Pledges for Trump

Things are looking up for the United States economy in 2017. You can just feel it. Something great is about to happen. |

|

| Earlier this week, for example, after meeting with the incoming President, Bayer and Monsanto announced they will spend at least half of their agriculture research and development budget – approximately $8 billion – in the U.S. over the next six years. It’s estimated the combined efforts of these two companies will add 3,000 new U.S. high-tech jobs.

Wal-Mart and General Motors also made job and investment pledges for Trump. Wal-Mart said they’ll add 10,000 jobs this year. General Motors announced $1 billion in investment, which would generate 1,500 U.S. jobs. Following these pledges, Trump tweeted:

In a separate tweet, Trump added:

|

The new chief claims several more propaganda victories in the field of micro-management of the economy. He is sworn in as we write this and yours truly is looking forward to years of great entertainment. What more do we want really? It actually doesn’t matter what the Donald does – the fact that Hillary the war harpy has lost the election means we no longer have nightmares about mushroom clouds. That is probably the most important thing about the recent election – in our opinion, we really dodged a bullet, or rather, an ICBM or two. Image via disclose.tv - Click to enlarge |

“Big Stuff”No doubt, ‘big stuff’ is a sight to behold. Before taking office, Trump’s already created new jobs, new growth, and new demand. What a remarkable achievement. Indeed, President Trump’s efforts are impressive on surface. They’re noble too. As an American working stiff, we can certainly appreciate Trump’s sentiments. But are Trump’s efforts to bring jobs back to the U.S. equally impressive below the surface? To satisfy our insatiable curiosity, we scratched off the top layer of curd to see what we could find. In the case of Bayer and Monsanto, we discover their pronouncement is more than simply an act benevolence. In fact, the two companies are awaiting regulatory approval of their agreed $66 billion deal from Trump’s incoming administration. What’s more, the $8 billion investment pledge is equal to what they’d already planned to spend. |

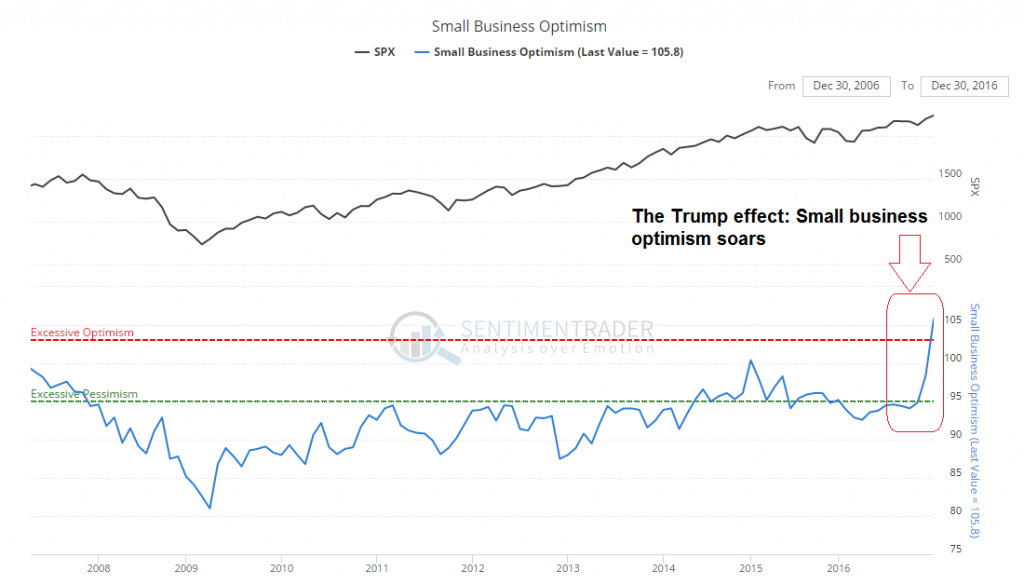

Small Business Optimism Trump’s real achievement is actually depicted above: small business optimism has soared in the wake of his election victory. We can absolutely guarantee that this would not have happened if Clinton had won. Her economic program was a pure mixture of socialism and big business cronyism – in many ways it would have been Barrack “You Didn’t Build That” Obama on steroids. Small businessmen would have faced rising taxes and a vast increase in onerous regulations – many allegedly needed to “save the planet”, which is the most hubristic and absurd promotion authoritarian Western central planning elites have ever come up with (here is George Carlin’s classic take-down of this propaganda meme, which we encourage everyone to spread far and wide) - Click to enlarge |

