Swiss FrancThe euro is higher at 1.1010 CHF (+0.23%). – samo da se smenqt stoinostite |

EUR/CHF - Euro Swiss Franc, July 10(see more posts on EUR/CHF, ) |

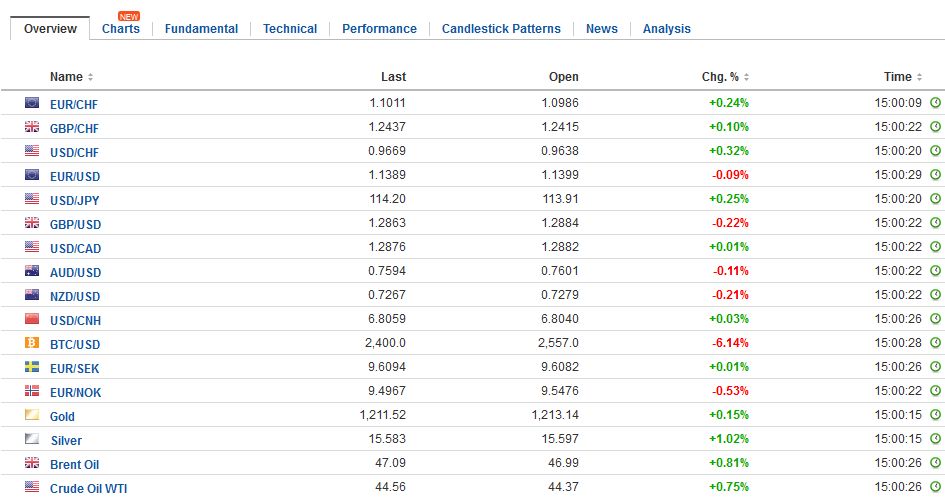

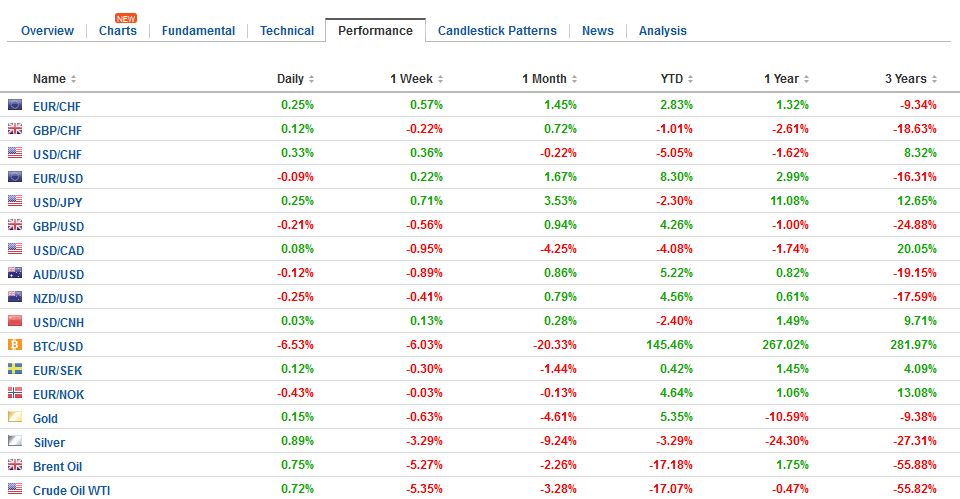

FX RatesThe US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last week. Equities are mostly firmer. The MSCI Asia Pacific Index, which fell to a five-week low at the end of last week, rose by 0.3%. Greater China (including Hong Kong and Taiwan) shares fell, but Japan, Korea, Index, and Australian share prices rose. The Dow Jones Stoxx 600 gapped higher at the open today. It remains unfilled through the European morning and extends to the pre-weekend high of 380.33. The DAX gapped higher, but last week’s highs, a little below 12500 is still capping the index. Consumer staples, real estate, and utilities are leading the European advance. Spain is the notable exception. Its bourse is off 0.3% as telecoms and financials act as drags offsetting the rise in health care, real estate, and utilities. A light North American calendar may give great sway to some chunky option expiries today. The $1.14-level in the euro holds 1.1 bln option that will be cut today. There are $458 mln struck at JPY114.00 today (and $1.7 bln struck at JPY115 tomorrow). The Japanese yen remains the weakest of the major currencies. It is off 0.3% today to trade at its lowest level in two months. BOJ’s Kuroda has made it clear that the 2% inflation target remains the goal and it is still premature to talk about an exit. Japan reported an unexpected decline in machine orders (-3.6% May month-over-month vs. expectations for a 1.7% rise after a 3.1% decline in April). This may point to a pullback in capex. |

FX Daily Rates, July 10 |

| The euro recorded a low near $1.1380 after the US jobs data. To confirm a double top, break of $1.1310-$1.1320 is needed, and ideally the $1.1280 area. The dollar has approached the May high near JPY114.35. The JPY114.60 area corresponds with a 6.18% retracement objective of this year’s decline.

Sterling has extended last week’s decline and is now at its lowest level since June 28. Weak data and a government that is being challenged on several fronts are taking a toll. Employment data is due in the middle of the week. Although some economists are focused on the unemployment rates and the proximity to full employment, we suspect investors will take their cues from the earnings data (reported with an additional month lag), and the headline pace is expected to slow. Sterling is probing support near $1.2860, which is the 38.2% retracement of the advance since June 21. The next chart points are in the $1.2810-$1.2825 band, that will likely prove sufficient to hold steeper losses in check today. The Bank of Canada is the only major central bank meeting this week, and it is widely expected to lift overnight rate a quarter of a point to 75 bp. Since the US dollar posted the key reversal on May 5, it has fallen by 6.8% against the Canadian dollar through the end of last week. Canada’s employment data was stronger than expected. The US dollar briefly traded above CAD1.30 last week and now is trying to re-establish a hand hold above CAD1.29. |

FX Performance, July 10 |

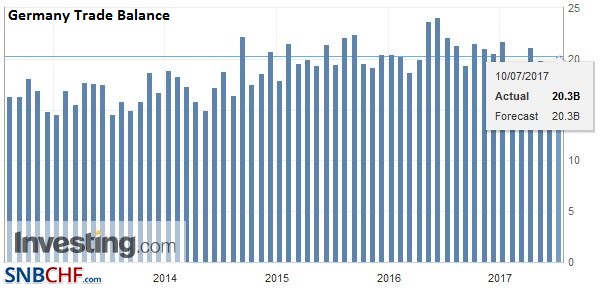

GermanyThis is stands in contrast to Germany, which reported May’s current account and trade balance. Germany’s trade surplus surged to 22.0 bln euros from 18.1 bln euros in April. It was more than 10% larger than expected. The current account surplus increased to 17.3 bln euros from 14.9 bln. German exports increased 1.4% on the month. This year, exports have risen an average of 1.2% a month, while last year exports averaged a 0.3% increase per month. German imports rose 1.2% matching April’s increase. Imports have increased by an average of 1.1% this year after an average pace of 0.5% in 2016. |

Germany Trade Balance, May 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

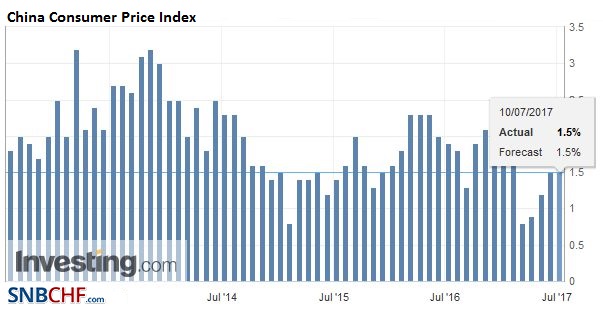

ChinaChina reported June inflation readings. The year-over-year pace of both CPI and PPI were unchanged at 1.5% and 5.5% respectively. These were in line with expectations. Given the base effect, as last year’s surge drops out of the comparison. |

China Consumer Price Index (CPI) YoY, June 2017(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Chinese producer prices are likely to decline in the coming months. Food prices are keeping Chinese CPI tame. Food prices have declined 1.2% year-over-year, while non-food prices are up 2.2%. After a squeeze higher into the end of Q2, the yuan has returned to the trading range from the first half of June, with the dollar around CNY6.80. |

China Producer Price Index (PPI) YoY, July 2017(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

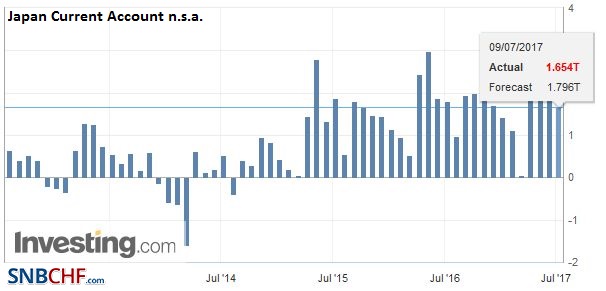

JapanSeparately, Japan reported a somewhat smaller than expected May current account surplus. Of note, Japan reported a trade deficit in May of JPY115. bln. May is seasonally a soft month for trade as the Golden Week holiday is disruptive. Last May’s JPY30 bln surplus was the smallest of the year, and May 2015 showed a deficit. However, the Japan’s primary income balance is the real driver of the current account surplus. The primary income surplus of JPY1.92 trillion compares with the overall current account surplus of JPY1.65 trillion. |

Japan Current Account n.s.a., May 2017(see more posts on Japan Current Account n.s.a., ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,$TLT,China Consumer Price Index,China Producer Price Index,EUR/CHF,FX Daily,Germany Trade Balance,Japan Current Account n.s.a.,newslettersent