We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true.

Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

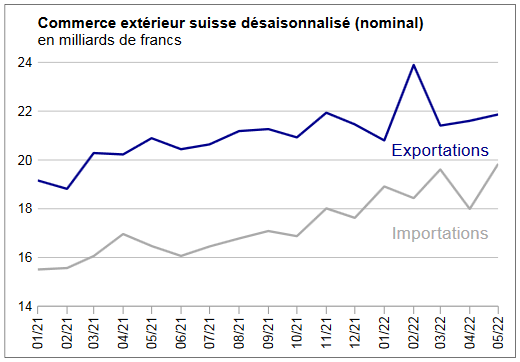

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

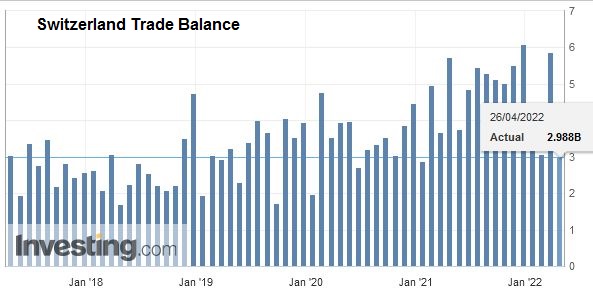

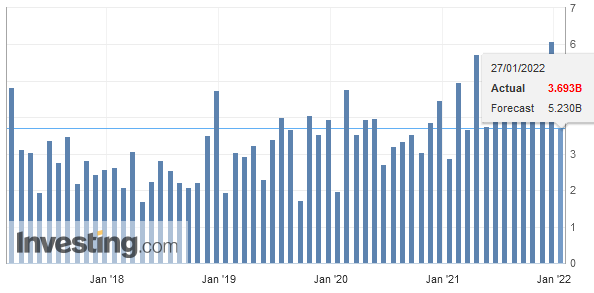

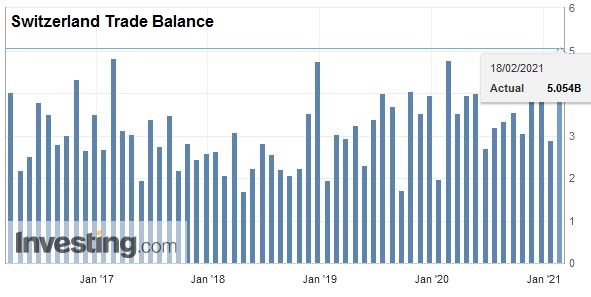

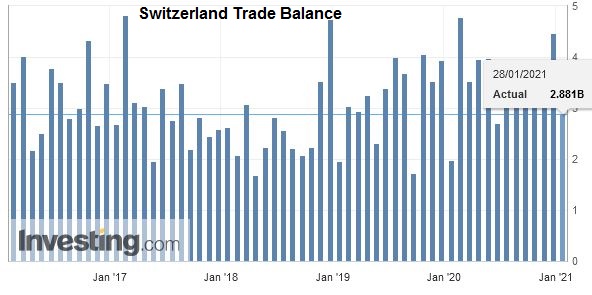

Exports and Imports YoY DevelopmentIn the first half of 2017, both exports (+ 4.4%) and imports (+ 4.8%) were dynamic. While the former scored a record result, the latter scored a higher in eight years. In both directions of traffic, chemicals and pharmaceuticals contributed decisively to growth. The trade balance loops with a surplus of 19 billion francs. In short |

