See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Fundamental DevelopmentsLast week he price of gold was up nine bucks, and that of silver 6 cents. These small changes mask the relatively big drop on Tuesday—$13 in gold and $0.48 in silver — and recovery the rest of the week. The gains above previous week occurred on Thursday.

|

|

Gold and Silver PriceThe question is which move is driven by fundamentals, and which is by speculation against the trend? We will show graphs of the basis, the true measure of the fundamentals. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

|

Gold and Silver Price(see more posts on gold price, silver price, ) |

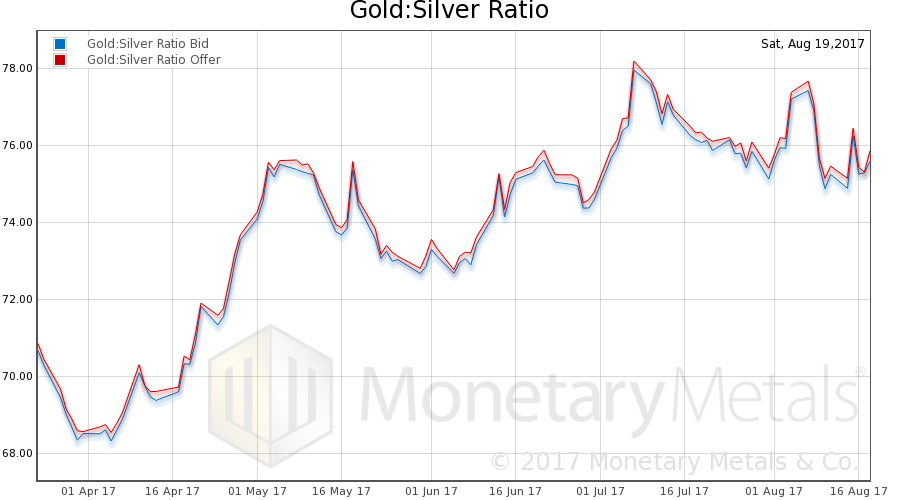

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up slightly this week.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

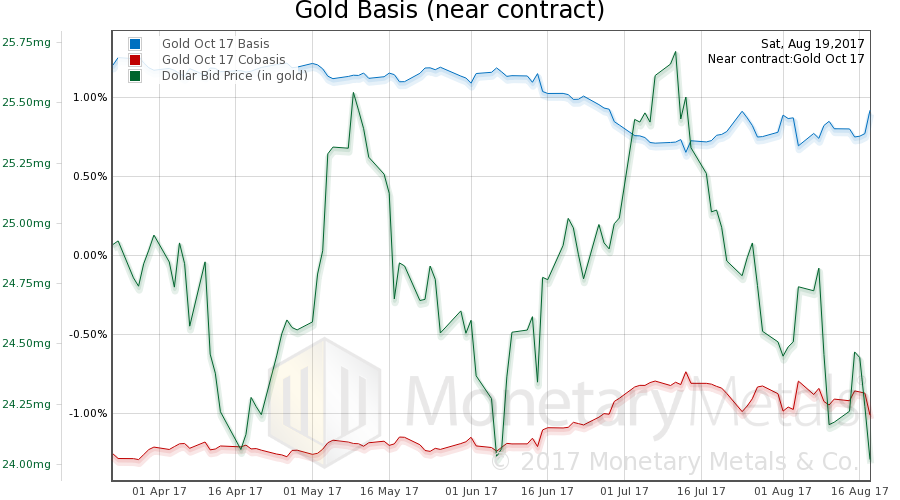

Gold Basis and Co-basis and Dollar PriceFor each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red. Gold basis and co-basis and the dollar priced in milligrams of gold The dollar fell this week (the mirror image of the rising price of gold), now down to 24mg gold. And the basis rose a bit, another 12bps on top of the 11bps move last week. |

