Summary:

FOMC minutes increased likelihood that Fed will begin reducing its balance sheet late this year.

There does not seem to be a consensus on other issues.

The strength of the ADP report contrasts with softness seen in the ISM and PMI non-manufacturing surveys.

The FOMC minutes were clear that officials are contemplating beginning address the balance sheet, which is another sign of confidence in the normalization process. However, beyond that very little else is clear. There does not appear to be much agreement yet on the pace or the scope of the adjustment.

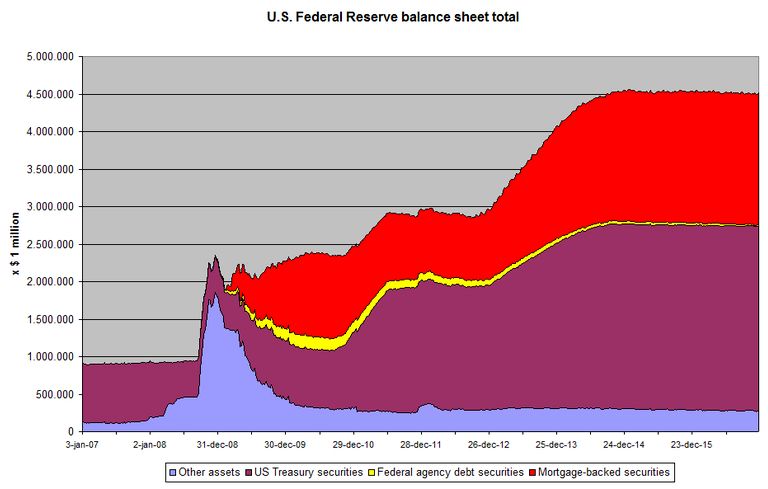

There are roughly $425 bln of US Treasuries that are maturing next year. The Fed also own Mortgage Backed Securities (MBS). Over the past 12 months, the Fed has reinvestment about $350 bln of maturing MBS securities. Officials have indicated a preference to return to an all-Treasury balance sheet in the long-term, but this does not mean it needs to focus on MBS in the short-term. Indeed, there seemed to stop rolling over maturing issues of both asset classes.

| There was also no light shed on the relationship between the Fed’s balance sheet and the rate adjustment cycle. At her press conference following last month’s FOMC meeting, Yellen reiterated that the Fed funds target is the main tool of monetary policy. However, Dudley has suggested that maybe the Fed would pause its rate hikes as it turned to the balance sheet. During the asset purchase operations, Fed officials argued that it was the holding (stock) rather than the buying (flow) that was the key to policy. Reducing its holdings (reducing the balance sheet) would then seem tantamount to rate increases.

If the Federal Reserve does not roll-over as many Treasury(and MBS) securities, some other buyers need to emerge, or prices will have to fall (yields rise) to attract new demand. In recent months, China and Japan have reduced their Treasury holdings according to the TIC data. Private sector demand, partly encouraged by regulatory needs, fill the gap left by the official sector. There are many considerations, including the pace by which the Fed allows the balance sheet to shrink. Despite some thought that the Fed can let Treasuries full roll off, we suspect that one of the most important considerations not to destabilize the capital markets. This would seem to suggest a modest, rules-based regime of the gradual phasing out the reinvestment of maturing issues. Recall that former Fed Chair Bernanke set tapering course before his term was up. Yellen & Co. implemented it. Similarly, because the issues need to be thought out and a strategic plan developed, Yellen’s Fed will likely set the course for addressing the balance sheet. The composition of the Board of Governors will change dramatically over the next year and a half, with as many as five new members of the seven-person board. |

US Federal Reserve balance sheet total 2007-2017 Source: commons.wikimedia.org - Click to enlarge |

The FOMC minutes indicated that in its overview of financial conditions, some officials expressed concern about the equity market. The rally had been one of the sources of the easing of financial conditions. There was an expression of concern on valuation grounds, and some fear that its prices may incorporate assumptions that do not materialize.

The S&P 500 gapped higher today after the ADP jobs estimated surprised to the upside at 263k. Even with the downward revision to the February estimate, ADP’s two-month private sector jobs creation was 508k. The market had expected 483k. That opening gap is found between yesterday’s high 2360.53 and today’s low 2366.59. In addition, there is a downtrend line from the record high on March 1 (~2401) and March 15 (~2390). It is found near 2376 today, which was penetrated on an intraday basis, but is struggling to hold it post-FOMC minutes.

The US PMI and ISM for the non-manufacturing sector showed weakness in the jobs component in contrast to the ADP report. Due to the methodological differences, economists may put more emphasis on the ISM, and PMI reports.

The dollar has softened a little after the FOMC minutes. Once again, the euro has recovered after dipping below $1.0650. Ahead of the Friday’s US jobs report, we still see the risk to the euro’s upside. The dollar entered a band of technical resistance against the yen seen in the JPY111.20-JPY111.50 area. Sterling returned to its highs just below $1.25. The Australian and Canadian dollars are also firmer. US rates are steady to slightly higher.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Federal Reserve,newslettersent,SPY