Swiss FrancThe euro is up by 0.06% to 1.0922 CHF |

EUR/CHF - Euro Swiss Franc, May 24(see more posts on EUR/CHF, ) |

GBP/CHFLabour gains ground The Conservatives were in a very strong position following the election announcement. A snap election historically causes the currency in question to weaken, but on this occasion the opposite occurred. A Torie victory is deemed to be positive for the UK economy. Investor confidence grew and the pound strengthened as a result. With the election now closer than previously expected I would expect to see Sterling weakness due to political uncertainty. Looking at the last general election, we did not see any significant movement on the exchange until just before the event so be prepared for volatility around 48hrs before the vote Following Theresa May’s announcement of plans for the elderly to finance their own care if they have assets in excess of £100k we have seen Labour gain significant ground in the polls. The conservative lead has moved from 20-14 points in the latest ICM/Guardian poll. The tories are leading at 47%, but Labour are cutting the tore lead at 33%. Inflation a growing concern for Sterling There has been a recent rapid rise in inflation from 2.3% to 2.7%. Such a sharp rise is worrying, as imports become more expensive due to the weak value of the pound. Retailers will then pass on the price increase to the consumer, the problem is that the average wage is not rising at the same speed as inflation. If people choose not to purchase goods due to the inflated prices this could potentially lead to recession. UK GDP data will be keenly watched when released tomorrow. |

GBP/CHF - British Pound Swiss Franc, May 24(see more posts on GBP/CHF, ) |

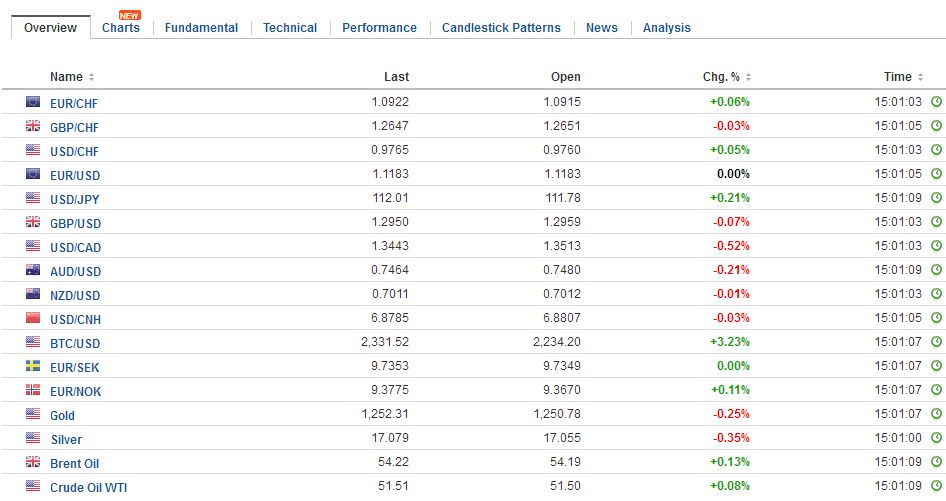

FX RatesAfter staging a modest recovery in North America yesterday afternoon, the greenback is consolidating in narrow ranges. Momentum traders, who appeared to dominate activity recently, paused. To be sure, the greenbacks upticks have been modest, and little technical damage has been inflicting on the major foreign currencies. The main development today was Moody’s decision to cut China’s credit rating to A1 from Aa3. It cited the risk of a material rise in economy-wide debt levels as the economy slows. The outlook was shifted to stable from negative. It is Moody’s first downgrade of China since 1989. S&P, which has China on a negative outlook, rates it A-, while Fitch sees it as A+. |

FX Daily Rates, May 24 |

| Note that tomorrow New Zealand’s milk coop will set initial prices for the new fiscal year, and separately the government may announce that the economy’s performance is generating greater revenue. It is likely to announce modest tax cuts ahead of the September election. This may allow the New Zealand dollar to extend its recovery. It had fallen to a one-year low on May 11 near $0.6820. It pushed above $0.7000 yesterday. Offers were seen in front of $0.7050, but near-term potential extends toward $0.7100.