Gold Basis and Co-basis and Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

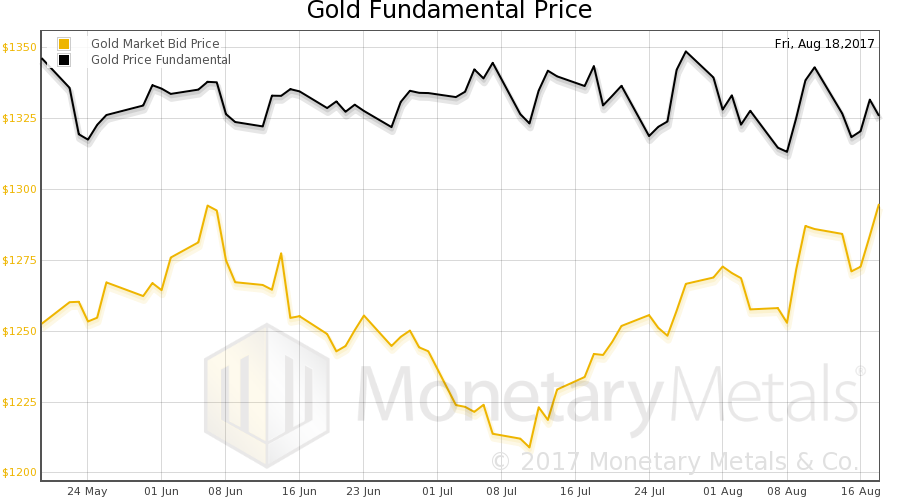

Gold Fundamental PriceOur calculated gold fundamental price dropped about $17. So the market price is rising, and the fundamental price is still above the market price by about $31. A big change from last week when the fundamental price was $57 over the market price. |

Gold Fundamental Price(see more posts on Gold, gold price, ) |

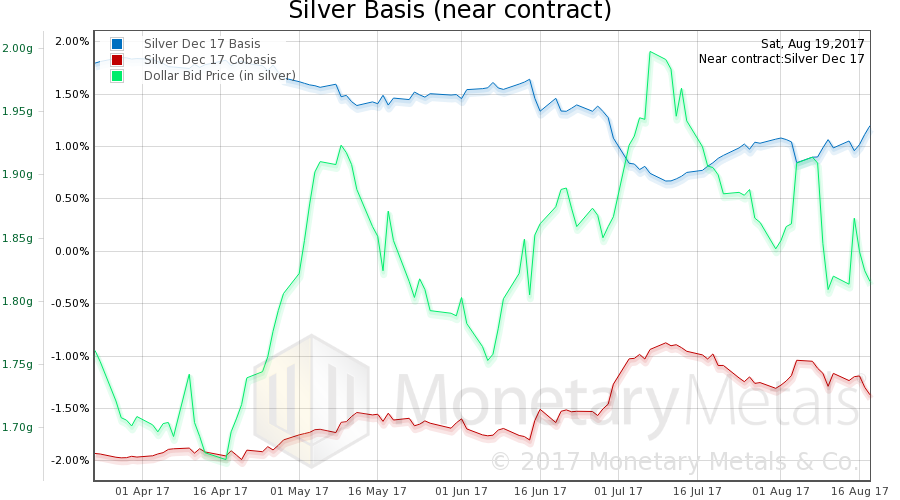

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, the price did not move much. However, the basis jumped up 22bps (against the pressures of the contract roll which is ongoing). The continuous silver basis, which is not subject to contract roll pressures, also jumped 21bps. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

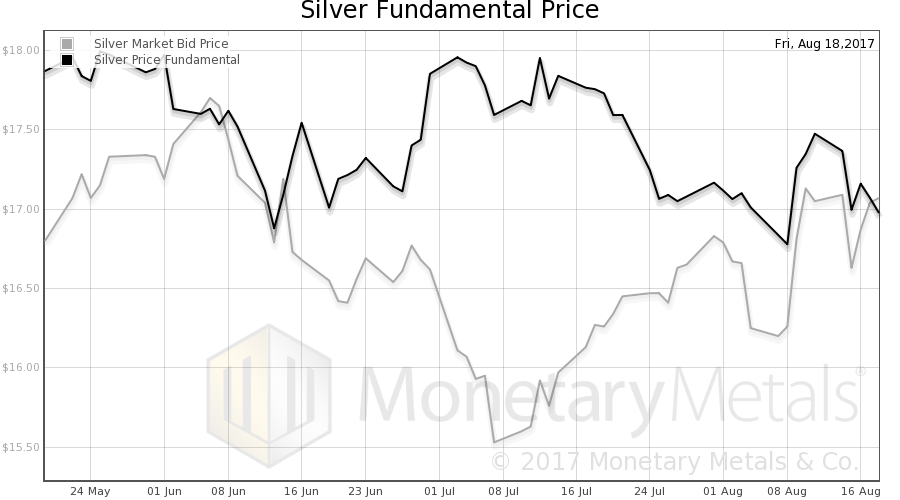

Silver Fundamental PriceSo it should be no surprise that our calculated silver fundamental price fell $0.50. The fundamental price is now below the market price (though not a lot). |

Silver Fundamental Price(see more posts on silver, silver price, ) |

Two weeks ago, we asked:

So is the silver sell-off over?

Now it is time to ask if the silver buy-up is over.

Last week, we noted:

One thing is for sure. If the fundamentals don’t continue to firm up further, or at least hold at the present level, then this rally is doomed like all of the others in the last 6 years.

© 2017 Monetary Metals

Image captions by PT where indicated

Full story here Are you the author? Previous post See more for Next postTags: Chart Update,dollar price,Gold,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver,silver basis,Silver co-basis,silver price