Bent and DistortedPOITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

|

|

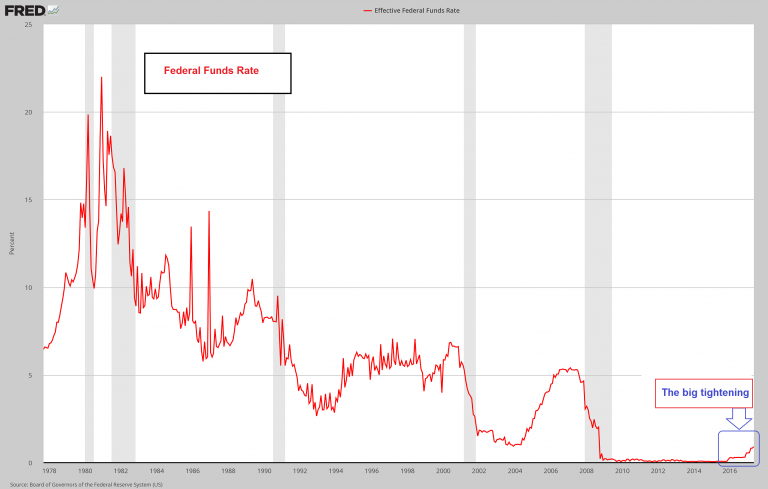

| If you believe the newspapers, the Fed has begun a “tightening cycle.” It is on course to raise its key interest rate, little by little, in quarter-point increments.

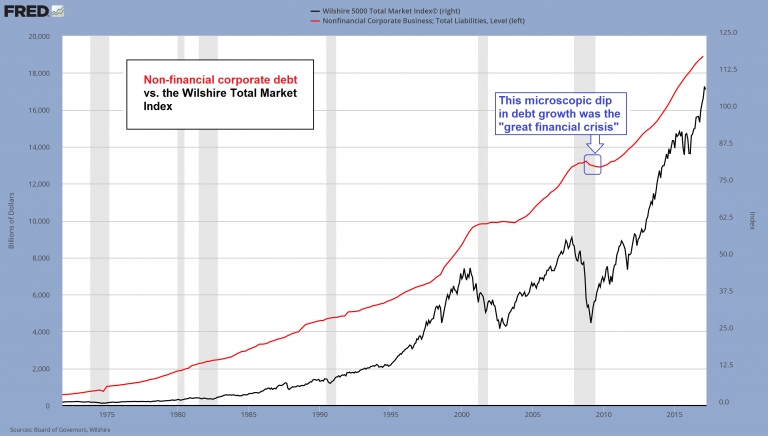

It must know that this is a perilous thing to do. After so much market manipulation over such a long period, prices all up and down the capital structure – from junk bonds to quality stocks and solid real estate – have been bent and distorted. After all, that was the idea: drive up the price of stocks and bonds by driving down interest rates. People would be forced to spend or invest their money rather than save it. And higher financial asset prices would make the rich feel even richer. Walking down the street, the dollars would overflow from their pockets like turnips rolling off the back of a produce truck. They’d feel so flush, they’d buy, buy, buy… sending the plain people into a flurry of trucking, toting, and busting their humps to provide them with goods and services. Then, after the rich were fully satiated (after all, how many martinis can the 1% drink?), they’d have to invest. Cash would flow into money-losing start-ups like Tesla and Snapchat. Headline acquisitions, such as Amazon’s purchase of Whole Foods, would keep stock prices bubbling higher. And trillions of dollars in stock buybacks would make the rich even richer still! What a wonderful work of art… the pièce de résistance of financial bubbles, the one you really had to see to believe. The red line depicts all the debt companies have amassed to grease the financial engineering wheels. This is a game that is indeed coming close to its end. US money supply and credit growth have tanked – the lagged effects of this change in the monetary backdrop will play out. We suspect that the huge surge in corporate debt will become cause for big regrets at that juncture. |

Non-Financial Corporate Debt and Wilshire Total Market Index Compared, 1975 - 2017 |

Money MirageBut the feds could only work this miracle by buying bonds. And the feds didn’t have any money. What could they do? No problem! They used their fake money, the post-1971 credit dollars – trillions of them… money they could create at will. From the post-crash bottom in 2009 to today’s top, U.S. stocks and bonds registered a cumulative increase of about $21 trillion. And upon that mirage now rest the hopes, dreams, and contentment of millions of people all over the planet. One has planned his retirement based on his gains over the last eight years. Another has taken out a loan against his stocks to fund his business. Still another – a major player on Wall Street – has a billion-dollar hedge fund portfolio, a leveraged bet on “low vol,” which depends on further support from the Fed. And look at super investor Warren Buffett… the latest headline news tells us his gifts to charities now top $27 billion. The money is to be used to fight illness and poverty worldwide. But the gifts came in the form of Berkshire stock – not cash. Imagine how the halt and the hungry will suffer if the stock goes down! |

