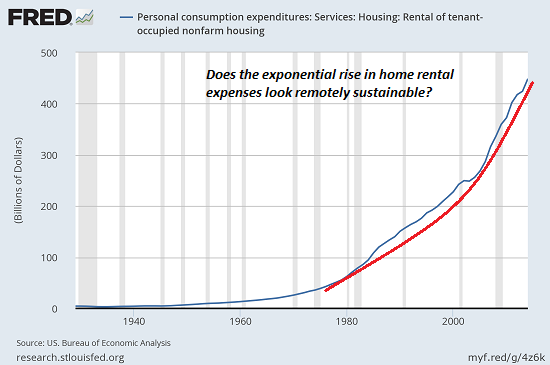

| If we measure these “Big Ticket” items, we find inflation rates of 100+% over the past decade. I laid this out in detail in The Burrito Index: Consumer Prices Have Soared 160% Since 2001 | |

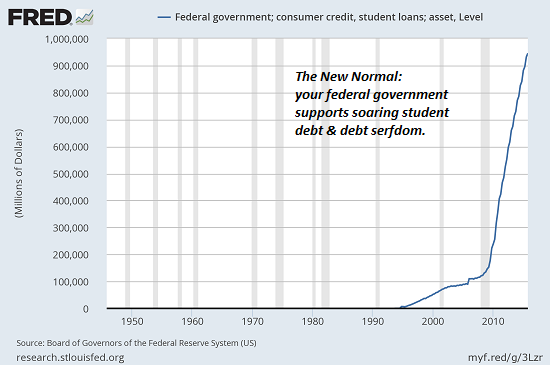

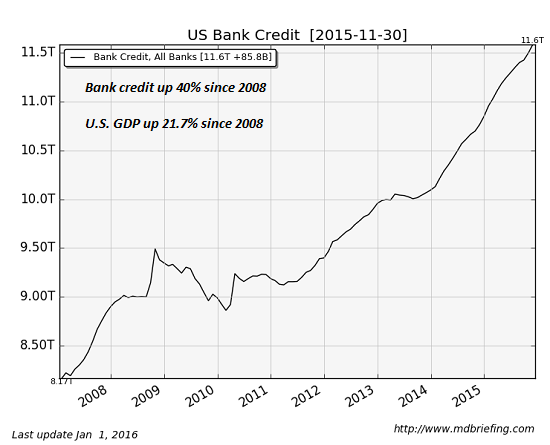

| The “experts” solution to out-of-control costs is to borrow trillions of dollars— in other words, the “fix” to out-of-control costs is out-of-control borrowing.

And remember: borrowing is nothing but consuming future earnings today, leaving less disposable income to spend in the future as interest payments eat the borrower alive. |

|

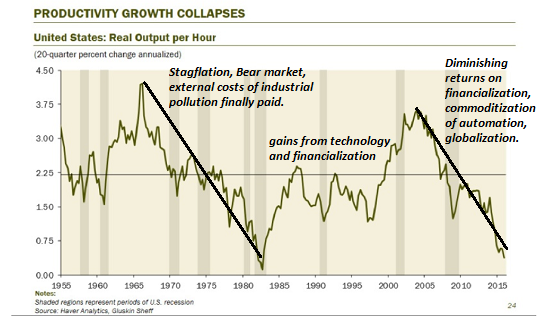

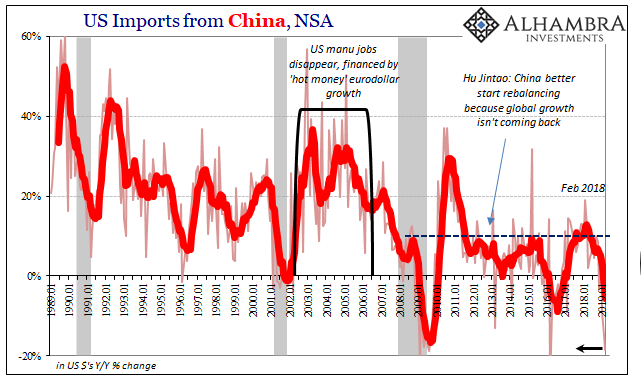

| 2. Productivity. The honest “experts” admit they are flummoxed by the steep decline in productivity, which is the only enduring source of higher wages and profits.

