Swiss Franc |

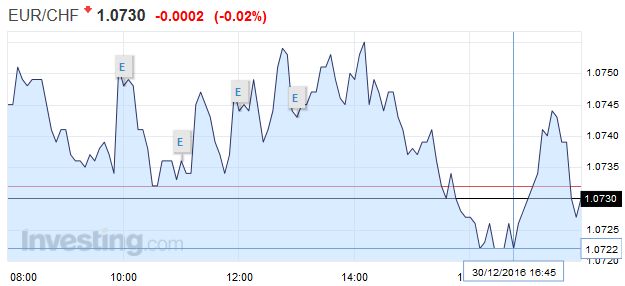

EUR/CHF - Euro Swiss Franc, December 30(see more posts on EUR/CHF, ) |

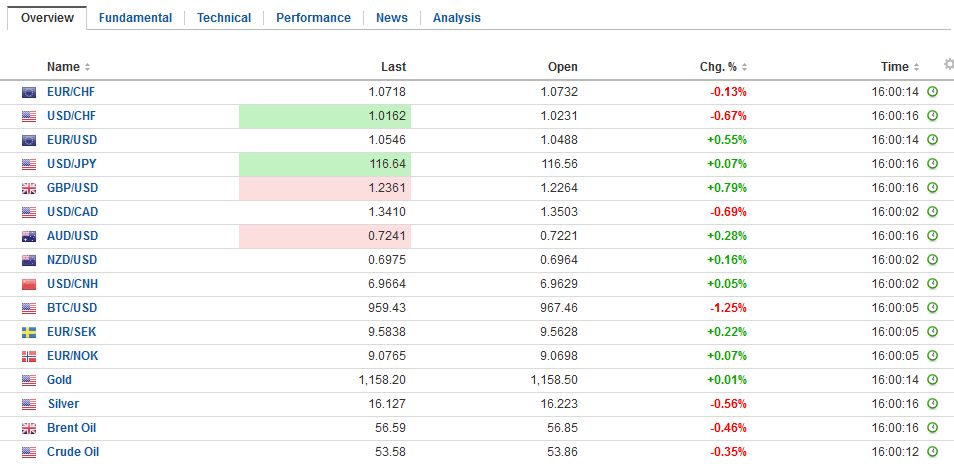

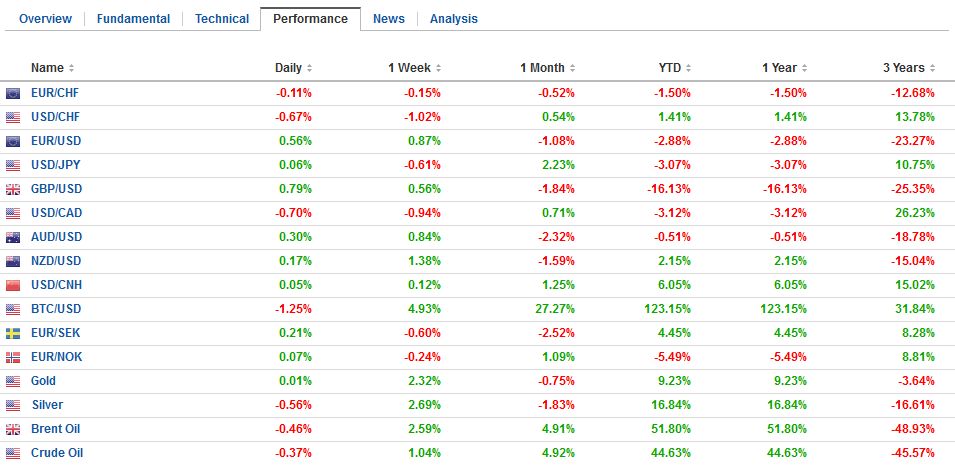

FX RatesIn exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions. Before European markets opened the euro drifted back toward $1.05 where buying re-emerged. Other European currencies, like the Swiss franc, and the Scandis tracked the euro. Sterling traded higher, though lagged behind the others in the euro orbit. The dollar tested the JPY116.00 in early Asia, though, by early European activity, it was encountering offers above JPY117.00. |

FX Daily Rates, December 30 |

| There are two other developments that are talking points. First, with around three weeks left in his presidency, Obama cited reports by the FBI and Homeland Security that linked Russia’s military and civilian intelligence services to the computer hacking that tried to influence the US election. Obama announced sanction against top Russian officials and agencies and expelled 35 Russian operatives. He hinted that there were be other measures as well, but did not specify, leading some to believe the other measures may include its own cyber efforts. The Russian ruble is off 1.8% today and is the weakest currency. Russia’s 10-year yield is up two basis points. Of course, the new US President could reverse these sanctions, but it puts it in an awkward position, esp ecially given the support showed by Republican leadership in Congress.

The other development is yesterday’s announcement by China that it was nearly doubling the number of currencies that it will be included in its reference basket. As we noted yesterday, the dollar’s weight in the basket will be reduced by 4%. However, we disagree with the media reports that suggest that this is an attempt by China to reduce the role of the dollar. For example, in some media coverage, it is not even reported that the euro’s weighting was cut by more than the dollar’s share. |

FX Performance, December 30 |

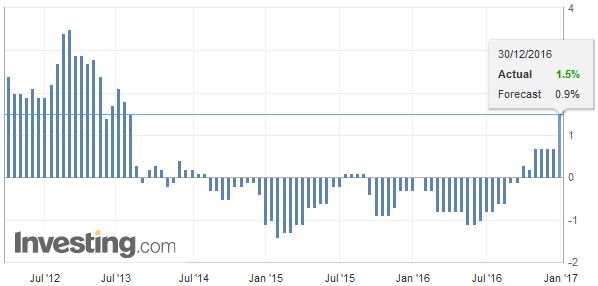

SpainThe news stream is especially light. In terms of economic data, the only report of note is the preliminary December CPI from Spain. It jumped 0.5% on the month for a 1.4% year-over-year pace. This is the fastest pace in a little more than three years. Recall Spain was still experiencing deflation (negative CPI readings) as recently as August. It may offer investors an inkling of what to expect from the eurozone in early January when the region’s inflation report is released. The headline CPI is expected to jump to 1.0% from 0.6%. It will appear to be largely an energy story as the core rate is expected to be little changed from the 0.8%, where it has been since August. |

Spain Consumer Price Index (CPI) YoY, November 2016(see more posts on Spain Consumer Price Index, ) Last years' oil prices were very low. This comparison has driven the CPI to a 1.5% increase. Source: Investing.com - Click to enlarge |

Russia |

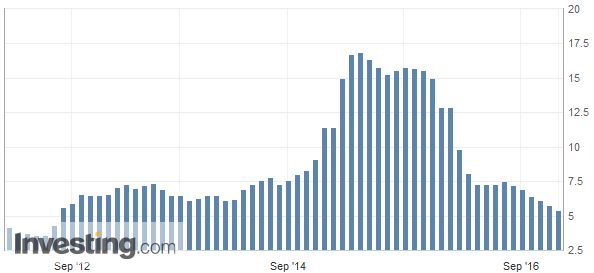

Russia Consumer Price Index (CPI) YoY, November 2016 With the stronger rouble , inflation rates in Russia have fallen to 5.4% This is lower than the values observed in 2012. Source: Investing.com - Click to enlarge |

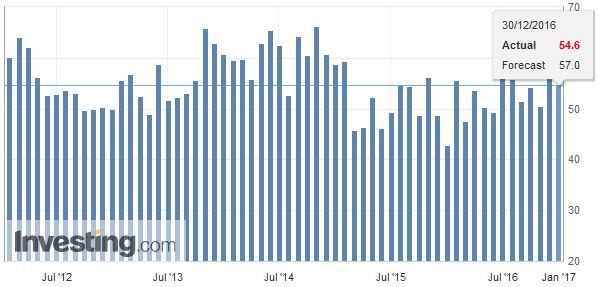

United StatesIn North America, the only economic report is the Chicago PMI. It is expected to slip to 56.8 from 57.6. Recall that the GM had earlier indicated that it was temporarily closing a few plants due to excess inventory. The national ISM report is due on January 3, and the Bloomberg median forecast is for a small gain. |

U.S. Chicago PMI, November 2016(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

Given that, the dollar, euro, yen, and sterling’s weightings were reduced, while mostly emerging market currencies were added, including incidentally, the Saudi riyal, which is pegged to the dollar, a fairer description may be the China adjusted its basket to give more weight to the emerging market currencies. The Korean won was given a 10.8% weighting, making it the fourth most important currency, behind the dollar, euro, and yen. Proportionately, it is almost half the weight of the US dollar. One implication of this adjustment is that if the emerging market currencies weaken next year as we expect, then Chinese officials can continue to show that although it is falling against the dollar, it is stable against is basket.

This is largely a public relations and marketing ploy. It has a little substantive impact. When the PBOC intervenes in the foreign exchange market, it intervenes primarily against the dollar. The US and other countries have numerous measures of the value of their currencies. The value lies shedding light on the economic forces and impacts. However, Chinese officials appear to be using their basket, the way it is said a drunk uses a lamp post, for support, not illumination. Still, media reports that do not discuss the changes in the other currency weightings, like the euro, and instead assert that it is about the reducing the role of the dollar needlessly and mistakenly serve to confuse the issues and their importance.

In other market developments, the Asian equities mostly moved higher, with the MSCI Asia-Pacific Index rising 0.7%. It is the third day of small gains. It snapped a two-week decline. European shares are heavier. The Dow Jones Stoxx 600 is off about 0.3%. The second day of losses is sufficient to push the index down on the week, for the second consecutive declining week. The S&P 500 needs to gain about 0.6% of 14 points to avoid finishing the last week of the year in the red.

Bond yields mostly slipped in Asia, but are firmer in Europe. The 10-year US Treasury yield is a little higher today, though still about five basis points lower on the week. European yields are 1-3 bp higher on the session to pare this week’s decline.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$EUR,$JPY,China,EUR/CHF,FX Daily,newslettersent,Russia,Spain Consumer Price Index,U.S. Chicago PMI