The Looming Last Gasp of Indoctrination?The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years. Whether the student loan bubble bursts on its own or implodes due to a general economic collapse, does not matter as long as higher education is dealt a death blow and can no longer be a conduit of socialist and egalitarian nonsense for the inculcation of young minds. |

|

| The perilous condition of the student loan sector can be seen by looking at a few ominous pieces of data:

As economic conditions deteriorate and there are even less meaningful jobs for college graduates than there are now, these numbers will only get worse. Not only have colleges and universities been havens of leftist thought for many years, but they have become ridiculously expensive and beyond the reach of most middle-class income earners to afford without going into significant debt. Moreover, the incessant barrage by the Establishment about the necessity of a college degree has distorted the labor market to where worthless, debt-ridden degrees are pursued instead of much needed blue-collar employment. The readjustment of the labor market to a proper balance will not only take time, but it will be a costly, painful process. |

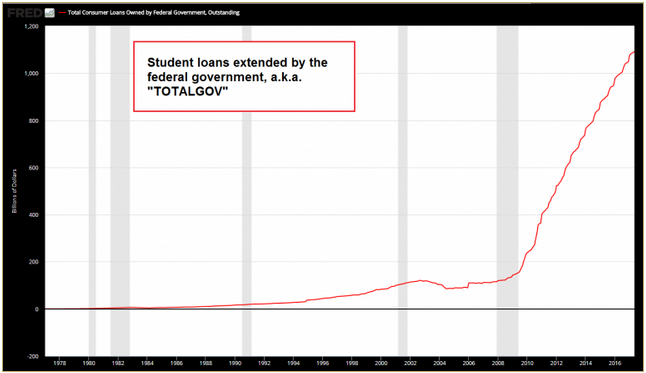

Student Loans, 1978 - 2017(see more posts on Student Loans, ) Student loans granted by the federal government. The total outstanding is actually around $300 billion more, but the above loans are backstopped by the tax serfs. Note when this bubble took off. - Click to enlarge It happened just as the financial crisis triggered by the collapse of the housing bubble started. This is unlikely to be a coincidence – to us it looks like one of several methods that were used to re-inflate the credit bubble. Funny enough, the shorthand for this chart at the Fed’s economic data web site is indeed “TOTALGOV”. You couldn’t make this up. [PT] |

Marxist Intellectual WastelandWhile the “hard” sciences have not been as affected by the Left, the social sciences have long been an intellectual wasteland devoid of any freedom of thought or opinion. Promotion and recognition of academic excellence is, more often than not, based on diversity and one’s skin color instead of merit. Arguably, economic science has been the most corrupted discipline. Economics departments of major universities are now training grounds for employment in state and federal bureaucracies, the banking industry, and Federal Reserve where Marxism, Keynesianism, neo-Keynesianism or whatever kooky, nonsensical theory of the day can be put into practice. While higher education has long been hostile to the ideals of Western Civilization, it is now explicitly a bastion of anti-white discrimination and hostility especially against white heterosexual men. Few days pass these days without an incident, often with the approval of school authorities, blatantly attacking white Americans or symbols that supposedly represent them. Of course, the higher education apparatchiks have had an easy time in their brainwashing task since the impressionable minds in their charge have been indoctrinated by twelve years of public “schooling.” Not only has the public school been a mechanism of social engineering, but it has constantly pushed its chattel to continue their “education” at the collegiate level. |