The pledges made by Wal-Mart and General Motors are also less impressive below the surface. Namely, the new jobs pledges ain’t new. Reuters reports:

|

|

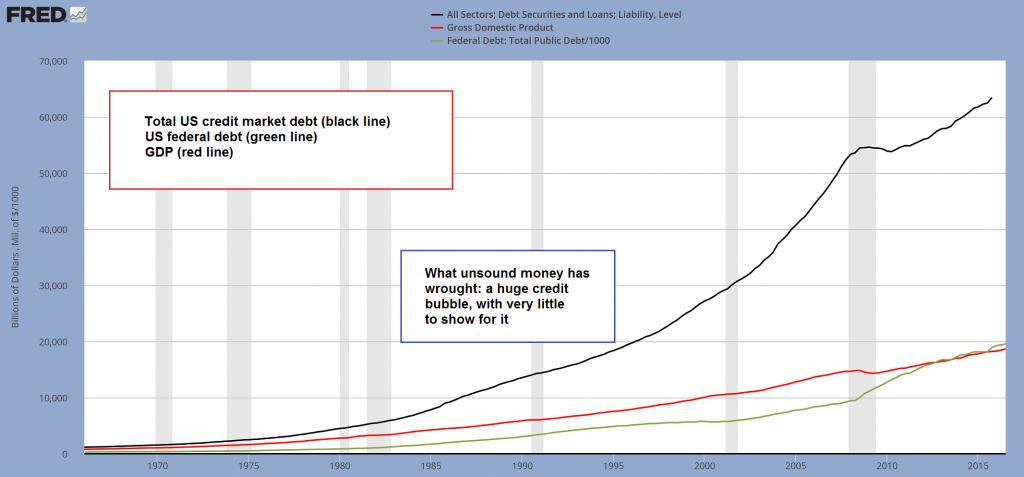

The Right Stuff“Facts are stubborn things,” President John Adams once remarked. Obviously, Adams was speaking in a different day and age. Because these days no one cares about the facts. Bayer, Monsanto, Wal-Mart, General Motors, and the like; these companies know what’s good for their businesses. Specifically, they know that politics is good business. Their pledges make great headlines. Moreover, they allow Trump to tout all the ‘big stuff’ that is happening. Here at the Economic Prism we are in full support of ‘big stuff,’ whatever it may be. Go big or go homes, they say. But what we really want to know is if Trump’s ‘big stuff’ is the right stuff? Larry Summers – former Treasury Secretary, and all around know-it-all – doesn’t think so. This week he told the rich and powerful at their annual hootenanny in Davos, Switzerland, that Trump’s policies will end up hurting his voters. But what does Summers know anyway? When it comes down to it, mass credit creation by the Federal Reserve is what allowed the trade balance to get so out of whack in the first place. This, in turn, accelerated globalization and offshoring of American jobs. Attempting to reverse the flow of jobs while not correcting the fiat money problem is a losing proposition. It’s the wrong stuff. To the contrary, sound money, and the just discipline that comes with it, is the right stuff. Unfortunately, a major collapse – or two – will be needed for people to seriously consider such outmoded ideals. |

Federal Debt, GDP, Debt Securities The result of a system of unsound money running wild for decades: a huge mountain of debt and very little to show for it in terms of economic output growth. In fact, the enormous growth in the supply of money and credit has lowered growth in economic output rather than increasing it. - Click to enlarge |

Charts by: SentimenTrader, St. Louis Federal Reserve Research

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics