Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers

by Frank Holmes

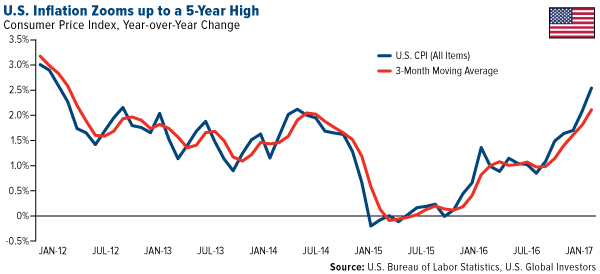

| Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced for the sixth straight month. In addition, January is the second straight month for rates to be above the Federal Reserve’s target of 2 percent.

Air fares are also climbing, and speaking of air fares, billionaire investor Warren Buffett added to his domestic airline holdings, we learned last week. Buffett’s holding company, Berkshire Hathaway, is now the second-largest holder of American Airlines, with an 8.79 percent share of the company. It also increased its holdings in Delta Air Lines by over 800 percent, to 60 million shares. The company now owns 43.2 million shares of Southwest Airlines, and it increased its stake in United Continental to about 28 million shares. |

US Inflation Zooms up 5 Year High |

||||||||||||||||||||

| A March rate hike now looks all but imminent. Many economists—including the Goldman Sachs economists I had the pleasure to hear speak this week—expect to see at least three such hikes this year alone.

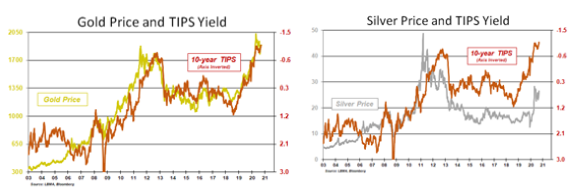

Gold responded accordingly, closing above $1,240 for the first time since soon after the November election. Below you can see the gold price charted against the inflation-adjusted 10-year Treasury yield, which is now in subzero territory. |

|||||||||||||||||||||

| The question I have is: Why would an investor deliberately choose to lose money? But that’s precisely what’s happening now with inflation where it is. |

|

||||||||||||||||||||

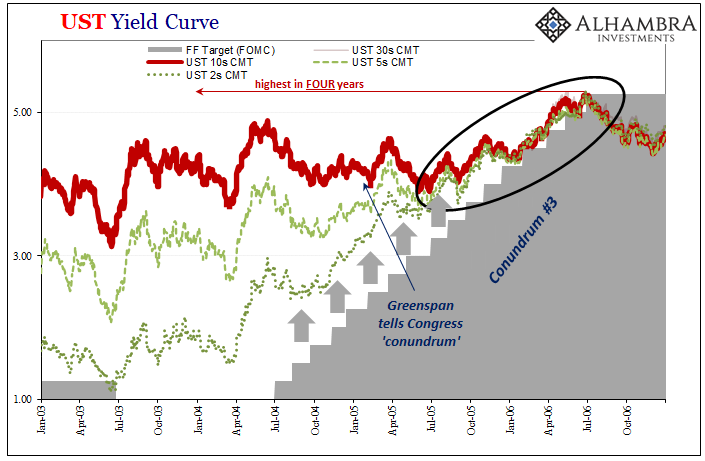

| These were among some of the topics addressed by former Fed Chair Alan Greenspan, who spoke with the World Gold Council (WGC) for the winter edition of its “Gold Investor.”

“Significant increases in inflation will ultimately increase the price of gold,” Greenspan said. “Investment in gold now is insurance. It’s not for short-term gain, but for long-term protection.”

|

|

||||||||||||||||||||

“I view gold as the primary global currency. It is the only currency, along with silver, that does not require a counterparty signature. Gold, however, has always been far more valuable per ounce than silver. No one refuses gold as payment to discharge an obligation. Credit instruments and fiat currency depend on the credit worthiness of a counterparty. Gold, along with silver, is one of the only currencies that has an intrinsic value. It has always been that way. No one questions its value, and it has always been a valuable commodity, first coined in Asia Minor in 600 BC.”

Although major stock indices continue to hit fresh all-time highs on hopes of tax reform and fiscal stimulus, it’s important to temper the exuberance with a little prudence. The bull market, currently in its eighth year, is facing some significant geopolitical and macroeconomic uncertainty, and we could be getting late in the economic cycle. This makes gold’s investment case even more attractive. For the 10-year period, the yellow metal has shown an inverse correlation to risk assets such as stocks and high-yield bonds.

It might be time to ensure that your portfolio has the recommended 10 percent in gold—that includes 5 percent in gold coins and jewelry, the other 5 percent in quality gold equities and mutual funds.

China and India to Lead World Economy by 2050

The long-term investment case for gold looks just as compelling following bullish reports last week from Pricewaterhouse Coopers (PwC) and Morgan Stanley. China and India are the world’s top two consumers of gold, and both countries are expected to make huge economic gains in the next few decades. This is likely to boost gold demand even more, which has a high correlation with discretionary income growth.

China alone consumed approximately 2,000 metric tons in 2016, or roughly 60 percent of all the new gold that was mined during the year, according to veteran mining commentator Lawrie Williams, who based his estimates on calculations made by BullionStar’s Koos Jansen. The 2,000 metric tons is a much higher figure than what analysts and the media have been telling us, but I’ve always suspected China’s annual consumption to run higher than “official” numbers.

Click here for rest of Frank Holme’s latest analysis on Forbes

Full story here Are you the author? Previous post See more for Next post

Tags: Alan Greenspan,Daily Market Update,newslettersent