The euro is trading with a slight downside bias. A break of $1.1150-$1.1160 could squeeze more momentum players and spur losses toward the $1.1080-$1.1100. Option expires today include $1.1140-$1.1150 (~1.5 bln euros). The dollar is in narrow ranges against the yen (~JPY111.75-JPY112.05). There is a large (~$2.55 bln) JPY112.0 strike that expires today. The intraday technicals warn that it will likely be a fight there today. Sterling is wrestling with the New Zealand dollar for the top position today, but it has so far been unable to resurface above $1.30. Although the low in sterling is debatable, 38.2% retracement of the sell-off since last year’s referendum, according to Bloomberg, is found near $1.3055. Thus far this has capped the resurgent pound. |

FX Performance, May 24 |

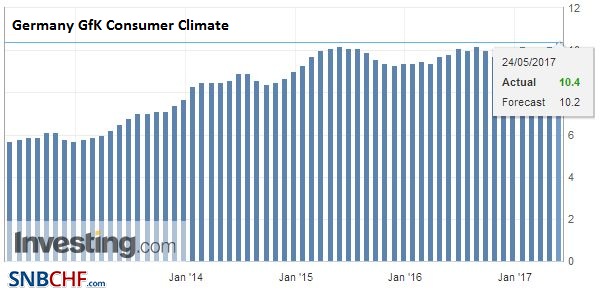

Germany |

Germany GfK Consumer Climate, June 2017(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

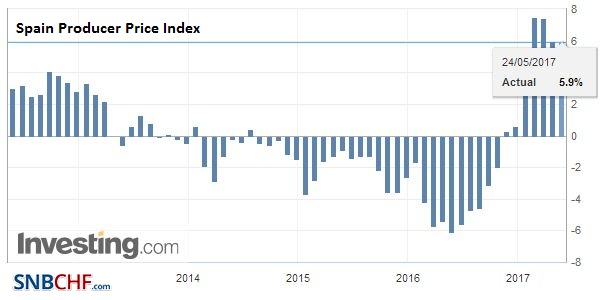

Spain |

Spain Producer Price Index (PPI) YoY, May 2017(see more posts on Spain Producer Price Index, ) Source: Investing.com - Click to enlarge |

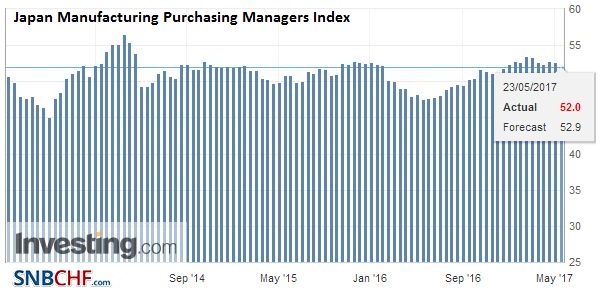

JapanJapan’s flash manufacturing PMI disappointed. It slipped to 52.0 from 52.7. Output fell to 52.9 from 53.4. |

Japan Manufacturing Purchasing Managers Index (PMI), May (flash) 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

United States |

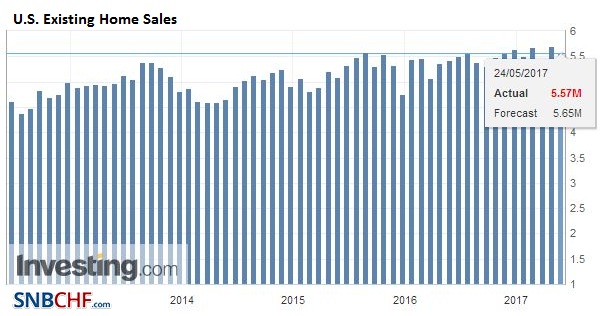

U.S. Existing Home Sales, Apirl 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

