FXDespite the tensions between Donald Trump and North Korea’s Kim Jong-un, the EUR/CHF only depreciated to a low of 1.1284.

|

Euro / Swiss Franc FX Cross Rate, August 14(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

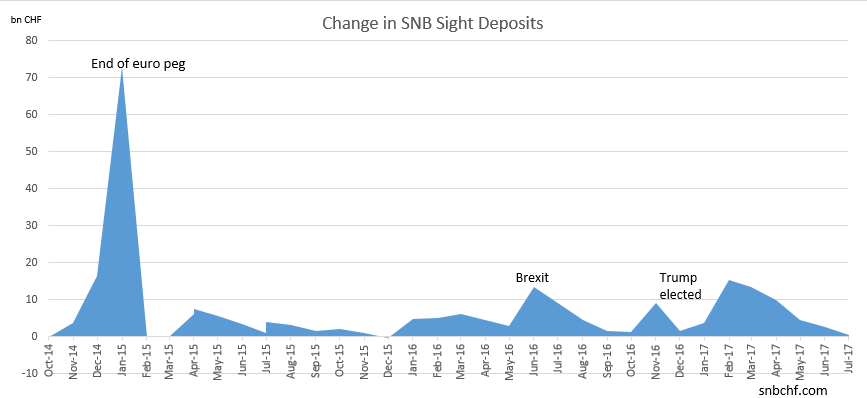

SNB interventions nearly at zero

Data for the last weeks: In the last week, the SNB did not have to intervene. This proves that investors haven’t taken the tensions seriously.

|

Change in SNB Sight Deposits July 2017(see more posts on SNB sight deposits, ) Source: snb.ch - Click to enlarge |

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed.

Last data as of August 08: The net speculative CHF position has risen from 1.4K long to -1.4K contracts short (against USD). |

Speculative Positions

source Oanda |

| Date of sight deposits (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 11 August | 1.1393 | 1.1780 | Trump’s tensions with North Korea | -1402X125K | +0.3 bn. per week | 578.9 bn. | 476.3 bn. | 102.6 bn. |

| 04 August | 1.1461 | 1.1828 | +1440X125K | -0.5 bn. per week | 578.6 bn. | 479.8 bn. | 98.8 bn. | |

| 28 July | 1.1184 | 1.1691 | -1550X125K | +0.0 bn. per week | 579.1 bn. | 478.9 bn. | 100.2 bn. | |

| 21 July | 1.1036 | 1.1569 | -3667X125K | +0.2 bn. per week | 579.1 bn. | 475.4 bn. | 103.7 bn. | |

| 14 July | 1.1030 | 1.1429 | +208X125K | +0.2 bn. per week | 578.9 bn. | 482.7 bn. | 96.2 bn. |

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Are you the author? Previous post See more for Next postTags: currency reserves. intervention,monetary data,newslettersent,SNB sight deposits