| A little while back I was part of a small exchange of views on twitter. It was about Italy. I was arguing against a claim that Italy’s woes are all about its past fiscal excesses. It is not just about about Italy’s legacy.

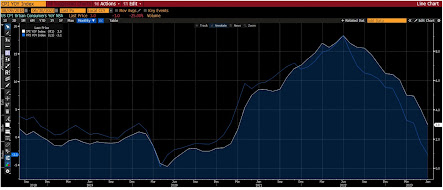

It is true that Italy runs a primary budget surplus. The primary budget surplus has averaged in excess of 2% for nearly two decades. Over this period, Italy debt has soared. I took exception with a reporter claiming that Italy is among the most fiscally sound countries in Europe. The fiscal condition of a country is not just about its budget balance (flow) but also its debt (stock). It debt is not simply a legacy of past fiscal profligacy. The debt burden has increased because Italy is unable to grow faster than its interest rates. The Italian economy has expanded by an average of 0.6% in the 2014-2016 period. Over the past 17 years it has averaged 0.3% growth (since birth of EMU). It averaged 2.1% growth in the previous 17 years. This Great Graphic comes from the IMF. It shows that real wage growth in the four largest member of EMU. Italy (red line) is the obvious outlier. It moved in tandem with Germany (black line) until around 2007. The timing of the break down suggests that it is not a function of EMU or Italy’s pass fiscal excesses. The IMF warns that it could take Italy another decade for its average take home pay to recoup the ground that has been lost since 2007. |

Global Financial Crisis, 1995 - 2016 |

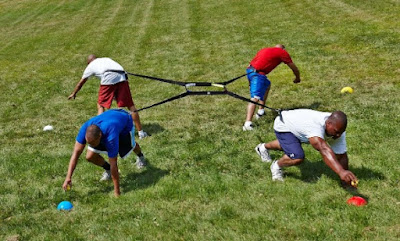

| Part for the issue, according to the IMF, is that Italian wages have grown faster than productivity for the past two decades. That is what this second chart shows–unit labor costs relative to Germany (100). The red line shows that in terms of labor, a unit of output in Italy’s factories is considerably higher than the other major European countries. In turn, the IMF argues this adversely impacts, investment, employment, and growth.

The IMF argues that Italian wages should be tied to productivity at the firm level rather than on the national level. The IMF estimates that this would boost employment by 4%, as well as boost other macro economic performance measures. Of course, the IMF has other reform proposals in the area of government spending and taxation. A full three-quarters of Italy’s revenues go to wages, pensions, health care, and debt servicing. It has little room to finance public investment. The traditional approach has focused on Italy’s debt burden and the NPLs at banks. This is the creditor’s narrative. The response is not to dismiss Italy’s problems as having been caused in the past, but the debtor’s narrative is to boost growth. The failure of Italy to grow is not simply the austerity (primary budget surplus) but its willingness not to challenge rent seeking behavior by the private as well as the public sectors. |

High Unit Labor Cost, 1999 - 2016 |

Full story here Are you the author? Previous post See more for Next post

Tags: Great Graphic,Italy,newslettersent,wages