Swiss Franc |

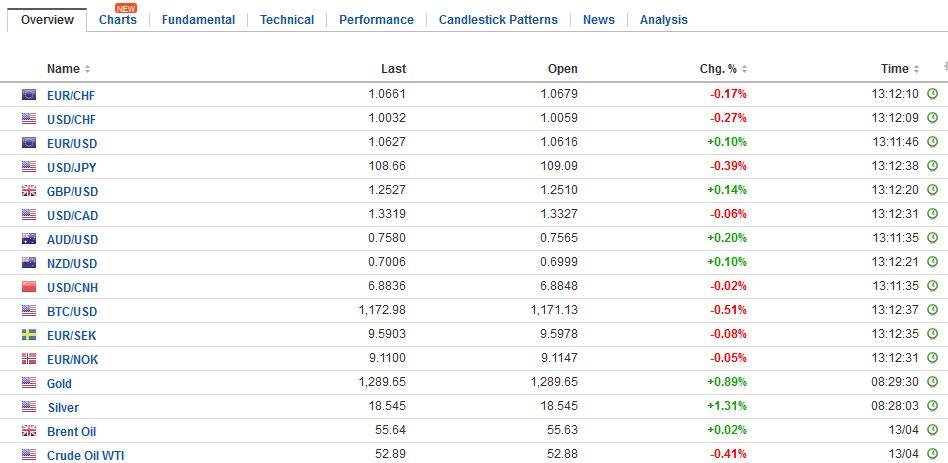

EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

FX RatesThe holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean peninsula, the US ordered a missile strike against Syria in retaliation for the use of chemical weapons and dropped the largest bomb in the world on Afghanistan. Investors do not seem to have gotten a handle on what is happening. For several years, even before deciding to run for President, Trump was critical of US foreign policy. He repeatedly argued against attacking Syria. He wanted to reset the relationship with Russia, but both sides now recognize that the relationship is strained at best. There were other remarkable volte-face moves this week. After repeatedly criticizing the Obama Administration for not citing China as a currency manipulator, he indicated this week, he won’t either. China’s abstention in the UN Security Council vote to condemn Syria for its use of chemical weapons was an important diplomatic signal. The US, Russia, and China are in a fluid dynamic. One of the criticisms of Obama’s foreign policy was that he allowed the other two large nuclear powers, China and Russia to have an alliance of convenience and frustrated US multilateral efforts, including at the UN. |

FX Daily Rates, April 14 |

| Initially, it appeared the Trump would try to peel Russia away so better to confront China on trade and activity in the South China Sea. The investigation into connections between some people in Trump’s campaign and Russia may add another dimension to the Administration’s response. Russia’s support for Syria’s Assad and its apparent complicity revealed the underlying conflict of interest. Meanwhile, Trump has made some warm comments about China and seems hopeful that China will rein in North Korea.

Many investors and observers are worried that North Korea may conduct another nuclear test as early as tomorrow, which is the 105th anniversary of the birth of North Korea’s founder Kim II Sung. Gold is has gained 2.6% this week, its fifth weekly advance. Indeed, here in 2017, the price of gold has fallen in only three weeks and is up around 12%. After posting corrective upticks over the past two sessions, the Korean won, and the Korean stock was sold earlier today. The US dollar rose almost 0.9% against the won and finished about 0.5% higher on the week, following last week’s 1.5% rise. The Kospi fell 0.6% today and about 0.8% on the week. It is the second weekly decline, leaving the Korean benchmark up 5.35% for year-to-date, though the KOSDAQ is off 2% this year. In the region, only Japanese markets are down on the year. The MSCI Asia Pacific Index fell 0.3% today, which reverses the previous gains to finish 0.1% lower on the week, its fourth consecutive weekly loss. |

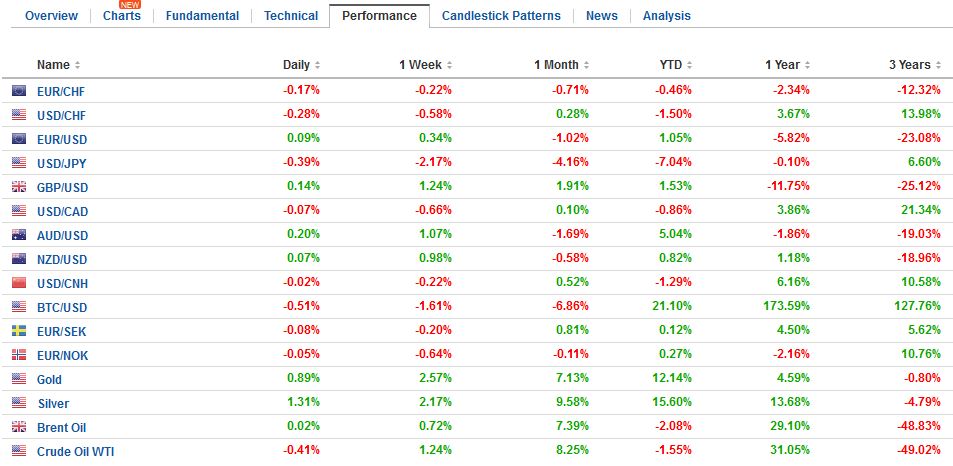

FX Performance, April 14 |

United StatesIt is a partial holiday in the United State, where the stock market will be closed. The US reports March consumer prices and retail sales. Headline CPI is expected to be flat, which would allow the year-over-year rate to ease to 2.6% from 2.7%. |

