Summary

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force.The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy.

Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

The topic at Jackson Hole is Fostering a Dynamic World Economy. It does not lend itself to a talk of the nuances of monetary policy. Besides, what could Yellen say that could truly impact expectations for the trajectory of monetary policy that she did not say to Congress in last month’s testimony? And if there were any questions, NY Fed President Dudley’s recent comments would seem to answer them.

We have suggested since the June FOMC meeting that the Fed’s likely path was clear. It had previously laid out its strategy to begin reducing its balance sheet. The FOMC will likely announce next month that starting in Q4. Iit will not reinvest the entire funds that are freed up by maturing Treasuries and MBS securities. At an initial gradual pace of $10 bln a month, the Fed’s balance sheet will fall by what appears to be an inconsequential $30 bln in Q4 17 ($60 bln in Q1 18 and $90 bln in Q2 18, increasing to a maximum pace of $150 bln a quarter).

After declining earlier this year, the CPI and PCE deflator have begun stabilizing. Nevertheless, there are Fed officials who are particularly concerned, even though a majority still views the decline as temporary. It seems clear that there is no consensus to hike rates next month, regardless of what the high frequency data show. Dudley had indicated earlier this year that the Fed might take a short pause around the beginning of its balance sheet operations.

Also, it appears that the Fed wants to decouple the unwinding of the balance sheet from the vagaries of the high frequency data and the conduct of monetary policy proper. Just as the Fed was the first of the major central banks to raise rates, it will also be the first to begin allowing its balance sheet to shrink. The Fed wants to make as less disruptive as possible. This partly means putting it on automatic pilot and not altering the preset course unless absolutely necessary, such as if the zero-bound comes back into play.

The CME and Bloomberg’s calculation of the Fed funds futures market have 30%-35% chance of a hike by the end of the year. We suspect this is on the low side. We think the weakness of the dollar and the easing of financial conditions, while the slack in the labor market continues to be absorbed favors a rate hike. Moreover, we suspect the bar to a hike is rather modest. The lack of downside surprises may suffice.

Yellen has broached two other topics that she may return to as part of the discussion of efforts to boost global growth. Growth is a function of two things–a quantity (hours worked) and quality (productivity). Yellen’s background was a labor economist, although she recognizes the importance of productivity, she seems to see the key in the quantity of work. In this context, she has discussed the opioid epidemic in the US as an important challenge to a more robust labor market. She has also discussed efforts needed to increase women participation in the labor market.

| The opioid epidemic in the US can be seen as part of a larger scourge of sharp rise midlife mortality that is particularly troublesome. Its underlying cause is not a new disease or infection immune to antibiotics. It is despair. It is mental and emotional, but also seems rooted in the America’s political economy. |

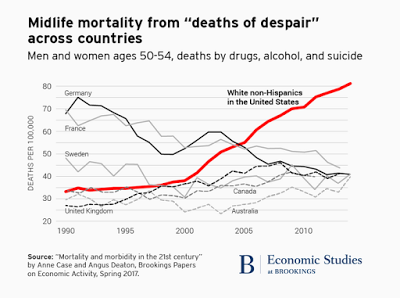

Midlife Mortality from "deaths of despair", 1990-2010 |

| First, it is important to see how what is happening in the US seems unique. Brookings Institution generated this Great Graphic. The red line is are the deaths of American men and women (per 100k) aged between 50 and 54 due to suicide, alcohol, and drugs (SAD). The various black lines are comparable numbers for a small selection of other countries. Not only are the other countries well below the US numbers, but most of the other countries see falling SAD mid-life mortality rates.

