Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 31(see more posts on EUR/CHF, ) |

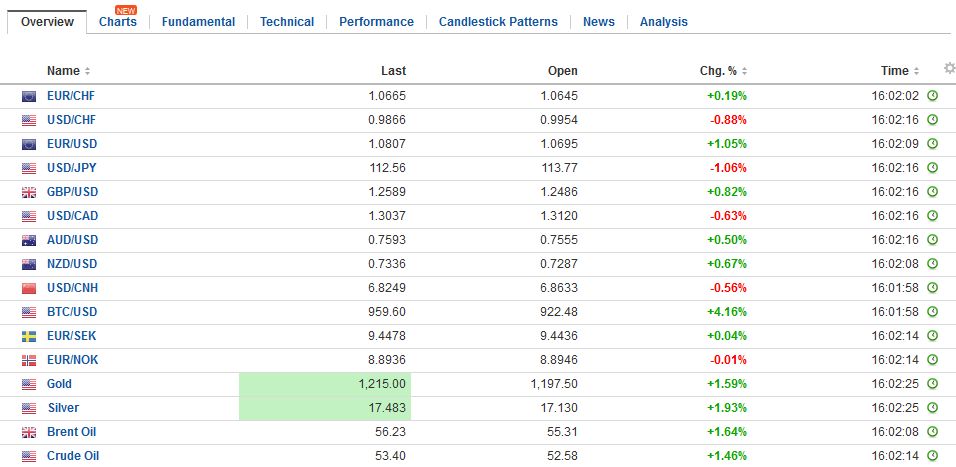

FX RatesThe immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday’s drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar’s losses yesterday, which it is consolidating today. We are a bit skeptical. The transmission mechanism is not articulated. One may object to the executive order and the way it is being enforced, but it is not obvious how that impacts expectations of future returns. |

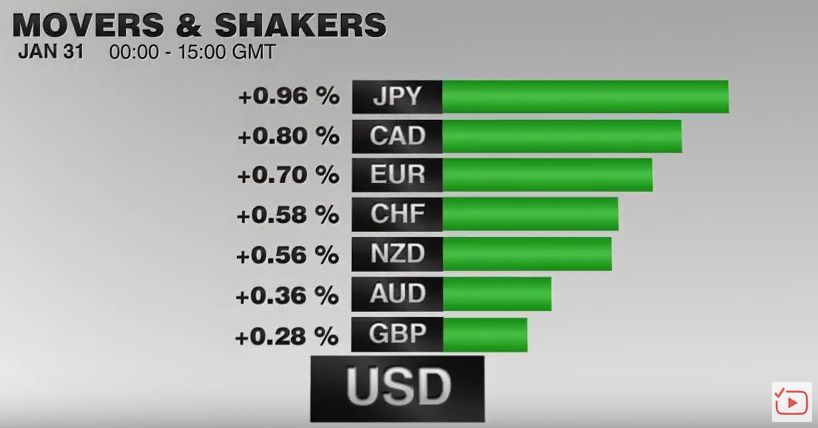

FX Performance, January 31 2017 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| On the contrary, we suggest the price action can be explained without resorting to the US immigration stance. And at the end of the day, neither the dollar nor US interest rates moved outside of recent ranges. The S&P 500 and the NASDAQ gapped higher in the middle of last week and gapped lower yesterday. The potential three-day island top is seen as a bearish technical development, but after the initial losses, equity prices slowly recovered nearly half of the losses. Yesterday’s gap is found between roughly 2286.0-2291.60.

The dollar remains well within the recent range marked by a double top in the JPY115.40-JPY115.60 area and a double bottom near JPY112.50. Within that range, the JPY114.00-JPY114.10 offers initial resistance. The JPY113.50 area that we had thought was support penetrated in early Asia but continues to deter dollar losses. |

FX Daily Rates, January 31 |

| The euro posted an outside day yesterday, trading on both sides of last Friday’s range. However, the close was neutral. It is trading in a narrow range (less than half a cent) holding on to the recovery in the North American morning. The euro’s upside momentum after a five-week advance, stalled near $1.0770 last week. Yesterday’s initial losses saw the euro trade down to $1.0620, the lowest level since January 19. Below there, support near $1.0580 likely marks the trading range.

Sterling is the weakest of the majors. It is 0.4% against the dollar near $1.2425. It is through yesterday’s lows. Sterling had been holding on to yesterday’s recovery through $1.25 when some disappointing data were reported. Net consumer credit growth was slower than expected in December (GBP1 bln vs. GBP1.9 bln in Nov), mortgage approvals disappointed expectations (67.9k vs.69.2k) and M4 money supply contracted (-0.5%). Separately, the BOE reported that net foreign holdings of Gilts fell in December (GBP2.9 bln) for the first month since July. In November, foreign investors bought GBP15.5 bln of Gilts. Broadly speaking, foreign investors own about 25% of UK Gilts. The $1.2410 area represents a 38.2% retracement of sterling rally since January 16 dip below $1.20. The 50% retracement is near $1.2330. |

FX Performance, January 31 |

JapanThe Bank of Japan left policy on hold, as widely anticipated. And as expected, it lifted its assessment for GDP. Growth in the current fiscal year was lifted to 1.4% from 1.0%. GDP for FY17 beginning April 1 was raised to 1.5% from 1.3%, and for FY18, the forecast was raised to 1.1% from 0.9%. The inflation forecast for the current fiscal year was trimmed to -0.2% from -0.1%. Inflation forecasts for the next two fiscal years were kept at 1.5% and 1.7% respectively. |

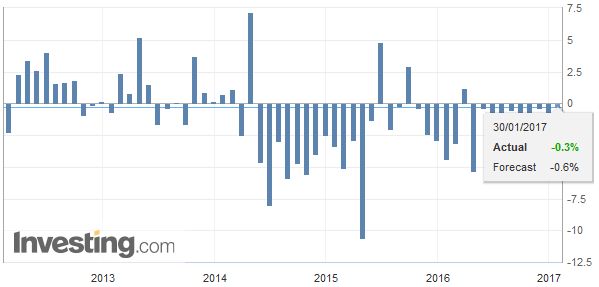

Japan Household Spending YoY, December 2016(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

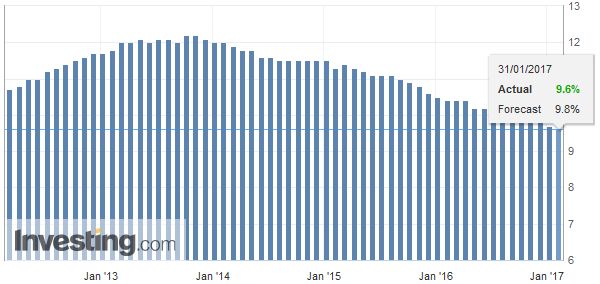

EurozoneUnemployment in the region fell to 9.6% in December from 9.7% in November, which had been revised from 9.8%. It is the lowest unemployment rate since 2009. The eurozone unemployment rate stood at 10.4% in December 2015 and 11.3% in December 2014. |

Eurozone Unemployment Rate, December 2016(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

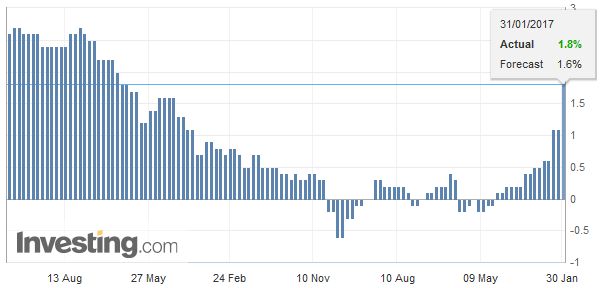

| Eurozone consumer inflation jumped to 1.8% in January. The median forecast in the Bloomberg survey was 1.5% after December had accelerated from November (1.1% and 0.6% respectively). Some claim that this will intensify the debate at the ECB. We are less convinced. |

Eurozone Consumer Price Index (CPI) YoY, December 2016(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

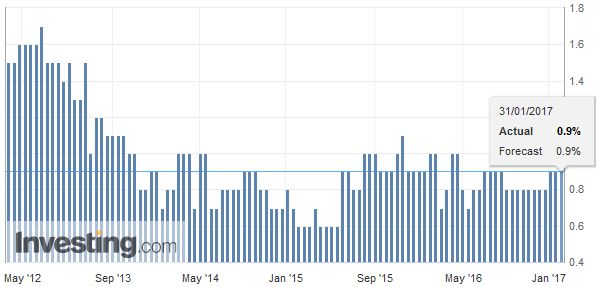

| First, the ECB decided less than six weeks ago to extend its asset purchases through the end of the year, albeit at a 60 bln euro a month pace rather than 80 bln that prevail for the next two months. It is too early to review it as it has not even been implemented. Second, the rise in headline CPI is largely a function of higher energy prices. The core rate was stable at 0.9%, and despite the headline increase, the core has been in a 0.8%-0.9% range since last May. Third, those who were opposed to QE and its extension are not about to change their minds, but the data is unlikely to persuade others. |

