| Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

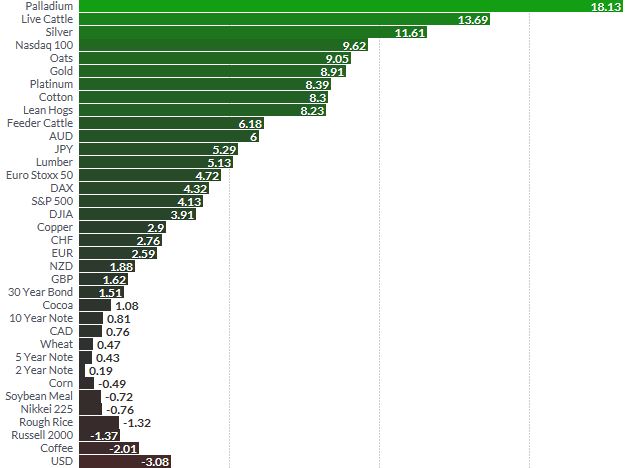

The precious metals had their second consecutive week of gains last week. Gold rose 1.5% and silver 2% while platinum rose 0.5% and palladium surged 4.8%. Today, gold has risen from $1,247.90 to a one month high of $1,259 per ounce and silver from $17.74 to $17.92 per ounce. The precious metals continue to outperform most assets in 2017. Year to date, gold is 9% higher and silver is 11.7% higher. Platinum is 8.4% higher and palladium has surged 18% to two year highs. Gold and silver have eked out gains as the dollar and stocks have come under pressure after U.S. President Donald Trump failed in his attempts to abolish Obama care. Trump suffered a major political setback on healthcare reform, raising doubts about his ability to steer the economic agenda. The dollar has fallen to the lowest level in five months and stock markets globally are seeing sharp falls today. Trump’s inability to deliver on a major election campaign promise marked a big defeat for a Republican president whose own party controls Congress, and raised doubts whether he would be able to push through tax reforms and mega-spending packages. Growing U.S. political uncertainty is creating concerns that a recent pick-up in global business and consumer sentiment, particularly in Asia, may be impacted. Bullion coin and bar demand remains robust. US Mint data shows that strong demand for gold and silver coins continued last week. Sales of gold coins were the highest since the week ended February 10 and silver coin sales were the highest since the week ending January 20. |

Gold and Silver March 2017 |

| Speculators became bullish on gold and raised net gold longs last week. Bullion banks, hedge funds and money managers boosted their net long positions in COMEX gold after two weeks of cuts and reduced them slightly in silver in the week to March 21, U.S. Commodity Futures Trading Commission (CFTC) data showed on Friday.

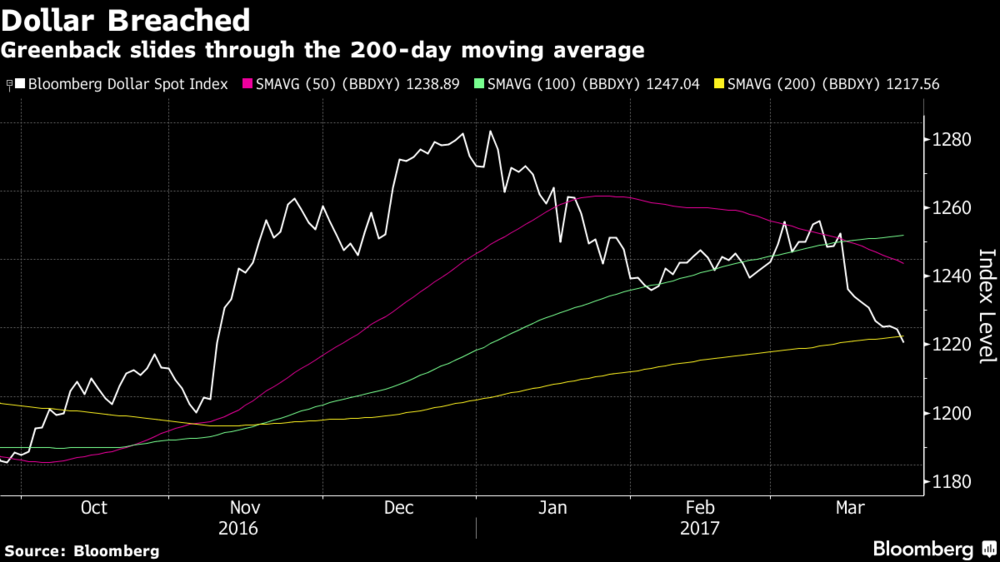

There is now the real risk that Trump becomes a “lame duck” President and that his business friendly policies struggle to be enacted. This bodes badly for stocks and the dollar and well for safe haven gold which should continue to see risk averse flows. |

Greenback Slides Through Moving Average, Oct 2016 - Mar 2017 |

As reported by Coin News:

– Gold coins advanced by 13,000 ounces after rising by 8,000 ounces last week. Splits include 9,000 ounces in American Gold Eagles compared to 5,500 ounces previously and 4,000 ounces in American Gold Buffalo compared to 2,500 ounces previously.

– Silver coins jumped by 795,000 ounces compared to 220,000 ounces previously. And like in the last two weeks, American Silver Eagles accounted for all sales.

| US Mint Bullion Sales (# of coins) | ||||||

|---|---|---|---|---|---|---|

| Friday Sales | Last Week | This Week | Feb Sales | Mar Sales | 2017 Sales | |

| $100 American Eagle 1 Oz Platinum Coin | 0 | 0 | 0 | 0 | 0 | 20,000 |

| $50 American Eagle 1 Oz Gold Coin | 0 | 2,500 | 8,500 | 21,000 | 14,500 | 122,000 |

| $25 American Eagle 1/2 Oz Gold Coin | 0 | 1,000 | 0 | 5,000 | 1,000 | 25,000 |

| $10 American Eagle 1/4 Oz Gold Coin | 0 | 2,000 | 0 | 4,000 | 2,000 | 42,000 |

| $5 American Eagle 1/10 Oz Gold Coin | 0 | 20,000 | 5,000 | 30,000 | 35,000 | 190,000 |

| $50 American Buffalo 1 Oz Gold Coin | 0 | 2,500 | 4,000 | 15,000 | 7,000 | 54,000 |

| $1 American Eagle 1 Oz Silver Coin | 0 | 220,000 | 795,000 | 1,215,000 | 1,295,000 | 7,637,500 |

| 2017 Effigy Mounds 5 Oz Silver Coin | 0 | 0 | 0 | 19,500 | 0 | 19,500 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent