|

The point is the present system cannot endure.

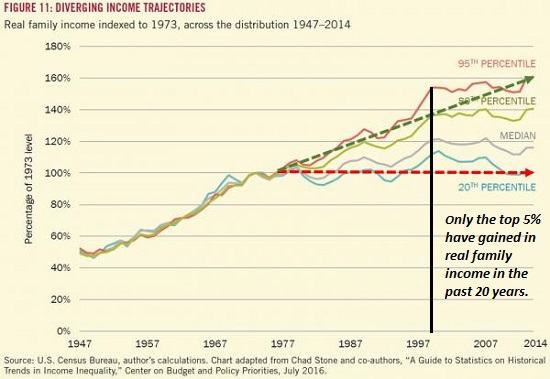

Despite all the happy talk about “recovery” and higher growth, wages have gone nowhere since 2000–and for the bottom 20% of workers, they’ve gone nowhere since the 1970s.

|

Diverging Income Trajectories 1947 - 2014 |

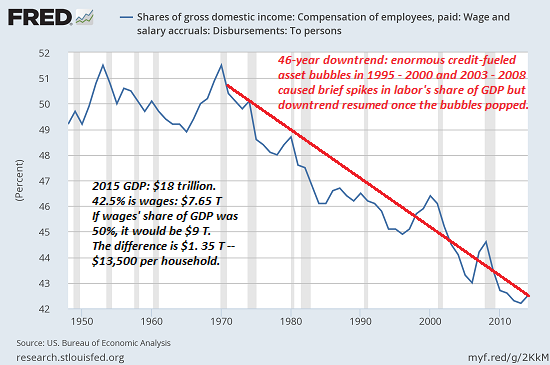

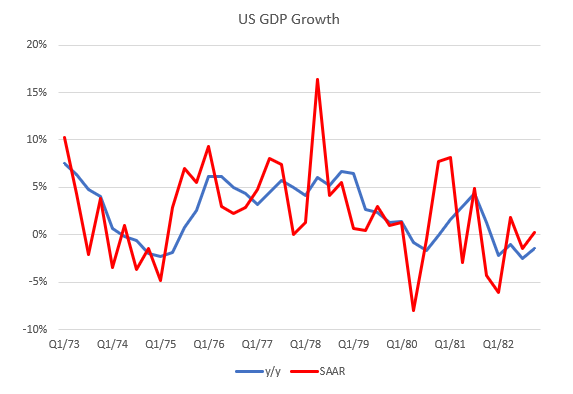

| Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend. |

Gross Domestic Income: Compensation of employees 1950-2017 |

Last month I posted one reason Why We’re Doomed: Our Economy’s Toxic Inequality (August 16, 2017). The second half of why we’re doomed is stagnant wages. Why do stagnating wages for the bottom 95% doom our status quo? As I noted yesterday in Why Wages Have Lost Ground in the 21st Century, our system requires ever-higher household incomes to function-not just in the top 5%, but in the top 80%.

Our federal social programs-Social Security, Medicare and Medicaid-are pay-as-you-go: all the expenditures this year are paid by taxes collected this year. As I have detailed many times, the so-called “Trust Funds” are fictions; when Social Security runs a deficit, the difference between receipts and expenses are filled by selling Treasury bonds in the open market–the exact same mechanism ther government uses to fund any other deficit.

The demographics of the nation have changed in the past two generations. The Baby Boom is retiring en masse, expanding the number of beneficiaries of these programs, while the number of full-time workers to retirees is down from 10-to-1 in the good old days to 2-to-1: there are 60 million beneficiaries of Social Security and Medicare and about 120 million full-time workers in the U.S.

Meanwhile, medical expenses per person are soaring. Profiteering by healthcare cartels, new and ever-more costly treatments, the rise of chronic lifestyle illnesses-there are many drivers of this trend. There is absolutely no evidence to support the fantasy that this trend will magically reverse.

Costs are skyrocketing and the number of retirees is ballooning, but wages are going nowhere. Do you see the problem? All pay-as-you-go programs are based on the assumption that the number of workers and the wages they earn will both rise at a rate that is above the underlying rate of inflation and equal to the rate of increase in pay-as-you-go programs.

If 95% of the households are earning less money when adjusted for inflation, and their wealth has also declined or stagnated, then how can we pay for programs which expand by 6% or more every year?

The short answer is you can’t.

The budgets of state and local governments also expand every year as citizens demand more services, infrastructure requires costly maintenance and upgrades, and the overall costs of providing government services rises (soaring healthcare premiums are a major driver of higher government expenses). How can households pay higher property and sales taxes if their incomes are going nowhere?

Stagnant wages = stagnant income tax revenues.

|

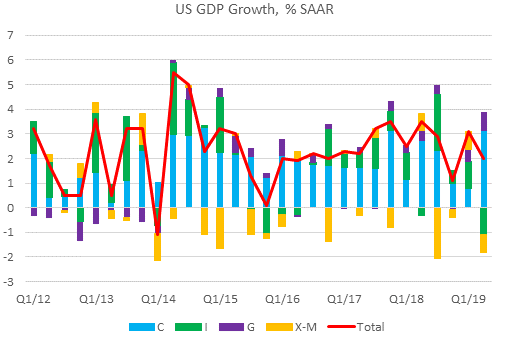

Then there’s the consumer economy that depends on ever-higher consumer spending. If wages are stagnant, how can households spend more money? The conventional answer is: we’ll blow asset bubbles in stocks, bonds and housing, and households can spend this newfound wealth.

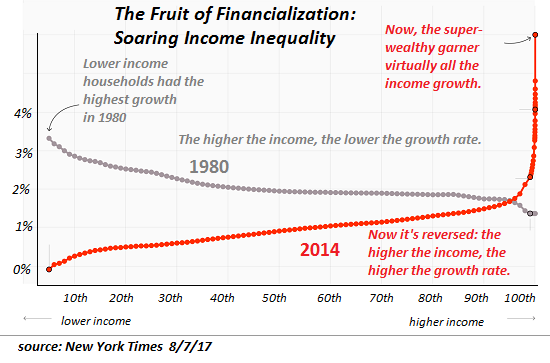

Nice theory, but only the top slice of American households own enough of these assets to matter. Feast your eyes on these two charts of skyrocketing income and wealth inequality. This chart shows that the majority of income growth is now concentrated in the top 1/0th of 1%, and most of what’s left has gone to the top 5%. This is the only possible outcome of financialization and central-bank inflated asset bubbles.

|

The Fruit of Financialization 1980 - 2014 |

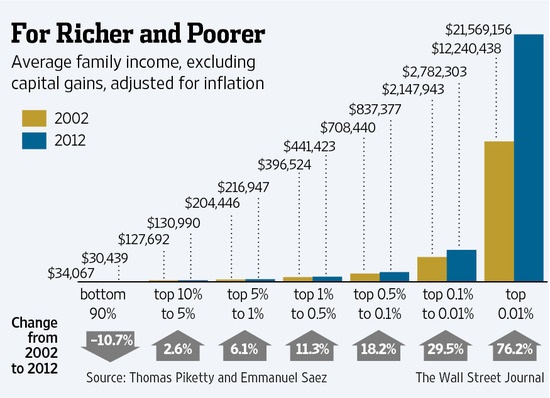

| Here’s another look at the same dynamic, but excluding capital gains, which flow to those who own most of the assets, i.e. the top 1%: the bottom 90% lost 10% in the decade 2002-2012, the top 5% gained 6% and the very top of the wealth-power pyramid, the top 1/100th of the 1%, gained 76%. |

Average Family Income 2002 - 2012 |

The conclusion is sobering: wages/salaries are no longer an adequate means to distribute income or paid work. Our system is broken at the deepest levels–not just economically broken, but socially broken as well. Clinging to this broken model and filling the widening gap between the super-wealthy and everyone else with more debt will doom the system.

This is why I’ve proposed a new way to organize production, consumption, work and income in my book A Radically Beneficial World: Automation, Technology & Creating Jobs for All.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,U.S. Gross Domestic Product