The “experts” are blind to the diminishing returns on financialization and globalization–the two engines of corporate profitability. |

|

|

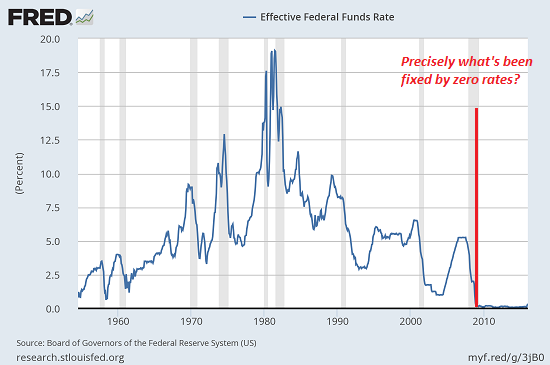

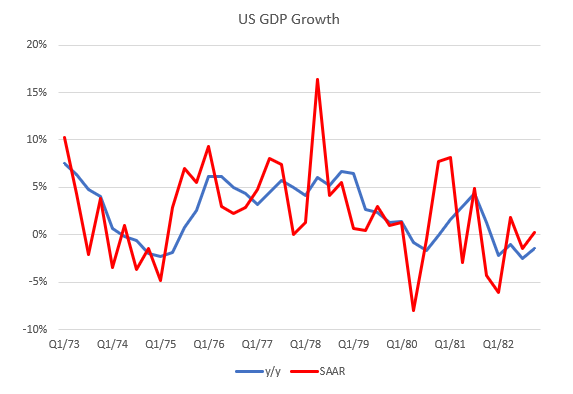

3. Zero interest rate policy (ZIRP). The “experts” at the Federal Reserve and elsewhere claimed that near-zero interest rates were the fix-all solution to low growth in GDP, employment, wages and business investment.

Precisely what’s been fixed by ZIRP?

We know the answer to the other side of that question: What’s been destroyed by ZIRP? Savers and pension funds. The hundreds of billions of dollars in interest income that once flowed to savers, pension funds, etc. have been diverted to banks and borrowers–except those paying 19% interest on credit cards.

The truth is ZIRP has been a gift to banks, lenders and corporations borrowing immense sums to buy back their own shares. There’s no mystery why productivity has plummeted; the borrowed money went to boost stock options and financial games, not productive investments.

The ZIRP/NIRP Gods and their PhD Priesthood Have Failed (September 20, 2016)

|

|

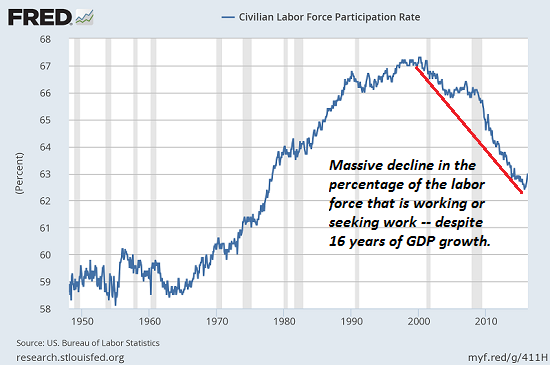

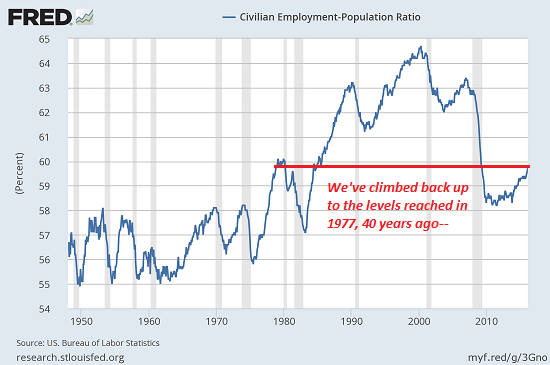

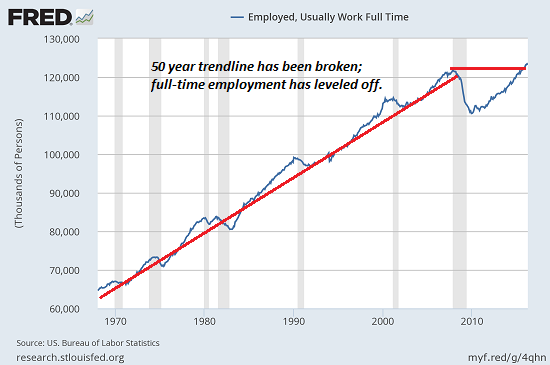

| 4. Employment. Statistical trickery cannot disguise the reality that meaningful employment (permanent, full-time) has weakened structurally, and the number of adults in the workforce with jobs has also weakened. | |

| A handful of high-profile economists (Michael Spence et al.) have addressed the issue of automation, and concluded that “software eating the world” is weakening employment across the spectrum from high-skill to low-skill. | |

| The conventional “experts” either ignore the issue, don’t understand it, or cling to a cargo-cult-like belief that “technology always creates more jobs than it destroys,” but with zero evidence to back up this faith-based assertion. | |

|

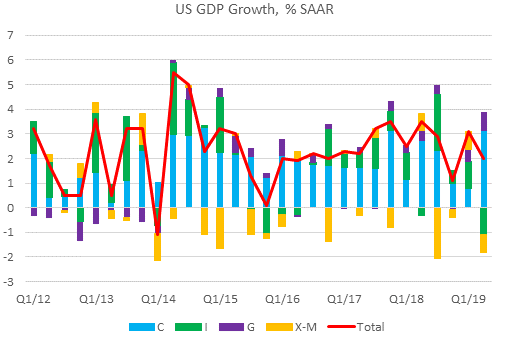

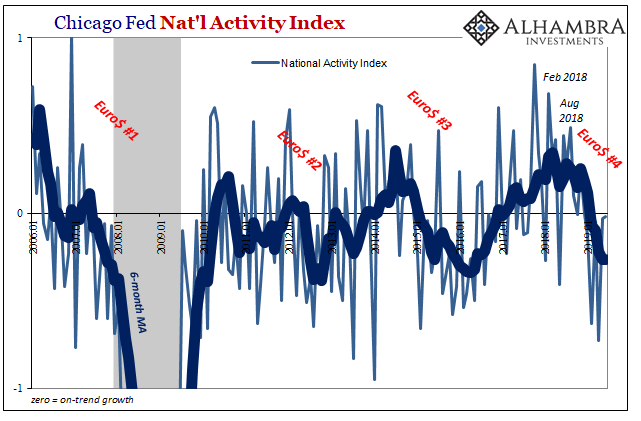

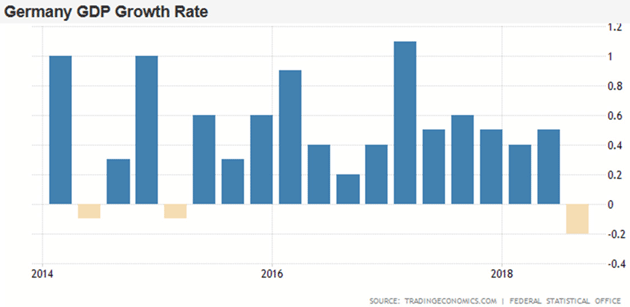

5. Growth. Few “experts” dare address stagnation and the Keynesian obsession with “growth” on a planet with declining resources (have you looked at fresh water recently? Central banks can’t print it) and rising competition for what’s left.

The “experts” reckoned that making borrowing cheaper would spur “growth”–but once again, they ignored the diminishing returns on cheap credit:

|

|

|

This chart is bank credit. Add in corporate, household and government debt, and you get a picture of massive increases in debt yielding pathetically low “growth” in GDP.

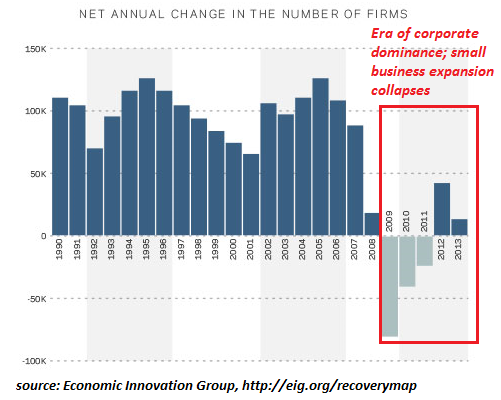

The “experts” are also flummoxed by the collapse of new business growth. How many conventional PhD economists have made a big-time academic or government career studying the stultifying consequence of over-regulation and regulatory capture by corporate cartels? How about the rise of local government junk fees and the crushing burdens of providing healthcare for employees?

|

|

|

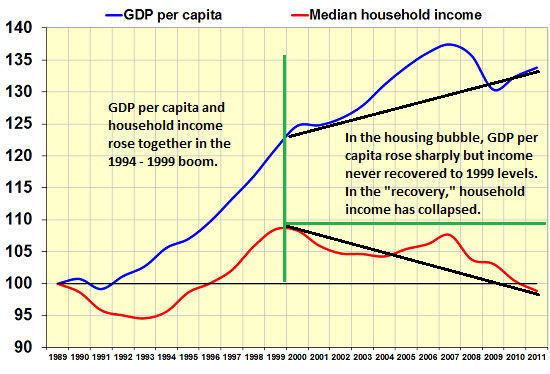

Whatever GDP growth did occur did not generate higher wages. Wages for the bottom 95% stagnated or declined when adjusted for inflation.

In the five dynamics that matter, the “experts” are 0 for 5. Malinvestment fueled by cheap credit, financialization, perverse incentives, over-regulation, the crushing pressure of soaring healthcare costs, the strangulation of small business– these are not independent dynamics, they are causally linked.

|

Tags: newslettersent,U.S. Gross Domestic Product