Goldman and Citigroup Turn Positive On Gold – Despite “Mysterious” Flash Crash

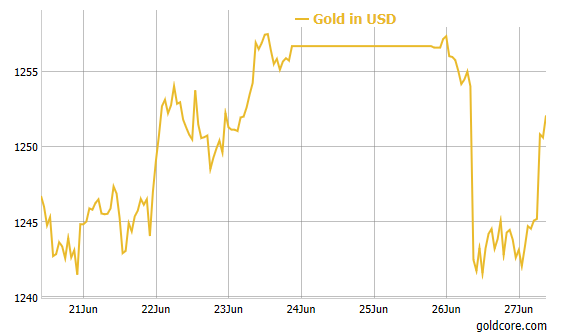

– Gold bounces higher after “mysterious” one minute “flash crash” mistake

– $2 billion, 50 tons or 1.8 million ounces “fat finger” trade blamed

| Gold in USD – 1 Week

– Massive selling at 0400 EST when U.S. markets closed and thin trading amid holidays in Muslim countries including Turkey, Singapore and Malaysia. – Mystery is that “fat fingers” in gold market are always sell trades that push prices lower – Traders or market ‘muppets’ frequently push gold market lower … not other markets – Only small 0.9% loss on the day and bounce back shows deep liquidity and robust nature of gold market – Similar massive selling of bitcoin or other crypto currencies would likely lead to massive price fall |

Gold in USD, June 2017 |

|

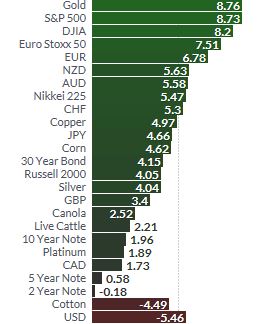

Asset Performance – 2017 YTD (Finviz) – Citigroup say gold’s “downtrend” is “running out of steam” (see News and Commentary) – 3 reasons why Goldman now bullish on gold including “peak gold” (see News and Commentary) – Gold still 8.75% higher year to date 2017; S&P at 8.7% gain ytd |

|

Full story here Are you the author?

Previous post See more for Next postTags: Bitcoin,Business,central banks,Citigroup,European central bank,Finance,flash,Gold as an investment,India,investment,Jim Rogers,London bullion market,money,newslettersent,Precious Metals,Reuters,Silver as an investment,Sovereigns,Switzerland,Turkey