Style Over Substance

“May you live in interesting times,” says the ancient Chinese curse. No doubt about it, we live in interesting times. Hardly a day goes by that we’re not aghast and astounded by a series of grotesque caricatures of the world as at devolves towards vulgarity. Just this week, for instance, U.S. Representative Maxine Waters tweeted, “Get ready for impeachment.”

Well, Maxine Waters is obviously right – impeaching the president is an urgent task of the utmost importance. As everybody knows, he is best friends with Vladimir Putin, the shirtless barbarian who rules the Evil Russian Empire (they were seen drinking kompromat together in Moscow, a vile Russian liquor that reportedly tastes a bit like urine. Senator McCain has the details on that story). And as Maxine Waters has just disclosed, Putin’s armies are recently advancing into Korea! We cannot let this stand, or he’ll invade Kekistan next (note that he already controls Limpopo and Gabon). Who knows where it will end?

We assume this was directed at President Trump. But what Waters meant by this was sufficiently vague. There was no guidance as to how President Trump should be getting ready.

Should he pack his bags? Should he double knot his shoelaces? Should he say a prayer? Naturally, the specifics don’t matter in the darnedest. Rather, these days, it’s style over substance in just about everything. This is why Waters – a committed moron – rises to the top of class in the lost republic of the early 21st century.

At the same time, the individual has been displaced by the almighty aggregate. Economists pencil out the unemployment rate, with certain omissions, as if it represents something meaningful. Then lunkheads like Waters repeat it as if it’s the gospel truth.

Somehow, through all of this, our representatives are oblivious to what’s really going on; that the U.S. government is just months away from a possible default.

The Dutch ExperienceLast week, via our friends at Zero Hedge, we came across as article by Simon Black of Sovereign Man titled, The U.S. Government Now Has Less Cash Than Google. Inside, Black details the invention of the government bond in 1517 Amsterdam and the long term ramifications for the Dutch government. Here we turn to Black for edification:

|

Amsterdamsche Wisselbank, a.k.a. the Bank of Amsterdam. The bank’s history is deeply intertwined with the Dutch march toward default in 1814. When the bank was originally founded, it was rightly considered the soundest bank in Europe – it was 100% reserved and for a long time its notes were indeed “as good as gold” and were accepted in payment all over Europe. Holland’s downfall was closely tied to the decision to abuse the bank’s hard-won reputation by surreptitiously forcing it to adopt fractional reserve banking in order the fund the government (in particular, in order to fund its wars). Painting by Gerrit Adriaenszoon Berckheyde |

March to DefaultLike the Dutch several hundred years ago, everyone believes it’s impossible for the U.S. government to default on its debt obligations. U.S. Treasuries are considered the safest investment in the world. Nonetheless, a series of events are coming down the turnpike in such rapid succession that Washington will be incapable of dealing with them. Before Congress can say knife, irreparable damage will be done to the government’s financial standing. No doubt, the great story of our time, that few seem to appreciate, is the increasing likelihood the U.S. government will default on its debt before the year is over. Of course, this isn’t a certainty. But by simply connecting a dot or two, one can construct a highly plausible scenario where this happens. |

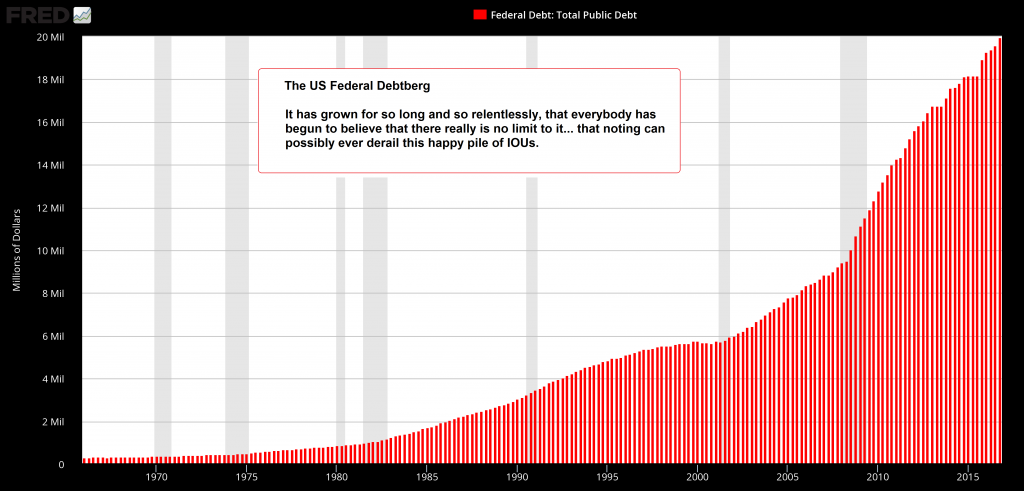

Federal Debt: Total Public Debt 1970-2017The federal debtberg. As Ludwig von Mises noted: “The long-term public and semi-public credit is a foreign and disturbing element in the structure of a market society. Its establishment was a futile attempt to go beyond the limits of human action and to create an orbit of security and eternity removed from the transitoriness and instability of earthly affairs. What an arrogant presumption to borrow and to lend money for ever and ever, to make contracts for eternity, to stipulate for all times to come!” |

Presently, the national debt is over $19.8 trillion. The $20.1 trillion debt ceiling will be reached in the second quarter. After that, Treasury Secretary Steven Mnuchin will be forced to take extraordinary measures to avoid a default.

However, Mnuchin can only rob Peter to pay Paul for so long. By summer’s end, Congress will have to increase the borrowing limit or suffer a default. Most likely Congress will wait until the 11th hour to take action. They have in the past. But this time, given its complete dysfunction, Congress may not get it done.

Yesterday, the Obamacare repeal and replace vote was postponed so the Republicans could circle the wagon. Today they’ll try it again. Regardless of the outcome, this highlights why Congress will be unable to raise the debt ceiling. There’s just plain too much animosity to get it done.

Ultimately, the quickest way to reduce the size of government is to cut off its funding. Here at the Economic Prism, where we believe in smaller government and greater individual autonomy, a U.S. government default sooner rather than later is more preferable.

Still, the march to default is a stoic trudge. For the looming chaos to financial markets, the economy, and everything else will be unconditionally ruthless.

Chart by St. Louis Federal Reserve Research

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics