See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Silver Is Pushed Up AgainThis week, the prices of the metals moved up on Monday. Then the gold price went sideways for the rest of the week, but the silver price jumped on Friday. Is this the rocket ship to $50? Will Trump’s stimulus plan push up the price of silver? Or just push silver speculators to push up the price, at their own expense, again? This will again be a brief Report this week, as we are busy working on something new and big. And Keith is on the road, in New York and Miami. |

|

Gold Fundamentals Improve FurtherBelow, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. |

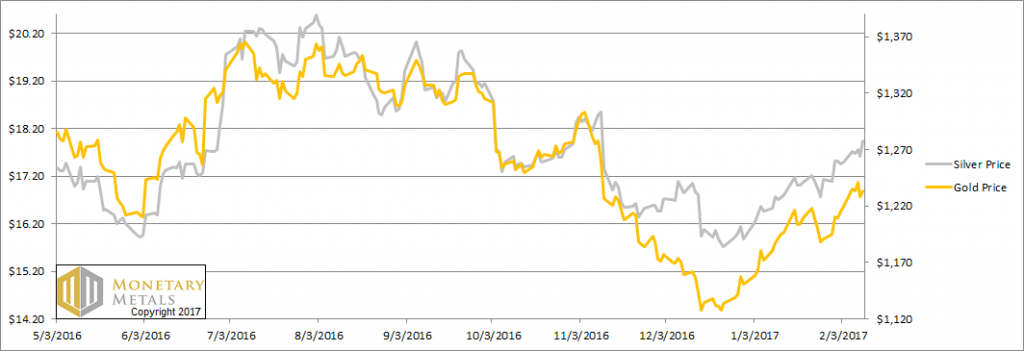

Prices of gold and silver(see more posts on gold price, silver price, ) |

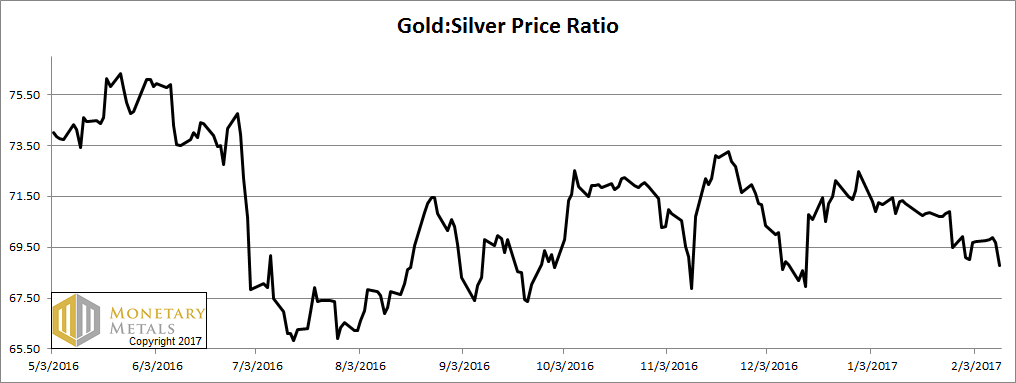

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell this week. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

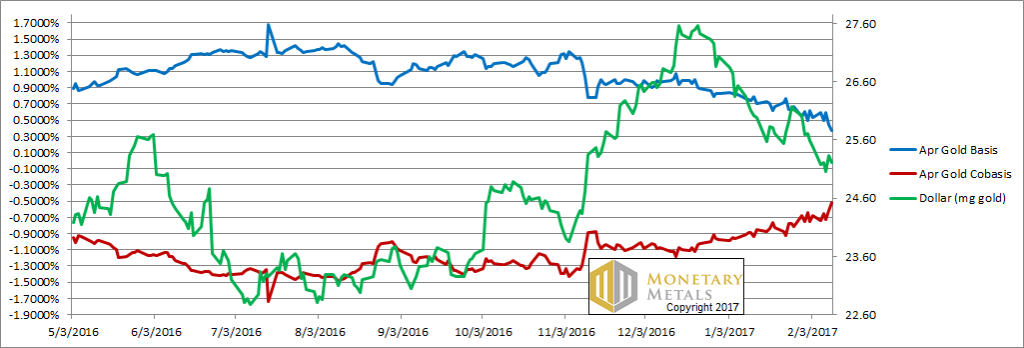

Gold basis and co-basis and the dollar priceHere is the gold graph. Again, we see a higher price of gold (shown here in its true form, a lower price of the dollar) along with greater scarcity (i.e., co-basis, the red line). This pattern continues. What does it mean? First, it means the price of gold is being pushed up by buyers of physical metal. Not by buyers of futures (which would push up the basis, and reduce scarcity). Second, if it continues too much more, it means nothing good for the banking system. There is one force that can make all the gold in the world—which mankind has been accumulating for thousands of years—disappear faster than you can say “bank bail in”. The force is fear of counterparties, fear of banks, fear of currencies, fear of central bank balance sheets… fear of government finances. We want to emphasize that the gold basis is not signaling disaster at the moment. It is merely moving in that direction, for the first time in a long time. It has a ways to go yet. Our calculated fundamental price is up another $40 (on top of last week’s +$40). It is now about $130 over the market price. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

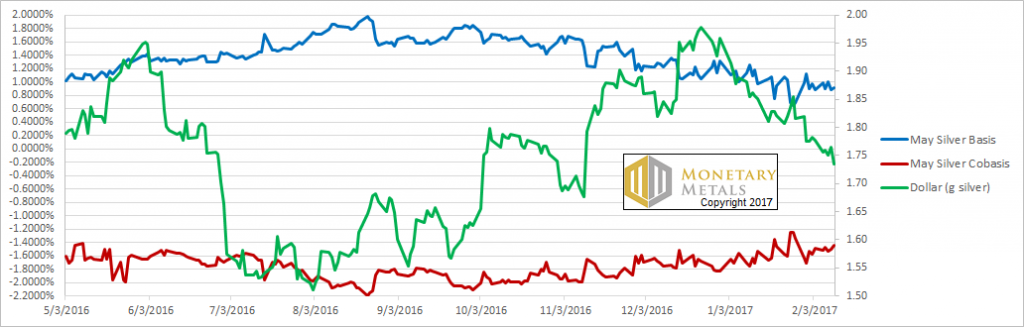

Silver Market Price in Lockstep with Fundamental PriceNow let’s look at silver. Note: we switched to the May contract, as March was becoming unusable in its approach to expiry. In silver, the story is a bit less compelling. The scarcity of the metal is holding, as the price rises. However, scarcity is not increasing. Were we to take a guess, we would say there is some good demand for physical, and the price action had futures market assistance. While the market price moved up 44 cents, our calculated fundamental price moved up… 46 cents. Charts © 2016 Monetary Metals |

Silver basis and co-basis and the dollar price.(see more posts on dollar price, silver basis, Silver co-basis, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price