Eurozone Core Consumer Price Index (CPI) YoY, December 2016(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

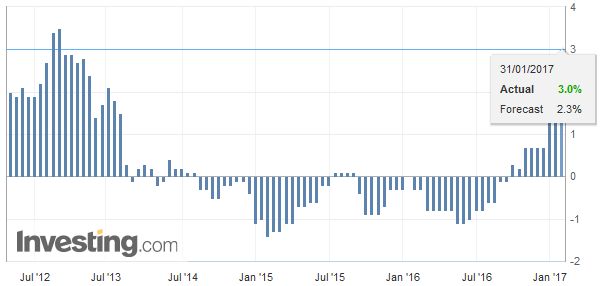

SpainEMU reported growth, inflation, and unemployment today. Growth in Q4 was in line with expectations for a 0.5% expansion, after 0.4% in Q3 16. The year-over-year pace was steady at 1.8%. Details were lacking, but national figures from France, Spain, and Austria show that it was not simply a German story. Unemployment and CPI were the surprises. |

Spain Consumer Price Index (CPI) YoY, December 2016(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Austria |

Austria Gross Domestic Product (GDP), Q4 2016 Source: Investing.com - Click to enlarge |

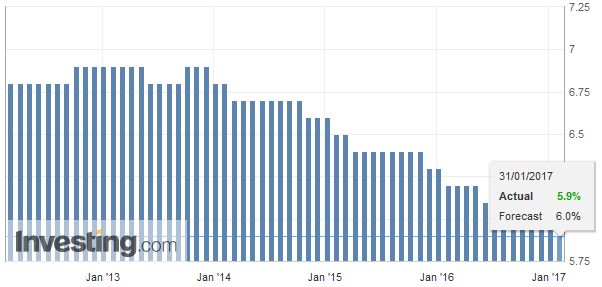

GermanyIn terms of national figures, German unemployment fell to a new post-reunification low of 5.9%, while Italian unemployment disappointed at 12% in December after the November series was revised to 12.0% from 11.9%. |

Germany Unemployment Rate, December 2016(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

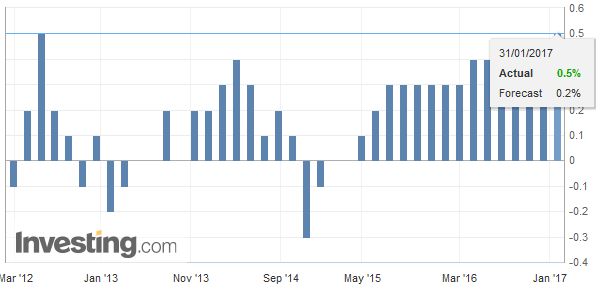

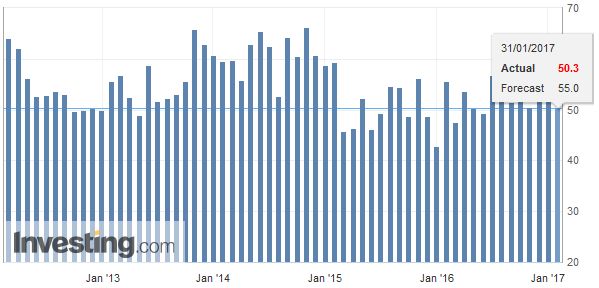

United StatesThe focus shifts to the US before the BOE meeting on Thursday. Today’s economic calendar is light, but the Employment Cost Index will be scrutinized for insight into wage pressure, and the Chicago PMI may give economists a reason to tweak forecasts for the national survey. Tomorrow is more important with the ADP employment estimate (Bloomberg median forecast 167k after 153k in December) and the conclusion of the FOMC meeting. No change is nearly universally expected. It seems unreasonable to expect any hint of the outcome of the March meeting or an assessment of the new US Administration, where fiscal policy has little visibility. |

U.S. Chicago PMI, December 2016(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,Germany Unemployment Rate,Japan Household Spending,newslettersent,Spain Consumer Price Index,U.S. Chicago PMI