Summary:

The Trump Administration seems to be trying to cast the US as a revisionist power.

Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others.

The outlook of US interest rates is critical to the outlook of the dollar.

The main risk to investors in the week ahead comes from two unknowns. On the international stage, the biggest change in the last six months is not China or Russia. It is not OPEC or North Korea. It is the United States and the seemingly impulsive and transaction-driven affairs of state. Defection from the international agreements or regime seems to be a right claimed in deed, if not word, by both powerful and weak countries.

The US position at the G7 meeting on trade was along these lines. The US, Treasury Secretary Mnuchin insisted, reserved the right to protectionism if it judged trade not to be free or fair. Who is not for free or fair trade?

The practical problem lies in what these noble concepts mean. Because of the inherent conflict, multilateral institutions, like the World Trade Organization define those concepts. Is Trump posturing or is he defecting from the very international order the US, more than any other nation, envisioned and created?

Can Trump succeed to make the US the leading revisionist country, or will its national interests lie with defending the status quo? The actions he authorized in Syria, Afghanistan and escalating rhetoric toward North Korea have received bipartisan support, though the Trump Administration’s response to the launch earlier today of two missile tests that may or may not have been intercontinental ballistic missiles. Still, up until now, the Trump’s Administration’s actions have been well within American traditional foreign policy approach.

He also recommitted to NATO, after calling the treaty organization “obsolete,” though Secretary of State Tillerson gave members two months from the end of March to boost defense spending or present such plans. Trump has backed away from campaign pledges to confront China via its currency and exports to the US.

Trump made his early trade moves were very much part of the mainstream. He signaled intentions to renegotiate NAFTA not leave it. Trump noted when formally withdrawing from the TPP that Clinton had also opposed it. Canadian lumber, steel, and aluminum were not picked randomly, but have long been areas of concern.

A new phase is about to begin. Lighthizer was confirmed by the Senate and is now the new US Trade Representative. Renegotiating NAFTA is thought to be the priority, though Lighthizer is better known for his criticism of China. Soon it should be clearer to investors: On one hand, Trump may be like the emperors of old and simply be demanding greater tribute from everyone else. This seems negotiable and ultimately acceptable. Several countries have made concessions, including China and Saudi Arabia.

On the other hand, the cross-border movement of capital, goods, and services, has not returned to pre-crisis peak levels. Some suggest that peak globalization is behind us. Trump may be both an effect and cause of the de-globalization forces. He may purposely seek to re-align US interests with anti-globalization forces. Although the border adjustment tax has been rejected in its current form, some disincentives for the fragmentation of production and extensive supply chains cannot be ruled out.

The US behavior on the world stage has become somewhat less predictable, and the Trump Administration continues to make noises as if it were revisionist as an opposed to a status quo power. Barely an ally or trade partner has escaped criticism. At first, other countries are trying to proceed without the US, such as TPP or if the US withdraws from the Paris Accord. However, the risk is that US nationalism/unilateralism spurs others down the same path. In game theory terms, the defection of the US from cooperation will encourage others to defect as well.

Some observers have been crying “currency war” for several years, and therefore do not fully appreciate the marked departure that is possible under the Trump Administration. Similarly, many have been suggesting a hegemonic stability crisis since at least 2001 and may be slow to recognize the new threats along this line.

United StatesThe second known unknown is the outlook for US interest rates, which arguably is among the most important influences in the capital markets. The softer than expected retail sales and inflation report before the weekend spurred a pullback in US interest rates. The two-year yield slipped four basis points to finish the week below 1.30%, snapping a two-week advance. Expectations for Fed policy next month did not change substantially. Bloomberg’s calculations suggest the June contract is pricing in a 97.5% chance of a hike next month, down from 98.8% the previous week. The CME’s model suggests the odds were unchanged on the week at 78.5%. Our estimate, which assumes that Fed funds would average 116 bp after a hike, which, relative to the range, is where the effective Fed funds rate has been averaging, and that on the last day of the quarter the effective rate drops nine basis points, as it did at the end of Q1, would suggest about a 73% chance of a hike is discounted. At the end of the previous week, our calculation put the odds at nearly 77%. Even incorporating the July and August contracts into our calculations, we don’t see the market discounting more than a 76% chance. There is a risk the April core PCE deflator pulls back further when it is published at the end of the month (May 30). Recall it peaked in January near 1.78% and in March stood at 1.56%, which was the lowest since March 2016. Any further slippage, which the CPI (and softer rents) hint at, would see the Fed’s preferred inflation measure ease to its lowest level since the end of 2015. At the same time, inflation expectations have fallen. Before the weekend, the University of Michigan’s survey found the 5-10 year inflation expectation fell back to the 2.3%, the cyclical low from the end of last year. The 10-year breakeven ( the difference between the conventional yield and the 10-year TIPS has to the lower end of its range since last November. The US yield curve (two-year to 10-year yield) has flattened considerably. When the Fed hiked rates in mid-March, the spread was about 120 bp. Now it is threatening to push below 100 bp. The US 10-year yield fell last week for the first time in three weeks. The yield had been gradually rising in five of the past six weeks. The setback in response to data is threatening to continue. The downside gap created on April 24 in response to the first round of the French election lies near 2.24% may draw prices. Mixed signals are expected from the first round of the Fed’s May manufacturing, while the April housing starts and industrial output figures recovery from the March weakness, but might not be sufficient to push US yields higher. And without higher US yields, the dollar may not find much traction. News from Asia and Europe will likely confirm what investors already know. Japan’s economy likely accelerated from the 1.2% annualized pace in Q4 16 toward 1.5%-1.8% in Q1 17, bolstered by exports and industrial output. Household spending and capex appear to have disappointed. Although Chinese credit expansion remained strong (and stronger than expected), retail sales and industrial output are expected to have moderated from Q1’s pace. |

Economic Events: United States, Week May 15 |

EurozoneThe eurozone is expected to confirm its earlier estimate of Q1 GDP (0.5%) and April CPI (1.9% and 1.2% core). Economic strength and a DAX at new record highs should help underpin the German ZEW survey. Meanwhile, more reports seem to prepare the market for a change in the ECB’s risk assessment and forward guidance. |

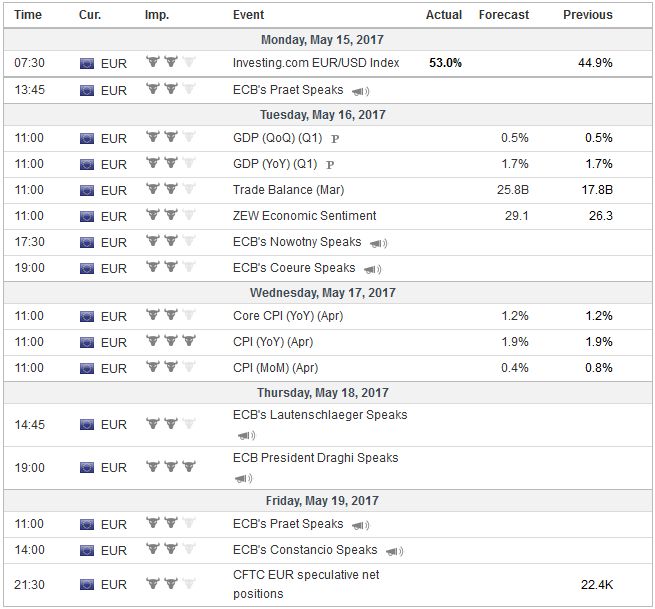

Economic Events: Eurozone, Week May 15 |

United KingdomIn the UK inflation is likely expected to accelerate, spurred in part by new taxes, including council taxes, prescription changes, and excise duties on vehicles. Investors will be carefully monitoring the UK’s labor market developments. There was a large jump in new claims for unemployment benefits in March (25.5k, the most in six years). Weekly earnings are reported with an extra month lag, but the concern is that wages will not keep pace with inflation and that this will squeeze the purchasing power, and therefore, the consumption of the household sector. Still, it may take some time for this emerge, as April retail sales likely bounced back from the March weakness that overstated the case. |

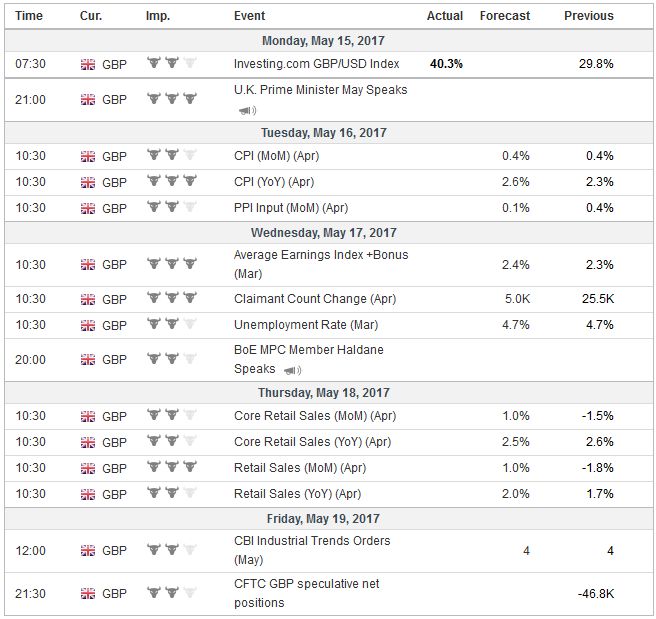

Economic Events: United Kingdom, Week May 15 |

Switzerland |

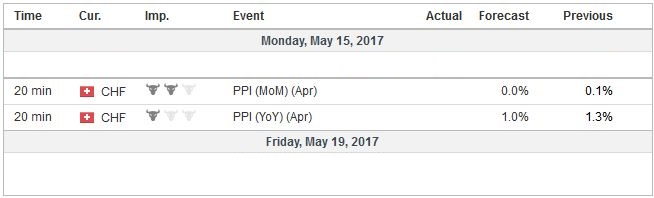

Economic Events: Switzerland, Week May 15 |

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,newslettersent