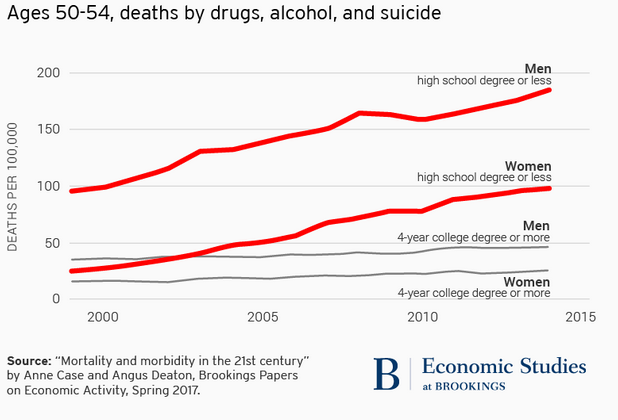

Second, the same report from Brookings looks a bit closer at some of the sociological characteristics of these SAD deaths. There are two cuts. One is gender. Man are more susceptible than women. The other cut is education. Less educated men and women are particularly vulnerable. The top red line shows that roughly SAD takes 200 out of every 100,000 of our brothers, fathers, uncles, and friends with a high school degree or less formal education. SAD takes 100 out of every 100,000 of our sisters, mothers, aunts, and friends with no more than high school education. As the gray lines illustrate, the men and women with at least a college degree appear as vulnerable to SAD as we saw in the first chart for other countries. |

Ages 50-54, deaths by drugs,alcohol and suicide, 2000-2005 |

There also appears to be an ethnic component. In the convoluted language of American classifications, white non-Hispanics, with no more than a high school education appear more at risk of death by SAD than overall Hispanics or African-Americans. The increase in SAD deaths appears to be accompanied by a deterioration in economic and social well being.

Most of the analysis about the labor market focuses on the rate of unemployment and/or underemployment, and wage growth, or indeed the lack thereof. Yellen is one of highest placed US officials that have tried incorporating the disturbing SAD epidemic in the US into economic analysis. It is not only a personal tragedy, but it is also a larger social issue that is having economic and, arguably, political consequences.

The participation in the US labor force of 25-54 (traditional but ageist definition of prime working age) in the US is about 79%, which as the Economist recently noted, is lower than in France, where the unemployment rate is more than twice the US level. There has been some improvement in the US over the past couple of years. Research shows this is largely a function of women.

In 1990, women participation in the US labor force (working or looking for work) was the sixth highest among 22 high income countries. By 2010 the US had slipped to 17th place. Yellen is sympathetic to arguments that suggest that this was due to failure in the US to adopt family-friendly policies that have been implemented in most other high income countries. In my new book, Political Economy of Tomorrow, I too look at some of these issues, and discuss at length important policies, like family-leave, and access to affordable childcare.

Women in their late 20s and early 30s account for nearly 40% of the increase in the US labor force growth since the prime aged participation rate bottomed two years ago. However, the economists at the Atlanta Fed recently found a new wrinkle. The increase in women participation in the US labor force is being led by nominally unskilled women. An economist at Brookings suggested a possible explanation: the new low skilled job openings are concentrated in service sectors that do not traditionally attract men. Yet as the Economist points out, the relatively low skilled service sector jobs, such as in the hospitality industry, are almost equally split among gender lines.

Some have tried to square the circle by suggesting that women’s choices may be more influenced by wage than men’s choices. This seems reasonable for women who provide a second income for the household. The recent wage growth (median earnings appear to be growing faster for full-time employees with only a high school diploma than for a bachelor’s degree (4% vs. 3%) may have tempted more women than men. However, the gap in sensitivity to wages has narrowed. and a growing number of women are primary breadwinners in their household.

Still, there is something important going on in the US labor force, which is a subset of society. The participation of men 25-34 years old remains near the record low. There has been no meaningful improvement eight years after the financial crisis and recession ended. Women of the same age cohort have seen their participation rate recover to 2001 levels.

Yellen has spoken about both women participation in the work force and the opioid (SAD) epidemic in the US. Discussing these issues at Jackson Hole would raise awareness of the importance of these sociological issues on the broader political economy. Addressing these issues would be an important way to ensure a more dynamic US economy, which in turn would foster a more dynamic world economy.

Are you the author? Previous post See more for Next postTags: Federal Reserve,Great Graphic,Labor,newslettersent,US