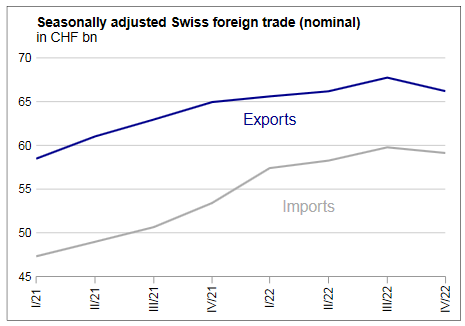

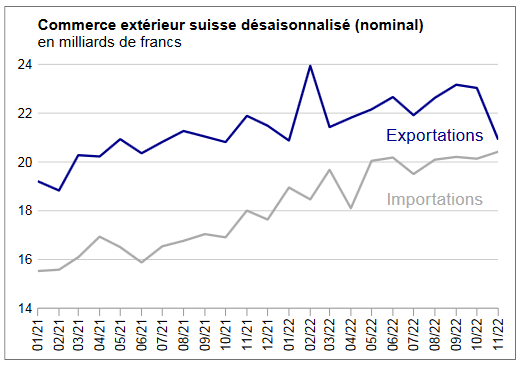

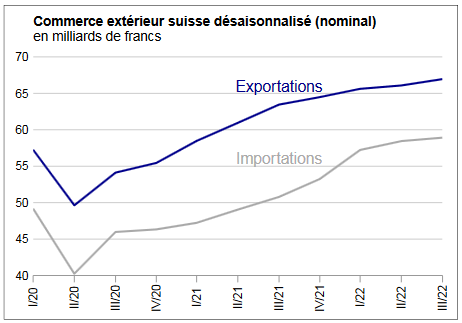

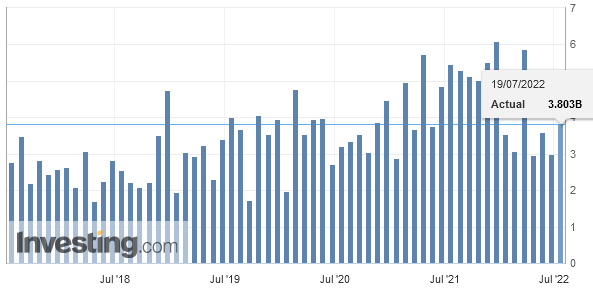

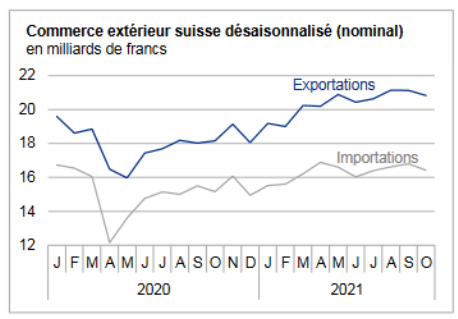

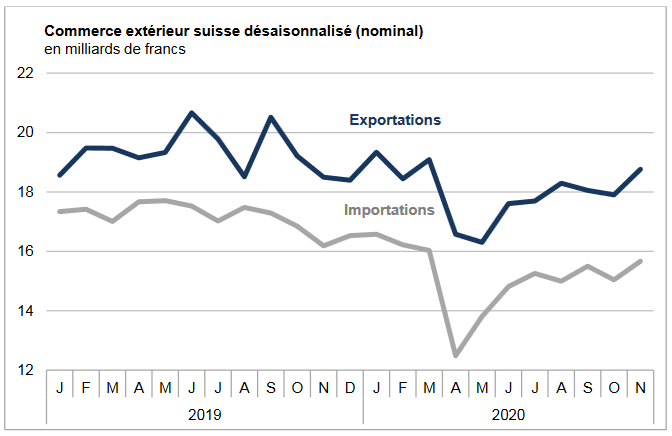

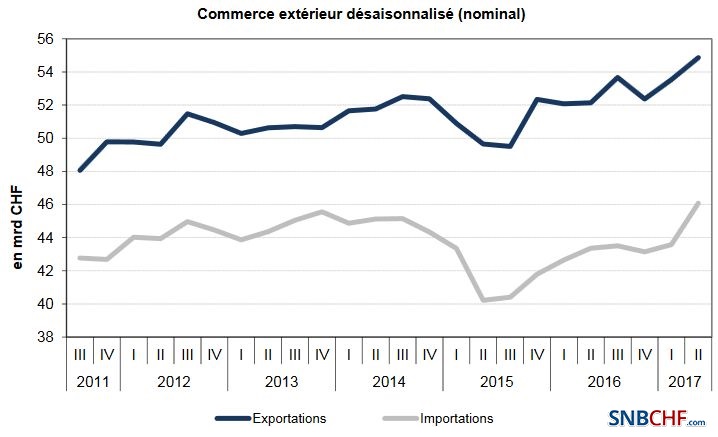

Swiss exports and imports, seasonally adjusted (in bn CHF), First Half 2017(see more posts on Switzerland Exports, Switzerland Imports, ) Source: .newsd.admin.ch - Click to enlarge |

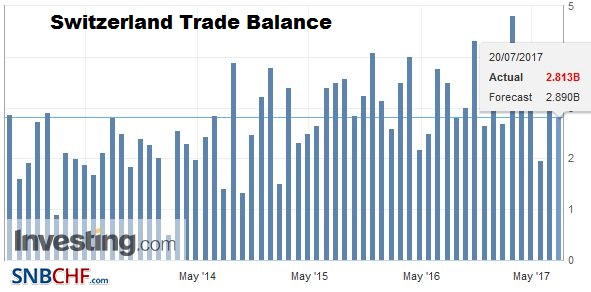

Overall EvolutionFrom January to June 2017, exports rose by 4.4% to reach 109.6 billion francs (real: + 2.6%). On a quarterly and seasonally adjusted basis, the positive wave started in mid – 2015 continued: sales increased in both the first quarter and the second quarter of 2017 (+2.2 and + 2.5% From the previous quarter). Imports increased by 4.8% (real: 0.8%) to 90.7 billion francs. At the quarterly level, they even see their upward trend since mid-2015, with a jump of 5.7% in seasonally adjusted terms in the second quarter of 2017 (actual: + 3.8%). June 2017: imports twice as dynamic as exportsSwiss foreign trade showed strong growth in June 2017. Adjusted for working days, exports increased by 6.2% (real: + 3.4%) and imports even by 12.9% (real: + 5.2%). Jewellery gave the momentum to the output while chemicals and pharmaceuticals were picking up at the entrance. The trade balance loops with a surplus of 2.7 billion francs. On a seasonally adjusted basis and after a sharp rise in May 2017, both exports (-0.9%, real: -1.9%) and imports (-0.2%, real: -0.5% ) Declined over a month.