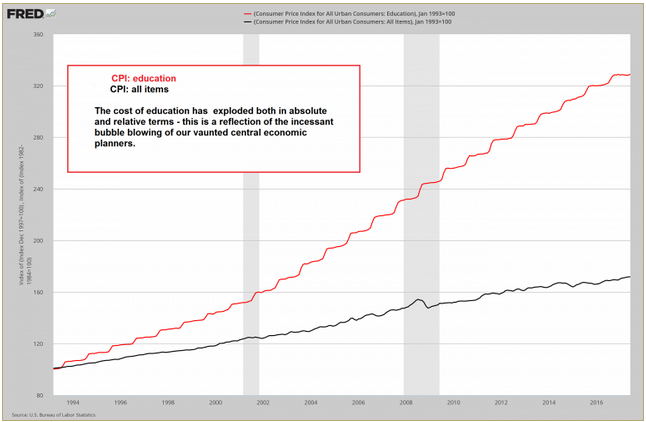

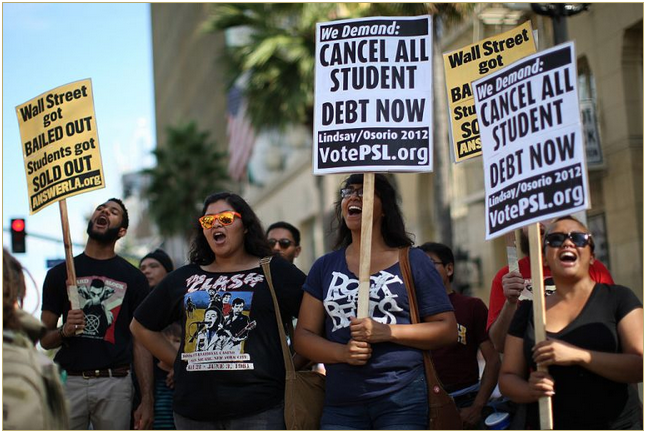

Protests like the one shown above have increasingly flared up in recent years as the student loan bubble has grown. One may be inclined to sympathize with students to some extent considering that the cost of education has exploded into the blue yonder, but it is not quite that simple. - Click to enlarge Education is certainly an area of the economy that is highly sensitive to monetary inflation. For one thing, it is not easily “tradable” (although that may actually soon change). For another thing, as a long-range investment in human capital, college education is part of the higher stages of the economy’s capital structure. A long period of time passes from the beginning of a college education to the production of a consumable service by those receiving it. Monetary inflation always steers investment spending toward the higher stages of the production structure, as it tends to push gross market interest rates below the natural interest rate determined by society-wide time preferences. This distorts relative prices in the economy and artificially boosts the perceived profitability of long-range investments. Many of these investments are unmasked as malinvestments as soon as the monetary pumping stops, and college education is definitely no exception to this rule. However, even at the current high cost of education, students obtaining marketable degrees should be able to cope with their debt load once they enter the job market. Of course, marketable degrees usually involve a lot more work than nonsense like “gender studies” and similar cultural Marxism-type indoctrination masquerading as education. As an aside, students of economics have to keep in mind that the majority of macro-economists would be completely superfluous in a free market economy. Most universities therefore offer economics studies designed to produce central economic planners. To paraphrase Hans-Hermann Hoppe, one will mostly be fed “viciously statist, incomprehensible gibberish”. There are exceptions though, but one has to choose one’s alma mater very carefully if one is genuinely interested in being taught sound economic theory. To come back to the protesters above: if their student debt were to be canceled, their creditors would be forced to bear the losses. The vast majority of said creditors are tax serfs, who have lent them money involuntarily. By contrast, no-one forced these students to borrow money and spend it on obtaining useless degrees. [PT] Photo credit: David McNew / Getty Images |

Strike the RootThe Trump Administration and most on the Right have failed to grasp the socialistic bias of American education. Education Department Secretary Betsy DeVos has spoken about “competition” via school choice, vouchers, magnet and charter schools to increase school and student performance. The Administration’s proposed 2018 education budget calls for an increase in federal spending on school choice by $1.4 billion, a $168 million increase for charter schools, and a $1 billion increase for Title I “to encourage school districts to adopt a system of student-based budgeting and open enrollment that enables Federal, State, and local funding to follow a student to the public school of his or her choice.”** |

CPI for Education and CPI for All Times, 1994 - 2017 |

| These shopworn ideas and policies are not only fundamentally flawed and will make matters worse, but they will do nothing to counteract and or end the Left’s domination of education. Instead, President Trump should do what he spoke of at times on the campaign trail and what President Reagan promised to do, but never did – abolish the Department of Education!

While the collapse of the student loan bubble may be the catalyst for a general financial downturn and will certainly be the cause of tremendous social pain and dislocation, it will, nevertheless, be a necessary prerequisite if America and, for that matter, the Western world is to ever break the grip of leftist ideology which rules it. May the bursting of the student loan bubble commence! |

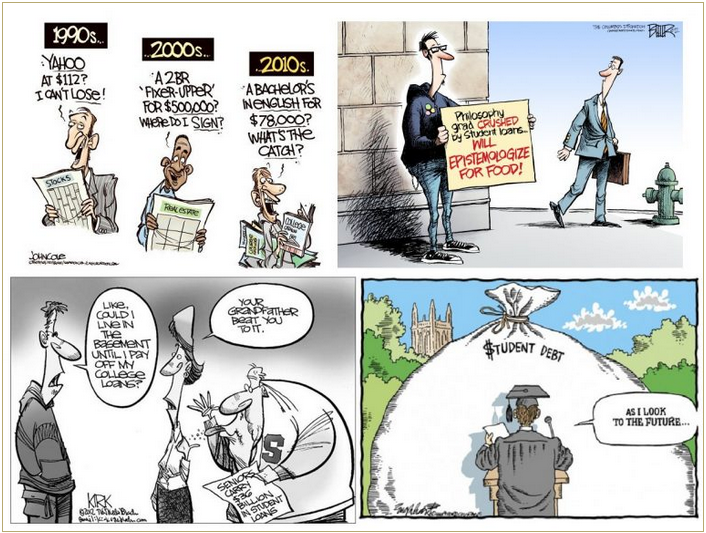

A few cartoons on student debt we have come across. Grandpa beats his grandson to the parental basement… and once you find out that there actually was a catch to that Bachelor’s in English for the everyday low price of $78,000, you can always try and epistemologize for your food! 🙂 - Click to enlarge |

References:

Full story here Are you the author? Previous post See more for Next post*Tyler Durden, “Staggering’ Student Loan Defaults On Deck: 27% Of Students Are A Month Behind On Their Payments.” Zero Hedge, 15 April 2017.

**Jade Scipioni, “Why Betsy DeVos Is Visiting This Ohio School Today.” Fox Business, 20 April 2017.

Tags: newslettersent,On Economy,Student Loans