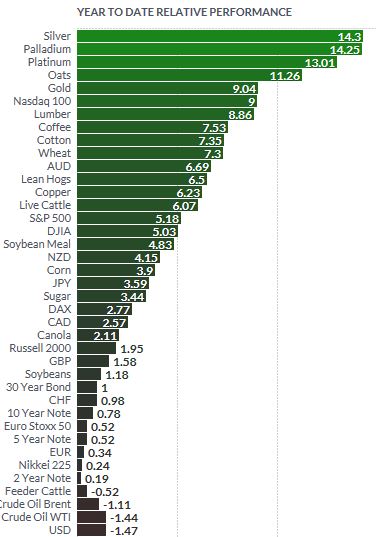

Gold pushed to near a four month high amid heightened political uncertainty in the U.S. and the EU this morning. Gold rose another $6.40, or 0.5%, to $1,258 an ounce and is currently set for a 1.5% gain this week. It is higher for a second day today and looks set for a fourth consecutive week of gains which is positive from a technical and momentum perspective. All precious metals have made gains, gold, silver, platinum and palladium, as both the euro and the dollar weakened. Silver jumped another 1% to $18.25 an ounce. Silver was set for a weekly gain of 1.3%, a ninth straight week of advances and is now 14.3% higher year to date. The best performing market in the world. |

Year to date relative performance Source: Finviz.com - Click to enlarge |

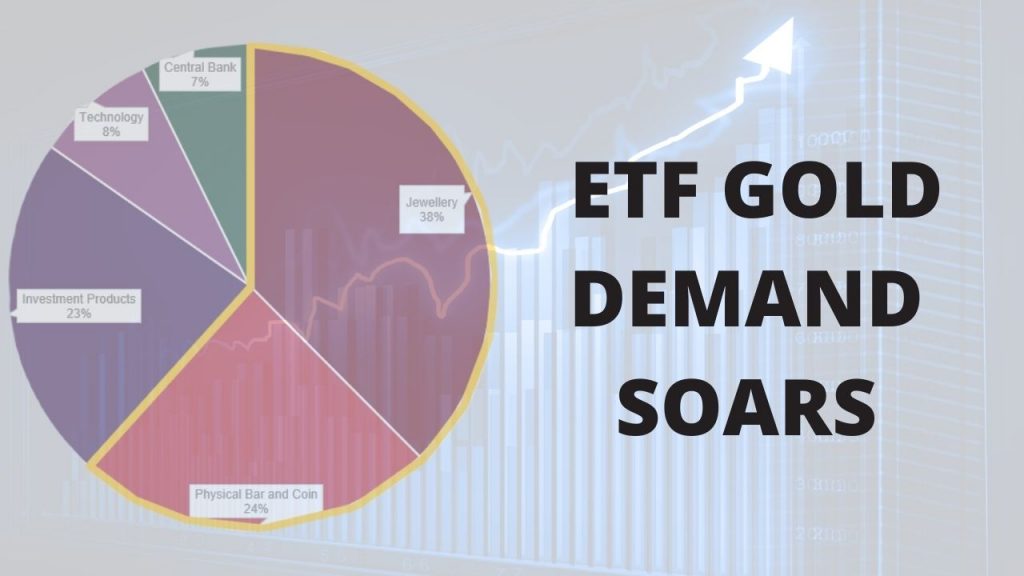

| Geo-political worries and political concerns in the EU continue which is leading a flight to safety bid in gold futures market and gold exchange traded funds (ETFs) and demand for safe haven gold bullion.

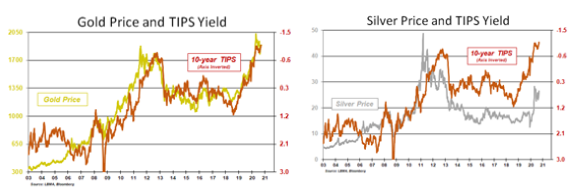

The dollar looks vulnerable due to the uncertainty about US President Donald Trump and the new U.S. administration’s policies. Overnight Trump attacked China and accused the Chinese of being ‘grand champions’ of currency manipulation (see gold news below). This alone is quite bullish for gold. It does not create confidence about trade relations between the world’s two biggest economies and it suggests that we may be about to embark on the next phase of the global currency wars. Reduced expectations of a US rate hike in March following the release of the minutes from the US Federal Reserve’s last meeting are also helping gold. Gold is up 9.4% in euros year to date as Le Pen’s lead in polls has widened. Gold is 6.4% higher in sterling pounds year to date as the feared ‘Hard Brexit’ looms. The French and Dutch elections pose serious risks to the Eurozone itself and indeed the entire European Union project. There is a real risk of contagion and renewed concerns this week about new debt crises due to extremely high public debt and very fragile banks in Greece, Italy and Portugal – See GoldCore News |

Gold in Euros (1 Week) |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent