Swiss FrancThe euro has depreciated by 0.09% to 1.0926 CHF.

|

EUR/CHF - Euro Swiss Franc, June 30(see more posts on EUR/CHF, ) |

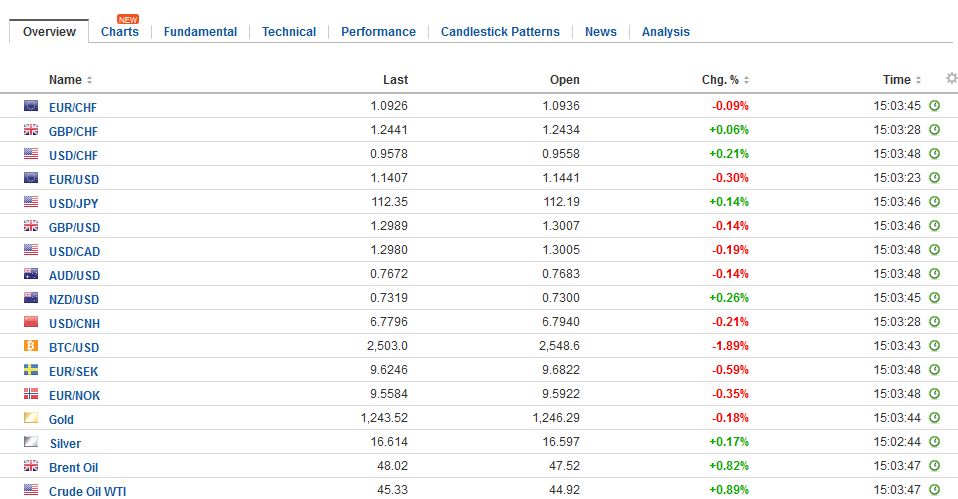

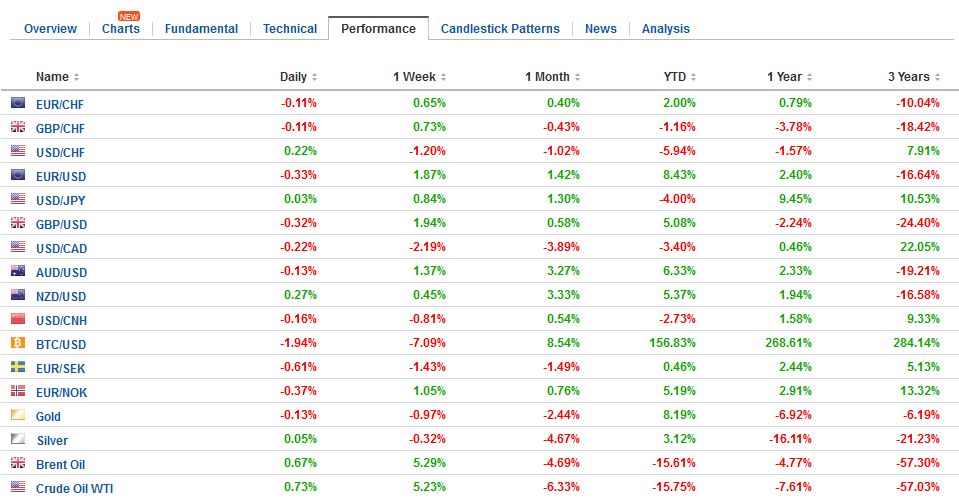

FX RatesThe US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB’s annual conference. It is not really clear that Draghi or Carney gave new policy indications. The ECB President has recognized the improved growth prospects, but until inflation is on a sustainable and durable path toward, a heavy dose of monetary accommodation is still needed. The Bank of England Governor Carney indicated a week ago that it was not the time to raises the rate. He has not changed his mind. He identified a couple of factors he will be looking at to see if removing more accommodation is warranted (the BOE announced an increase in the cash buffer required of banks). In recent days, the Fed’s leadership have added to their argument for a continued gradual increase in rates by noting rich asset prices and easier financial conditions when the Fed desires less accommodative conditions. This is a reminder that contrary to the traditional understanding of the Fed’s dual mandate, it really has three goals: Price stability, full employment, and least we forget, financial stability. Meanwhile, the Labour Party is unable to enjoy its strong showing in the recent election. More than four dozen Labour MPs voted with the Tories on the Queen Speech and will lose the whip. Some were leaders and will have to be replaced. What many observers do not seem to realize is that Labour’s manifesto (political platform) and the Tory’s was not very different on exit from the EU. However, there are many remains (in both parties) who do not want to lose access to the single market, which is arguably the litmus test for a hard Brexit. |

FX Daily Rates, June 30 |

| The market is tired. After rising mostly 15-20 bp this week, 10-year yields in Europe are mostly a little lower. The US 10-year yield is steady. Yesterday’s jump in Europe and the US forced Asia-Pacific countries to play catch-up a bit. Australian and New Zealand benchmark 10-year yields jumped nine bp. Japan’s 10-year yield rose two basis points, but the yield rose to three-month highs, just inside the BOJ 10 bpband on either side of zero.

The US dollar is mixed. The three worst performing majors for the week, the yen, the New Zealand dollar and Norwegian krona are the three strongest currencies on the day. The euro could not get much above the $1.1440 area seen the NY afternoon yesterday. Options struck at $1.1360 (~810 mln euros), and $1.1450 (~700 mln euros) may mark the range. It terms of sentiment; it is striking that despite the slightly higher than expected preliminary June inflation, the eurocould not make more headway. This also seems to reflect a stretched or maybe just a cautious market. After reaching almost JPY113 yesterday, the dollar has pulled back against the yen, as the Japanese currency benefits from short-covering on some of the crosses today. It appears to be finding support around JPY111.70-JPY111.80. There is a $382 mln option struck at JPY112.00 that rolls off today. The yuan had fallen against the dollar in all but one session from June 12 through June 26. However, in a squeeze in what may have been spurred by the PBOC, the yuan has now risen for four consecutive sessions. It has risen 0.8% this week, which appears to be its biggest weekly advance since March 2015. |

FX Performance, June 30 |

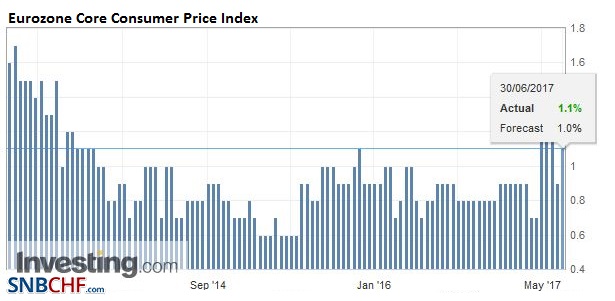

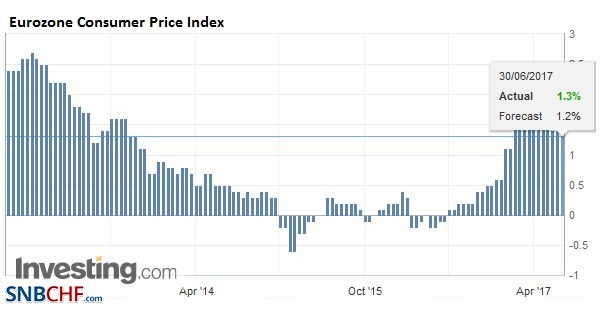

EurozoneHeadline eurozone inflation eased to 1.3% from 1.4% in May. Before yesterday’s German report, a decline to 1.2% was expected. The core rate rose more than expected to stand at 1.1%, up from 0.9% in May. Recall that core rate bottomed at 0.6% in early 2015, and at 0.7% as recently as March. The threat of deflation has been averted. |

Eurozone Core Consumer Price Index (CPI) YoY, June 2017 (flash)(see more posts on Eurozone Core Consumer Price Index, ) |

Eurozone Consumer Price Index (CPI) YoY, June 2017 (flash)(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

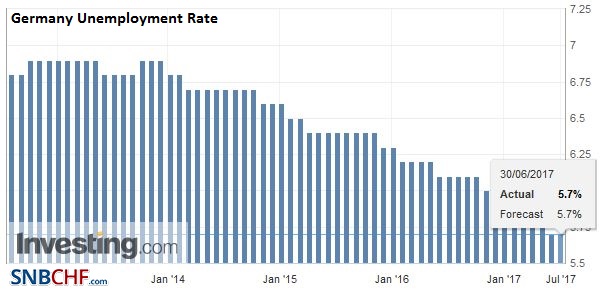

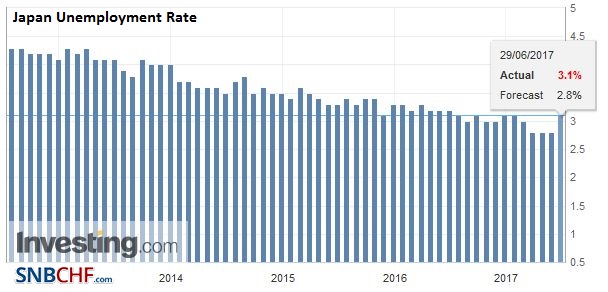

GermanySeparately, the unemployment rate unexpectedly rose to 3.1% from 2.8%, even as employment rose to its higher since 2007 and the job-to-applicant ratio rose (1.49 from 1.48). The number of unemployed unexpectedly rose in German as well. While unemployment claims were unchanged at 5.7%, |

Germany Unemployment Rate, June 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

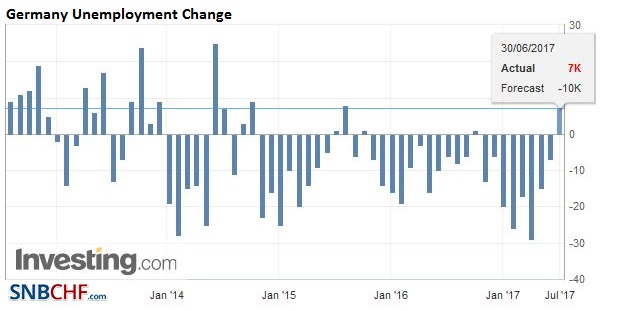

| Germany reported that unemployment increased by 7k instead of fall by 10k as the market expected. |

Germany Unemployment Change, June 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

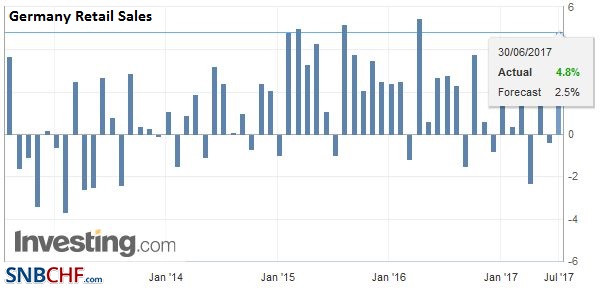

Germany Retail Sales YoY, May 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

|

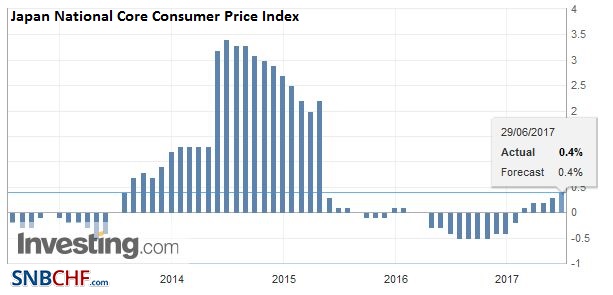

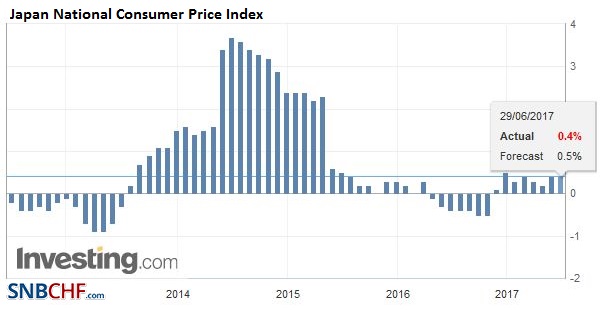

JapanIn contrast, Japan’s May CPI was little changed. The 0.4% headline pace was unchanged, while the core rate, which excludes fresh food, ticked up to 0.4% from 0.3%. Excluding food and energy, the year-over-year rate was unchanged at zero. |

Japan National Core Consumer Price Index (CPI) YoY, May 2017(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

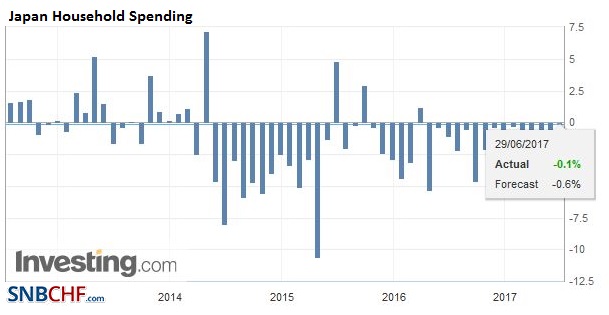

| The 0.1% contraction is the smallest in the run, suggest consumption is stabilizing. |

Japan National Consumer Price Index (CPI) YoY, May 2017(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Separately, Japan reported that for the 15th month, household spending on a year-over-year basis contracted. |

Japan Household Spending YoY, May 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

Japan Unemployment Rate, May 2017(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

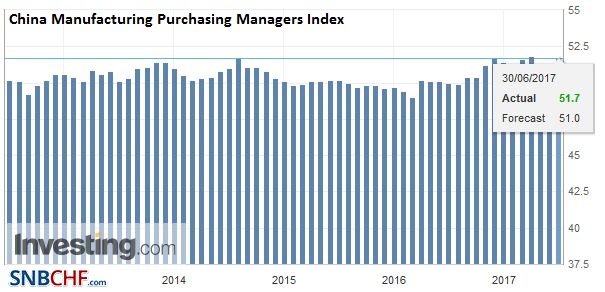

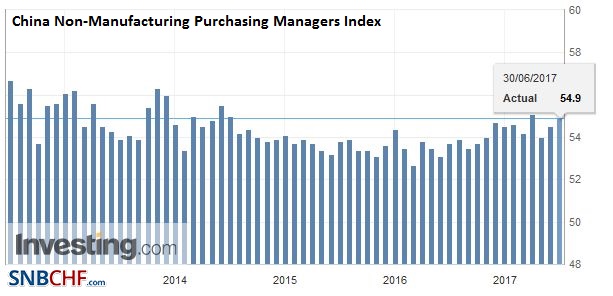

ChinaThe resilience of the Chinese economy is one of the notable developments in the H1 17. It appears to be finishing the period on a positive note. The official manufacturing PMI rose to 51.7 from 51.2, defying expectations for a decline. |

China Manufacturing Purchasing Managers Index (PMI), June 2017(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| The non-manufacturing PMI increased to 54.9 from 54.5. New export orders rose to 52.0, the highest since April 2012, and more broadly, new orders rose to 53.1 from 52.3. Price components rose. |

China Non-Manufacturing Purchasing Managers Index (PMI), June 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

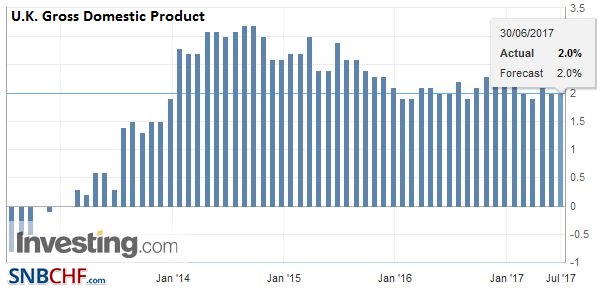

United KingdomSterling extended this week’s survey to $1.3030 in Asia before pulling back, perhaps encouraged by a soft GfK consumer confidence (lowest since the referendum) and the lack of an upward revision to Q1 GDP (remained unchanged at 0.2%). The $1.3055 area corresponds to a retracement objective of the decline since the referendum. A move above it would encourage talk of $1.34-$1.35. |

U.K. Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

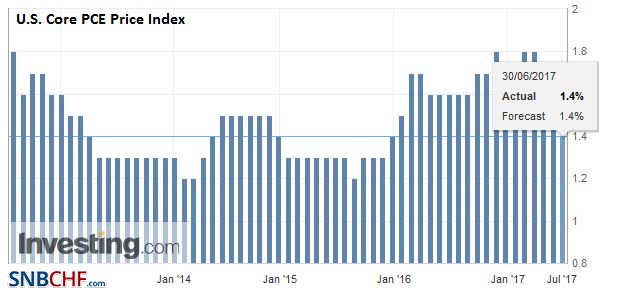

United StatesThe US reports personal income and consumption data that will shape forecasts for Q2 GDP. The core PCE deflator is expected to confirm the general movement in the core CPI and ease for the fourth consecutive month. |

U.S. Core PCE Price Index YoY, May 2017(see more posts on U.S. Core PCE Price Index (PCE Deflator), ) Source: Investing.com - Click to enlarge |

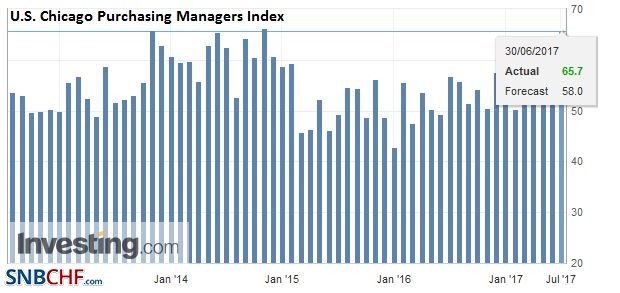

| Chicago PMI and University of Michigan consumer confidence reports are not typically market movers. |

U.S. Chicago Purchasing Managers Index (PMI), June 2017(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

U.S. Michigan Consumer Sentiment, June 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports April GDP, and perhaps, more importantly, the Bank of Canada’s survey of senior loan officers may solidify expectations for a rate hike at the next meeting (July 12). Indicative pricing in the OIS market implies almost a 70% chance of a hike then.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$CAD,$CNY,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,FX Daily,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment Rate,Japan Household Spending,Japan National Consumer Price Index,Japan National Core Consumer Price Index,Japan Unemployment Rate,newslettersent,U.K. Gross Domestic Product,U.S. Chicago PMI,U.S. Core PCE Price Index (PCE Deflator),U.S. Michigan Consumer Sentiment