U.S. Consumer Price Index (CPI) YoY, March 2017(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

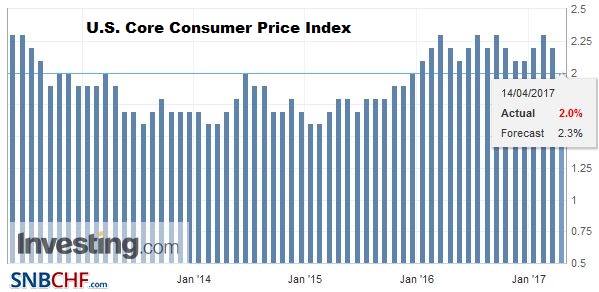

| The core rate, on the other hand, may tick up to 2.3% from 2.2%. That would put it back at the upper end of where it has been since early last year. |

U.S. Core Consumer Price Index (CPI) YoY, March 2017(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

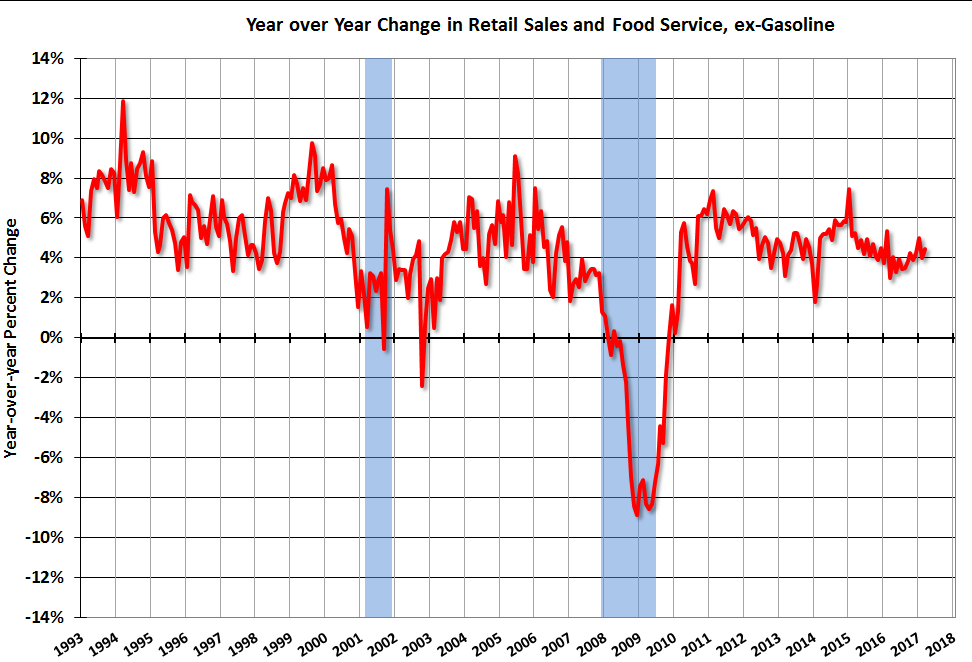

| Headline retail sales may be dragged a little lower by the softness in auto sales and gas prices. Excluding these components, retail sales are expected to have increased by 0.3%, which is also what the GDP component is expected to have risen. The risk, however, is on the downside. Consumers have pulled back in Q1 17 after a strong showing in Q4 16. In addition, the poor weather in part of March that depressed auto sales may have deterred shopping more generally. |

U.S. Retail Sales YoY, March 2017(see more posts on U.S. Retail Sales, ) Source: macro.economicblogs.org - Click to enlarge |

China reported its yuan loans and aggregate financing for March. Yuan loans slowed to CNY1.02 trillion from CNY1.17. The median guesstimate in the Bloomberg survey was for a small increase rather than a decline. Nevertheless, the slower yuan lending was more than offset by the jump in shadow banking activity. The aggregate financing in March jumped to CNY2.12 trillion from CNY1.15 in February. Since last September, aggregate financing has alternated between rising and falling. Many observers see China’s debt binge to be a key challenge and vulnerability. Some also see it part of the fuel of capital outflows.

While most European centers are closed, the French presidential election remains a source of angst. Adjusting for the margin of error, recent polls suggest a four-way draw. France’s premium over Germany on 10-year yields widened seven basis points this week to return to levels since in February after a calmer March. The spread has narrowed in only three weeks since the start of the year. The two-year premium jumped 10 bp this week to new five-year highs.

Nevertheless, we argue that the Fed’s hike last month renders less relevant Q1 data. The forward-looking nature of monetary policy means the March data will not influence the FOMC’s decision in June (there is practically no chance of a May move). We do note that since the US election last November, the Fed hiked interest rates twice, more than in the previous eight years.

US 10-year yield fell 14 bp this past week; it is the fifth consecutive weekly decline and the biggest since early last June. The yield on the two-year note fell eight basis points this week, which is also the most since last June. The US dollar fell against all the major currencies this week (and on the day is only up against the New Zealand dollar), led by the Japanese yen (2%) and sterling (1.1%). The euro (and Danish krone) are the poorest performers, gaining around 0.3%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,EUR/CHF,FX Daily,Gold,Interest rates,Korea,newslettersent,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Retail Sales,yuan