Berkshire Stock, |

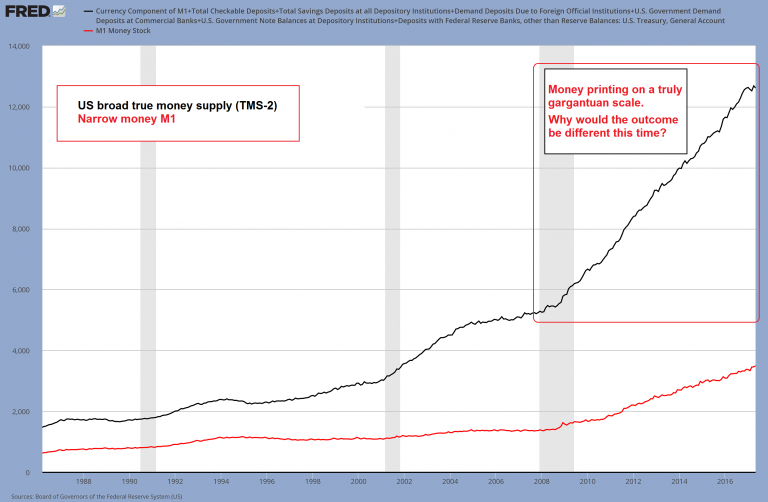

Classic Credit BubbleWhich brings us back to our question: How dumb is the Fed? As you can see from the foregoing, the boom of 2009–17 was wrought by the Fed and paid for with fake money. It is a classic credit bubble, in other words – not genuine prosperity. Almost all the new jobs created during this period were low-wage or part-time jobs in health care or government, not high-value jobs in manufacturing. That’s why real earnings, per family, have scarcely improved – and real employment (as a percentage of the available workforce) has gone down. All the bubbly action, in other words, is in the financial markets, not the real Main Street economy. And as the Austrian School economists tell us, every boom not financed on real savings must end in a bust. Phantom wealth driver: the Fed’s electronic printing press. This orgy of money printing (TMS-2 is up more than 140% since early 2008) has driven asset prices to the stratosphere and has gone hand in hand with the explosion in outstanding debt depicted further above. Most of the “wealth” created in this manner is a mirage that will eventually disappear, one way or another. It should be clear that it is simply not possible to print an economy to “prosperity”. |

US Broad True Money Supply, 1998 - 2017 |

| Federal funds rate since 1978 – the recent tightening is historically still small, but one has to keep in mind that the end of QE was a tightening move as well. It is noteworthy in this context how quickly money supply growth has declined since its last interim growth peak in November 2016.

Nothing comes from nothing. Fake money produces fake prosperity. Take away the fake money… and the fake prosperity goes “poof,” too. Which is why the Fed will never, voluntarily, stop manipulating prices. It can’t let the markets return to “normal” price discovery. Because the markets are likely to discover prices a lot lower than Dow 20,000. “Normal” may be a lot higher than a 2% yield on a 10-year Treasury yield, too. “Normal” may mean a deep depression as the economy shakes off the foolish investments and misallocations of the last eight years. “Normal” would also mean the disgrace of Janet Yellen and Ben Bernanke, who are largely responsible for this bubble. But “normal” won’t stop there. The crisis of 2008–09 was a repudiation of the Fed’s fake-money debt bubble. The stock market crashed as the bubble deflated, just as it normally does. But then central banks went back to work, doubling down on their error with more hot air than ever before. Federal debt alone almost doubled from about $10 trillion to about $20 trillion. Worldwide, $68 trillion in debt has been added since 2007 – a 45% increase – bringing the debt-to-GDP ratio to 327%. |

Federal Funds Rate, 1978 - 2017(see more posts on Federal Funds Rate, ) |

| All of this debt now hangs on the feeble reed of more ultra-low interest rate policies. The Fed says it is going to return its interest rate policy back to normal…

No chance. It’s not that dumb. |

Generally central planners do not have much of a clue. Evidence to that effect abounds, as do sound theoretical explanations as to why it cannot be otherwise, regardless of the knowledge, intelligence or intentions of the planners. What we can state is that the Fed is reactive. Since it has embarked on a tightening path, it will probably continue until something breaks – and that could happen very soon. - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,Chart Update,Federal Funds Rate,newslettersent