|

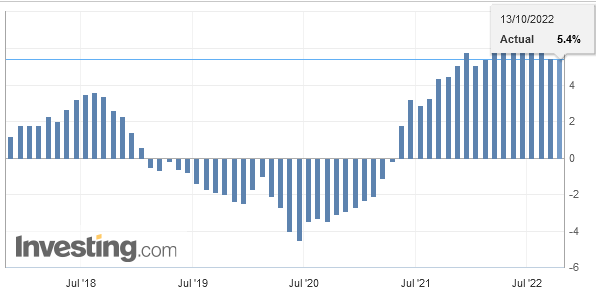

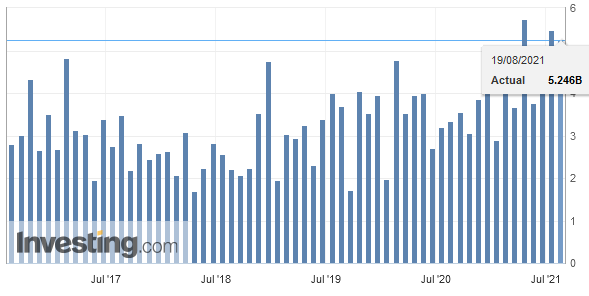

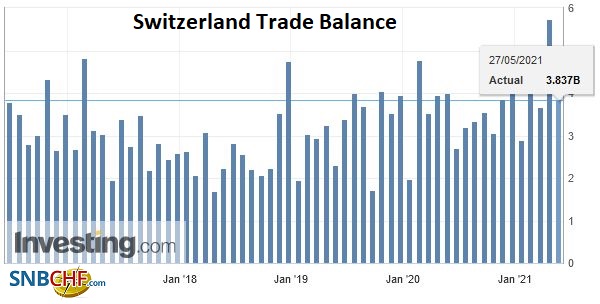

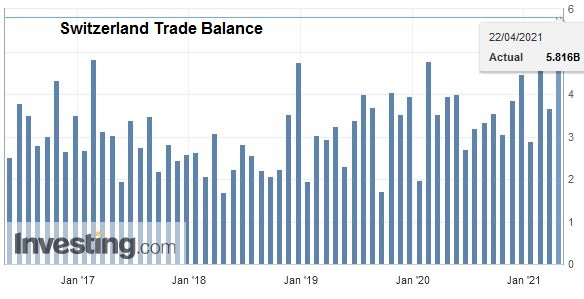

Switzerland Trade Balance, June 2017(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

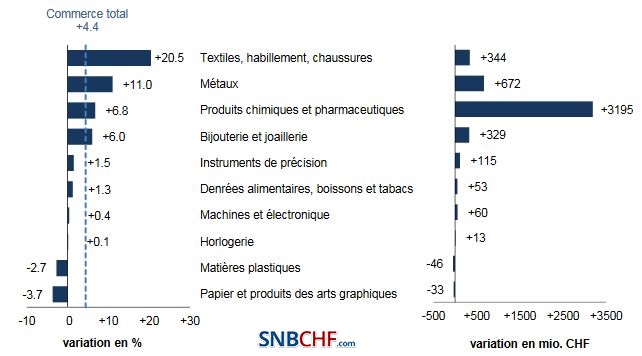

Exports“Rain of records” for exportIn the first half of 2017, exports grew by two-thirds on chemicals and pharmaceuticals. They have indeed gained 7% to reach a historical level. On the other hand, the numbers two and three of the export, the machinery and electronics sector as well as the watch industry, stagnated. After three semesters in retreat, the latter was able to stop the haemorrhage. Up one-fifth, the textile, clothing and footwear (goods in return) group was the most dynamic. With + 11%, metals have not been left behind. In the chemicals and pharmaceuticals sector, growth was based on immunological products (+1.2 billion francs), medicines (+993 million) and active ingredients (+889 million). Jewellery (+ 6%) and precision instruments (+ 2%) also increased, both of which were a record year. Falling a ninth, the aircraft drove the vehicle sector in the red numbers (-4%). |

