to signal a new challenge on the key $1.1660 area. That said, the intraday technical indicators suggest this is not going to happen today. Sterling fell to a new low for the week just below $1.3090 but has since recovered to test $1.3160. The intraday charts warn it may run out of steam shortly. The dollar edged through the high from October 6 against the yen to trade at a new three-month high. With the US yield already at the upper end of its range, a new impetus may be needed to lift the greenback much more against the yen.

There are large options expiring today. There are a billion euros struck at $1.18 and $1.1855 that expire today. There are roughly $450 mln struck at JPY113.00 and JPY113.50.

The broadly stronger US dollar is also evident within the dollar bloc. The Canadian dollar is fairing the best, down almost 0.2%. The Australian dollar was nearly flat for the week coming into today but is down 0.4%. The New Zealand dollar has been sold through the $0.7000 support and is down 0.75% today to take the week’s decline to 2.8%. Investors continue to digest the unlikely political coalition between Labour and the New Zealand First Party. A two-year tend line has been violated and the low from earlier this year is near $0.6820.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Current Account,Germany Producer Price Index,newslettersent,Spain Trade Balance,USD/CHF