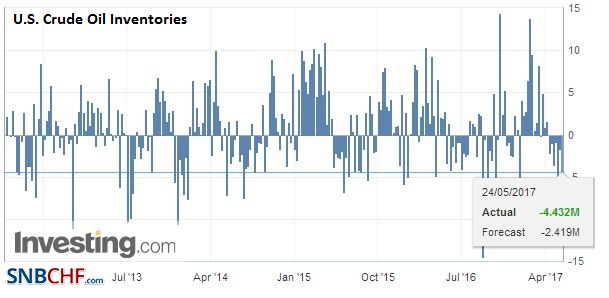

U.S. Crude Oil Inventories, May 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

|

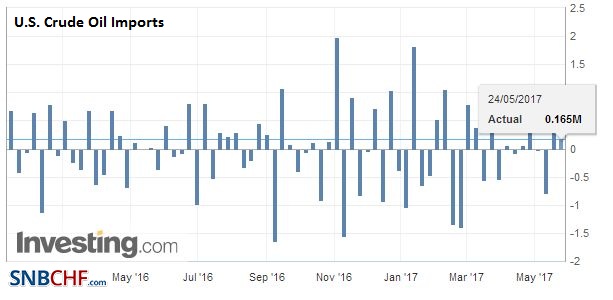

U.S. Crude Oil Imports, May 2017(see more posts on U.S. Crude Oil Imports, ) Source: Investing.com - Click to enlarge |

Although many will look at the FOMC minutes; it is difficult to imagine the minutes will be much more revealing that the meeting itself, which was as much of a non-event as an FOMC meeting can be. The FOMC statement looked through the recent softness of the US economy and said nothing to dissuade ideas that the Fed is poised to hike rates in June. Given that the minute’s pick-up sentiment from non-voters as much as voters, the risk seems asymmetrical for more hawkish rather than dovish minutes. It still seems early to expect many revelations about the balance sheet strategy.

China

The impact was marginal. In part, this is due to the exaggeration of the internationalization of China. Specifically, China’s external debt is low at around 12% of GDP. The PBOC estimates that foreign investors own about CNY830 bln (~$121 bln) of mainland bonds at the end of March, compared with CNY853 bln at the end of 2016. That is equivalent to about 1.5% of the CNY63.7 trillion outstanding.

Chinese shares initially weakened but recovered and closed fractionally higher. The price of industrial metals fell, but it is difficult to say the downgrade was the spur. Iron ore fell 4%, for example, after falling 3% yesterday. Nickel fell 1.7%, while copper slipped 1%. Among the currencies, the Australian dollar and the Malaysian ringgit seemed to be the most sensitive, but both recovered fully.

Canada

There are three events in North America that are noteworthy: the Bank of Canada meeting, the Congressional Budget Office scoring the health care reform that already passed the House of Representatives, and the FOMC minutes.

The Bank of Canada will leave rates on hold. The economy has generally evolved as it has expected. However, there is little reason to abandon its cautious posture. The risks from trade are significant. NAFTA negotiations begin in a few months. Although the White House has balked at the border adjustment tax, the vacuous of the Administration’s budget gives breathing space to the ongoing efforts in Congress to keep it alive. The Canadian economy has accelerated faster than the US, but the output gap is only slowly closing, and a rate hike seems unlikely over the next few quarters, at least.

The Canadian dollar staged a key reversal on May 5, after the US dollar almost reached CAD1.38. The US dollar has fallen about 2.5% against the Canadian dollar to hit almost CAD1.3455 yesterday. The speculative market is leaning the other way, as non-commercial accounts have a record gross short CAD position in the futures market as of a week ago. With US dollar resistance seen around CAD1.3550, there is potential toward CAD1.3440, which corresponds to a 61.8% retracement of the greenback’s rally that began in mid-April.

The CBO scoring of the health care reform bill that passed the House of Representative is important. It is the official arbiter of such issues. If the deficit is not reduced by two billion dollars over the next decade, it is possible that the bill is modified again and a new vote is needed. This is problematic because the bill passed narrowly (217-213) before and was a delicate and fragile balance. A new provision that had been added allows states to waive some regulations that could lead to more people becoming eligible for tax credits, which has deficit implications. Recall that the savings from health care were going to be used to fund tax reform.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$JPY,China,EUR/CHF,FX Daily,gbp-chf,Germany GfK Consumer Climate,Japan Manufacturing PMI,newslettersent,NZD,Spain Producer Price Index,U.S. Crude Oil Imports,U.S. Crude Oil Inventories,U.S. Existing Home Sales