Swiss Exports per Sector, First Half 2017 vs. 2016(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) Source: newsd.admin.ch - Click to enlarge |

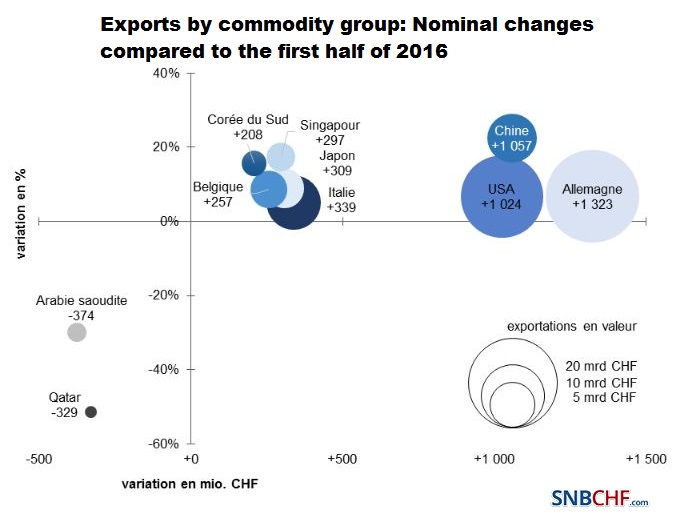

| At the export level, developments have taken hold in the three main markets. North America (+ 7%) and Asia grew by 6%. Sales to the latter thus increased by CHF 1.3 billion. In a fifth year, turnover with China reached a new high. Singapore and South Korea also recorded double-digit growth while Japan gained 9%. Conversely, the Middle East plunged by 16%. The European continent grew by 4% (+2.2 billion francs). Here, Germany increased by 7% (+1.3 billion), imitated by Belgium (+ 9%) and Austria and Italy (+ 5% each). |

Nominal changes compared to the first half of 2016 Source: newsd.admin.ch - Click to enlarge |

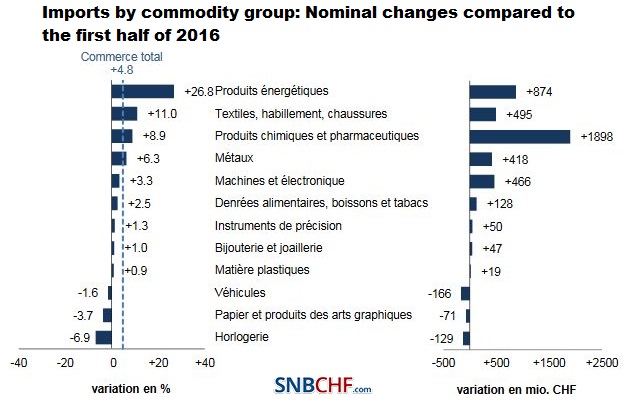

ImportsBroad support for increased imports

|

Nominal changes compared to the first half of 2016(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) Source: newsd.admin.ch - Click to enlarge |

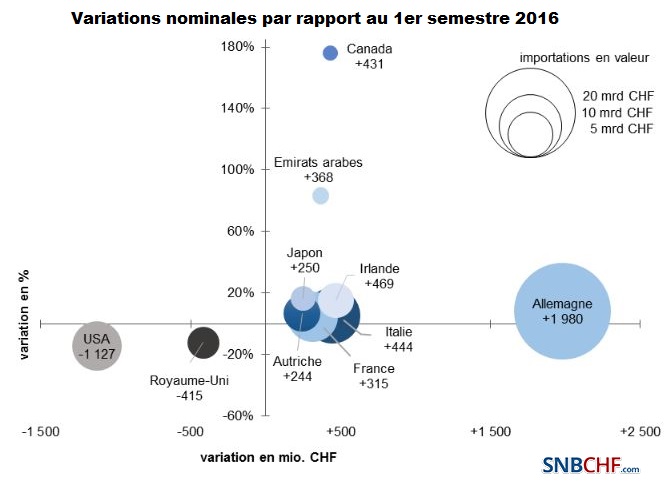

| Imports increased from all continents with the exception of North America (-9%). Asia (+ 8%), followed by the United Arab Emirates and Japan (+83 and + 17% respectively). Conversely, Chinese-based inflows stagnated. In Europe (+ 6%), Ireland and Belgium jumped by 15%. France, Italy, Austria and Germany rose by 5 to 8%, adding additional imports of CHF 3 billion, led by pharmaceutical products. For its part, Latin America gained 2%. The weakness of the North American continent, and in particular of the US (-14%), has taken root in the vehicle sector: several airliners had been imported from the USA in 2016. Conversely, Shipments in Canada almost tripled in one year (+431 million francs). |

Variations nominales par rapport au 1er semestre 2016 Source: newsd.admin.ch - Click to enlarge |

Tags: newslettersent,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance